In today’s fast-evolving financial landscape, RWA tokenization – the process of turning real-world assets into blockchain-based digital tokens is not just another blockchain trend. It is a game-changing innovation that is reshaping how global capital flows, who gets to invest and what kinds of assets are accessible to whom.

From fractional ownership to global accessibility, RWA tokenization is systematically unlocking entirely new investment channels. Understanding how this transformation is happening is essential to navigating and capitalizing on the next phase of blockchain finance.

The Problem with Traditional Investment Channels

Before we understand how RWA tokenization creates new opportunities, let’s clarify the limitations of current investment infrastructures:

- Illiquidity: Assets like real estate, fine art, or private equity are notoriously hard to trade. Transactions are slow, opaque, and burdened with legal friction.

- Geographic Barriers: Cross-border investments are complex due to regulatory discrepancies, custodial trust issues, and high fees.

- High Entry Thresholds: Many lucrative assets are available only to institutional investors or high-net-worth individuals.

- Lack of Transparency: Paper-based processes and intermediaries reduce trust and increase the cost of auditing and compliance.

These pain points result in massive underutilization of capital and leave many asset classes out of reach for global investors.

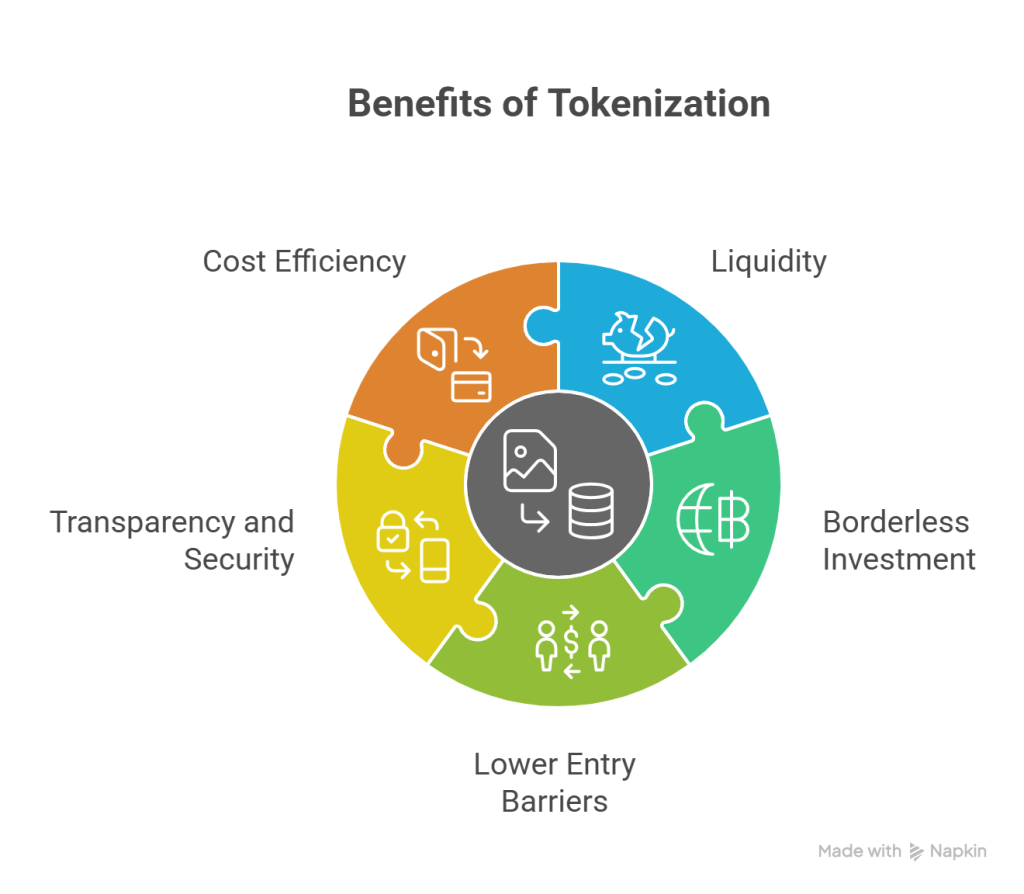

Benefits of Tokenization (Source: Digital Currency Traders)

RWA Tokenization: The Technology Shift

RWA tokenization addresses these structural problems by using blockchain to represent ownership rights of physical or off-chain assets as digital tokens. These tokens are programmable, transferable, and verifiable in real-time fundamentally changing how assets are managed and traded.

