In Web3, expansion is no longer about being early, it’s about choosing the right battleground. By 2025, the most strategic founders aren’t asking who’s using crypto, but where adoption, regulation, and capital are finally aligning. That’s where real traction begins and where infrastructure can scale with confidence.

This blog breaks down the top 10 Web3 expansion markets not by trend, but by substance: rapid wallet growth, regulatory momentum, and active funding flows. Each country is viewed through a founder’s lens revealing where to build, where to raise, and where to tread carefully.

How We Evaluate Web3 Expansion Markets

To identify the most promising markets for Web3 expansion, we looked beyond headlines and into the fundamentals which truly signals readiness for scale. Each country in this list is assessed through three core dimensions:

- Regulatory Openness: Are crypto laws clear, evolving, or restrictive? Markets with defined frameworks or active sandbox models offer stronger ground for sustainable growth.

- User & Wallet Adoption: We look beyond hype to see where wallets are growing and on-chain activity reflects real usage not just speculation.

- Funding Activity: A vibrant ecosystem of VCs, grants, and local capital signals not just momentum, but staying power.

But more than just scoring these metrics, we added a founder-focused question to each analysis: Is this where users, wallets, and capital are truly converging or just crossing paths? That’s the difference between entering a trend and entering a market.

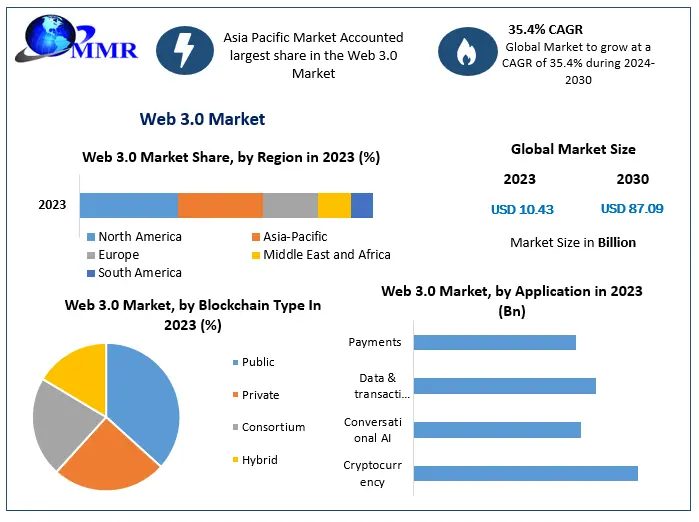

Web3 market size, region share, and blockchain types in 2023 (Source: MMR)

THE TOP 10 WEB3 EXPANSION MARKETS IN 2025

🇸🇬 Singapore

Regulatory Openness:

Singapore remains a regional benchmark for crypto regulation. Under the Payment Services Act, the Monetary Authority of Singapore (MAS) has granted full or in-principle licenses to over 19 digital asset firms, including Circle, Ripple, and Crypto.com. The launch of its Stablecoin Regulatory Framework in 2023 sets clear standards for reserve management, redemption, and capital requirements offering legal clarity that most markets still lack. This predictable, structured environment makes Singapore highly attractive for Web3 companies planning long-term operations.

For startups looking to scale globally without triggering regulatory pitfalls, Singapore is often cited as a model jurisdiction, one that balances compliance and innovation. See How to Offer Crypto Services Globally Without Breaking Local Laws for a deeper breakdown of cross-border compliance strategies.

User & Wallet Adoption:

With a relatively small population (~5.9 million), Singapore doesn’t offer mass retail scale but what it lacks in volume, it makes up in depth of engagement. According to Triple A’s 2023 report, over 19% of Singaporeans own crypto, one of the highest rates in Asia. The local user base actively participates in DeFi, tokenized finance, and digital asset staking. Institutional players are also involved: DBS Bank has launched tokenized bond issuances and operates a regulated crypto exchange for accredited investors.

Funding Activity:

Singapore is the venture capital hub of Southeast Asia, with leading Web3 funds like Signum Capital, Spartan Group, Temasek, and Golden Gate Ventures based here. In 2023, Web3 startups headquartered in Singapore raised over $535 million (Tracxn), with many rounds supported by both local and cross-border investors. The government also supports innovation through schemes run by IMDA and Enterprise Singapore, targeting blockchain infrastructure, cybersecurity, and regulated financial applications.

Founder Lens:

Singapore isn’t a mass-market growth play, it’s a strategic launchpad. With legal certainty, investor access, and infrastructure for compliance-first scaling, it’s an ideal base for startups offering DeFi protocols, fintech-integrated crypto apps, or tokenized financial products. For founders eyeing APAC expansion or institutional-grade product launches, Singapore is infrastructure-ready.

