KYC/AML API for crypto applications has become a cornerstone of trust and compliance in today’s blockchain and fintech industries. As regulators tighten oversight on cryptocurrency platforms and fintech services, having robust Know Your Customer (KYC) and Anti-Money Laundering (AML) processes is no longer optional, it’s mandatory for security and legal compliance.

In fact, over 40% of crypto platforms faced regulatory actions in 2023 due to insufficient KYC measures. In this post, we’ll explore why compliance is critical and compare the best KYC/AML API providers that help crypto exchanges, DeFi apps and fintech platforms verify user identities, detect fraud and meet global regulations without sacrificing user experience.

Why Compliance is Critical in Crypto and Fintech

Maintaining strong compliance isn’t just about avoiding fines, it’s about protecting your business and users. Crypto and fintech apps deal with sensitive financial transactions, making them targets for fraud, money laundering, and other illicit activities.

Here’s why investing in a reliable fintech identity verification and AML solution is so important:

- Regulatory Requirements: Governments worldwide are imposing strict KYC/AML rules on crypto businesses. For example, the U.S. Bank Secrecy Act and FATF guidelines require crypto exchanges and wallets to implement customer due diligence and report suspicious activity. Non-compliance can result in heavy penalties or even shutdowns.

- Preventing Fraud & Money Laundering: Robust KYC checks help weed out fake identities and bad actors, stopping fraudsters from misusing your platform. AML transaction monitoring can flag suspicious crypto wallet addresses or large transfers, preventing money laundering and terrorist financing through crypto.

- Building User Trust: A secure onboarding KYC API process gives legitimate users confidence. When customers know you follow strict KYC/AML, they feel safer trading or investing on your platform. This trust can be a competitive advantage in mainstream adoption of crypto. For most customers, a quick identity check is a small price for greater security.

In short, crypto compliance tools are essential for the long-term success of any blockchain or fintech app. Below we compare leading KYC/AML API providers, focusing on how they serve crypto and fintech use cases, to help you choose the right partner for identity verification and compliance.

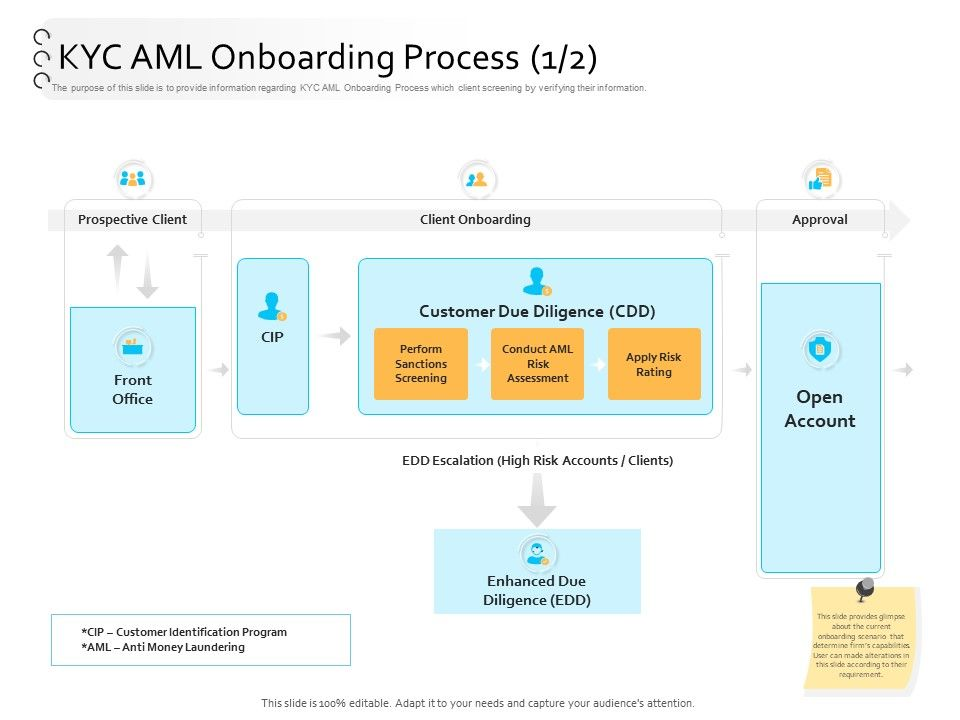

Illustration of full KYC/AML onboarding process including Customer Due Diligence and Enhanced Due Diligence for high-risk cases (Source: SlideModel / Editable KYC AML Process Slide)

