Stablecoin adoption is rapidly transforming the crypto landscape, signaling a shift from speculative token launches to building real-world payment infrastructure. In 2024 alone, stablecoins facilitated over $27.6 trillion in transactions surpassing the combined volume of Visa and Mastercard that year.

Meanwhile, most new crypto tokens have struggled to retain value; roughly 85% of tokens launched in 2025 are trading below their initial valuations, with a median drop of over 70%. This contrast highlights a pivotal trend: the market’s focus is moving away from hyped new coins toward the practical utility of stablecoins.

The Rise of Stablecoin Adoption

The numbers underscore how stablecoin adoption is accelerating worldwide. The total supply of major stablecoins in circulation has exploded from just a few billion dollars a few years ago to over $200 billion today. In fact, by September 2025 the stablecoin market capitalization reached $300 billion, up 75% from the year prior. This growth reflects surging demand for stablecoins as a trusted medium of exchange. Stablecoins now account for roughly 30% of all on-chain crypto transaction volume, recording their highest volumes on record in 2025. Analysts estimate stablecoin transactions totaled $18+ trillion in 2024, a 140% year-over-year increase, and could reach $100 trillion within five years as adoption broadens.

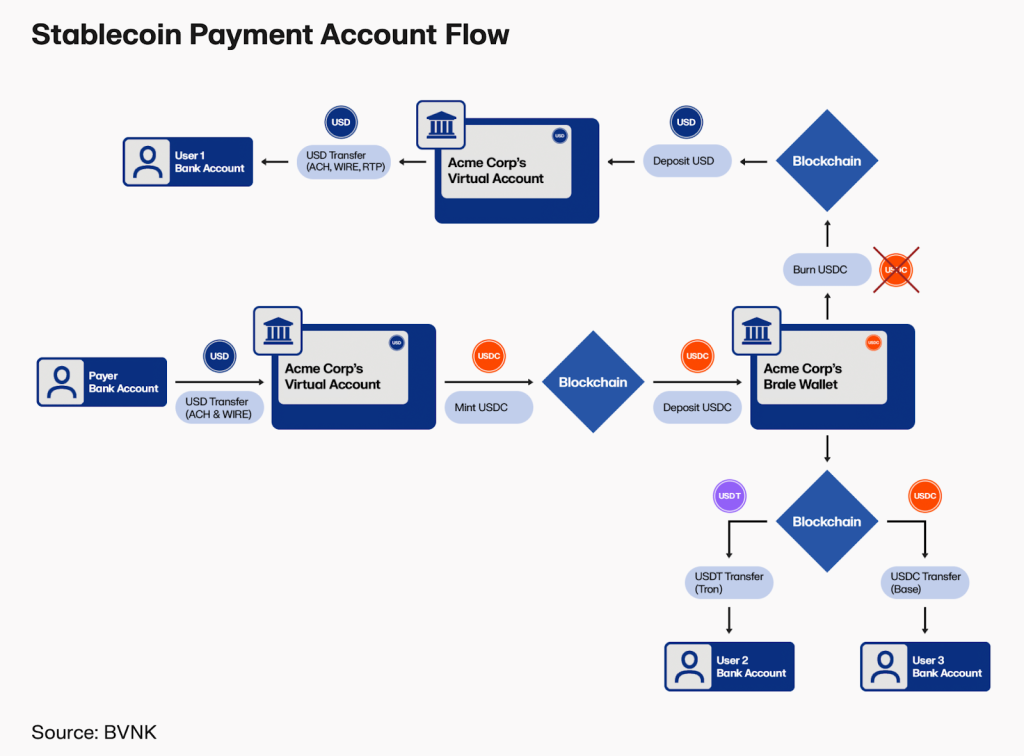

Stablecoin payment flow connecting bank accounts with on-chain settlement (Source: BVNK)

Some key indicators of this trend include:

- Massive Transaction Volumes: Stablecoins handled trillions in on-chain payments in 2024, even outpacing major payment networks by processing more volume than Visa and Mastercard combined. This points to real usage at a scale unimaginable for most individual altcoins.

