Once a technical extension to Ethereum staking, restaking has now become a strategic asset class especially for institutional capital. As yield farming becomes increasingly inefficient and lending protocols plateau under risk constraints, large investors are turning to restaking platforms in DeFi as the next dominant yield layer.

These platforms offer more than passive returns, they’re structuring yield around infrastructure security, allowing institutions to allocate capital in ways that are efficient, defensible, and aligned with long-term ecosystem growth.

Restaking Mechanics & Institutional Appeal

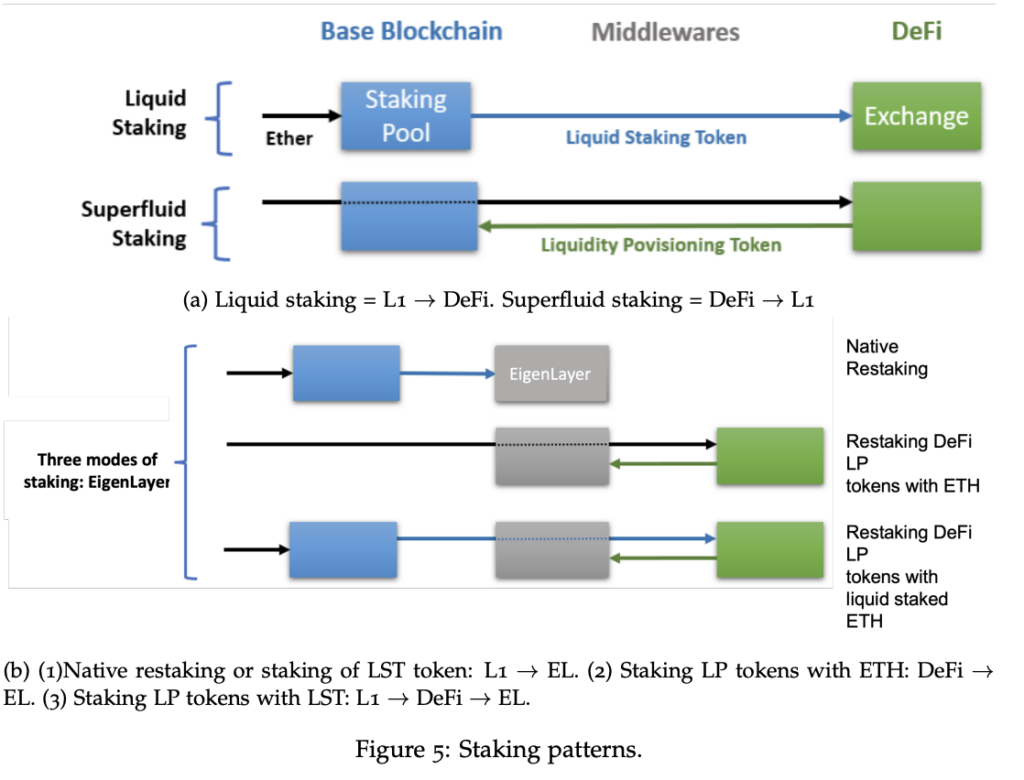

At the heart of Ethereum restaking protocols like EigenLayer is a simple idea with powerful implications: allow users to reuse staked ETH or liquid staking tokens (LSTs) such as stETH, ETHx, eETH as cryptoeconomic security for additional decentralized services known as AVSs (Actively Validated Services).

Three restaking pathways via EigenLayer: native, LP with ETH, and LP with LSTs (Source: CEUR Workshop Paper, 2024).

Institutions find this appealing for three reasons:

- Dual Yield Potential: Base ETH staking yields (~3.5% APY) can now be layered with AVS rewards, often pushing effective returns into the 10–12% range without rehypothecating the principal.

- Capital Efficiency: Unlike lending or LP farming, restaking doesn’t introduce liquidation risks or dependency on volatile token pairs. Assets remain bonded to security functions aligned with institutional mandates for capital preservation and systemic alignment.

- Infrastructure Exposure: Restaking doesn’t just offer yield, it offers exposure to modular Web3 infrastructure. This matters as institutions shift from speculative DeFi instruments to infrastructure-aligned digital transformation. As Twendee outlines here, the future of finance is defined by programmable, composable architecture. Restaking is a gateway into exactly that.

This model transforms staking from a static capital allocation into a dynamic, yield-producing infrastructure layer, where each validator role becomes an income-generating node in a larger modular ecosystem.