Top KYC/AML API Providers for Crypto & Fintech Apps

Choosing the best KYC/AML API provider comes down to finding a solution that balances strong compliance features with seamless user experience. The following providers are among the top in the industry, known for their technical capabilities and focus on crypto/fintech:

Veriff – AI-Powered Global Identity Verification

Veriff is a popular KYC provider specializing in video-based identity verification and fraud prevention. Used by many crypto exchanges and fintech platforms, Veriff offers an AI-driven platform to verify government IDs and user selfies in real time. It boasts support for over 12,000 government identity documents across 230+ countries and territories – one of the broadest coverages in the market. Veriff’s features include automated document authenticity checks, biometric face matching, and even AML watchlist screening as part of its full-stack compliance offering.

Notable strengths of Veriff for crypto apps:

- High Scalability: Veriff is built to handle surges in onboarding volume. A case study with VALR crypto exchange noted Veriff’s ability to keep up during high-traffic signup campaigns when a previous provider lagged.

- Fraud Detection: Veriff’s system analyzes device and behavioral signals to flag potential fraud. In 2024, Veriff even introduced a “RiskScore” system that analyzes document, biometric, and device data to predict fraud risk.

- Compliance Tools: Beyond KYC, Veriff provides ongoing AML monitoring. It can perform sanction and PEP list checks during onboarding and periodically thereafter, helping fintech companies stay compliant with evolving regulations.

Overall, Veriff delivers a fast, user-friendly verification flow (often taking under a minute) with rigorous security. Pricing is typically usage-based (per verification) with enterprise plans for high volumes. Given its extensive global document support and crypto industry experience, Veriff is a strong choice to quickly verify users while meeting KYC/AML requirements.

Jumio – Established Identity Verification with AML Integration

Jumio is one of the longest-standing providers of online identity verification, trusted by banks, fintech firms, and crypto companies worldwide. Its AI-powered platform (formerly known as Netverify) has performed over 1 billion verifications to date and supports more than 5,000 ID types across 200+ countries. Jumio uses a combination of computer vision and biometrics to authenticate passports, driver’s licenses, and IDs, along with liveness detection to ensure the person is real (e.g. selfie “video selfie” checks).

Key features for crypto and fintech use cases:

- Comprehensive KYC Suite: Jumio’s end-to-end solution handles ID document capture, selfie match, and address verification, and can also screen against AML watchlists automatically. This means a user’s identity can be verified and checked against sanctions/PEPs in one flow.

- Global Coverage & Accuracy: With verifications in over 200 countries, Jumio is truly global. It supports ID documents in numerous languages and formats, using machine learning to detect forgeries (even subtle issues like hole-punched IDs or multiple document versions). This is crucial for fintech platforms serving international customers.

- Crypto Industry Adoption: Jumio has a proven track record in crypto – for example, blockchain payment provider Tevau integrated Jumio’s AI-driven identity verification (ID + selfie + liveness) in 2024 to securely onboard users and meet AML mandates. Many early crypto exchanges (like Coinbase in the past) have also used Jumio for KYC.

Jumio typically offers custom enterprise pricing, tailored to an organization’s verification volume and requirements. It often appeals to larger exchanges and financial institutions that need a robust, all-in-one KYC/AML compliance tool. With new developments (like winning awards for its AI-powered platform in 2024), Jumio remains a top-tier choice to ensure compliance and user trust in crypto apps.