Here’s how it works:

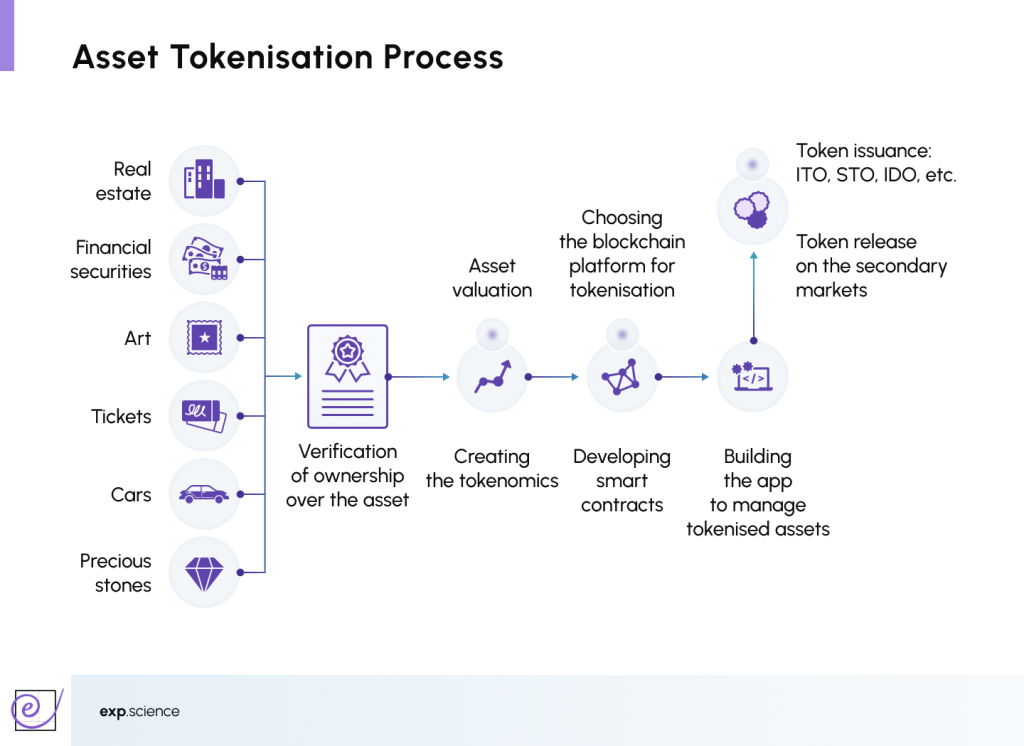

1. Asset Identification & Legal Structuring

– The real-world asset (e.g., real estate, corporate bond, or luxury item) is registered within a legal wrapper — typically a Special Purpose Vehicle (SPV).

– The SPV issues tokenized representations of the asset, which confer enforceable ownership or profit-sharing rights.

2. Blockchain Token Minting

– Smart contracts are used to mint a fixed supply of tokens, representing partial or full ownership.

– Tokens can include compliance logic, such as restricting transfers to verified investors.

RWA Tokenization Could Be the Biggest FinTech Shift of the Decade (Source: Digital Currency Traders)

3. Distribution & Trading

– Tokens are offered through regulated platforms or decentralized exchanges.

– Investors around the world can purchase them using fiat or cryptocurrencies.

4. Ongoing Management

– Revenue (e.g. rent, dividends) is distributed to token holders automatically.

– Secondary trading markets allow users to buy/sell tokens for liquidity.

This framework turns previously static and illiquid assets into dynamic instruments within the compliance DeFi ecosystem.

How RWA Tokenization Creates New Investment Channels

Let’s now break down exactly how tokenization expands access and builds new pipelines for capital:

1. Democratizing Access Through Fractional Ownership

Traditionally, a luxury apartment in Tokyo or a Warhol painting in New York could only be owned by a handful of wealthy investors. Fractional ownership via tokenization breaks these assets into affordable digital shares.

- An investor in Vietnam can now own 0.01% of a London commercial property.

- Institutions can diversify into fine art or private credit using smart contracts to manage risk and payouts.

This unlocks new capital from previously excluded retail or mid-tier investors, increasing overall demand and liquidity.

2. Liquidity Where It Didn’t Exist

Through on-chain trading and interoperability with DeFi protocols, RWA tokens offer liquidity to traditionally illiquid markets.

- Token holders can sell shares 24/7 on compatible marketplaces.

- Programmable lending (e.g. using a tokenized bond as collateral) increases utility.

As a result, assets that once required long holding periods now become part of a liquid, tradable investment universe.

3. Borderless Investment Participation

Global asset exposure is no longer gated by geographic or political constraints.

