Stablecoins have moved far beyond their origins as a crypto-market tool. Once viewed as a bridge currency for trading digital assets, they are now emerging as a core financial infrastructure powering payments, settlements, and liquidity across global markets. The shift is unmistakable: with market capitalization above $150 billion and growing integration with fintech platforms, stablecoins are setting the foundation for a new era in financial services.

This transformation is best understood through their role in cross-border payments, B2B settlements, DeFi adoption, and the interplay with central bank digital currencies (CBDCs). Together, these elements illustrate how stablecoins are not just financial products but new rails for the global economy.

Stablecoins and Cross-Border Payments

Beyond retail payments, the biggest opportunity lies in B2B settlements. Multinational corporations, supply chains, and fintechs routinely move billions across borders. Yet they remain dependent on correspondent banking networks with high fees, compliance delays, and fragmented reporting.

Stablecoins introduce a path to instant corporate treasury management. Imagine an exporter in Vietnam receiving settlement in USDC within seconds after shipping goods, or a fintech startup paying global contractors in stablecoins with real-time reconciliation. These improvements reduce working capital friction and unlock operational agility.

The efficiency gains are not theoretical. Pilot programs in Asia and Europe have demonstrated that stablecoin-based B2B settlements can cut transaction costs by up to 80% while reducing clearing time from days to minutes. For enterprises, the ability to settle invoices and manage liquidity in stablecoins will soon become a competitive necessity.

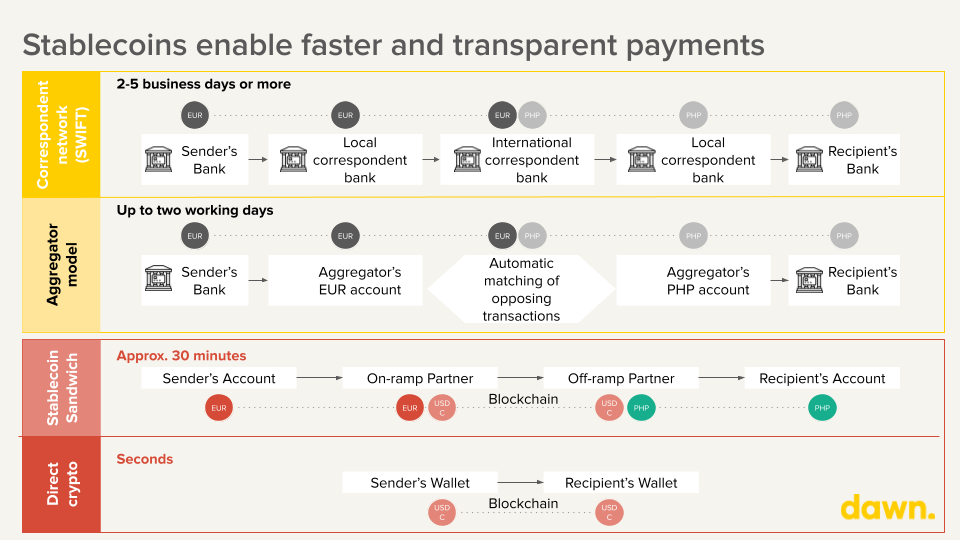

Stablecoin rails cut cross-border settlement time from days to seconds (Source: Dawn).

Mini Case Study Payroll at Scale: A European fintech piloted stablecoin payouts to its network of freelance developers across three continents. Instead of holding prefunded accounts in multiple jurisdictions, it sent USDC directly on-chain, with local on/off-ramps converting into fiat. The result: payroll processing time dropped from 72 hours to under 30 minutes, and reconciliation mismatches fell by over 90%.

Stablecoins are not just making transfers cheaper, they are transforming global payments into programmable, transparent, and always-on infrastructure.

B2B Settlements: From Corporate Treasury to Supply Chains

While remittances often grab the headlines, the real disruptive force of stablecoins is emerging in B2B settlements. Multinational corporations, supply chains, and fintech platforms move billions of dollars daily across borders, yet remain bound by correspondent banking systems that impose high fees, delayed clearing, and fragmented reporting. These inefficiencies tie up working capital and erode operational agility.

