In the rapidly evolving landscape of decentralized finance, a new technological paradigm is emerging that promises to revolutionize how automated trading operates. AI Agents are transforming automated trading in DeFi, bringing intelligent, adaptive, and autonomous systems to a market worth over $80 billion. Going beyond rule-based bots, these next-gen solutions can learn, reason, and make independent decisions, paving the way for the next wave of DeFi innovation and efficiency.

What Are AI Agents?

AI Agents are autonomous software entities powered by artificial intelligence that can perceive their environment, make decisions, and take actions to achieve specific goals without continuous human guidance. Unlike conventional programs that simply execute predefined instructions, AI Agents possess several distinctive capabilities:

- Autonomous decision-making: They can evaluate situations and determine actions independently.

- Learning and adaptation: They improve performance over time by analyzing outcomes.

- Environment perception: They collect and process data from various sources to understand market contexts.

- Goal-oriented behavior: They work toward specific objectives, optimizing their actions accordingly.

In the Web3 context, AI Agents represent a crucial evolution beyond smart contracts. While smart contracts execute predetermined logic in an “if-this-then-that” fashion, AI Agents can dynamically respond to changing conditions, identify patterns, and make complex decisions based on multi-dimensional data inputs.

Understanding AI Agent in DeFi

AI agents are autonomous software entities designed to perform specific tasks within decentralized ecosystems.

Unlike traditional bots, AI agents actively engage with blockchain networks, smart contracts, and user accounts, often operating independently to handle complex tasks such as trading, asset management, and protocol data analysis. Many of these agents leverage large language models (LLMs), enabling them to make API calls, interact directly with blockchain environments, and process vast amounts of information without human oversight.

In DeFi, AI agents can fundamentally reshape user and protocol interactions by acting as autonomous facilitators, decision-makers, and data processors within financial applications, all without the need for constant human input.

Why AI Agents Are the “Next Wave”: What’s Different?

The transition from conventional trading bots to AI Agents represents a fundamental shift in functionality and capability. To understand the magnitude of this change, let’s take a closer look:

Traditional Trading Bots vs. AI Agents: A Strategic Shift in Trading Intelligence

Traditional trading bots operate based on predefined rules and react strictly to specific input parameters. These systems require manual intervention to adjust strategies, making them rigid and less adaptable to dynamic market conditions.

For example, if a trading bot is set to buy Bitcoin when it drops 5% in 24 hours, it will execute this rule regardless of broader market sentiment or off-chain events. Their decision-making logic is linear, limited to on-chain data (like transaction history or smart contract activity), and their performance tends to remain static over time.

In contrast, AI agents represent a transformative approach to automated trading. Rather than simply executing preset instructions, AI agents make autonomous decisions by processing a wide range of diverse data streams, including on-chain metrics and off-chain signals such as news sentiment, social media trends, macroeconomic indicators, and regulatory updates.

For instance, an AI-powered trading agent might detect negative sentiment building around a particular token across Twitter and Reddit, correlate that with increased on-chain sell pressure, and proactively adjust its strategy before a major price drop. These agents leverage complex reasoning models and machine learning to continuously learn, adapt, and optimize their trading strategies. Over time, this results in improved performance and greater resilience in volatile markets.

By bridging both quantitative data and contextual insights, AI agents provide a more holistic, adaptive, and forward-looking trading solution compared to their rule-based predecessors.

Core Capabilities That Set AI Agents Apart

1. Analyze Complex Data Patterns

Why It Matters in DeFi: DeFi’s on-chain data is vast and multidimensional liquidity pools, yield strategies, arbitrage opportunities, and flash loan dynamics interact in ways too intricate for human analysis. AI agents process these layers simultaneously, uncovering hidden correlations.

Real-World Example: Gauntlet Network uses agent-based simulations to model DeFi protocol interactions, identifying risks in platforms like Aave and Compound. Their AI detects vulnerabilities that emerge only when multiple protocols interact something traditional analytics miss.

Transformational Shift: This isn’t just faster data crunching, it’s discovering entirely new market patterns. While legacy bots track predefined metrics, AI agents spot emergent behaviors, revealing profit opportunities (or risks) at the intersection of fragmented data streams.

2. Learn From Market Behavior

Why It Matters in DeFi: DeFi evolves rapidly – new protocols, tokenomics changes, and shifting liquidity require constant adaptation. Static algorithms fail; AI agents improve continuously.

Real-World Example: Numerai’s “meta-model” crowdsources predictions from thousands of data scientists, then uses AI to synthesize the best strategies. It doesn’t just learn from price data, it evolves by absorbing how traders adapt to new conditions.