Sumsub – All-in-One KYC/AML Platform Built for Crypto

Sumsub (Sum & Substance) stands out as a holistic compliance platform designed with crypto in mind. It provides identity verification and crypto-specific AML tools in one API. Sumsub supports 14,000+ ID document types across 220+ countries and territories, offering features like document OCR, selfie biometrics, and proof-of-address checks. What really differentiates Sumsub is its focus on the crypto user journey: it includes transaction monitoring, crypto wallet risk analysis, and even Travel Rule compliance for VASPs.

Notable capabilities for crypto/fintech:

- Integrated Crypto AML: In March 2024, Sumsub partnered with Chainalysis to integrate Chainalysis’s blockchain analytics into Sumsub’s platform. This means crypto businesses can not only verify user identities, but also automatically monitor cryptocurrency transactions and wallets for illicit activity within the same dashboard. Sumsub’s Transaction Monitoring and Travel Rule solutions now leverage Chainalysis data to flag risky addresses (over one billion blockchain addresses mapped) and ensure compliance with crypto AML regulations.

- Travel Rule & Ongoing Monitoring: Sumsub helps exchanges comply with the FATF Travel Rule by securely collecting and sharing sender/recipient information for crypto transfers. They even released a Travel Rule SDK for crypto apps that cut customer drop-off rates by 35% by streamlining the process. Continuous AML screening (e.g. re-checking users against sanctions lists or monitoring for fraud patterns) is built-in, which is essential as threats evolve.

- Developer-Friendly & Customizable: Sumsub offers rich workflow customization – businesses can adjust which document types or countries to accept, set risk rules, and integrate via API or SDK easily. The platform emphasizes a smooth UX with options like Non-Doc verification (verifying low-risk users via database checks in seconds, without requiring an ID upload) to reduce friction.

Sumsub’s pricing is usually tiered or usage-based, with packages suitable for startups up to enterprise. Fintech startups appreciate that they can start with pay-per-verification and later scale to volume licenses. For any crypto app needing both KYC and on-chain AML checks in one solution, Sumsub is a compelling choice. Their recent partnerships (with Chainalysis, Elliptic, etc.) show a commitment to being the one-stop compliance tool for the crypto industry.

