In 2025, fintech app pricing has become a pivotal planning factor for companies investing in digital wallets. Building an e-wallet application involves many cost drivers, and understanding these can mean the difference between a lean MVP launch and a full-featured product with a global user base. E-wallet development costs in 2025 span a wide range, starting as low as five figures for a basic MVP and extending into multiple six figures for a comprehensive solution.

This blog will break down the key cost factors influencing e-wallet app development, from the scope of the app (MVP vs. full product) and team structure to design complexity, backend infrastructure, regional cost differences, and long-term maintenance.

App Scope: MVP vs. Full Product

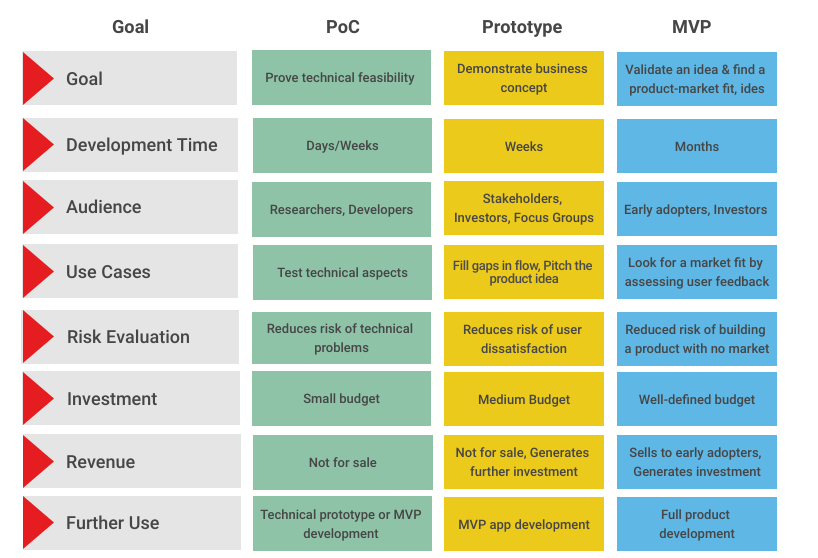

One of the biggest determinants of cost is the scope of the app, namely whether you’re building a minimal viable product (MVP) or a full-featured product. An MVP e-wallet includes just the core features (e.g. basic user registration, adding funds, simple transfers) required to test the concept, whereas a full product encompasses a rich feature set (multi-currency support, advanced security, integrations, etc.) and robust scalability.

Cost Differences

- In 2025, an MVP e-wallet app can be developed for a relatively modest budget compared to a complete product. Sources indicate that a simple MVP e-wallet might cost roughly $10,000 to $30,000 if it’s limited to essential functions.

- In practice, many startups allocate in the range of $25,000 – $50,000 for an MVP or basic digital wallet with standard features. This initial version can often be built and launched within a few weeks to a couple of months.

- On the other hand, a full-scale e-wallet product with extensive functionality, top-notch security, and multi-platform support requires a far larger investment. Feature-rich, multi-platform wallets with full security measures commonly run into the six figures, potentially $100,000 to $200,000 or more by 2025.

- Industry analyses affirm that sophisticated fintech applications can even reach $250,000+ for development when they incorporate cutting-edge features like AI or blockchain. These full products also entail longer development timelines (often 9–12 months or more of active development and testing).

MVP vs Full-Scale Product Comparison, shows the development timeline, budget categories, and feature depth differences between a lean MVP and a full digital wallet app (Source: Business of Apps)

Feature Set Impact: The wide cost gulf between an MVP and a full product comes down to features and complexity. A basic wallet might support simple balance checks and P2P payments, but a full product could include bill payments, loyalty rewards, multi-currency wallets, investment options, and regulatory compliance features – each addition driving up development hours and cost.

As a rule of thumb, every major feature (e.g. biometric authentication, offline payment capability, crypto integration) adds to both the initial build cost and the ongoing maintenance overhead. It’s therefore critical to prioritize features based on business value. Many firms choose to “start with an MVP” – launch a lean version to gather user feedback, then scale up to a full product once the concept is validated and additional budget is justified. This phased approach can optimize spending and reduce risk.

Development Team Size and Structure

The composition and location of your development team is another pivotal cost factor. E-wallet projects can be tackled by a solo developer or a full squad of specialists and whether you build an in-house team or outsource to a development partner will significantly influence your budget.