EigenLayer and the Institutional Shift Toward Infrastructure Yield

No protocol reflects the institutionalization of DeFi yield more clearly than EigenLayer. Originally launched as a security-layer primitive, EigenLayer has evolved into the de facto gateway for institutional restaking strategies in 2025.

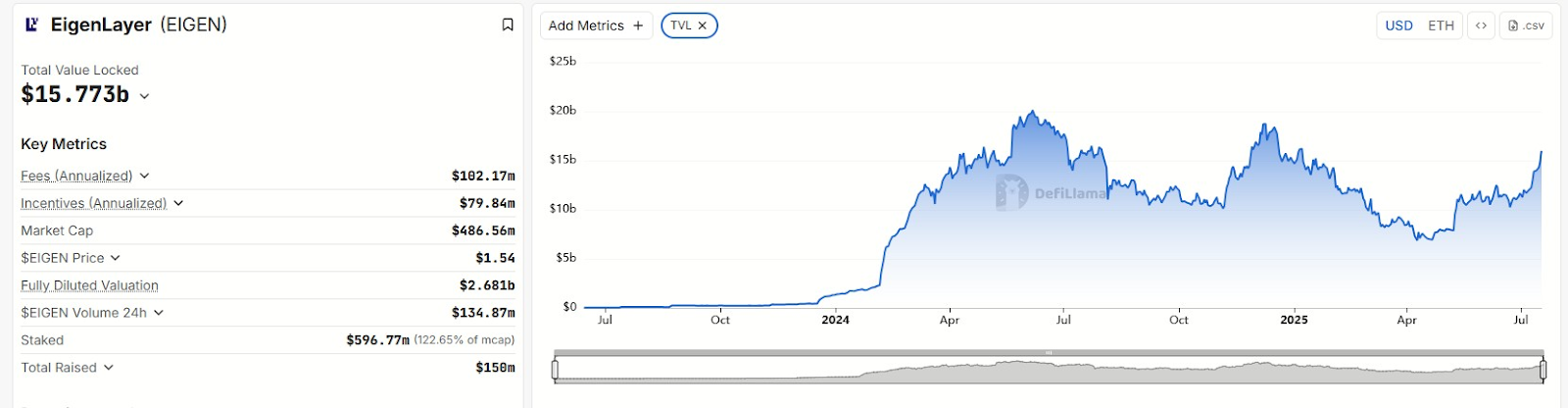

As of Q3 2025:

- Total Value Locked (TVL) on EigenLayer suggested $18.2B, marking a >400% year-over-year growth, driven largely by structured deposits from staking service providers and large capital allocators (Source: DeFiLlama, July 2025).

- Over 45% of restaked ETH originates from institutional entities, including Lido, Kiln, Coinbase Cloud, and Blockdaemon, most of which operate restaking modules at scale.

- Deposit windows close within minutes of opening, consistently hitting capped limits clear signs of automated liquidity pre-commitments from syndicates and staking aggregators.

EigenLayer’s TVL climbed to $15.77B by mid-2025, reflecting sustained institutional inflows (Source: DeFiLlama)

But capital inflow is just the surface. EigenLayer’s true institutional appeal lies in how it transforms infrastructure risk into yield-bearing opportunity.

1. Why Institutions Treat EigenLayer as Infrastructure Equity

Institutions are no longer chasing ephemeral APRs, they are allocating capital to become infrastructure shareholders, not just passive lenders. EigenLayer enables that via:

- Validator Yield Stacking: Restakers earn ETH from the base protocol and AVS-specific rewards (in ETH, tokens, or AVS service fees). This aligns with real-world yield stacking seen in traditional capital markets (e.g., equity + convertible debt).

- Early-Stage Protocol Equity: Most AVSs launching on EigenLayer pre-allocate tokens or revenue shares to early restakers. This gives institutions a direct stake in emerging infrastructure layers, with upside comparable to venture equity yet liquid and on-chain.

- Modular Validator Portfolios: AVSs are plug-and-play. Institutions can selectively opt into validating services based on their risk, yield, and duration profile effectively creating portfolios of security providers, similar to fixed-income laddering.

Each of these projects leverages EigenLayer’s pooled trust mechanism, while offering custom reward programs to attract institutional restakers often in the form of token airdrops, governance shares, or service fees.

