The global banking sector is undergoing its most radical transformation since the rise of online banking in the early 2000s. Today, digital transformation in finance is no longer a back-office initiative, it is a core survival strategy. Faced with rising customer expectations, disruptive fintechs, and the need to scale securely, financial institutions are reprogramming themselves at every level. This article outlines five key shifts that are actively reshaping the future of banking from infrastructure to intelligence, experience to ecosystem.

1. From Product-Centric to Experience-Centric Banking

For decades, banks structured their offerings around isolated product lines checking accounts, credit cards, mortgages each supported by its own backend systems, processes, and service teams. This product-centric model prioritized operational efficiency over user needs, assuming customers would navigate complexity to access what they needed.

But in today’s digital-first economy, that model is rapidly becoming obsolete. Consumers no longer think in terms of banking products, they think in terms of daily financial moments: paying rent, managing subscriptions, splitting dinner bills, or building a safety net. The shift underway is not just about redesigning interfaces, it’s about reimagining banking as a service that fits seamlessly into life.

This evolution is not a superficial UX trend. It reflects a fundamental business model transformation, where the central question moves from “What product can we sell?” to “What real-world problem are we solving?”

To lead in this new paradigm, banks must break down internal silos and deliver fluid, cross-functional experiences across channels. That requires not only UI enhancements but also the ability to interpret and act on customer intent in real time before the user even makes a request.

The urgency is clear: According to PwC’s 2024 Global Consumer Insights, 75% of banking customers expect a seamless experience across web, mobile app, and in-person touchpoints. Yet only 22% of traditional banks are currently able to meet that expectation without friction.

This focus on experience isn’t just about user satisfaction, it directly drives business performance. A 2023 McKinsey study found that banks delivering strong digital experiences achieve:

- 20% higher retention,

- 40% higher cross-sell success, and

- Up to 2x customer lifetime value compared to those still focused on siloed product delivery.

In a market increasingly shaped by Gen Z and millennial preferences, poor experience is now one of the top causes of churn. What used to be a “nice-to-have” is now a critical differentiator. The message is clear: UX is no longer a cost center, it’s a return-on-investment engine.

To deliver truly seamless, human-centered banking, institutions must go deeper than interface design, they must build experience-first architectures.

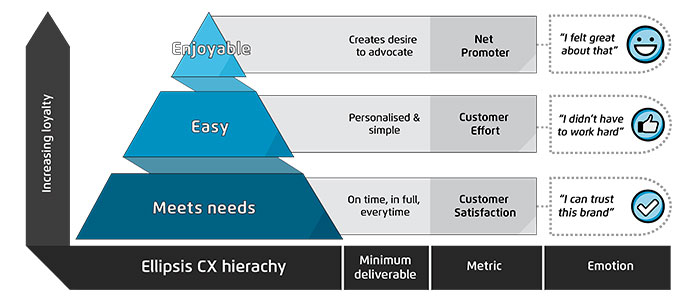

Customer experience pyramid: from meeting needs to driving advocacy (Source: Ellipsis)

That means:

- Composable frontends that unify multi-product journeys into a single flow;

- Real-time behavioral data pipelines that adjust interfaces and offers dynamically;

- And modular design systems that maintain consistency at scale across channels and markets.

This technical foundation aligns with broader banking tech trends such as headless core banking, embedded finance, and API orchestration. It decouples the experience layer from legacy infrastructure, allowing banks to innovate at the pace of user expectation without needing to rebuild backend systems every time a new feature is introduced.

Ultimately, digital transformation in finance doesn’t start with AI or the cloud, it starts with deep empathy. The real shift is designing banking around human lives, not internal product structures..

2. Rise of AI and Automation in Decision-Making

As banking becomes increasingly data-intensive and real-time, the limits of human-led decision-making have become clear. The demand for accuracy, speed, and scale far exceeds what traditional workflows can deliver. In response, AI and automation are no longer peripheral tools, they are becoming central engines of strategy, compliance, and growth.