Stablecoins create a pathway to instant corporate treasury management. Imagine an exporter in Vietnam receiving settlement in USDC immediately after goods are shipped, or a fintech startup paying hundreds of contractors worldwide with real-time reconciliation. By removing intermediaries and operating on-chain, stablecoins enable enterprises to accelerate cash cycles, improve liquidity, and strengthen supply chain resilience.

The benefits are already measurable. Pilot programs in Asia and Europe have shown that stablecoin-based B2B settlements can reduce transaction costs by up to 80% and cut settlement time from several days to minutes. This is not incremental optimization; it is a structural shift in how enterprises handle capital flows.

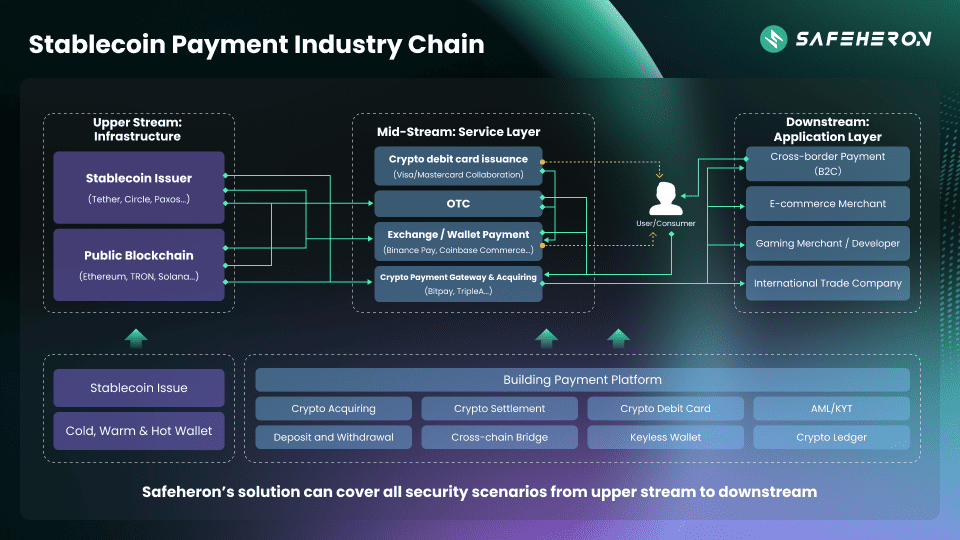

Stablecoin payment industry chain from issuers to applications (Source: Safeheron).

Export Trade Settlement: A mid-sized electronics exporter in Southeast Asia tried USDC to settle invoices with a European distributor. Instead of navigating multiple bank hops and waiting three business days, payment was confirmed on-chain and released to the exporter’s local account in under one hour. The company reported a 70% reduction in transaction fees and freed up working capital days earlier, allowing faster reinvestment in raw materials.

For global enterprises, stablecoins are no longer a speculative experiment. They are becoming an infrastructure-level necessity for managing cross-border trade, treasury functions, and complex B2B networks with speed, transparency, and efficiency.

DeFi Adoption: Stablecoins as the On/Off-Ramp

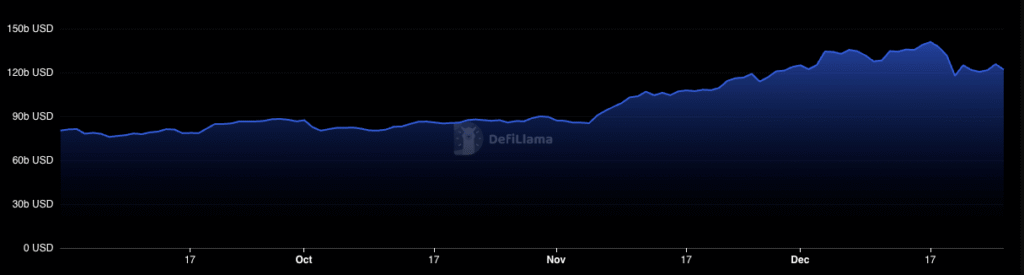

Stablecoins are also the primary gateway for decentralized finance (DeFi). Unlike volatile cryptocurrencies, they serve as the trusted unit of account in lending, liquidity pools, and trading platforms. More than 70% of DeFi total value locked (TVL) involves stablecoins, underscoring their role as the trust anchor of the decentralized economy. They are equally crucial in lowering barriers for users and enterprises entering Web3 from onboarding first-time users to enabling microtransactions that traditional rails cannot support, as we discussed in Stablecoins as the Foundation for Web3 Onboarding and Microtransactions

