In 2025, building a tokenized asset platform for real-world assets (RWA) has moved from a niche experiment to a strategic priority in finance. Trillions of dollars of traditionally illiquid assets are poised to move on-chain – over $24 billion in real-world assets have already been tokenized (growing ~85% year-over-year). Industry forecasts even project the tokenized asset market to reach $16 trillion by 2030. This surge is driven by RWA tokenization unlocking fractional ownership, 24/7 trading, and global liquidity for assets like real estate, credit, and commodities.

However, launching a successful tokenized asset platform requires more than just minting tokens. It demands a robust technical architecture and strict compliance measures to establish the trust needed for mainstream adoption. Many founders recognize the opportunity but are unsure where to start, faced with questions about regulations (KYC/AML, securities laws), custody of assets, smart contract security, and integrating real-world data.

In this comprehensive guide, we outline the core requirements for building a tokenized asset platform in 2025. From compliance and custody to smart contract design and settlement flows, each aspect is critical to bridging traditional finance with blockchain.

1. Asset Onboarding and Token Issuance

Before any tokens circulate, you must onboard real-world assets onto the platform in a legally sound way. This involves:

- Asset Due Diligence & Valuation: Verify the asset’s authenticity, value and ownership. For example, if tokenizing real estate, perform title checks and appraisal.

- Legal Structuring (SPVs/Trusts): Create a legal vehicle (such as a Special Purpose Vehicle) to hold the asset on behalf of token holders. The on-chain token is only as enforceable as the legal wrapper behind it. This ensures token holders have a claim on the underlying asset through a legally recognized entity.

- Token Creation via Smart Contracts: Use smart contracts to mint digital tokens that represent shares of the asset. Each token carries ownership rights (fractional or full) to the real-world asset. The smart contract should encode the asset’s total supply (e.g. number of tokens equating to the asset’s value) and the rules for token transfers.

- Proof of Asset Backing: Implement mechanisms (often via oracles or attestation) to prove the asset is securely held off-chain. For instance, a custodian’s attestation or an oracle feed can confirm that a real-world asset (a gold bar, property deed, etc.) is locked in reserve corresponding to the tokens issued. This instills confidence that every token is backed by the actual asset.

Asset tokenization workflow from verification to token issuance (Source: SCNSoft)

By carefully handling asset onboarding, the platform builds a foundation of trust. Investors can confidently buy tokens knowing each token is anchored to a real, compliant asset.

2. Compliance and Regulatory Alignment

Regulatory compliance is a make-or-break element of any tokenized asset platform. In 2025, authorities worldwide have sharpened focus on digital assets, so your platform must bake compliance into its core design:

- KYC/AML Checks: Enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures for all investors during onboarding. This means verifying user identities, performing background checks, and monitoring transactions for suspicious activity. Robust KYC/AML is the backbone of compliance, filtering out illicit actors and building trust with regulators.

- Accreditation and Investor Eligibility: If the tokens are deemed securities, restrict access to eligible or accredited investors as required by law. Smart contracts can enforce permissioned transfers – only whitelisted, verified addresses can hold or trade the token, which helps meet securities regulations.

- Token Classification & Jurisdictional Compliance: Clearly define whether the token is a security token, utility token, or other asset class. Misclassification can lead to legal issues. Design your platform in line with relevant laws (e.g. SEC regulations in the US, the EU’s MiCA framework, Singapore’s MAS guidelines). Often this requires consultation with legal experts and possibly obtaining licenses or regulatory sandboxes in certain jurisdictions.

The Token Classification Framework: A multi-dimensional tool for understanding and classifying crypto tokens (Source: INC)

- Embedded Compliance in Smart Contracts: Implement compliance modules in the token smart contract that automatically enforce rules. For example, transfer restrictions based on jurisdiction or investor status, caps on holdings, and cooldown periods can be coded in. Some advanced token standards (ERC-1400, ERC-1404) include built-in compliance features to facilitate this.

- Audit Trails & Reporting: Maintain an immutable on-chain or off-chain log of all transactions and ownership changes. This transparency allows regulators to audit activity in real-time if needed. Integrate reporting tools to generate compliance reports (for taxation, regulatory filings, etc.) automatically from the platform’s data.