In-House vs. Outsourced

- Building an in-house team gives you direct control and alignment with your company culture, but it comes with high fixed costs (salaries, benefits, office space, equipment). Maintaining a full in-house squad – e.g. front-end and back-end developers, a QA engineer, designers, a project manager, means shouldering ongoing expenses regardless of project changes.

- In contrast, outsourcing development (whether to an offshore agency or freelancers) can reduce costs by roughly 30–60% by leveraging lower labor rates and on-demand contracts. According to a 2025 cost guide, hiring equivalent talent in regions like Eastern Europe or Southeast Asia can be 3–4 times cheaper than in the US or Western Europe.

Team Size and Roles: The size of the development team must align with the project scope and timeline. A solo developer or very small team might lower the hourly burn rate, but can dramatically slow down development and may lack specialized skills (security, UX, etc.). On the other hand, a full cross-functional team (with dedicated roles for engineering, design, QA, DevOps, etc.) can build a complex e-wallet faster and with higher quality, but naturally at a higher upfront cost due to many salaries working in parallel. There’s a trade-off between time and cost: a larger team can deliver a product to market faster (critical if timing is a competitive advantage) while a smaller team or individual might fit a tighter budget but extend the timeline. In some cases, companies adopt a hybrid approach, keeping a small in-house core team for domain knowledge and outsourcing specific components or using staff augmentation to control costs.

Choosing the Right Team Model: For budget-conscious companies, outsourcing to a trusted firm in a cost-effective region is a common choice. In contrast, businesses prioritizing control and IP security (like banks) often build in-house teams despite higher costs. While outsourcing can increase management complexity, strong project management helps maintain alignment. A balanced approach: start with a small expert team for the MVP, then scale through hiring or outsourcing for full development.

Design Complexity and UI/UX Requirements

Design and user experience complexity play a substantial role in e-wallet app pricing. In fintech apps, a well-crafted UI/UX isn’t just about aesthetics, it influences user trust and retention but achieving a premium design can significantly increase development costs.

Simple vs Complex E‑Wallet UI Designs, side‑by‑side design mockups demonstrating minimalist vs feature‑rich fintech interfaces (Source: Behance)

Basic vs. Custom Design:

- A simple, functional design for a digital wallet (think minimalistic screens, standard components) is relatively cost-effective to produce. Using basic templates or standard platform guidelines can keep the design phase lean.

- However, if your project demands a custom, high-end UI – with rich visuals, custom graphics/illustrations, seamless animations, and an optimized user journey – you should be prepared to invest more in design work. In fact, industry data suggests that the UI/UX design phase typically accounts for about 10–15% of the total project budget for an MVP-level fintech app.

For a 2025 e-wallet MVP, that translates to roughly $10,000 up to $50,000 spent purely on design, depending on complexity and the number of screens/user flows involved. This cost covers the work of UX designers (research, wireframing, prototyping) and UI designers (high-fidelity mockups, interaction design), as well as rounds of user testing and iteration.

Design Complexity Factors: Several factors drive design cost.

- Number of screens and unique interface elements is one obvious driver, a straightforward wallet with a handful of screens (login, dashboard, send money, history) will be cheaper than a multifaceted finance app with dozens of screens and states.

- Interactive elements and animations also add complexity; for example, implementing animated transitions or custom charts in the app takes additional front-end development time.

- Moreover, designing for multiple platforms (iOS, Android, web) increases effort since each has distinct guidelines and requires adapted layouts.

- Lastly, branding and polish level matters: if a company requires a unique visual identity and delightful micro-interactions, the design team may need more rounds of refinement to meet that premium standard.

ROI of Good Design: Good design pays off, especially in fintech, where great UX boosts user adoption. Studies show $1 spent on UX can return up to $100. But late design changes are expensive, so finalizing the prototype early is key. On tight budgets? Use UI kits or follow established systems like Material Design to save time and cost. The goal: a clean, functional UI that fits the budget.

Regional Development Cost Differences

Where you develop your e-wallet app (geographically) can have a profound impact on cost. The global tech talent market in 2025 shows huge regional variation in development rates, so “fintech app pricing” will differ markedly if your project is built by a Silicon Valley team versus, say, a team in Vietnam or Eastern Europe.

Labor Rate Variations: Developer salaries and hourly rates are highest in North America and Western Europe, and considerably lower in regions like Eastern Europe, India, Southeast Asia, and parts of Latin America.