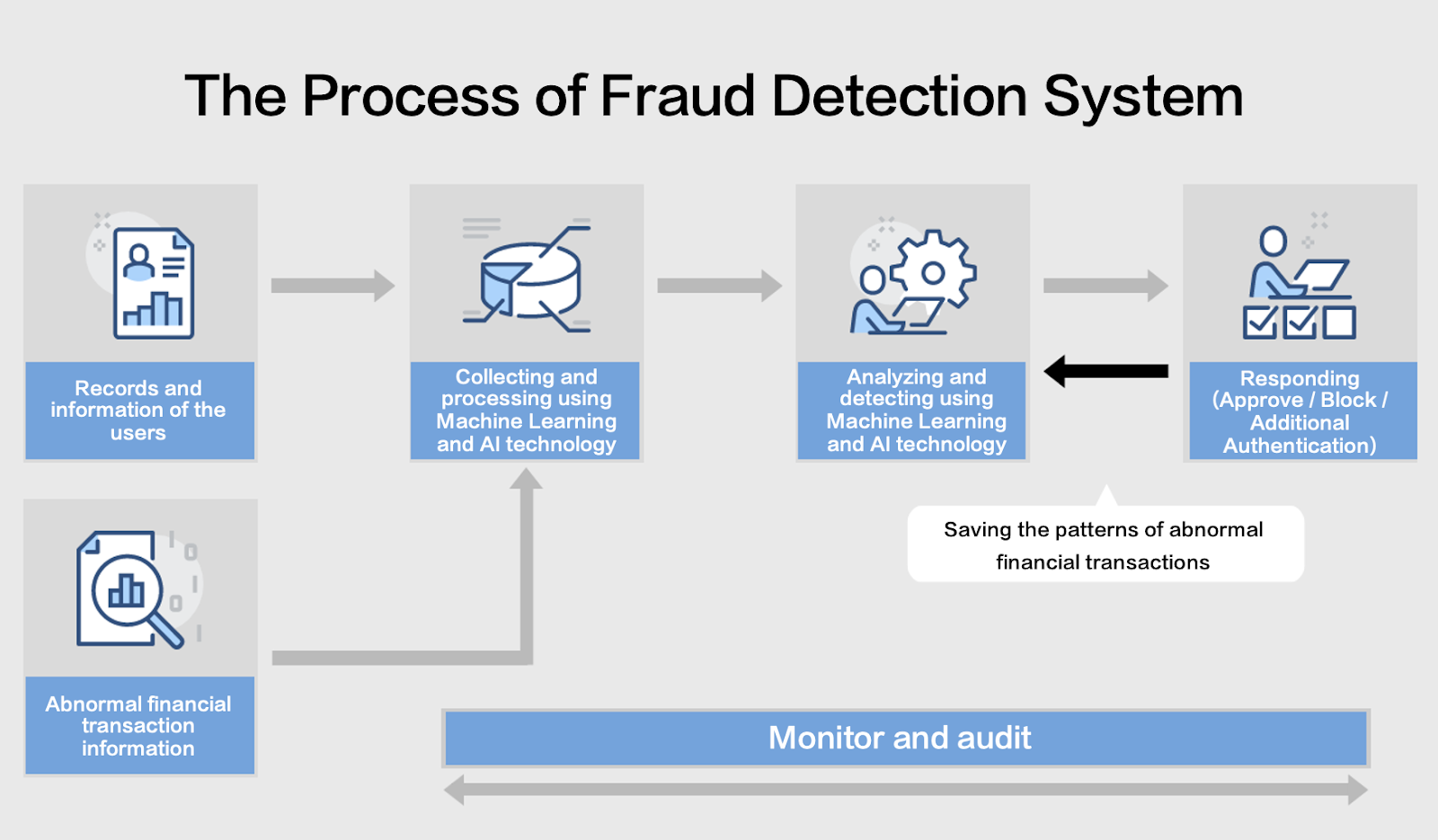

One of the most visible shifts is the move from manual processes to predictive intelligence. AI systems today don’t just follow rules, they learn, anticipate, and act. In credit risk, for example, traditional scoring models are being replaced by AI-driven systems that incorporate behavioral signals, transactional patterns, and non-traditional data sources. Fraud detection has evolved, too. Machine learning models now flag anomalies within milliseconds, cutting false positives by over 60% (IBM, 2024), which not only improves accuracy but reduces friction for legitimate users. Meanwhile, natural language processing (NLP) enables virtual agents to resolve 80% of Tier-1 support queries, offering around-the-clock personalized service with human-like fluency.

