DeFi’s largest failures rarely come from inaccurate price feeds. They come from a deeper structural issue: protocols relying on a single datapoint to evaluate a multi-dimensional risk environment. Liquidity erosion, execution delays, volatility surges, and cross-protocol contagion often build silently long before a price oracle signals danger. As Web3 moves into institutional lending, RWAs, and more complex collateral models, applications need a data layer that interprets market stability not just market value.

Risk oracles meet this requirement by incorporating liquidity depth, volatility patterns, execution behavior, and real-world indicators into the on-chain decision-making process. They allow smart contracts to respond to changing conditions with higher precision.

Why Price-Only Oracles Fail to Capture Real DeFi Risk

Most DeFi systems still depend heavily on price feeds to judge whether collateral is safe. But a price feed is just a surface-level signal. It cannot reflect how liquidity behaves under stress, how volatility accelerates within seconds, or how execution paths become congested when liquidations spike. The true risk lies in the conditions behind the price not the price itself.

A major limitation is that price does not equal executable value. OECD analyzed over 50,000 liquidation events across Aave, Compound, and Maker, showing that market depth often collapses before prices move. In that moment, a token that appears stable on-chain may already be several percentage points lower in real execution. Price feeds cannot detect thinning liquidity, slippage curves, or fragmented depth across venues.

This issue becomes even more dangerous during fast volatility cycles. With typical DeFi leverage ranging from 1.4x to 1.9x (BIS), even a small 2–3% price movement can flip a position from healthy to underwater within seconds. Oracle updates, no matter how secure or frequent, cannot keep up with rapid micro-movements in stressed markets. The protocol ends up reacting to outdated information.

Another blind spot is manipulation. Price feeds read the final value but cannot see how that value was produced. This enables attackers to exploit shallow liquidity or timing delays to distort the oracle.

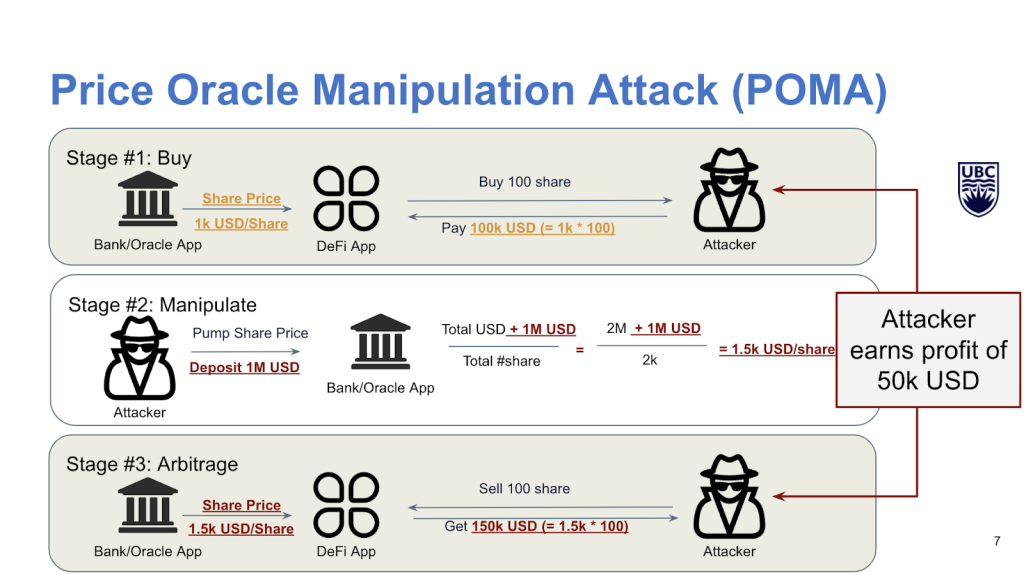

Price oracle manipulation attack diagram showing how an attacker inflates price, exploits oracle timing, and arbitrages the difference. (Source: UBC)

The diagram shows a typical pattern: an attacker buys assets, pushes the price up using a concentrated deposit, waits for the oracle to read the inflated value, and sells at the artificial price. The protocol sees a “valid” price, but the underlying conditions are distorted. Price feeds have no visibility into liquidity quality or manipulation pressure, they only report the result.

Execution friction adds more risk. OECD reports that around 60% of all liquidations are handled by a small group of liquidators. During stress, queues form, collateral is dumped into thinner liquidity, and losses grow even when oracle prices appear accurate. Price feeds cannot detect solver congestion or queue buildup.

Finally, DeFi is deeply interconnected. A collateral asset may support lending positions, LP tokens, derivatives, and RWA structures across multiple protocols. A minor change in one market can create downstream pressure elsewhere. Price alone cannot show:

- How much collateral is reused

- Which protocols depend on each other

- Where a cascade may start

These are systemic conditions that price-only feeds cannot express.