- To put this in perspective, consider typical hourly rates for software developers in 2025: a mid-level mobile app developer in the U.S. might charge around $80–$110/hour, whereas a similarly skilled developer in an emerging tech hub (for example, India or Vietnam) might cost around $30–$45/hour.

- This aligns with the earlier note that Western developers can be 3-4x more expensive than their Asia-based counterparts for the same roles and experience level. Thus, if a project requires, say, 1000 hours of development work, the difference between paying $100/hour (U.S. rates) and $30/hour (offshore rates) is enormous, that’s $100,000 vs $30,000 for the same work, purely due to location.

Regional Talent Pools: Cost must be balanced with considerations of quality and expertise.

- Certain regions are known for specific expertise (Eastern Europe and South America have many skilled fintech and blockchain developers, India and Southeast Asia offer large IT talent pools, etc.). Working with top-tier developers in any region will cost more than average ones, but the top-tier in a lower-cost region may still be more affordable than average engineers in a high-cost region.

- Additionally, time zone differences and language/cultural factors come into play, managing an overseas team might introduce communication overhead. Some companies opt for a blended model, e.g., a local project manager or architect to interface with an offshore development team, aiming to get the best of both worlds.

Global Software Development Rates Map, cost-per-hour comparison across regions (US, Eastern Europe, India, etc.), highlighting regional pricing differences (Source: Brainhub)

Offshore Development Benefits and Drawbacks

- From a pure budgeting standpoint, offshore development can drastically reduce the development cost of a mobile app (fintech or otherwise) without necessarily compromising quality. Countries like India, Vietnam, Ukraine, Poland, Brazil, etc., have well-established IT outsourcing industries catering to fintech projects worldwide. Many successful e-wallets and fintech apps have been built or augmented by offshore teams. The cost savings can free up budget for other needs (design, marketing, additional features).

- However, it’s important to engage reputable teams that understand fintech security and compliance requirements. Vetting the vendor’s experience in fintech is critical, a lower rate means little if the code delivered isn’t secure or scalable. It’s also prudent to account for slightly longer timelines in distributed projects (to accommodate time zone gaps and coordination). Even with those caveats, the financial upside of using global talent is compelling for many firms.

In summary, regional cost differences present an opportunity to optimize fintech app pricing. By strategically choosing your development location or partner, you can stretch your budget further. Others go fully offshore for development and rely on local expertise for consulting and review. The right mix will depend on your in-house capabilities, tolerance for remote collaboration, and of course, your budget constraints.

Long-Term Scaling and Maintenance Costs

When budgeting for an e-wallet app, it’s crucial to look beyond the initial development. Launching the app is just the beginning, there will be ongoing costs to maintain, scale, and update the product over time. Savvy tech leaders plan for these long-term expenses from the outset.