AI-powered fraud detection process in banking using machine learning (Source: internal visual)

Beyond task automation, the rise of generative AI marks a deeper transformation in how decisions are made. In 2024, Morgan Stanley launched a GPT-powered assistant that helps financial advisors sift through over 100,000 internal documents to surface insights in real time dramatically improving client service without overwhelming human capacity. Similarly, DBS Bank integrated AI co-pilots into its loan underwriting process, reducing approval times from two days to just three hours. In both cases, AI augments human decision-making, lightening cognitive load and accelerating complex judgment calls.

AI and automation are also becoming core strategies for scale. According to Accenture (2024), banks that implement end-to-end AI workflows rather than siloed models report a 30–45% reduction in operational costs, three times faster product launches, and measurable gains in customer retention due to more personalized engagement. Just as important, automation helps banks adapt to rapid regulatory change. Modern regtech systems, powered by AI, can now track policy shifts in real time and flag inconsistencies proactively, reducing compliance risk before it becomes costly.

However, as AI takes on more responsibility, trust and transparency must be prioritized. Finance operates under stricter scrutiny than most industries, and decisions affecting creditworthiness, fraud risk, or financial advice require explainability. That’s why leading banks are investing in explainable AI (XAI) models that not only perform well, but can also be understood and audited. Bias mitigation, especially in lending models, is equally critical. Clear governance frameworks must define when and how human oversight is applied, ensuring compliance, fairness, and accountability.

In short, the rise of AI in finance isn’t about eliminating people, it’s about elevating human capability with systems that continuously learn, adapt, and respond in real time. This shift doesn’t just improve operational efficiency, it fundamentally redefines how banking decisions are made, and who or what is empowered to make them..

3. Core Modernization & Cloud-Native Infrastructure

At the heart of digital transformation in finance lies a fundamental challenge that most customers never see but that every bank must confront: modernizing the core. For decades, banks have operated on monolithic, on-premise core systems built for security and reliability. But these legacy cores were designed for batch processing, internal workflows, and siloed data not for the open, fast-moving, real-time environment today’s banking ecosystem demands. In this new landscape, where API connectivity and instant scalability are the norm, legacy systems have become the biggest obstacle to innovation.

Modern banking demands flexibility at the infrastructure level. Yet most traditional cores are rigid, expensive to update, and painfully slow to adapt. Even minor product changes can take months to deploy due to tightly coupled architectures and waterfall development models. A 2024 study by Temenos revealed that 63% of global banks cite legacy systems as their primary barrier to digital growth above regulation, customer adoption, or even cybersecurity. It’s not just about technical limitations, it’s about losing competitive ground to more agile fintechs and cloud-native challengers.

The solution is a shift toward cloud-native core systems, which are modular, scalable, and built for composability. These platforms offered by providers like Mambu, Thought Machine, and 10x Banking enable banks to decouple services into microservices, deploy updates independently, and process transactions in real time. Unlike monolithic cores, cloud-native infrastructure supports continuous integration, embedded analytics, and seamless integration with external partners. Even Tier 1 banks are making the move: JPMorgan Chase allocated over $12 billion to tech investment in 2023 alone, a significant portion of which was spent refactoring legacy infrastructure into containerized and hybrid-cloud environments.

But core modernization isn’t just a backend upgrade—it redefines how a bank operates at every level. Cloud-based systems allow for real-time processing instead of batch reconciliation, elastic compute resources instead of fixed hardware, and open APIs that support embedded finance rather than proprietary lock-ins. This transformation is also what powers next-generation banking tech trends, such as programmable payments, decentralized identity, and AI-driven credit models. Without modern infrastructure, these capabilities remain out of reach.

A real-world example of this transformation can be seen in the rise of peer-to-peer (P2P) payment apps. Legacy banking cores are poorly suited to the instant, mobile-first demands of modern P2P platforms. Latency, compliance friction, and a lack of API flexibility often render them obsolete in this context. In contrast, banks or fintechs that operate on cloud-native cores can support real-time settlement, integrate KYC checks seamlessly, and scale to meet surges in user demand, all essential for success in a competitive P2P market. For a detailed breakdown, refer to this step-by-step guide to building a P2P payment app.