- Global Usage & Liquidity: By mid-2025, stablecoins had facilitated over $4 trillion in transactions for the year (an 83% jump over 2024). They’ve become deeply liquid and globally traded, providing a dependable base currency across crypto markets and DeFi platforms.

- Growing Market Share: The stablecoin sector’s expansion has made it one of the fastest-growing segments in crypto. Over the past five years, stablecoin supply has grown more than 30-fold, vastly outpacing the growth of speculative tokens. This reflects users gravitating to assets that hold their value and can be readily transacted.

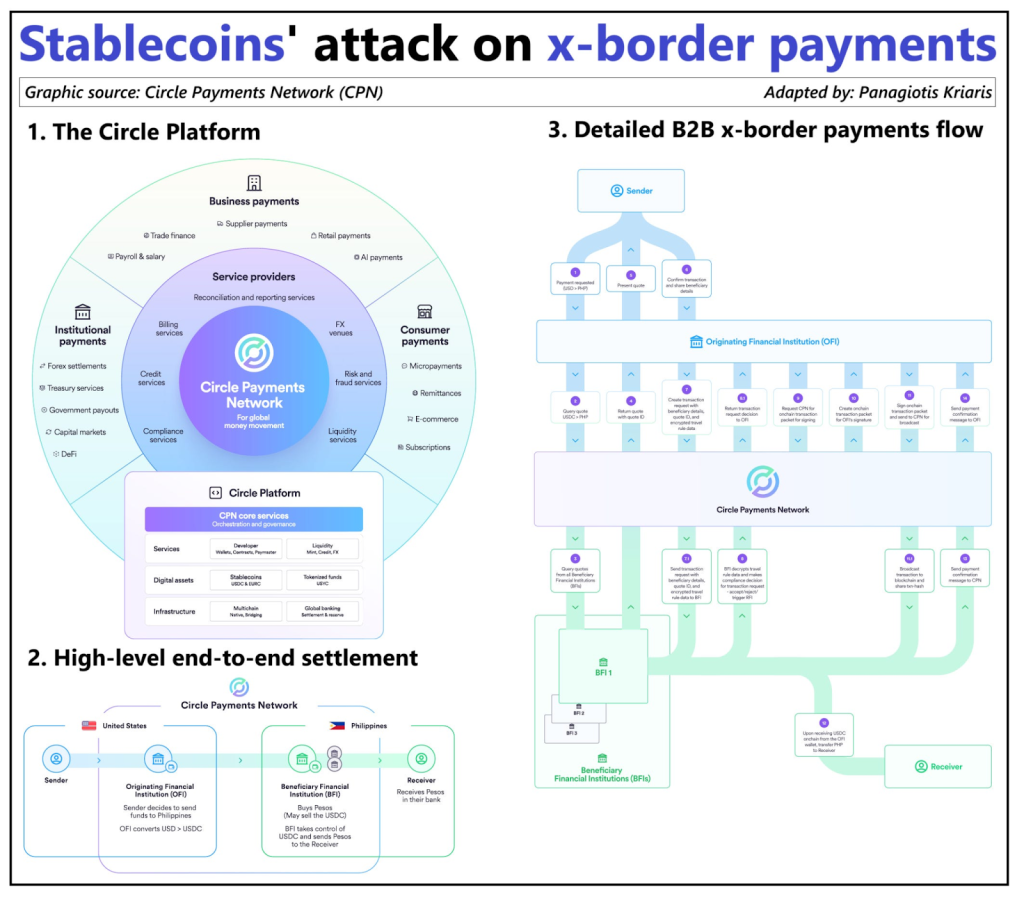

- Institutional and Retail Adoption: What began as a tool for crypto traders has gone mainstream. Multinational companies, fintechs, and even banks are now using stablecoins for 24/7 cross-border payments and treasury operations. In early 2025, for example, Stripe (a major payments company) acquired a stablecoin startup for $1+ billion, underscoring the confidence in stablecoin-based payments. Visa and Mastercard have also built stablecoin capabilities (enabling card payments funded by stablecoins), and several large banks have announced plans to issue their own stablecoins pending regulatory clarity. This level of institutional uptake is seldom seen with newly minted altcoins.