🇻🇳 Vietnam

Regulatory Openness:

Vietnam has yet to formalize a comprehensive legal framework for cryptocurrencies, but signals from regulators suggest a shift toward constructive engagement. The Ministry of Finance, State Bank, and other bodies have jointly studied crypto regulations since 2021, and in 2023, the Prime Minister approved a directive assigning the central bank to develop a pilot legal framework for digital assets. While crypto is not officially banned, trading and holding operate in a legal grey zone, with no licensing regime yet in place. That said, the government’s cautious but open stance has allowed Web3 innovation to flourish in practice especially in gaming and DeFi.

User & Wallet Adoption:

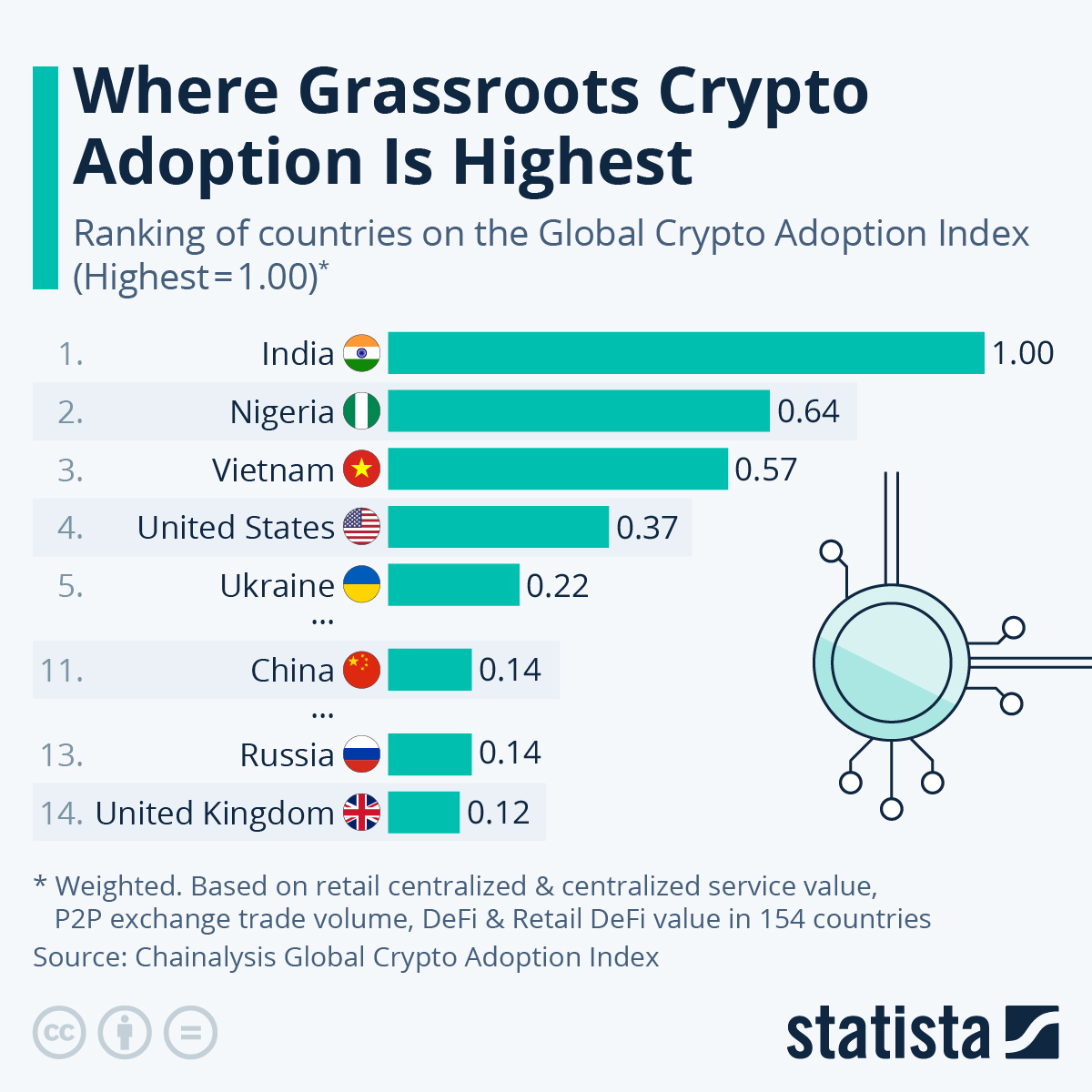

Vietnam consistently ranks among the top crypto adoption countries globally. According to Chainalysis’ 2023 Global Crypto Adoption Index, Vietnam ranked #3 worldwide, driven by high engagement in P2E games, DeFi platforms, and stablecoin usage for remittances and savings. Despite relatively low GDP per capita, Vietnamese users are tech-savvy, mobile-first, and often treat crypto as both speculative and functional finance. Local communities around GameFi, NFT, and SocialFi projects remain vibrant, and the number of active non-custodial wallets continues to grow rapidly.