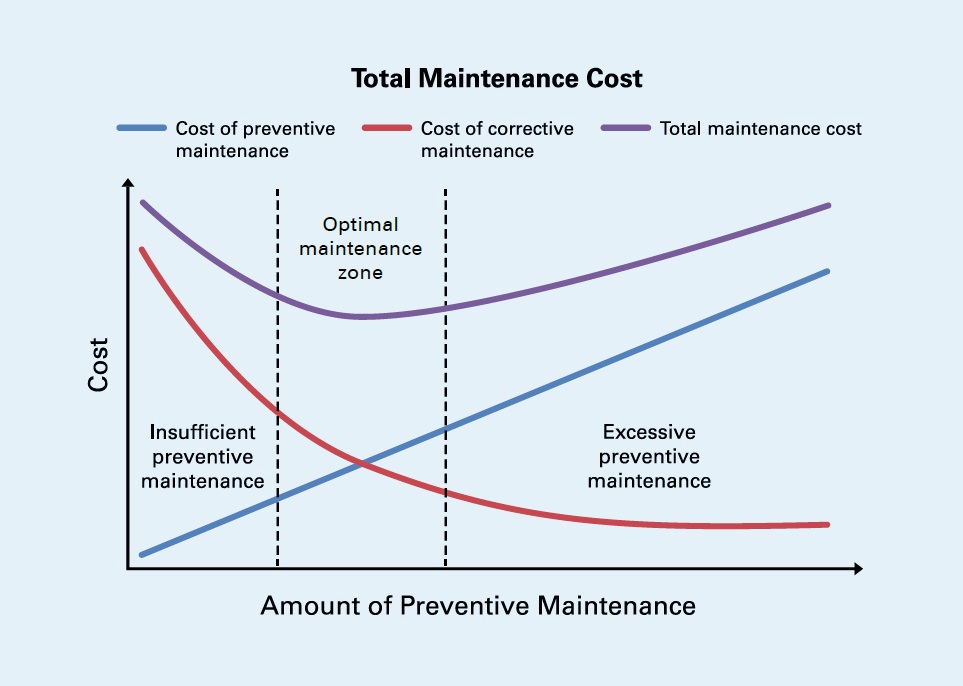

Maintenance and Updates: After the app is live, you’ll need to provide regular maintenance: fixing bugs, releasing app updates for new OS versions, improving security defenses, and adding minor enhancements. A common rule in the software industry is to budget an annual maintenance cost around 15–25% of the original development cost.

- In practice, that means if your e-wallet app cost $100k to build, you might spend $15k–$25k per year on upkeep. This covers developer time for patching issues, responding to user feedback, and ensuring the app remains compatible with evolving technologies and compliance requirements.

- For fintech apps, security updates are especially important, regulations and threats change constantly, so you’ll be updating encryption, libraries, and compliance measures frequently to keep the wallet safe and legal. Indeed, one source notes that maintenance charges for e-wallets typically run 15–20% of the initial development budget each year to keep up with security standards and platform changes.

Scalability and Infrastructure: As your user base grows, scaling costs will rise.

- This includes the cost of cloud servers, data storage, content delivery networks, and other infrastructure to serve a larger audience. Early on (for example, with only a few thousand users), these costs might be trivial, perhaps a few hundred dollars a month on cloud hosting.

- But if your app gains hundreds of thousands of users, you’ll need robust servers and possibly dedicated resources. It’s not uncommon for successful e-wallet services to incur infrastructure costs of several thousand dollars per month, especially if they run on cloud platforms that charge per usage.

It’s wise to project these costs under different growth scenarios – e.g., “what if we reach 1 million transactions a month, can our current infrastructure handle it and what will it cost?” and include a scaling budget in your financial plans.

Cost Trend Over Time for Software Projects, illustrative curve showing how maintenance, infrastructure, and scaling costs rise beyond initial development. (Source: Limble CMMS)

Customer Support and Other Overheads: A often overlooked aspect of long-term cost is customer support and operations for your e-wallet app. As users start transacting, they will inevitably need support for issues (failed transactions, account recovery, etc.). You may need to maintain a support team or outsource a support service, which adds to the ongoing cost. Additionally, consider costs like app store fees (Apple App Store charges $99/year, Google Play a one-time $25, plus both take a cut of in-app purchase revenue if applicable). Marketing and user acquisition costs are also significant if you plan to grow the user base (though that is outside development, it’s part of overall project budgeting). In fintech, acquiring users can be expensive, some estimates put customer acquisition costs (CAC) in the $10–$50 per user range for finance apps, which could equal or exceed the development cost if you need to quickly scale to millions of users.

Planning for the Long Haul: The key takeaway is that an e-wallet app is not a one-time expenditure. Smart budgeting will allocate funds not just for building the app, but for running and improving it year after year. This is why sometimes the “cheaper” initial development option might not be cheapest in the long run. Many companies find value in building a roadmap for features and improvements over a 2-3 year horizon, and estimating the resources needed to support that. Engaging in a long-term partnership with a development firm can also help, as they may offer maintenance contracts or scaling support as part of their services.

Conclusion

E-wallet development in 2025 involves many moving parts, from feature scope to team structure and long-term costs. Startups may benefit from a lean MVP with an offshore team to launch quickly and affordably, while enterprises might opt for full development teams for robust builds.

A partner with fintech domain expertise can advise you on which features to prioritize for an MVP, how to architect the app for future growth, and where you might use third-party solutions to save time. They can also help you navigate regional cost advantages through their global talent networks. For example, Twendee, a full-cycle IT development company with experience in fintech projects, provides consultative guidance to tailor the development approach to your needs. Whether you need to build an MVP under a tight budget or scale an existing product with a larger team, working with experts will ensure you invest money wisely and avoid costly missteps.

Now is a great time to act on your e-wallet project, armed with cost insights, you can engage with development professionals to get accurate estimates and refine your plan. If you’re ready to explore your options, consider reaching out to a specialized fintech development provider like Twendee to discuss your project requirements. With the right preparation and the right team, you can turn your e-wallet vision into a reality while staying within budget and on schedule.

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn PageRead latest blog: Top 8 Ways AI Is Transforming Healthcare Operations and Diagnosis