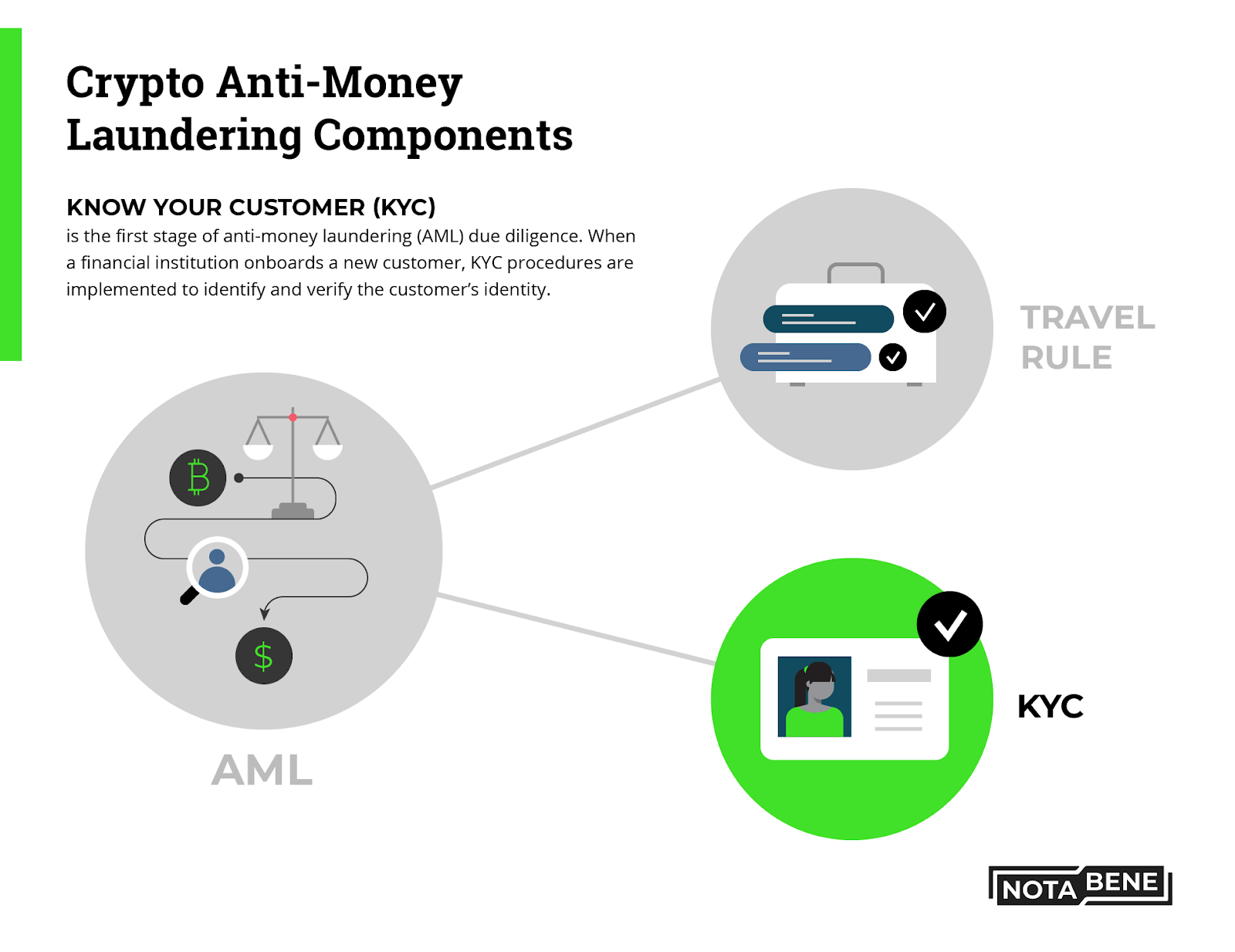

Key components of crypto anti-money laundering: identity verification (KYC), transaction monitoring (AML), and compliance with Travel Rule regulations (Source: Nota Bene / Crypto AML Components Visual)

Persona – Customizable Identity Verification for Fintech Apps

Persona has emerged as a leading KYC/AML provider known for its flexibility and user experience. Unlike one-size-fits-all solutions, Persona allows crypto and fintech companies to tailor verification workflows to their needs. Its platform can verify users and businesses instantly to meet global KYC, KYB, and AML standards. Persona supports a wide range of verification methods – government IDs, selfies (with liveness), database checks, email/phone risk checks – which businesses can mix and match via a drag-and-drop flow designer.

Why Persona resonates for crypto/fintech use cases:

- User Experience & Conversion: Persona puts heavy emphasis on UX. It provides a sleek, multi-language verification interface that guides users through each step, leading to higher completion rates. One crypto exchange doubled its customer conversion rate after switching to Persona’s smoother verification flow. Features like smart autofill, 20+ language support, and real-time feedback help onboarding happen in minutes instead of days.

- Custom Workflows & Risk-Based Checks: Crypto platforms often have varied needs – e.g. higher KYC tiers for large traders or different checks for retail vs. institutional clients. Persona excels here: you can set up multiple verification flows for different user types or trigger extra steps (like a source-of-funds check) for higher-risk scenarios. This flexibility lets companies balance conversion and risk, applying tougher checks only when needed.

- Integrated Watchlist Screening: Persona’s API includes running users against global watchlists, sanctions, politically exposed persons (PEP), and adverse media sources as part of the verification process. Compliance teams can review any flagged reports in Persona’s case management dashboard. Essentially, it combines identity proofing with AML due diligence in one platform – useful for fintechs that want a simple onboarding KYC API with all compliance boxes checked.

Persona offers a cloud-based SaaS platform with transparent pricing that scales with usage. Developers appreciate its modern APIs and SDKs, and companies value the dedicated support (Persona often acts as a partner, providing shared Slack channels and close collaboration. For crypto companies prioritizing user experience and modular compliance tools, Persona is a top contender. It helps you ensure users are real and not on watchlists – all while keeping the onboarding process snappy and customizable.