Funding Activity:

While Vietnam doesn’t have a strong domestic VC ecosystem focused on Web3, its startups have attracted significant capital from regional and global funds. Examples include:

- Sky Mavis (Axie Infinity), which raised $150M+ from a16z, Accel, and Binance Labs,

- Ancient8, backed by Pantera Capital and Dragonfly,

- Coin98, with investments from Hashed and Alameda Research.

Additionally, some Vietnamese Web3 teams have relocated their legal entities to Singapore or Dubai to facilitate fundraising, though operations remain Vietnam-based. The country’s strength lies in product talent and early user traction, rather than in fundraising infrastructure.

Founder Lens:

Vietnam is a high-adoption, high-velocity testbed, ideal for launching MVPs, building grassroots communities, and iterating quickly. However, the lack of a clear regulatory framework limits institutional partnerships and fiat on/off-ramp integration. For startups in GameFi, SocialFi, or DePIN, Vietnam offers real user data at scale, but founders should prepare to structure their corporate entities offshore for fundraising or compliance.

Top countries in grassroots crypto adoption index 2023: India, Nigeria, Vietnam (Source: Statista / Chainalysis)

🇧🇷 Brazil

Regulatory Openness:

Brazil is one of Latin America’s most advanced countries in terms of crypto regulation. In December 2022, the government enacted a national crypto law (Law No. 14,478) that defines virtual assets and assigns oversight to the Central Bank. While implementation is ongoing, the law provides a legal foundation for licensed exchanges and custodians, with clear provisions around fraud prevention, AML, and consumer protection. Notably, Brazilian lawmakers have taken a pro-innovation stance, supporting sandbox models and integration with the country’s instant payment system, PIX.

User & Wallet Adoption:

Brazil is a crypto adoption leader in LATAM, particularly among underbanked and inflation-conscious populations. According to Triple A, over 11.9 million Brazilians owned crypto by 2023 (~5.9% of the population), and that number is projected to grow further due to rising demand for stablecoins and DeFi services. MetaMask and Trust Wallet usage is widespread, and integrations with PIX allow smoother crypto-fiat flows. The country’s high smartphone penetration and digitally literate youth also support healthy wallet growth.

Funding Activity:

Brazil is increasingly recognized as a Web3 funding hotspot in LATAM. Startups such as:

- Hashdex, a crypto asset manager that launched one of the first regulated Bitcoin ETFs,

- Liqi, a tokenization platform backed by Kinea (Itaú group),

- Transfero, issuer of BRZ (Brazilian Real stablecoin),

have raised significant rounds. Global VCs including a16z, Kaszek, and SoftBank are actively exploring the market, especially in crypto-fintech convergence.

Founder Lens:

Brazil strikes a rare balance between regulatory clarity, growing user demand, and VC interest. It’s particularly attractive for startups building consumer wallets, stablecoin payment rails, or tokenized asset platforms. While FX controls and compliance processes exist, the framework is relatively navigable. Founders targeting LATAM should seriously consider Brazil as both a launch and scaling destination.

🇦🇪 United Arab Emirates (Dubai)

Regulatory Openness:

Dubai has positioned itself as a global crypto hub with the creation of VARA — the world’s first dedicated virtual asset regulator. The licensing framework is clear, tiered (advisory, exchange, custody, etc.), and backed by zero corporate tax and fast-track company setup. By 2024, over 1,000 crypto entities were operating across Dubai’s free zones (DMCC, DIFC, ADGM), supported by stable legal protections and a pro-innovation stance.

User & Wallet Adoption:

While retail adoption is modest, wallet activity is growing steadily among high-net-worth users, expats, and Web3 professionals. According to Chainalysis, the UAE leads MENA in crypto transaction volume. Government plans to move 50% of public services to blockchain by 2030 reinforce its commitment to digital assets. Major banks like Emirates NBD are piloting blockchain for payments and finance.

Funding Activity:

Dubai is a magnet for crypto capital, boosted by programs like NextGenFDI and strong presence of funds such as Cypher Capital and Crypto Oasis. In 2023, crypto-related investment in the UAE exceeded $1.2B (Magnitt). Global firms like Binance, Bybit, and Animoca Brands now anchor operations here.