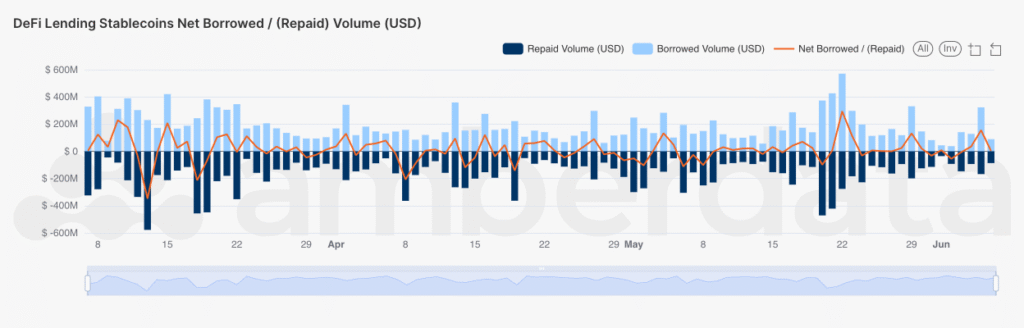

Stablecoin lending and repayment volumes in DeFi (Source: Amberdata).

For enterprises, stablecoins are more than a trading tool. They represent a bridge into DeFi’s programmable liquidity enabling corporate treasuries to earn yield, access instant credit lines, or use tokenized assets as collateral. This makes stablecoins the natural on/off-ramp for institutions experimenting with blockchain-based capital markets while limiting exposure to price volatility.

The adoption curve is accelerating. In 2024, on-chain lending platforms recorded over $50 billion in stablecoin-based loans, reflecting how businesses and investors increasingly view stablecoins as the entry point to DeFi rather than speculative crypto assets.

DeFi total value locked growth with stablecoins (Source: DeFiLlama).

Institutional DeFi Lending: A European asset management firm tested stablecoin lending on Aave to finance short-term liquidity needs. By depositing USDC, the firm accessed variable-rate credit in under 10 minutes compared to days of processing with traditional credit facilities. With integrated risk controls and real-time monitoring, the firm reported both higher speed and lower operational costs versus its legacy short-term financing options.

Stablecoins thus serve as the gateway that connects traditional finance to DeFi. They transform decentralized markets from experimental sandboxes into usable, liquid infrastructure for enterprises seeking programmable, efficient capital solutions.

CBDC vs Stablecoin: Competition or Complementary Layers?

