In today’s fast-paced digital economy, XRP AI Payments are emerging as a game-changer for global businesses. The goal is to enable smart business transactions – algorithmic, autonomous payments executed by systems with minimal human intervention.

By integrating AI blockchain integration into payment systems, companies can achieve near-instant cross-border transfers, reduced fees and intelligent automation. This introduction sets the stage for how XRP and AI together empower business transactions that are faster, cheaper and smarter on a global scale!

How XRP Enhances Payment Efficiency in Global Contexts

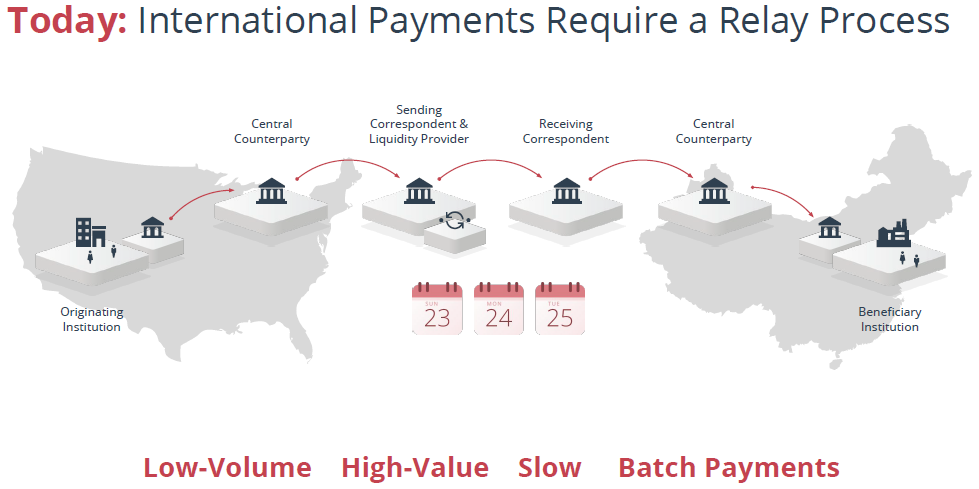

Cross-border payments have long been burdened by high costs and slow speeds. Traditional networks like SWIFT can take days and require multiple intermediaries (correspondent banks), adding fees at each step.

Legacy cross-border payments: multiple intermediaries, high cost, and long delays – (Source: World Economic Forum / Ripple)

Ripple’s XRP Ledger offers a transformative alternative by elevating the efficiency of global payments, ensuring they are cheaper, faster, and more transparent. Unlike proof-of-work systems, XRP uses a consensus protocol (Federated Byzantine Agreement) with trusted validators, avoiding energy-intensive mining while maintaining security. This means transactions clear near-instantly, making XRP ideal for on-demand international transfers.

Key performance metrics of XRP Ledger:

- Speed: Finality in about 3–5 seconds, compared to the 1–5 day settlement of traditional cross-border methods.

- Throughput: Capacity of 1,500 TPS, scalable to tens of thousands of TPS using payment channels – enough to handle enterprise volume.

- Low Fees: Typical transaction cost is just $0.0002 (fractions of a penny). Essentially near-zero cost, allowing high-volume microtransactions without significant fees.