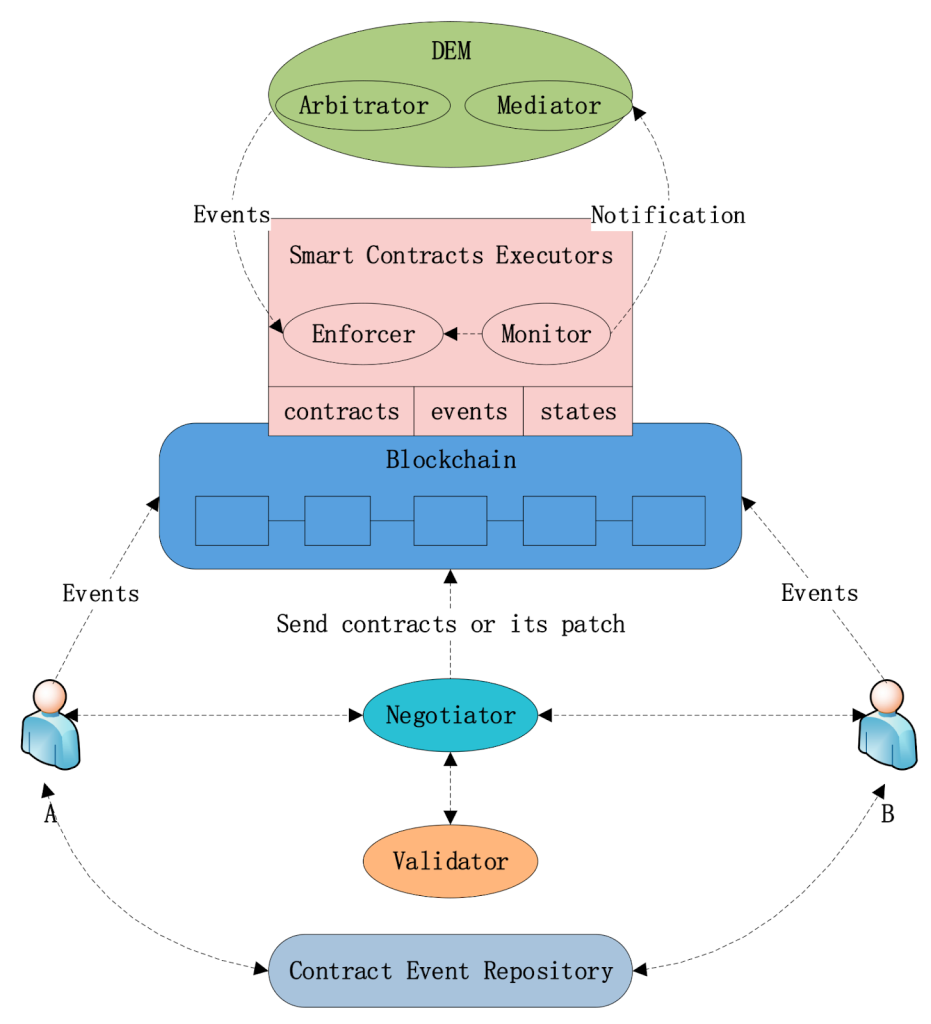

- Legal Dispute Mechanisms: Despite automation, disputes or exceptional cases may arise (e.g. fraud, lost keys, court orders). Plan for how to handle these within legal frameworks – perhaps through an arbitration clause, or admin smart contract functions to freeze or recover assets under defined conditions.

A platform that prioritizes compliance from day one not only avoids legal shutdowns but also attracts institutional investors. By meeting KYC, AML, and securities laws requirements, you signal that your RWA tokenization venture is a serious, lawful market player and not a renegade operation. In fact, many RWA platforms work with regulated entities (custodians, transfer agents, broker-dealers) to ensure end-to-end compliance.

3. Secure Custody Solutions (Digital & Physical)

Custody is one of the biggest trust barriers in tokenized finance. Both the digital tokens and the underlying physical assets must be securely custodied to protect investor interests:

- Digital Asset Custody: For the blockchain tokens, use secure wallet infrastructures. This can include multi-signature wallets (requiring multiple approvals to execute a transaction) and Multi-Party Computation (MPC) wallets that split the private key among several parties. These techniques ensure no single point of failure – significantly reducing the risk of hacks or insider malfeasance. Determine a policy for hot vs. cold storage: frequently traded tokens might reside in secure hot wallets for liquidity, while the majority are kept in cold (offline) storage to prevent online attacks. Additionally, consider engaging a regulated crypto custodian for institutional-grade asset protection and insurance coverage against theft or loss.

- Underlying Asset Custody: Equally important is custody of the real-world asset itself (if applicable). When tokenizing a physical asset like real estate, artwork, or commodities, typically a trusted third-party custodian or escrow holds the asset (or its title) on behalf of the token holders. For example, a bank or trust company might hold the property deed, or a vault holds the physical gold that backs tokenized gold tokens. This ensures the asset is bankruptcy-remote (segregated from the platform operator’s assets) and can be liquidated or transferred to token holders if needed. Using regulated custodians builds investor confidence that the link between token and asset is secure and legally enforceable.