Notably, stablecoins are gaining particular traction in regions where traditional finance falls short. In emerging markets, businesses and individuals turn to dollar-pegged stablecoins as a safe haven against currency instability and a faster way to move money. Turkey alone processed over $63 billion in cross-border stablecoin payments in 2024, with countries like Argentina and Nigeria also seeing sharp growth in usage. For users facing high inflation or limited banking access, stablecoins offer a stable store of value and a gateway to global commerce in a way new volatile tokens cannot match.

Stablecoins vs. New Tokens: Key Advantages

Why are stablecoins eclipsing new tokens in importance? The answer lies in fundamental advantages that stablecoins offer as a form of digital cash, especially for payments and settlements, which most freshly minted tokens lack. Below are the key reasons stablecoins matter more than speculative tokens:

- Price Stability and Trust: Stablecoins are designed to hold stable value (often 1:1 to a reserve currency like USD). Users and businesses can transact with confidence that a stablecoin today will be worth the same tomorrow. This stability makes them a reliable medium of exchange and store of value, unlike new tokens prone to wild price swings. By avoiding volatility, stablecoins engender greater trust for everyday transactions – a merchant or developer is far more willing to accept USDC or USDT (pegged to $1) than an unproven token that could lose half its value in a week. In short, stability unlocks utility.

- Deep Liquidity & Adoption: Stablecoins enjoy widespread adoption and liquidity across virtually every major exchange and blockchain ecosystem. They have become the base trading pair and unit of account in much of the crypto economy. With a combined float in the hundreds of billions and trillions in annual transaction volume, stablecoins offer liquidity on a global scale that new project tokens simply cannot replicate. This liquidity means users can easily convert stablecoins to local currency or other assets when needed, making stablecoins far more practical for commerce and payments. A niche token by contrast might be hard to trade or spend beyond its initial hype circle.

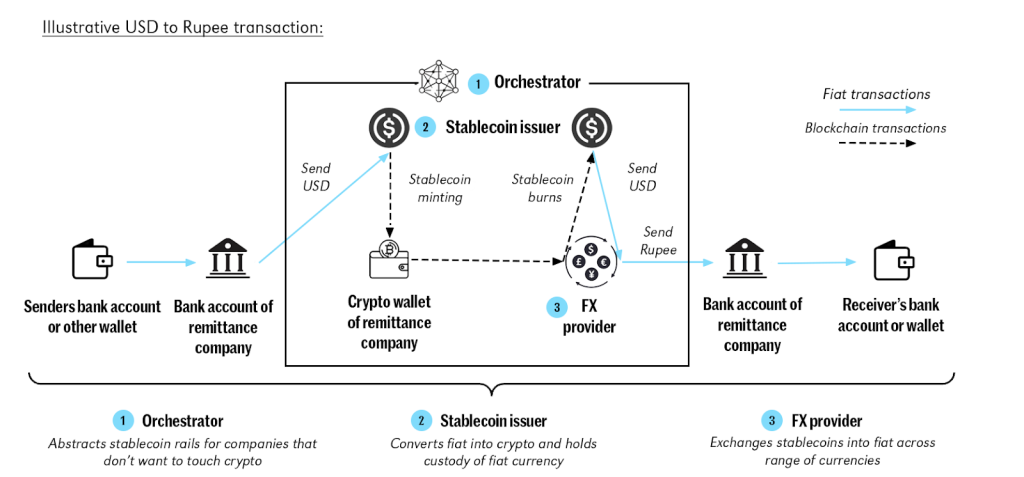

- Payment Efficiency (Speed & Cost): Transacting with stablecoins on blockchain rails is fast, frictionless, and cost-effective. Payments settle in near real-time, 24/7, without relying on slow banking networks or intermediaries. For example, sending money abroad via stablecoins can be done almost instantaneously at any time, instead of waiting days for bank wires to clear. Fees are often just pennies, regardless of amount, which is a game-changer for remittances and online commerce. Blockchain-based stablecoin payments bypass traditional intermediaries, delivering internet-speed transfers with greater transparency and finality. New tokens don’t inherently provide these advantages—indeed many ride on the very same blockchain rails where stablecoins already excel. It’s the stablecoin’s price stability that lets users realize the full benefit of on-chain payment efficiency without worrying about exchange rate risk at every transaction.