Chainalysis – Crypto Transaction Monitoring & AML Compliance

Chainalysis is not an identity verifier like the others above; instead, it’s the market leader in blockchain AML analytics. For any crypto-focused business, Chainalysis tools are extremely valuable alongside a KYC provider. Chainalysis provides APIs and software to monitor cryptocurrency transactions, trace funds, and assess risk of crypto addresses in real-time. It’s used by government agencies, major exchanges, and banks in over 70 countries to ensure crypto compliance and investigate illicit activity.

Key offerings relevant to crypto platforms:

- Know-Your-Transaction (KYT): Chainalysis KYT is an API that flags risky transactions. It screens incoming and outgoing crypto transfers against typologies of money laundering, hacks, sanctions violations, darknet markets, and more. Exchanges use it to automatically block or review transactions involving addresses linked to crime or embargoed entities (e.g. OFAC-sanctioned wallets).

- Address Risk Scoring & Alerts: Chainalysis has a vast database of cryptocurrency addresses (over 1 billion addresses mapped across multiple blockchains) and labels identifying if an address is associated with illicit activities. By integrating this data, crypto businesses can get a risk score for any customer deposit or withdrawal address. If a user tries to interact with a high-risk address (say one tied to ransomware), the system can alert compliance teams or freeze the transfer – preventing money laundering before it happens.

- Investigations & Reporting: For compliance officers, Chainalysis offers investigative tools (like Chainalysis Reactor) to follow the flow of funds through the blockchain. This is useful if your platform triggers a suspicious activity report; you can dig into where funds came from or went. Chainalysis also helps with Travel Rule compliance by enriching transactions with originator/beneficiary data through partner solutions. Their system has been used to solve high-profile crypto criminal cases, bringing greater trust and transparency to the crypto economy.

Chainalysis typically operates on a subscription model, with pricing based on the number of transactions monitored, the blockchains covered, and the level of support and training required. It’s an enterprise-grade solution – smaller startups might use alternatives like Elliptic or TRM Labs – but Chainalysis is often regarded as the gold standard for crypto AML.

For any crypto exchange, wallet, or DeFi platform handling significant volume, integrating Chainalysis’s crypto compliance tools can be critical to stay on regulators’ good side. (Notably, as mentioned, Sumsub and others have formed partnerships to offer Chainalysis data within their KYC suites, underlining how central Chainalysis is in this space.)

Other Notable KYC/AML Providers

While the above are among the top choices, there are a few other notable providers worth mentioning:

- Onfido: A well-known identity verification API provider popular with fintechs. Onfido offers document and selfie verification with AI checks, and it’s used by several crypto exchanges and neobanks. It provides a mobile-friendly SDK and often partners with AML data services (like ComplyAdvantage) for sanction screening. Onfido supports verifications in ~195 countries and is recognized for its strong fraud detection and ease of integration.

- Elliptic & TRM Labs: Alongside Chainalysis, Elliptic and TRM Labs are leading crypto compliance tool providers that focus on blockchain analytics, transaction monitoring, and wallet screening. Crypto businesses sometimes use these as alternatives or complements to Chainalysis to analyze risk across cryptocurrencies.

- ComplyAdvantage & LexisNexis: These are specialized AML data providers offering extensive databases of sanctions, PEPs, and adverse media. They don’t do document verification; rather, they are often integrated into KYC workflows to automatically screen users’ names against high-risk lists (for example, some identity platforms have built-in ComplyAdvantage checks). For fintech apps that need strong AML compliance, using such data providers via API is common.

Each provider has its strengths – for instance, Trulioo (now rebranded as Sumsub in some contexts via acquisition, as Sumsub was a notable mention in 2025 reports) is known for electronic ID verification through databases worldwide, and Shufti Pro, iDenfy, IDnow and others cater to various niches or regions. Ultimately, the “best” choice depends on your specific needs (coverage, cost, crypto focus, etc.), but understanding the landscape ensures you can make an informed decision.