- Asset Segregation: Maintain clear separation between customer-owned assets and the platform’s own assets. Client token holdings (and underlying assets) should be held in designated accounts or wallets that the company cannot misuse for other purposes. This segregation is often a legal requirement and protects investors if the platform provider encounters financial issues.

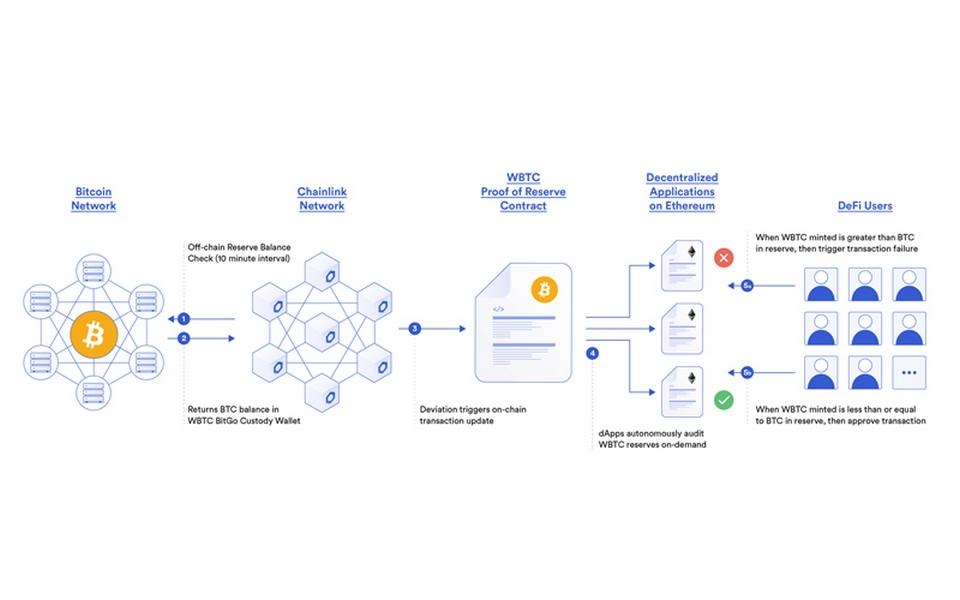

- Custody Audit and Proof-of-Reserve: Regularly audit the reserves backing tokens. Some platforms publish proof-of-reserve attestations (sometimes on-chain) to show that for every token issued, the equivalent asset is indeed held in custody. Periodic audits by independent firms can verify that digital and physical holdings match the token supply, further boosting transparency.

Proof of Reserves (Source: FPT Shop)

By implementing strong custody solutions, you address the critical question of trust. Investors and regulators will ask: “Are my assets safe?” Your answer lies in multi-layered custody protections, insurance where possible, and independent validations. In a landscape marred by occasional crypto custody failures, this rigorous approach to custody and security can become a key differentiator for your tokenized asset platform.

4. Smart Contract Design and Programmability

The smart contracts are the engine of a tokenized asset platform – they encode asset details, investor rights, and platform rules into immutable code.

Smart Contract Engineering (Source: MDPI)

In designing these contracts, security and flexibility are paramount:

- Robust Token Contracts: Build your token smart contracts following best practices and vetted standards. Standard ERC-20 tokens alone may be too simplistic for RWA needs (lacking features for compliance or complex logic). Instead, security token standards like ERC-1400 (which supports partitions, transfer restrictions, etc.) or extensions of ERC-20 with compliance logic can be used as a base. Ensure the contract includes essential functions for minting/burning tokens tied to real-world asset events (e.g. mint when a new asset is added; burn if an asset is redeemed or destroyed).

- Compliance Logic in Code: As noted, embed compliance in the smart contract layer. This includes enforcing that only eligible, KYC-verified addresses can hold or transfer tokens (often via a whitelist/blacklist mechanism). If regulations require freezing assets under certain conditions (court order, sanctions list, etc.), include an emergency freeze or admin pause function that can halt transfers when invoked by an authorized compliance admin. Though decentralization is valued, a degree of administrative control is often necessary for regulatory compliance in RWA platforms.

- Automated Workflows: One advantage of tokenization is programmability – leverage it to automate complex asset workflows. For instance, program the smart contract to handle dividend or interest payments to token holders by distributing on-chain stablecoins or tokens according to predefined schedules (useful for tokenized bonds or revenue-sharing real estate). You can also encode rules like automatic buybacks or margin calls (if token represents a loan or leveraged asset) triggered by certain conditions, eliminating manual intervention.