Founder Lens:

Dubai offers regulatory clarity, tax efficiency, and investor access, ideal for scaling infrastructure, DeFi protocols, and tokenized finance. Though not a mass-user market, it’s a strategic base for regional or global operations.

🇵🇭 Philippines

Regulatory Openness:

The Philippines has taken a measured but enabling approach to crypto regulation. The Bangko Sentral ng Pilipinas (BSP) issues licenses to Virtual Asset Service Providers (VASPs) and allows approved exchanges to operate legally. While there’s no comprehensive Web3 framework yet, the regulatory stance is tolerant and adaptive, especially toward fintech and cross-border payments. NFT gaming and DeFi remain in gray areas, but without active enforcement.

User & Wallet Adoption:

The country ranks among the highest in global crypto adoption, driven by massive participation in play-to-earn (P2E) games like Axie Infinity. In 2023, a study by Finder reported over 16.6% of adult Filipinos had owned crypto among the top rates worldwide. Crypto usage has grown beyond gaming, with stablecoins increasingly used for remittances and informal commerce. Mobile-first behavior, high internet penetration, and a young, digitally literate population create strong tailwinds for wallet growth.

Funding Activity:

Local funding remains limited, but Filipino-led projects have drawn international capital including Yield Guild Games (YGG), which raised $22.4M from a16z and Animoca. Government tech agencies such as DICT also support blockchain experimentation, though not yet focused on token economies. Overall, the funding environment is early-stage, with potential for regional spillover from Singapore and HK-based VCs.

Founder Lens:

The Philippines is ideal for community-driven MVPs especially in GameFi, SocialFi, and microtransactions. Legal clarity for tokens is limited, but strong grassroots adoption and P2P infrastructure make it a powerful early-stage testing ground. Founders often launch here to validate traction before scaling to better-capitalized markets.

🇳🇬 Nigeria

Regulatory Openness:

Nigeria’s crypto regulation has shifted notably. After years of banking restrictions, the Central Bank lifted its crypto ban in Dec 2023, allowing VASPs under new KYC/AML rules. A full licensing regime is underway, but regulatory uncertainty and enforcement risk remain high.

User & Wallet Adoption:

Nigeria ranks #2 globally in grassroots crypto adoption (Chainalysis 2023). Inflation, currency instability, and limited banking access drive widespread use of stablecoins and P2P platforms. Crypto is used not for speculation, but daily survival. Google Trends consistently places Nigeria among the top for “Bitcoin” and “USDT.”

Funding Activity:

Funding is early-stage but growing. Startups like Yellow Card, Nestcoin, and Canza Finance have attracted global backers (a16z, Blockchain Capital). VC infrastructure is still maturing, but founder activity is robust.

Founder Lens:

Nigeria is a high-adoption, high-friction market. It’s a strong entry point for P2P finance, stablecoin products, and DeFi-for-necessity use cases. However, regulatory risk and infrastructure gaps make it less suitable for compliance-first models or institutional plays. For bold consumer-facing startups, the upside is real but so is the volatility.

🇮🇳 India

Regulatory Openness:

India’s stance on crypto is ambiguous but evolving. While not banned, crypto faces strict taxation: 30% capital gains tax and 1% TDS per transaction, introduced in 2022. The government is also pushing for global coordination on regulation via the G20 framework. A licensing system doesn’t yet exist, making the regulatory climate uncertain for startups.

User & Wallet Adoption:

India hosts one of the largest crypto user bases globally. Chainalysis ranks it #1 in adoption (2023), driven by retail trading, NFT interest, and mobile-first DeFi access. Despite tax pressure, millions remain active on platforms like CoinDCX, WazirX, and Zerodha-backed initiatives.

Funding Activity:

Indian Web3 startups have raised significant global capital, including:

- Polygon, the leading Layer 2 solution,

- CoinDCX, backed by Pantera and Bain Capital,

- Shardeum, a Layer 1 backed by Jane Street and Spartan.

However, many founders now incorporate in Singapore or Dubai to avoid domestic uncertainty.

Founder Lens:

India is a massive user market with world-class dev talent, but compliance is costly and inconsistent. It’s ideal for building and user acquisition, but offshore structuring is often essential.

🇹🇷 Turkey

Regulatory Openness:

Turkey has no formal crypto law yet, but that’s changing fast. After multiple exchange collapses (e.g. Thodex), the government began drafting crypto regulations, aiming to align with OECD and FATF standards. A new bill submitted in May 2024 outlines licensing for trading platforms, KYC mandates, and tax guidance signaling a move toward structured oversight, though still in early phases.