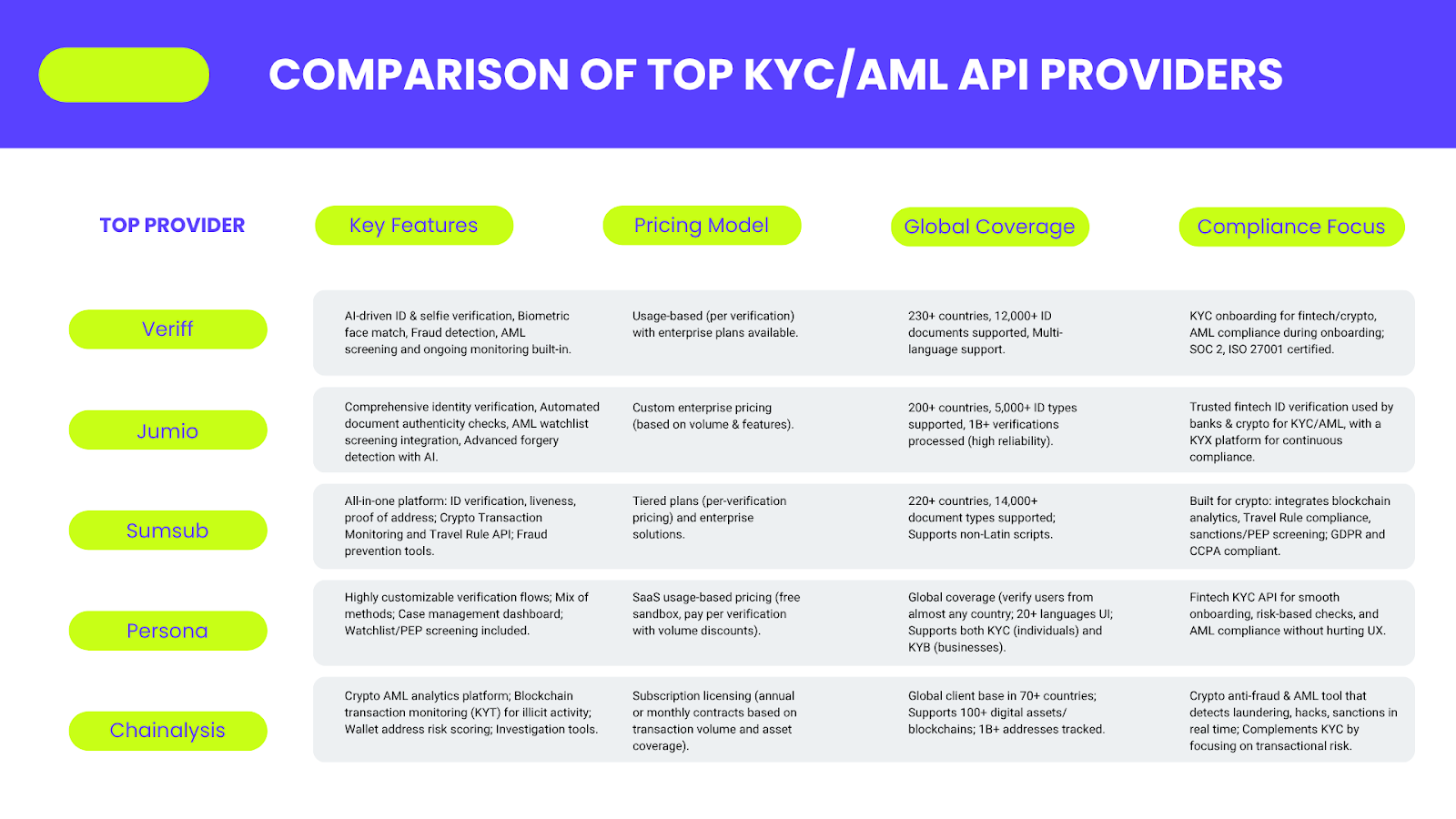

Comparison of Top KYC/AML API Providers

To summarize the features and offerings, here is a comparison of the leading KYC/AML API for crypto and fintech providers discussed:

Table: Feature and coverage comparison of leading KYC/AML API providers for crypto and fintech apps.