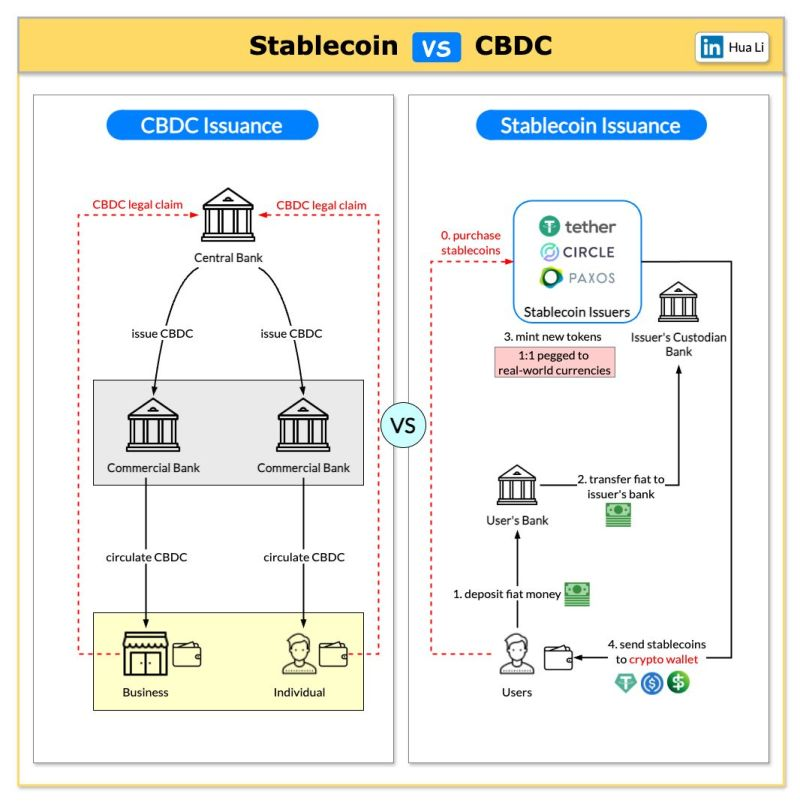

The emergence of central bank digital currencies (CBDCs) raises a critical question: will they replace stablecoins or exist alongside them? While both are forms of digital money, their design philosophies and adoption paths differ sharply.

CBDCs provide regulatory certainty, systemic backing, and integration into national payment systems. Stablecoins, in contrast, deliver market-driven innovation, faster adoption cycles, and cross-platform flexibility across DeFi and fintech ecosystems. Rather than head-to-head competition, the most likely outcome is a layered coexistence: CBDCs dominate wholesale banking and interbank settlement, while stablecoins lead in cross-border commerce, fintech innovation, and DeFi integration.

Global experiments already suggest this dual-track model. The Bank for International Settlements reported that by mid-2024, more than 60 central banks were exploring CBDCs, but adoption remains limited compared to stablecoins, which already settle billions of dollars daily across multiple chains.

CBDC issuance flows through central banks, while stablecoin issuance leverages custodial banks and wallets (Source)

Project Ubin vs. Stablecoin Pilots in Singapore: Singapore’s Project Ubin tested wholesale CBDC settlement for interbank transfers, showing efficiency gains in clearing and compliance. In parallel, local fintechs piloted USDC and XSGD for retail and B2B payments, achieving real-time settlement in commercial use cases. Together, these trials demonstrate that CBDCs and stablecoins can function as complementary layers: one ensuring systemic stability, the other driving market-level adoption.

In this landscape, enterprises need infrastructure that can integrate both rails, ensuring they are prepared whether capital flows through CBDCs, stablecoins, or a hybrid of the two.

Building Stablecoin Payment Rails

Stablecoins are no longer just digital assets, they are becoming the backbone of global financial infrastructure. To capture this potential, enterprises need more than market access: they require payment rails and settlement systems that are secure, scalable, and designed for real-world operations.

At Twendee Labs, we build exactly these foundations. With a team of blockchain and AI experts, we focus on developing:

- Stablecoin Payment Rails: Enabling financial institutions and fintechs to transfer funds across borders in real time, at lower cost and with greater transparency than traditional networks.

- B2B Settlement Systems: Helping enterprises, banks, and financial platforms process high-volume transactions in trade and supply chains quickly, securely, and in full compliance.

- TradFi–DeFi Connectivity: Designing infrastructure bridges that allow businesses to tap into DeFi while maintaining security and regulatory standards.

With this approach, Twendee Labs not only provides technology but also partners with enterprises to redefine the future of global payment infrastructure.

Conclusion

Stablecoins have crossed the threshold from niche crypto instruments into core infrastructure for global finance. They are streamlining cross-border transfers, accelerating B2B settlements, anchoring DeFi liquidity, and evolving alongside CBDCs to shape a hybrid financial future. What was once an experiment is now a foundation programmable, transparent, and always-on.

Enterprises that embrace this shift will not only gain efficiency but also secure a strategic edge in the digital economy. At Twendee Labs, we stand ready to help financial institutions, fintechs, and enterprises build stablecoin payment rails and settlement systems that are secure, compliant, and built to scale. Together, we can redefine how value moves across borders and industries.👉 Discover how Twendee Labs helps leading firms implement stablecoin infrastructure, and stay connected with us via X and LinkedIn.