Transformational Shift: Traditional bots need manual updates. AI agents self-optimize, developing strategies no human explicitly programmed. This shifts trading from rule-based execution to evolutionary intelligence.

3. Make Real-Time Decisions Without User-Defined Rules

Why It Matters in DeFi: DeFi moves at lightning speed liquidity shifts, flash crashes, and arbitrage windows appear and vanish in seconds. Human reaction times are too slow; rigid algorithms can’t handle the unexpected.

Real-World Example: Fetch.ai’s autonomous agents dynamically route trades across DEXs based on real-time conditions not fixed rules. They improvise strategies, like a trader would, but at machine speed.

Transformational Shift: This is true autonomy not “if-then” logic. AI agents formulate original strategies in novel market conditions, acting more like trading partners than tools.

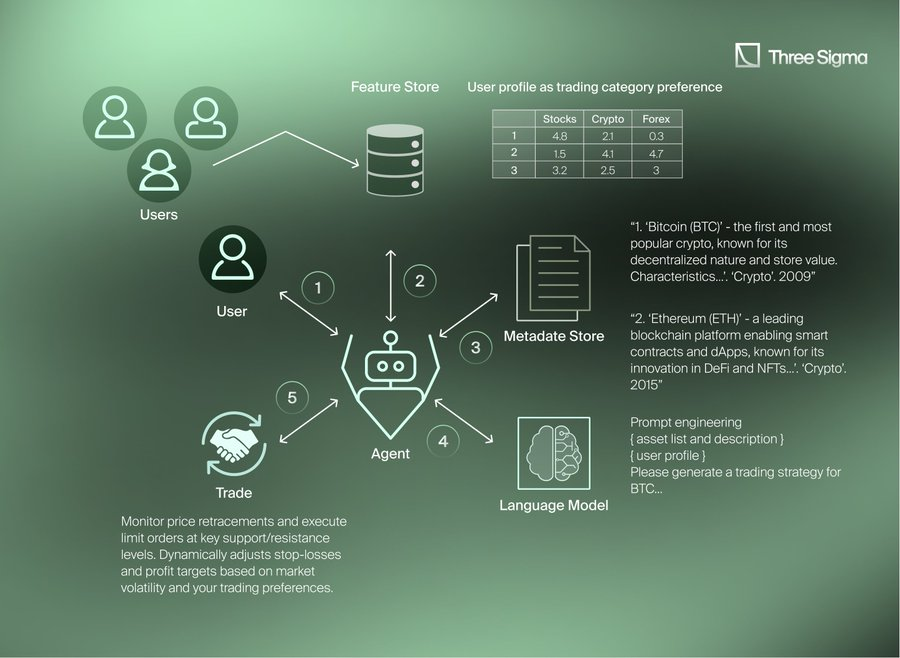

AI Agent Workflow: From User Data to Autonomous Trade Executions – source

4. Adapt to Changing Market Conditions

Why It Matters in DeFi: A governance vote, exploit, or macroeconomic shift can instantly alter DeFi’s landscape. Yesterday’s winning strategy may fail today.

Real-World Example: During Terra’s collapse, dFlow’s reinforcement learning models adapted instantly, while traditional bots kept following outdated assumptions. Its AI anticipates market shifts before they happen.

Transformational Shift: This is predictive adaptation not just reacting faster, but preparing for scenarios before they occur. AI agents move from reactive to proactive trading.

5. Integrate Diverse Information Sources

Why It Matters in DeFi: DeFi isn’t just charts and order books, it’s shaped by governance proposals, social sentiment, developer activity, and even regulatory news. AI agents fuse these signals into a coherent strategy.

Real-World Example: Enzyme Finance’s AI-powered vaults analyze GitHub commits, Twitter sentiment, and on-chain data to assess protocol health far beyond what price-based algorithms consider.

Transformational Shift: Legacy bots look at isolated data points; AI agents understand context. They see how social, technical, and economic factors converge enabling holistic trading intelligence.

Use Cases & Notable Projects

The AI Agent revolution in DeFi is already underway, with several pioneering projects developing agent-based systems:

1. Fetch.ai

Building a network of autonomous economic agents that can represent users in various DeFi activities, from trading to lending optimization.