- Compliance-embedded tokens ensure cross-jurisdictional legality.

- Investors in emerging markets can access yield-generating assets in G7 economies without going through legacy banks or brokers.

This blockchain finance model builds inclusive access for both developed and frontier capital.

4. Built-In Compliance Reduces Friction

A major blocker in traditional investing is the burden of compliance: KYC/AML, investor accreditation, tax reporting, etc. In tokenized ecosystems, these are baked into the protocol:

- Smart contracts enforce transfer restrictions, holding limits, and identity checks.

- On-chain auditability reduces reliance on manual back-office processing.

Asset Tokenisation Process (Source: Exponential Science)

This makes it feasible to scale offerings to a global audience while staying within legal boundaries — a true compliance DeFi architecture.

Real-World Examples of RWA Tokenization in Action

Tokenization is not hypothetical. Leading platforms are already live with working use cases:

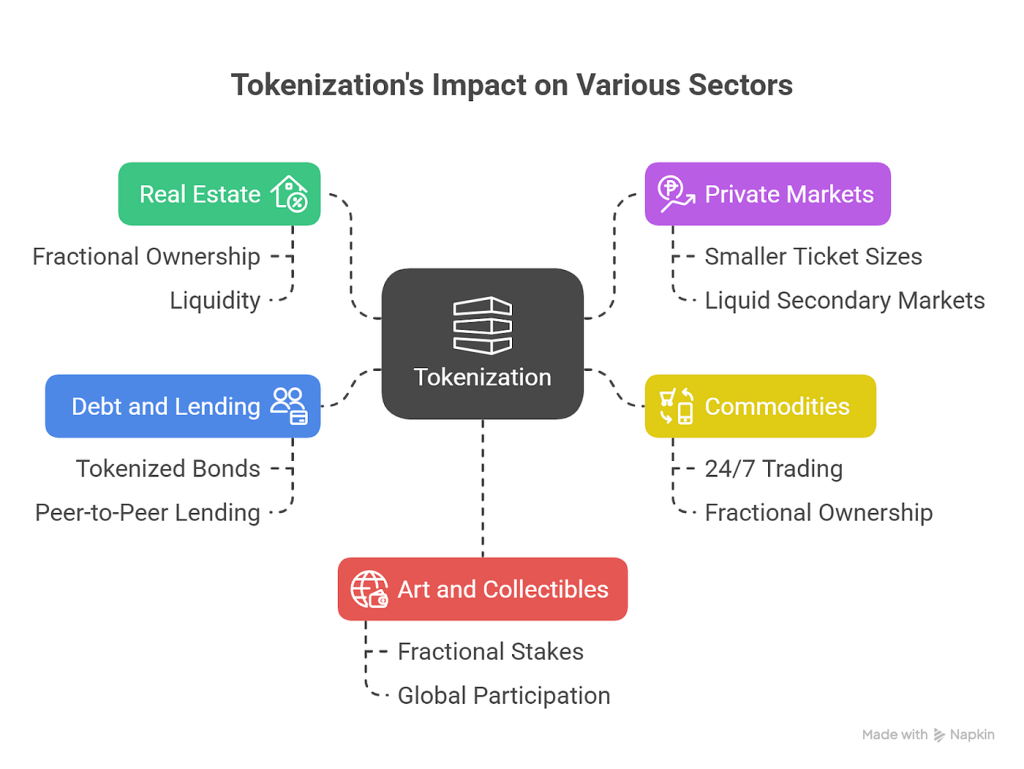

- Real Estate: Companies like RealT and Tangible tokenize physical rental properties in cities like Detroit and Manchester.

- Fine Art: Platforms such as Masterworks issue tokens representing fractional ownership in million-dollar paintings.

- Private Credit: Protocols like Goldfinch and Maple Finance enable global lending through tokenized loan portfolios.

- Government Bonds: Projects like Project Guardian (by MAS Singapore) explore sovereign bond tokenization on public blockchains.

Each of these examples showcases new channels of participation, liquidity and investor profiles, from everyday users to institutional capital allocators.

Conclusion

RWA tokenization is infrastructure. It is the bridge between traditional value and the programmable, open future of blockchain finance.

By enabling fractional ownership, real-time liquidity, borderless participation and compliance-first DeFi, tokenized real-world assets are creating investment channels that never existed before.

At Twendee, we help you build that bridge: securely, scalably and in full alignment with global regulations.

👉 Ready to transform your real-world assets into compliant digital investments?

Contact us: Twitter & LinkedIn Page

Read latest blog: How to Build a Compliant Stablecoin Payment System