2. New Financial Products Fuel the Restaking Flywheel

The institutional presence on EigenLayer is no longer informal. Financialization is accelerating:

- VanEck, Framework Ventures, and Dragonfly have launched or co-led dedicated restaking funds in H1 2025, with mandates focused on early-stage AVS exposure via validator restaking.

- IndexCoop is piloting the first Restaking Index Basket, tracking a weighted exposure across major AVSs and LST-backed positions offered to qualified investors under digital asset ETP frameworks in the EU and Singapore.

- Several prime brokerages (e.g., FalconX, Hidden Road) now offer structured restaking notes, blending fixed AVS yields with performance upside via token warrants.

These developments signal a turning point in yield architecture: restaking is no longer treated as experimental staking, it’s now a modular, composable layer of institutional finance, complete with indexes, risk tranching, and syndication.

Institutions are building long-duration positions in protocol-level infrastructure. EigenLayer’s restaking model provides: Yield predictability, Governance exposure and participation in the foundational security markets of Web3.

This is not DeFi yield farming repackaged. It is infrastructure-as-alpha, with capital flowing not into tokens but into the operating logic of decentralized compute.

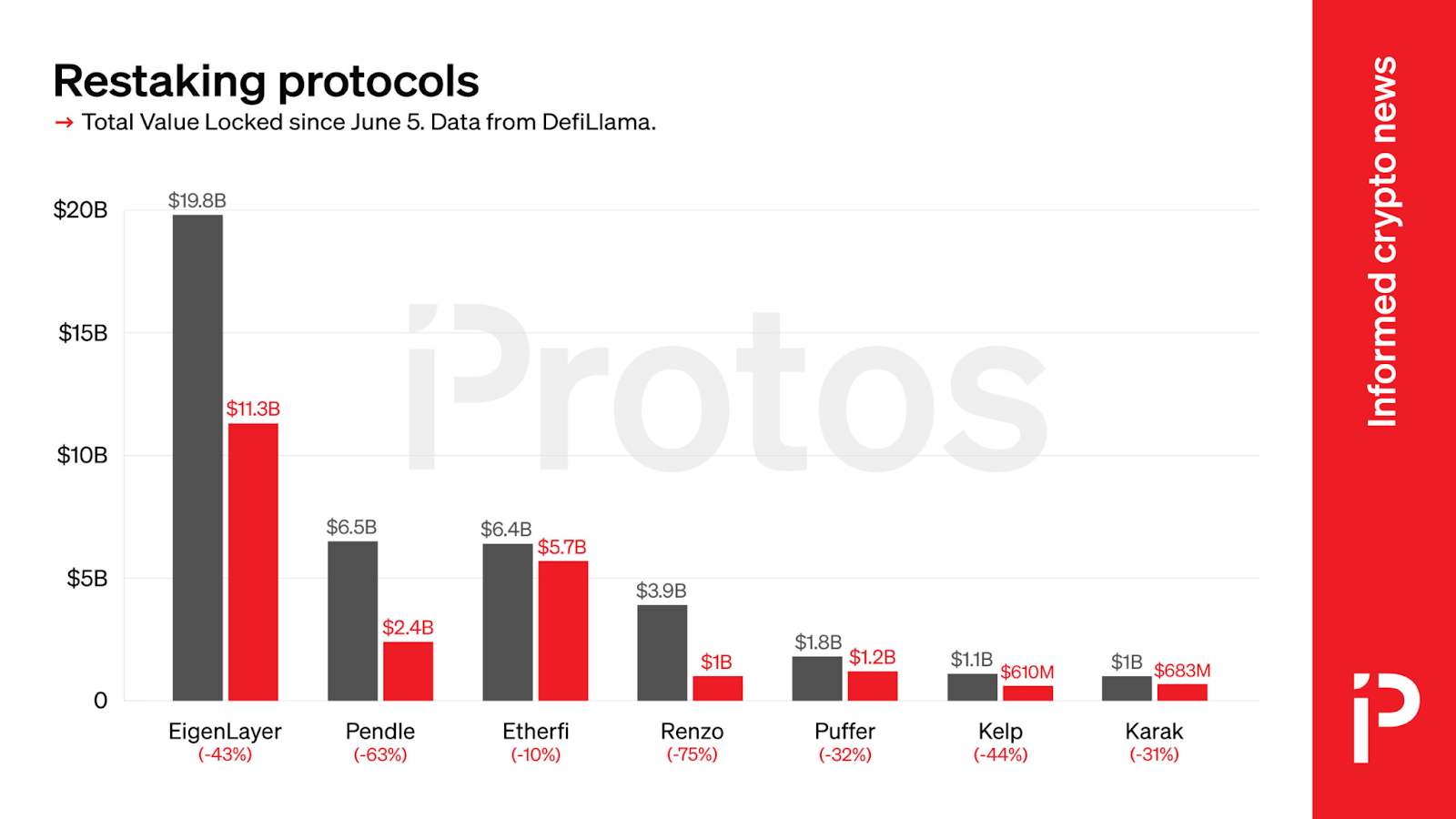

As of Q4 2024, EigenLayer controlled over 80% of total restaking market share (Source: Four Pillars / DeFiLlama)

The Restaking Arms Race Beyond Ethereum

EigenLayer may have pioneered restaking, but it’s no longer the only game in town. As capital searches for diversified, multichain exposure, a new cohort of platforms is emerging extending the restaking model beyond Ethereum and transforming it into a foundational category for infrastructure-level DeFi.

1. Multichain Security Protocols Are Gaining Momentum

Two notable challengers Karak and Symbiotic are gaining traction:

- Karak offers multichain restaking for assets like AVAX, OP, and stablecoins. It raised $48M in a Series A round (March 2025) led by Lightspeed and Pantera, with support from L1 ecosystems like Avalanche and Celestia.

- Symbiotic, backed by Paradigm and Modular Capital, focuses on custom slashing conditions and permissionless AVS deployment, attracting early users from ZK-rollup teams and oracle providers. Its testnet has over 800K bonded LST positions as of July 2025.

What differentiates these protocols is their modular validator model: institutions can choose to validate cross-chain services (not just Ethereum-based AVSs), expanding restaking’s security coverage across execution, DA, and oracle layers.

EigenLayer leads the restaking race with nearly $20B TVL, far ahead of emerging platforms like Karak and Etherfi (Source: Protos/DeFiLlama)

2. Why Institutions Are Interested in the Multichain Restaking Thesis