In April 2023, Fetch.ai launched these tools to address inefficiencies in DeFi trading. The agents utilize machine learning algorithms to analyze market conditions and execute trades based on user-defined parameters, such as maximum slippage and price impact. This approach aims to improve trade execution efficiency and reduce associated fees. By enabling direct peer-to-peer interactions without relying on traditional liquidity pools, Fetch.ai’s agents help mitigate risks like liquidity contract hacks and rug pulls, which have been significant concerns in the DeFi space.

How AI Agents Manage Liquidity in DeFi: A Visual Breakdown by Fetch.ai – source

2. Autonolas

Creating infrastructure for autonomous services that enable the development of off-chain trading agents that coordinate with on-chain execution.

Autonolas’ oracles integrate off-chain data into the main blockchain, allowing for decentralized and cost-effective data aggregation. These oracles employ consensus mechanisms to ensure data validity and can implement complex aggregation functions, including machine-learning-based approaches. By enabling a network of agents to provide off-chain bridge functionalities, Autonolas enhances the robustness and availability of decentralized services, reducing reliance on centralized entities and improving the overall resilience of DeFi protocols.

3. Ocean Protocol

The secure exchange of data and algorithms to power AI Agents with high-quality market information.

Ocean Protocol’s tools allow businesses and individuals to trade tokenized data assets seamlessly, managing data throughout the AI model lifecycle. The Ocean Predictor product, for instance, achieved over $800 million in monthly volume within six months of its launch, demonstrating significant traction and utility. By democratizing access to high-quality data, Ocean Protocol empowers AI agents with the information necessary to make informed decisions, thereby enhancing the effectiveness of AI-driven strategies in DeFi and beyond.

These projects are exploring different aspects of agent-based trading, from agent coordination frameworks to specialized trading algorithms designed for specific DeFi niches.

Future Trends: AI Agents and the Rise of Intelligent DeFi

The evolution from rule-based bots to intelligent AI Agents is just the beginning. What comes next is even more transformative. As the DeFi ecosystem matures, we are seeing the rise of a new paradigm agent-driven infrastructure, where autonomous AI systems don’t just execute trades, but shape entire financial strategies.

A few key trends highlight this upcoming wave:

1. Multi-Agent Systems (MAS)

Rather than relying on a single bot to handle everything, multi-agent frameworks allow for collaboration between specialized AI Agents. For example, one agent could analyze on-chain data, another could interpret off-chain news sentiment, and a third could manage execution and risk. Together, they form an adaptive, intelligent network capable of real-time decisions in volatile markets.

Example: An AI agent swarm that monitors liquidity across multiple DEXs like Uniswap and Balancer, executing trades only when optimal slippage and MEV resistance are ensured.

2. Agent Composability

Just as DeFi protocols are composable like Lego blocks, future AI Agents will be modular and programmable, allowing users to build custom strategies without coding. Think of it as a no-code AI strategy builder, where each agent acts as a plugin to a larger automation flow.

Insight: Platforms like Autonolas are already working on frameworks to make agents interoperable across Web3 use cases, not just trading.

3. Decentralized Agent Marketplaces

Emerging agent ecosystems like Fetch.ai, Morpheus Network, or SuperAGI are paving the way for AI agent marketplaces, where developers can publish agents, users can rent or subscribe to them, and DAOs can integrate them into treasury or strategy operations.

4. Governance Participation by AI Agents

As AI Agents become more sophisticated, they could begin playing an active role in DAO governance simulating proposal outcomes, identifying risk factors, or even initiating proposals backed by data models. This marks the arrival of machine reasoning in decentralized decision-making.

Want to learn how AI is already transforming business operations beyond DeFi? Check out our blog on AI-Powered Automation Tools: How They Revolutionize Business Workflows.

Conclusion

AI Agents aren’t just an upgrade to existing DeFi bots, they mark a true paradigm shift. By embedding intelligence, adaptability, and autonomous decision-making into trading systems, these agents are transforming the very fabric of decentralized finance. The move from rule-based automation to agent-based intelligence mirrors a broader tech evolution: from tools that follow orders to systems that think. For developers, traders, and DeFi participants, this shift presents both immense opportunity and new complexity. Those who embrace this intelligent layer early will gain an edge in strategy, speed, and scale.

At Twendee Labs, we’re building at the forefront of this next wave where AI meets blockchain to create more autonomous, adaptive, and intelligent financial systems. From designing smart contract architectures to crafting autonomous agent ecosystems, we empower Web3 builders to stay ahead of the curve. The age of intelligent DeFi isn’t a distant future, it’s already here. The only question is: will you lead the wave, or be swept away by it?Visit us here: Twitter & LinkedIn

One Response

Keep on writing, great job!

https://ww9.mbahtogel.top/