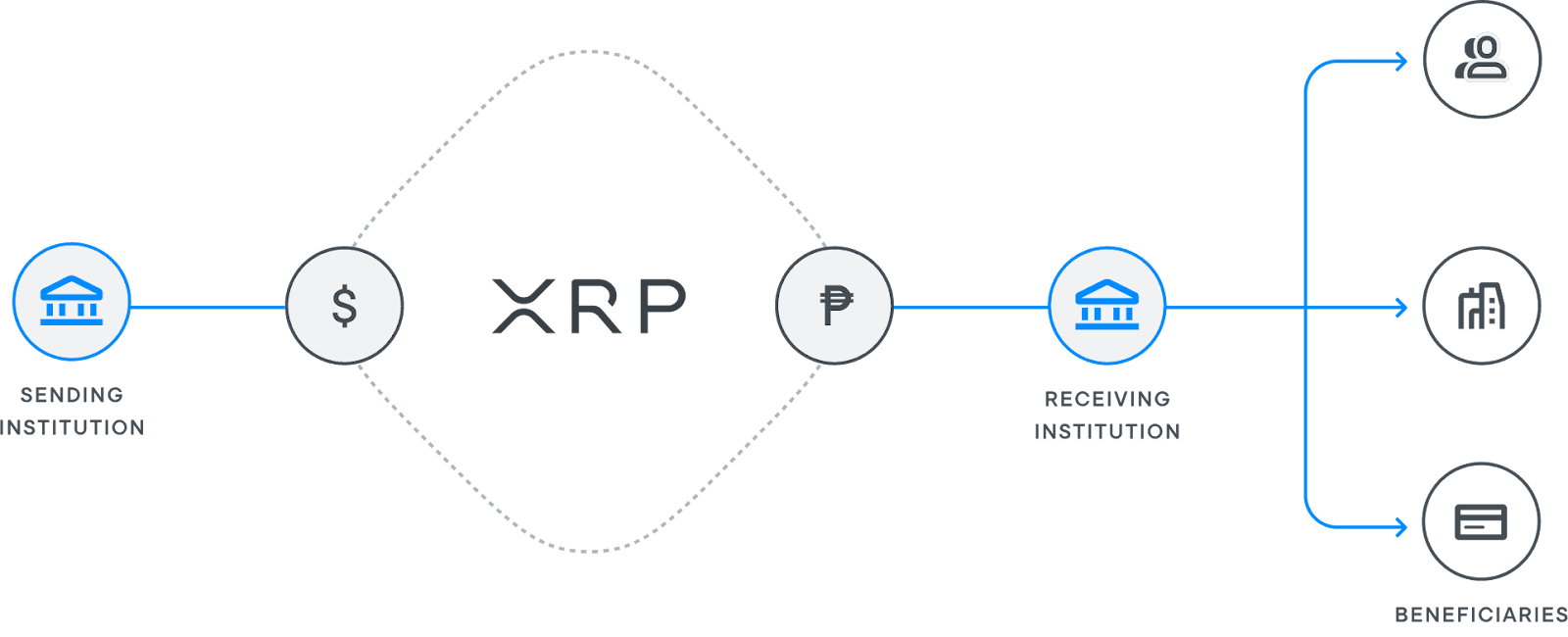

- Bridge Currency: XRP can act as a bridge between fiat currencies, enabling direct value exchange without multiple intermediaries. The network’s algorithm automatically finds the most effective path for payment transfer, whether through direct XRP settlement or via intermediate liquidity providers. This pathfinding and use of XRP reduce the complexity, time, and Nostro/Vostro pre-funding costs of international payments.

XRP as a bridge asset: enabling real-time value transfer between global financial institution (Source: Ripple)

In summary, XRP enhances payment efficiency in global contexts by providing a high-speed, low-cost rail for value transfer, tailor-made for the demands of modern enterprises.

AI Blockchain Integration: Automating and Optimizing Transactions

While XRP provides the fast and cost-effective payment rails, artificial intelligence adds an intelligent layer on top – automating processes and optimizing each transaction for the best outcome. AI integration in blockchain payments allows businesses to automate processes, reduce risks, and optimize decision-making. In practice, this means AI can handle many of the tasks that used to require manual oversight or weren’t possible at all with legacy systems:

- Real-time Compliance Checks: AI systems can automatically verify Know-Your-Customer (KYC) data and monitor transactions for Anti-Money Laundering (AML) compliance. This ensures each payment meets regulatory requirements across jurisdictions without slowing it down.

- Fraud Detection and Security: Machine learning models analyze transaction patterns to detect anomalies that might indicate fraud. On an immutable ledger like XRP’s, every transaction is traceable; AI can scrutinize this data to catch unusual behavior in real-time.

- Dynamic Routing & Optimization: AI can dynamically route payments through the most efficient corridors. By analyzing factors like exchange rates, network congestion, and available liquidity, an AI system finds the fastest and cheapest path for a payment.

- Automation of Smart Contracts: AI-driven smart contracts can trigger and execute agreements once predefined conditions are met. In a business context, this could mean automatically releasing payment when an IoT sensor reports a delivery received or when an invoice matches a purchase order.