Stablecoin payments enable near-instant, low-cost global settlement (Source: Visa Crypto Reports, BVNK)

- Integration into Real-World Systems: Stablecoins are increasingly integrated with existing financial and commerce infrastructure, blurring the line between crypto and traditional finance. Major payment processors, e-commerce platforms, and even retailers are exploring stablecoin integration. Visa and Mastercard have been piloting stablecoin payment cards, and retail giants like Amazon and Walmart are looking into stablecoin technology to reduce payment costs (avoiding hefty credit card fees). Banks view stablecoins as programmable deposits and are collaborating on standards to support them. This institutional embrace means stablecoins are becoming part of the everyday fintech infrastructure – from Web3 payments in decentralized apps to point-of-sale systems – offering a level of utility new tokens rarely attain. A freshly launched token would have to achieve overwhelming network effects to get similar support, an unlikely feat in today’s crowded market.

- Real Utility vs. Speculation: Perhaps most importantly, stablecoins are created for immediate real-world use rather than as speculative investments. Their core purpose is enabling payments, transfers, and liquidity, which gives them inherent utility. We see this in practice: stablecoins serve as the backbone of cross-border crypto payments and on-chain settlements, helping businesses and individuals transact seamlessly across borders. In decentralized finance (DeFi), stablecoins are used to denominate loans, yield products, and trading pairs, effectively acting as the “cash” of the crypto economy. In contrast, many new tokens are launched on promises of future utility that may never materialize. In 2025, numerous projects issued tokens before a clear use case or demand existed, hoping that utility would follow; instead, those tokens quickly lost value once initial hype died. A token with no clear purpose beyond trading cannot sustain long-term value, as evidenced by the wave of 2025 token launches that sank shortly after debut. Stablecoins, by design, avoid this trap – their value doesn’t depend on speculative growth but on the real demand for transacting in stable value. This makes them fundamentally more resilient and broadly useful in the long run.

In short, stablecoins combine the technological benefits of crypto (speed, decentralization, global reach) with the economic stability of fiat money. New tokens might promise innovation, but unless they achieve similar real-world usage, they remain niche or speculative. Stablecoins have emerged as the workhorse of the crypto economy, while most new altcoins are struggling to find a raison d’être beyond trading buzz.

Stablecoins in Web3 Payments and On-Chain Settlement

As Web3 applications and decentralized finance continue to grow, stablecoins have become the linchpin for on-chain payments and settlements. They provide a stable medium of exchange that allows Web3 platforms to conduct business in dollars (or other fiat equivalents) directly on blockchain. This is critical for use cases like decentralized marketplaces, gaming, digital services, and more, where using a volatile token for pricing would be impractical.

For example, consider a Web3 gaming platform or NFT marketplace: pricing assets in a stablecoin like USDC means neither buyers nor sellers have to worry about crypto price swings in the middle of a transaction. Settlement happens on-chain in seconds and the value exchanged remains consistent. This on-chain settlement with stablecoins unlocks a seamless user experience more akin to traditional e-commerce, but with the added benefits of blockchain (global reach, no intermediaries, programmable money). In fact, industry leaders have noted that stablecoins and blockchain-based solutions have found product-market fit in cross-border payments, where they deliver speed, transparency and low cost that traditional methods can’t match.

Stablecoins are not only enabling peer-to-peer payments in Web3, but also transforming back-end crypto infrastructure and financial plumbing:

- Real-Time On-Chain Settlement: Transactions using stablecoins settle nearly instantly on public ledgers, providing finality and clearing 24/7. This stands in stark contrast to traditional settlement systems (which may take days and only operate during business hours). As a result, businesses can settle invoices or remittances on a Saturday or at midnight just as easily as during a weekday. Money moves at the speed of the internet, at any time, with minimal cost, fulfilling the long-touted promise of blockchain in finance. On-chain stablecoin settlement is already being used for international B2B payments and treasury management, allowing firms to rebalance funds across borders on demand.