Because of these limitations, builders including teams supported by Twendee increasingly combine price feeds with liquidity depth metrics, volatility indicators, and cross-protocol exposure modeling. DeFi infrastructure now demands visibility into conditions, not just numbers, and this is where risk oracles become foundational.

How Liquidation Risk Builds Up Beyond What Price Oracles Can Detect

Liquidation failures almost never come from bad price data. They come from the conditions around the price — liquidity erosion, volatility shocks, execution congestion, and cross-protocol exposure. These risks accumulate long before the oracle reports anything unusual. Below are the four mechanisms that make liquidation risk fundamentally invisible to price-only feeds.

1. Liquidity Disappears Before Prices Move

Liquidity deterioration is often the earliest and most important warning signal in DeFi and it happens silently, long before the oracle shows any meaningful price change. OECD’s analysis of more than 50,000 liquidation events across Aave, Compound, and Maker highlights the same pattern: markets lose depth first, and only afterward do prices react.

In real market stress, orderbooks thin out, liquidity fragments across exchanges, LPs withdraw capital, and AMM depth collapses. The token may still appear stable at $50 on the oracle, but its executable value in live markets may have already dropped to $46–47 due to slippage and thin liquidity. This gap is invisible to price-only feeds, yet it directly determines whether a borrower stays safe or falls into liquidation.

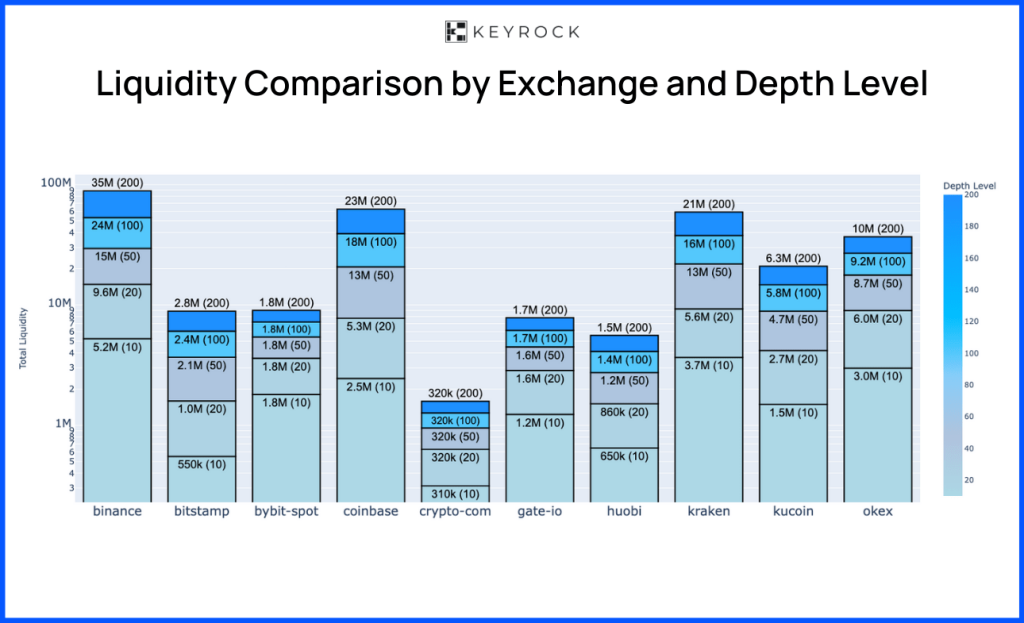

Liquidity comparison across major exchanges showing uneven depth levels that lead to execution gaps. (Source: Keyrock)

The visual above shows how liquidity varies dramatically across major exchanges even during normal market conditions. Depth at 10, 50, or 100 bps is not uniform; some venues offer tens of millions in depth while others offer only a fraction of that. During stress, these differences widen quickly. A protocol relying solely on a price feed cannot see that its collateral will execute through a venue with shallow depth, high slippage, or fragmented liquidity.

This is why most liquidation losses begin before any price movement appears in the oracle. The protocol evaluates collateral based on a clean number, while the underlying market structure has already deteriorated. Modern risk oracles integrate depth snapshots, slippage curves, and multi-venue liquidity data exactly to prevent this mismatch from turning into bad debt.

2. Execution Price Diverges From the Oracle Price

Even when a price oracle is technically accurate, it rarely reflects the execution price that liquidation engines actually receive. During fast market swings, the difference between “quoted price” and “real fill price” can explode within minutes, especially on venues with low depth or fragmented liquidity.

This divergence is a core reason why protocols accumulate bad debt. A borrower might appear safe according to the oracle, but the execution engine encounters a completely different market when trying to liquidate collateral. Slippage becomes the silent killer.

To illustrate this dynamic, look at the spike in intraday trading activity below.