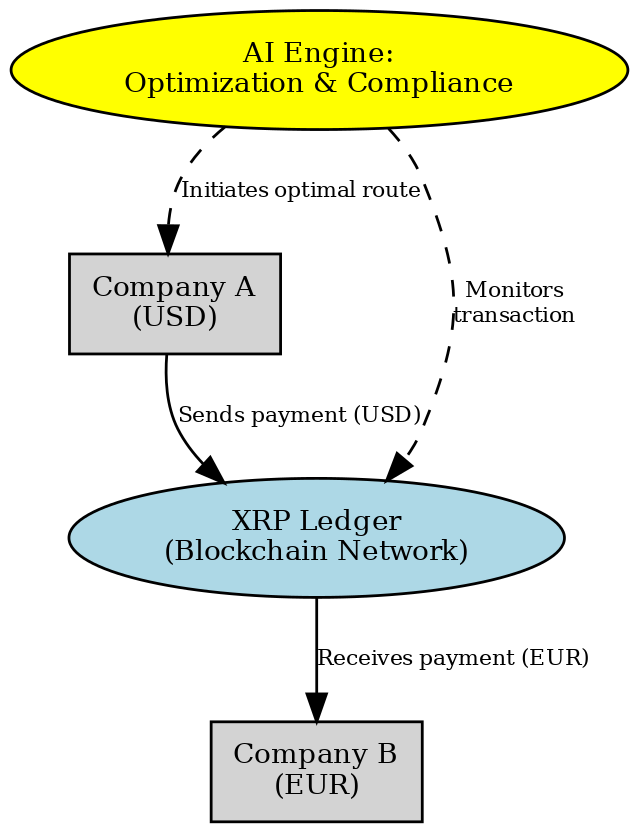

Figure: Conceptual diagram of an AI-enhanced cross-border payment flow using XRP. An AI engine oversees the transaction between Company A and Company B. The AI system initiates the optimal route and monitors the payment, while the XRP Ledger (blockchain network) transfers value from the payer in USD to the payee in EUR. By analyzing real-time data (rates, network conditions, compliance checks), the AI ensures the payment is executed via the fastest, most cost-effective path. XRP serves as a bridge asset, converting USD to EUR seamlessly through the ledger. This integration results in an intelligent, self-optimizing payment process – the AI handles decision-making and risk checks, and the blockchain handles the speedy value transfer.

In essence, AI adds “brains” to the payment network’s “brawn.” It continuously learns from transaction data to improve outcomes – predicting and preempting bottlenecks or risks. The AI blockchain integration enables a level of agility and intelligence in transactions that wasn’t possible before.

For example, if certain corridors are congested or a particular currency conversion would incur high slippage at the moment, AI can delay or reroute a payment for optimal timing. Corporate finance departments benefit from this by automating routine payment workflows (like matching invoices to payments) and optimizing treasury operations (such as scheduling foreign exchange transfers when rates are favorable). All told, integrating AI with XRP’s network results in payments that are not only fast and cheap, but also smart, adaptive, and reliable.

Real-World Benefits: Cost, Speed and Accuracy for Smart Business Transactions

When companies harness XRP and AI together, they unlock a trifecta of benefits. These align perfectly with the needs of smart business transactions, where autonomous systems handle payments with minimal friction. To support this, payments must be fast, accurate, and low-cost. Here are the key real-world benefits realized:

- Significantly Lower Costs: Businesses can save on transaction fees and FX spreads by using XRP as a bridge and cutting out intermediaries. Each XRP payment costs only a fraction of a cent in network fees, compared to the hefty fees of wire transfers or card payments. AI further reduces costs by optimizing routes (choosing the cheapest currency path or timing) and automating manual tasks.

According to industry reports, embracing blockchain for cross-border payments enables transactions at a fraction of the cost of traditional methods. A tangible example is MoneyGram’s adoption of XRP-based ODL, which reduced their global remittance costs by ~60%. By minimizing fees and operational overhead, companies can improve their margins or pass savings to customers.

- Faster Settlement & Liquidity: Speed is a standout advantage. With XRP, settlement is near-instant worldwide, eliminating the multi-day float period of legacy systems. This means improved cash flow for businesses, they get access to funds or complete transactions in seconds rather than waiting days. AI contributes by automating processes that used to create delays (such as compliance checks or reconciliation).

The result is end-to-end payment processing that is dramatically faster. Near-real-time payments allow companies to be more agile: suppliers get paid promptly, employees can be remunerated across borders without delay, and just-in-time supply chain financing becomes feasible. In trade finance, using Ripple’s blockchain has enabled faster transaction settlement at lower costs for exporters and importers, demonstrating how speed can unlock new business opportunities (e.g., shorter order-to-cash cycles).

- Higher Accuracy & Transparency: Automation through AI leads to error-free processing of transactions. By removing manual data entry and automating reconciliation, the risk of human error drops significantly. An AI-aided system can automatically match invoices to payments and flag discrepancies, ensuring accuracy in accounts payable/receivable. This improves financial reporting and trust in the system. Moreover, AI-driven fraud detection boosts security – catching suspicious activities before they cause damage. The net effect is a more reliable, trustworthy payment system, which is crucial when enterprises automate transactions at scale.