- Programmable Payments: Because stablecoins are digital and often implemented via smart contracts, they enable programmable money scenarios that weren’t possible before. Businesses can automate complex payment flows – for instance, releasing funds from escrow when goods are delivered, or splitting a payment among multiple parties according to predefined rules – all executed transparently on-chain. This programmability is a cornerstone of Web3 payments and decentralized finance. By using stablecoins as the currency in these smart contracts, developers combine stability with automation. Stablecoins thus act as an essential building block for advanced financial applications like escrow services, decentralized exchanges, lending platforms, and asset tokenization, where predictable value is required.

- Bridge Between Crypto and Traditional Finance: Stablecoins serve as a bridge between the crypto ecosystem and traditional finance (TradFi). They are effectively digital cash that can interact with both worlds. On one side, stablecoins plug into crypto-native platforms from blockchain games to DeFi protocols – providing the unit of account and liquidity needed for these platforms to flourish. On the other side, stablecoins are increasingly being accepted or explored by traditional institutions. Banks and payment companies are integrating stablecoin support to offer faster settlements and extended services to customers. This convergence means that a user might soon seamlessly use a stablecoin to pay for a Web3 service, and the merchant can instantly convert that to fiat or hold it in treasury – all without dealing with the volatility or complexity of cryptocurrencies. The stablecoin acts as the common language between blockchains and bank ledgers.

Illustrative flow of stablecoin-based cross-border settlement converting USD to local currency via on-chain rails (Source: World Economic Forum (WEF))

All these factors position stablecoins as critical infrastructure for the emerging Web3 economy. In the words of Morgan Stanley analysts, “Stablecoins are an important building block of a new financial operating system”, offering the real-time settlement and low-cost transactions needed for a more efficient global financial network. As blockchain technology proliferates, stablecoins provide the stable currency layer that enables mainstream adoption of Web3 payments. We are already seeing glimpses of this future: from content creators being tipped in stablecoins, to decentralized apps paying out rewards or salaries in stablecoins, to supply chain platforms settling invoices on-chain. Each of these is a step toward an internet of value where money moves as seamlessly as information. And unlike launching a new token for every project, leveraging stablecoins means tapping into a trusted, liquid, and interoperable monetary standard that users worldwide are comfortable with.

Conclusion

The crypto market’s evolution is clear: the era of chasing the next “hot” token is giving way to an era of building lasting financial infrastructure. Stablecoins have proven that they can carry the torch of innovation forward by marrying the efficiency of crypto technology with the trust and stability demanded in real-world finance. They matter more than new tokens now because they solve real problems today streamlining payments, preserving value, and connecting disparate financial systems into one borderless network. In contrast, most one-off token projects have struggled to demonstrate staying power or tangible utility in this new paradigm.

Stablecoin adoption is not just a trend but a strategic shift towards utility in the Web3 era. By integrating stablecoins into your payment flows and applications, you position your organization at the forefront of this transformation. You’ll be enabling faster business, wider reach, and more resilient financial operations – advantages that will only grow as stablecoin usage becomes ubiquitous.

The time to act is now. Embrace stablecoins as a core component of your digital strategy and crypto infrastructure. By doing so, you align with a future where money is programmable, transactions are instant, and financial services become more inclusive and innovative. And as you embark on this journey, remember that you don’t have to do it alone. Twendee is ready to help turn these possibilities into reality. With the right guidance and technology in place, you can leverage stablecoins to unlock new value for your business and users – staying ahead of the curve as the world of payments and finance enters a bold new phase.In summary, stablecoins matter more than new tokens because they are the bridge between blockchain innovation and practical adoption. They are the realization of crypto’s promise in everyday life. Those who understand and utilize this will lead the next wave of growth in the digital economy. If you’re looking to be one of them, now is the time to build on this stable foundation. Let’s move forward, on-chain and empowered by stability, into the future of payments.