Institutional allocators view multichain restaking as a way to:

- Balance L1 risk exposure, avoiding Ethereum concentration;

- Access new token-based incentives in emerging ecosystems;

- Leverage stablecoins or idle assets as staking collateral (not just ETH).

For example: restaking strategy combining ETH (EigenLayer) + USDC (Karak) + OP (Symbiotic) allows for geographic diversification of AVS exposure spreading security rewards across sequencers, DA layers, and attestation protocols.

This risk-adjusted, composable yield model is fueling the next wave of capital deployment:

- Delphi Ventures projects that restaking TVL across all platforms will surpass $35B by end of 2025, with 30–40% of new restaking growth coming from non-Ethereum assets.

- Early restakers in Symbiotic’s AVS testnets have already earned a cumulative ~$8.7M in airdrop-equivalent rewards (according to Token Terminal, July 2025).

3. From Yield Farming to Security Capital Allocation

The emerging trend is clear: capital is moving away from mercenary LP positions and toward infrastructure-aligned staking portfolios. Restaking, in its multichain form, becomes the backbone of this new capital logic:

- Instead of chasing 50% APRs with unstable tokens, institutions now allocate long-term capital into modular, composable validator roles, backed by real services sequencers, oracles, attestors.

- The upside is no longer just yield, it’s early governance rights, protocol equity, and network-level control.

This positions restaking not as an “add-on” to staking but as a native layer of capital formation for the modular blockchain stack.

Conclusion

The narrative around yield in DeFi is shifting from speculative farming toward structured, security-aligned returns. Restaking platforms are leading this transformation, offering institutional capital a rare combination of capital efficiency, protocol-level influence, and exposure to long-term infrastructure upside.

In 2021, staking proved that base-layer security could generate sustainable returns.

In 2025, restaking expands that principle into a modular capital system, where validator roles are programmable, composable, and rewarded across multiple layers of trust.

This is not a yield trend. It’s a structural redefinition of how value is secured and rewarded across Web3 and institutions are already embedding it into their next-generation portfolio architecture.At Twendee Labs , we work with institutional allocators, validator networks, and modular infrastructure projects to design capital-efficient restaking strategies that go beyond passive staking. Whether you’re optimizing validator operations or entering the AVS ecosystem early, we help you capture infrastructure-level alpha not just yield. Connect with us on LinkedIn or X to explore how we can support your transformation: Twitter & LinkedIn Page