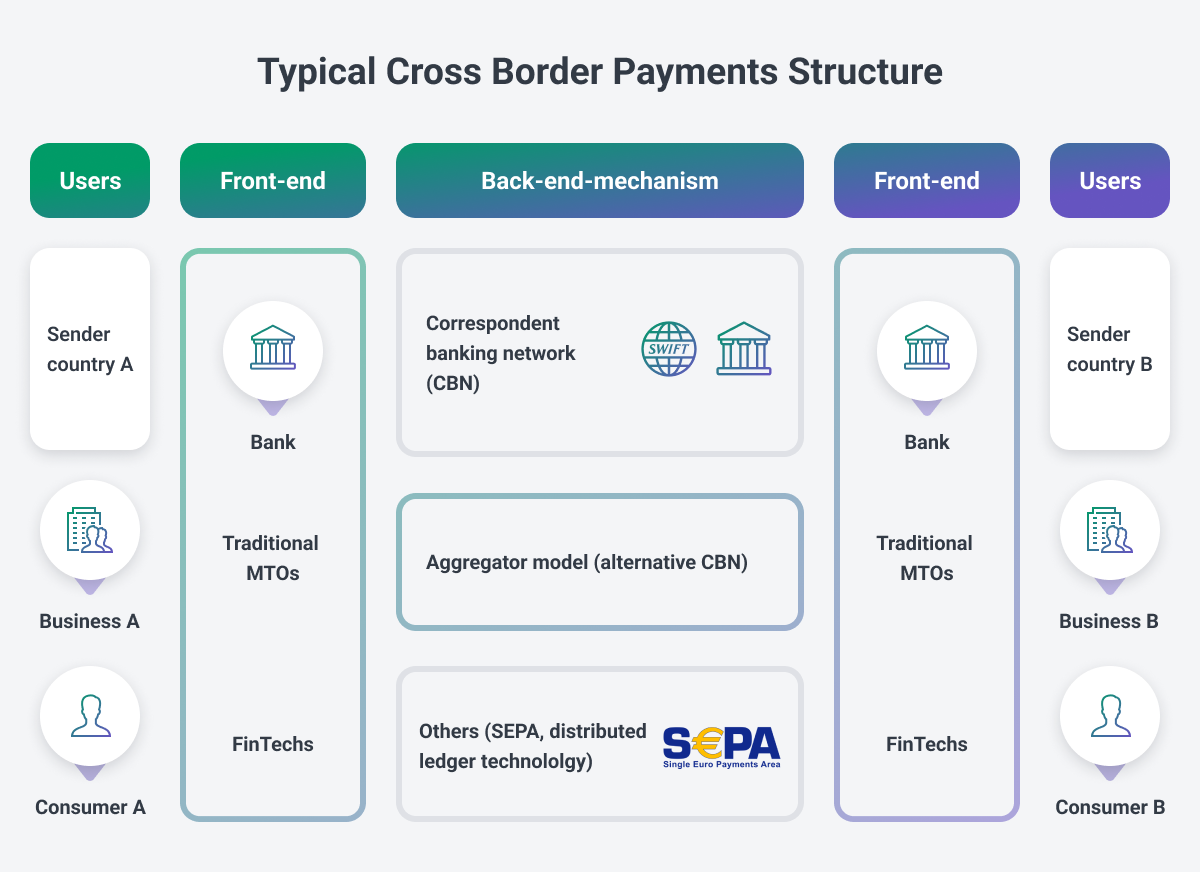

Typical structure of cross-border payments: complex backend and fragmented infrastructure (Source: SEPA / CBN / SWIFT Overview)

By achieving lightning-fast, low-cost, and highly accurate payments, organizations become more competitive and responsive in the global market. This is the foundation for truly smart business transactions – where autonomous systems can transact on behalf of businesses with confidence that each payment is optimized and secure.

Conclusion: Embracing XRP and AI for Smarter Payments

The fusion of XRP’s high-speed blockchain with AI’s intelligent automation is enhancing payment efficiency in unprecedented ways. By implementing XRP AI Payments, organizations can modernize their financial infrastructure, turning antiquated payment workflows into agile, smart business processes.

Twendee is at the forefront of this transformation. Our team has deep expertise in blockchain and AI integration, and we’re passionate about building solutions that drive tangible business value. (In fact, we explore cutting-edge blockchain innovations across industries – from payments to gaming. Check out our recent article on AI workflow strategy for a glimpse into how decentralization is changing other sectors as well.)

Ready to unlock faster, smarter transactions for your business?

Collaborate with Twendee to implement AI-optimized payment systems that leverage the power of XRP. From consulting on strategy to developing custom solutions, we can help you modernize your payment infrastructure and stay ahead in the digital economy. Explore our blockchain & AI services at Twendee Labs

Follow our insights on X and LinkedIn