User & Wallet Adoption:

Turkey consistently ranks among the top crypto adopters globally. High inflation and lira devaluation have pushed millions toward stablecoins (especially USDT) for savings and transactions. According to Statista, over 16% of Turkish internet users own crypto. Usage is practical, not speculative — including remittances, commerce, and FX hedging.

Funding Activity:

While local VC activity is modest, cross-border investments are increasing. Projects like Metatime and BiLira have raised capital, and Turkey’s position between Europe and MENA makes it strategically visible to international funds. Its strong fintech base (e.g. Papara, Iyzico) offers potential Web3 integration paths.

Founder Lens:

Turkey is ideal for stablecoin and DeFi-for-utility products, especially in volatile economies. Regulatory reforms are promising but still fluid. It’s a test-worthy market with regional gateway potential especially for founders eyeing MENA and Europe.

🇰🇷 South Korea

Regulatory Openness:

South Korea enforces strict but maturing crypto regulation. After the Terra-LUNA collapse in 2022, the government accelerated oversight. The Virtual Asset User Protection Act, set to take effect in July 2024, includes rules on asset segregation, insurance, market surveillance, and penalties for unfair trading. Exchanges must register and comply with real-name bank account rules, making the market heavily regulated but increasingly structured.

User & Wallet Adoption:

Crypto adoption in Korea is tech-driven and cultural. Over 6 million citizens more than 10% of the population — actively trade crypto. The country has a strong appetite for NFTs, blockchain gaming, and AI-integrated Web3 apps. Local giants like Kakao, Line, and Naver have integrated blockchain into consumer services, showing mainstream comfort with Web3.

Funding Activity:

South Korea has a deep domestic funding ecosystem, with support from both chaebols (conglomerates) and crypto-native funds. Companies like Hashed, Wemade, and Delight have raised or deployed significant Web3 capital. Government-backed innovation programs also fund blockchain R&D and gaming infrastructure.

Founder Lens:

Korea is a high-barrier, high-opportunity market. Consumer engagement is strong, and institutional readiness is growing but compliance is non-negotiable. Ideal for startups in gaming, NFTs, and consumer-AI interfaces, especially those ready to meet regulatory rigor.

🇭🇰 Hong Kong

Regulatory Openness:

Once dormant, Hong Kong has re-emerged as Asia’s proactive Web3 regulator. Since mid-2023, the Securities and Futures Commission (SFC) has issued a licensing regime for centralized exchanges and custodians, with requirements on token listings, AML, and investor protection. As of 2024, exchanges like HashKey and OSL are fully licensed. The city is also piloting stablecoin rules, tokenized bonds, and CBDC frameworks, aiming to become a regulated launchpad for institutional Web3 finance.

User & Wallet Adoption:

Retail adoption is growing, though still smaller than in Vietnam or Korea. However, institutional demand is strong, especially in tokenized securities, DeFi protocols, and cross-border payments. Government and banking players including HSBC, BOC, and the HKMA are exploring on-chain finance, signaling long-term integration.

Funding Activity:

Hong Kong remains a financial capital with access to Chinese and global capital. Funds like CMCC Global, SNZ, and HashKey Capital are active in Web3. Many startups and funds now use Hong Kong as a legal base, even if operations remain elsewhere. The government’s $50M Web3 innovation fund also reflects policy-level support.

Founder Lens:

Hong Kong is ideal for startups building regulated finance, DeFi infra, or tokenized asset platforms. Its institutional slant means consumer apps may struggle but for B2B, fintech, and compliant DeFi, it’s a high-potential gateway into Greater China and beyond.

Conclusion

Web3 may be global by design, but expansion is still deeply local. The right market isn’t just where people talk about crypto, it’s where users are active, wallets are growing, capital is flowing, and regulation is unlocking real possibilities.

From our analysis, a few patterns are clear:

- Infrastructure-ready hubs like Singapore, Dubai, and South Korea offer legal clarity and investor density ideal for scaling or launching regulated products.

- Adoption-driven markets such as Vietnam, Philippines, and Nigeria bring volume and energy perfect for MVPs, growth hacking, and community-led testing.

- Hybrid gateways like Brazil, Turkey, India, and Hong Kong are balancing compliance with traction offering both risk and opportunity depending on product maturity.

No single playbook fits all but mapping your stage, model, and appetite for risk to the right expansion market can be the difference between building noise and building momentum.

At Twendee Labs, we help Web3 and AI startups navigate market entry with clarity from multilingual development and tokenomics design to ecosystem localization and compliant smart contract builds. If you’re expanding into APAC, LATAM, or MENA, we’ll help you scale not just faster but smarter. Connect us on LinkedIn, or follow us on Twitter/X.