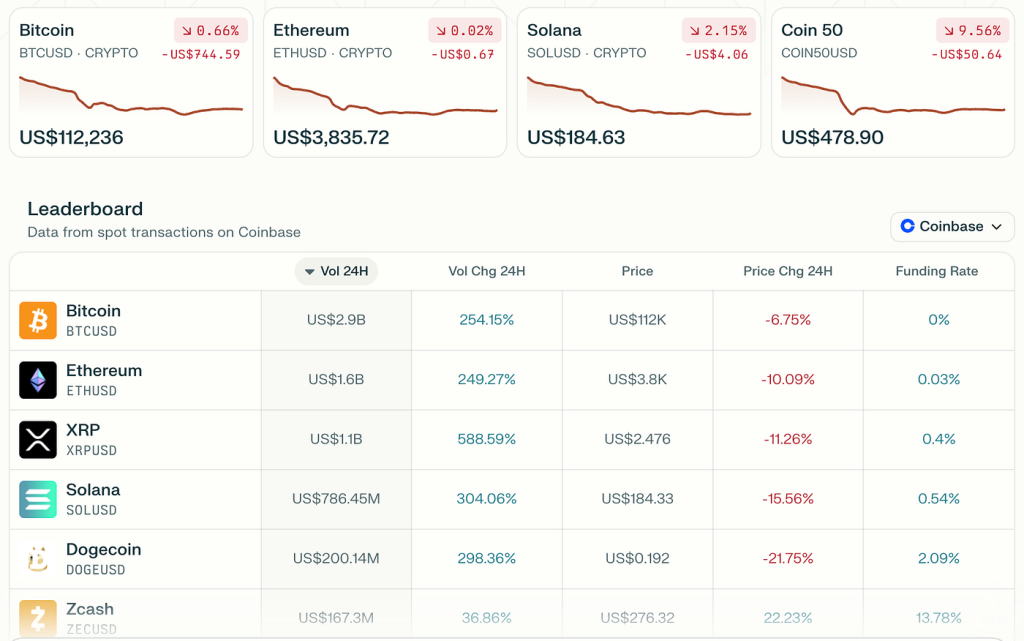

Sharp 24H trading volume increases during market stress across major crypto assets. (Source: Coinbase)

When 24-hour volumes jump 254 percent on Bitcoin or nearly 600 percent on XRP, oracle prices still look stable. But real execution conditions deteriorate instantly: spreads widen, depth collapses, and liquidation proceeds fall below what the protocol expects.

This dynamic becomes even clearer when examining how liquidity structure affects real execution quality. In practice, sustainable execution depends on how liquidity providers supply depth across venues something price-only feeds completely miss. A deeper breakdown of this behavior is explored in Twendee Labs’s analysis of token liquidity engineering.

Risk oracles integrate the data that price feeds ignore:

- Multi-venue slippage curves

- Real execution-adjusted pricing

- Depth snapshots at different bps levels

Twendee incorporates these models directly into risk engines and liquidation frameworks so protocols can evaluate collateral using market conditions they can realistically execute against, not simply the oracle’s headline price.

3. Liquidity Cascades Amplify Liquidation Risk

The most severe DeFi losses do not happen because the price dropped. They happen because liquidity collapses faster than oracles can update, turning a manageable correction into a liquidation cascade.

During market-wide stress, liquidity providers pull funds, market makers reduce inventory, and orderbooks thin out across every venue simultaneously. This chain reaction pushes execution prices far below oracle values, forcing protocols into mass liquidations that create even more slippage.

The chart below shows exactly how quickly conditions can spiral.

Crypto market liquidation cascade reaching $19.5B in 24 hours. (Source: Coinglass)

Liquidations hitting 19.5 billion dollars in one day nine times the previous record was not simply a consequence of price volatility. It was the result of liquidity vanishing across centralized exchanges and AMMs simultaneously. Oracle prices updated, but not fast enough to reflect execution reality, causing protocols to sell collateral into a thinning market and accumulate unprecedented bad debt.

Risk oracles solve this by continuously measuring:

- Depth deterioration across multiple exchanges

- Correlation-driven liquidity withdrawals

- Rising slippage curves during volatility spikes

- Execution price divergence at different trade sizes

Twendee Labs implements these models inside oracle infrastructure and collateral monitoring pipelines, enabling protocols to detect structural liquidity stress early instead of reacting after the cascade has already begun.

Conclusion

Price feeds solved the first problem of DeFi, but they were never designed to show how risk actually forms. Liquidation losses emerge long before a price moves: when liquidity thins, when execution spreads widen, when correlated assets start moving together, and when volatility accelerates faster than oracles can refresh. Risk oracles close this visibility gap by tracking the market conditions that truly matter for solvency. Protocols that adopt them early reduce bad debt, withstand stress cycles, and operate with a level of resilience that price-only systems cannot match.

Discover how Twendee Labs strengthens Web3 teams with real-world data modeling, depth-aware oracle integration, and secure market infrastructure through twendeelabs.com, and stay connected with us on X and LinkedIn.