Recent Trends & Case Studies (2024–2025)

The KYC/AML landscape for crypto is rapidly evolving. New partnerships and tech innovations are helping companies strengthen compliance without hurting growth. Here are a few notable recent developments:

- Identity + Blockchain Analytics Integration: A major trend is the convergence of KYC providers with on-chain analytics. For instance, Sumsub’s 2024 partnership with Chainalysis combined Sumsub’s user verification platform with Chainalysis’s blockchain monitoring. This gave crypto exchanges a unified tool to verify users and continuously monitor their crypto transactions for risks in one place. Similarly, Sumsub teamed up with Elliptic in 2024 to enhance crypto wallet screening and risk scoring. These collaborations underscore how compliance vendors are offering more crypto-specific AML capabilities to their clients.

- Improved Onboarding Experience: Many providers focused on reducing user friction in KYC. Persona’s case study with an international crypto exchange showed that by switching to Persona’s optimized flow, the exchange doubled its onboarding conversion rate while still complying with strict KYC/AML rules. Features like guided verification UIs, instant document capture, and risk-based tiers (verifying low-risk users faster) are becoming standard, ensuring compliance checks don’t drive users away.

- Partnerships with Crypto Platforms: KYC/AML vendors continued to win over crypto clients. In mid-2024, Jumio partnered with Tevau, a blockchain-based payment platform, to integrate real-time biometric ID verification for onboarding users and meeting AML mandates. This is one of many examples (CasinoCoin and others have done similar crypto projects proactively embracing regtech solutions. Even decentralized platforms are exploring creative ways to incorporate KYC (for example, via zero-knowledge proofs) to satisfy regulators without fully sacrificing user anonymity – a space to watch in 2025.

- Regulatory Crackdowns Driving Adoption: High-profile regulatory actions in 2023-2024 have pressured the industry to up its compliance game. Cases like the EU’s MiCA regulations and U.S. enforcement against non-compliant exchanges have sent a clear message: crypto companies must implement robust KYC/AML or face consequences. This has led to an increased demand for the providers we discussed. Many are publishing industry guides and compliance reports (e.g. Sumsub’s Crypto Compliance Report 2025) to help clients stay ahead of emerging rules, such as Travel Rule requirements, stricter customer due diligence, and so on.

Overall, the best practice emerging is a multi-layered approach: use a trusted KYC API to verify user identities during onboarding, then pair it with ongoing AML monitoring (transaction and wallet analysis) throughout the customer lifecycle. Automation and AI are playing a huge role in making this scalable – from AI-driven ID document checks to machine learning flagging suspicious behavior patterns. The result is crypto and fintech firms can grow globally, onboard users quickly, yet still keep regulators satisfied and bad actors out.

Conclusion

Compliance and security are non-negotiable in today’s crypto and fintech environment. As we’ve seen, a modern KYC/AML API for crypto and fintech applications can enable instant identity verification, global AML screening, and crypto transaction risk analysis – all through seamless integrations that don’t derail the user experience. By choosing the right provider (or combination of tools) from those compared above, companies can streamline onboarding, prevent fraud, and meet regulatory obligations in every market they operate. The investment in solid KYC/AML infrastructure pays off by protecting your platform’s reputation and enabling sustainable growth under the watchful eye of regulators.

In 2025 and beyond, expect compliance to become even more crucial as crypto goes mainstream. The good news is that today’s top providers make compliance achievable as a simple API integration, rather than a headache. Now is the time to evaluate your compliance stack and ensure it’s up to par with the best practices discussed.

Ready to fortify your crypto app’s compliance?

Modernizing your KYC/AML process is easier with expert guidance. Take the next step by exploring Twendee Labs’ offerings – from blockchain development to AI-driven compliance solutions – to stay ahead in the evolving regulatory landscape.

Contact Twendee Labs to learn how we can tailor a solution for your needs. For more insights and updates on blockchain compliance, feel free to connect with Twendee on X (Twitter) and LinkedIn. Together, we can build fintech and crypto products that are not only innovative but also secure and fully compliant – the foundation for long-term success in this dynamic industry!