Ultimately, core modernization is not a technical upgrade, it’s a strategic necessity. Banks that hesitate will face growing costs from technical debt, mounting regulatory risks, and declining relevance in an API-driven ecosystem. Those that move early will gain the architectural agility to innovate continuously, partner freely, and deliver banking as a service on their own terms..

4. Open Banking & Ecosystem Thinking

The banking industry is undergoing a profound mindset shift from building closed, vertically integrated systems to becoming platforms in open ecosystems. Open banking, once a regulatory obligation, is now emerging as a strategic lever for growth, innovation, and relevance in a hyper-connected digital economy.

At its core, open banking allows third-party providers to access financial data and initiate payments through APIs subject to user consent. This seemingly technical capability unlocks a far-reaching transformation. Instead of controlling every service within their own walls, banks can now collaborate with fintechs, insurers, retailers, and developers to create dynamic, multi-service financial journeys. The result is a new operating model where banks don’t just deliver services, they orchestrate ecosystems.

The regulatory wave that began with PSD2 in Europe has now gone global. In 2024, over 1,500 banks across Europe and Asia have implemented open banking frameworks, while countries like Brazil, Australia, and Singapore are moving toward Open Finance, expanding beyond banking data to include wealth, pensions, and insurance. But beyond compliance, many institutions are discovering that open APIs can accelerate revenue growth and deepen user engagement if used strategically.

Take OCBC Bank in Singapore, for example. It has developed one of the region’s largest API marketplaces, offering over 500 integrations that span sectors from travel and logistics to real estate and health. This enables third parties to plug directly into OCBC’s financial services stack whether to initiate loans, verify income, or embed payments without requiring the user to ever visit a branch or app.

Critically, open banking also changes how banks think about competition. Rather than guarding every product and channel, forward-thinking institutions are positioning themselves as infrastructure providers offering banking-as-a-service (BaaS) to fintechs, startups, and even non-banking enterprises. This shifts the business model from customer acquisition to platform monetization, allowing banks to profit from their regulatory licenses, data pipelines, and compliance capabilities without owning the front end.

Ultimately, open banking marks a shift from gatekeeping to enabling from standalone institutions to networked platforms. Banks that embrace this shift won’t just survive the next wave of fintech, they’ll become the foundation others build upon.

5. From Compliance-Driven to Proactive Security & Trust

As finance becomes fully digital, security is no longer just a compliance requirement, it’s a core enabler of trust and growth. The rise of open APIs, cloud infrastructure, and AI-powered services has expanded both the opportunity and the risk landscape for banks. Cybercrime damages are projected to exceed $10.5 trillion annually by 2025 (Cybersecurity Ventures), and legacy security models can no longer keep pace.

Modern banks are shifting from reactive defenses to real-time, intelligence-led security systems. This includes zero-trust architecture, biometric authentication, and AI-driven anomaly detection that monitors behavior continuously. The goal is not just to block threats but to enable secure, seamless user experiences.

Security now goes hand in hand with UX. Instead of adding friction, advanced security models allow banks to verify users passively through behavioral biometrics or device patterns building safety into the experience itself.

Crucially, banks must also address transparency. As AI takes a larger role in fraud detection and credit scoring, explainability and data ethics become essential. Trust is no longer assumed, it must be actively earned, through accountable algorithms, clear data governance, and consistent protection across the entire ecosystem.

In this new era, security is not just a shield, it’s a foundation for innovation and confidence in every digital interaction.

Conclusion

The transformation redefining finance today is not about adopting tools, it’s about replacing outdated foundations. AI, open ecosystems, and composable infrastructure are no longer experiments. They are the new baseline. And the banks that lead this shift won’t be the ones that wait, they’ll be the ones that architect intelligently, integrate boldly, and scale with purpose. Digital transformation in finance isn’t a project. It’s a reset. And the future belongs to those who move first not cautiously, but decisively.Whether it’s building next-gen financial products or modernizing core systems, Twendee Labs partners with forward-looking institutions to make digital transformation real. Our Web3-native architecture, AI expertise, and fintech experience make us the ideal tech ally for scaling securely and fast. Reach out at twendeelabs.com or connect with us on X or LinkedIn to start building with confidence.