- Security Audits and Upgradability: Given that large sums of real-world value will hinge on these contracts, security audits by reputable firms are non-negotiable. Audit for vulnerabilities, backdoors, and compliance with standards. Additionally, consider using upgradeable contract patterns or modular designs – this allows patches or feature upgrades in the future without disrupting issued tokens (e.g., using proxy contracts or pausable contracts that can migrate logic). However, balance upgradability with investor assurances; any upgrade mechanism should be transparent and ideally require multi-party approval to prevent abuse.

- Testing for All Scenarios: Rigorously test the smart contracts under various scenarios: normal trades, extreme market conditions, regulatory events (like blacklisting an address), oracle failures, etc. Simulate the end-to-end flows (e.g., what happens on a redemption request – tokens burned and custodian releases asset). This ensures the programmed logic handles both expected operations and edge cases gracefully.

A well-designed smart contract system enforces trust through code – it ensures that the platform operates exactly as advertised, without reliance on manual processes. By encoding compliance, custodial checks, and business logic on-chain, you reduce the chance of human error or malicious intervention. The result is a platform that can scale and handle institutional-grade complexity, from multi-party custody to real-time compliance checks and beyond.

5. Oracle Integration for Real-World Data

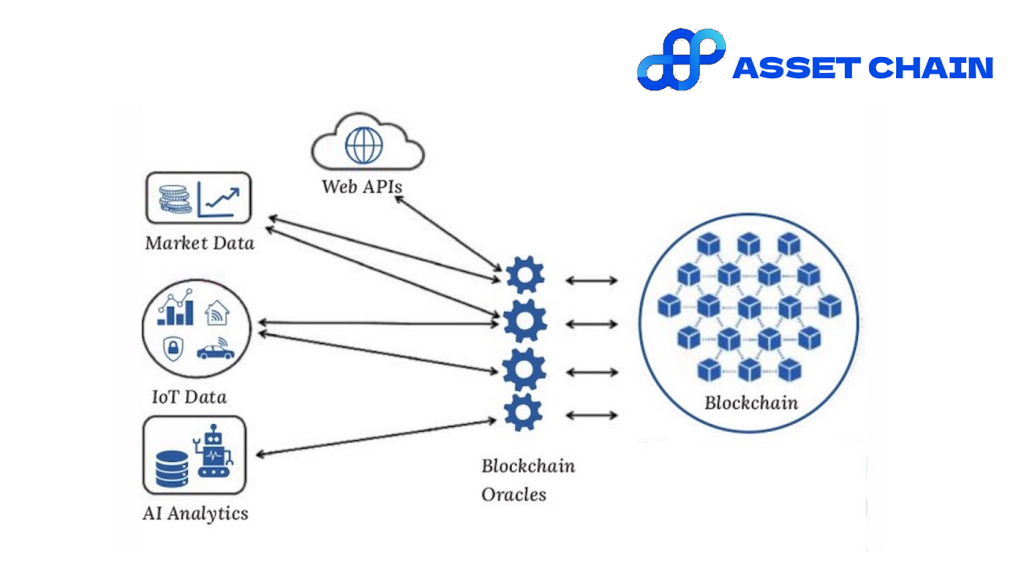

Oracles bridge the gap between on-chain tokens and off-chain reality. Since RWAs derive value and status from the real world, your platform must integrate reliable data feeds to keep smart contracts informed:

- Price Feeds: Use price oracles to supply up-to-date market values for the underlying assets. For example, if you tokenized real estate or commodities, an oracle can provide periodic appraisals or market prices to adjust Net Asset Value (NAV). For loan or credit tokens, oracles might feed in interest rates or exchange rates that affect asset value. Accurate price feeds enable features like on-chain collateralization and ensure tokens trade near their true asset value.

- Asset Performance Data: Many real assets have performance metrics (e.g. rental income for real estate, coupon payments for bonds, repayment status for loans). Performance oracles can report these off-chain events to the blockchain. Smart contracts might use this data to trigger actions – e.g., automatically distribute a rental income token to real estate token holders when rent is paid, or flag a loan token as in default if an off-chain loan payment is missed.

- Compliance Oracles: Some compliance checks can be oracle-mediated as well. For instance, an oracle could inform the smart contract that a certain investor’s accreditation status has expired or that a wallet address has been sanctioned, prompting the contract to restrict that address. Attestation oracles might be used in KYC workflows, where a regulated entity validates an address off-chain and the oracle feeds a signed approval on-chain. This helps in bridging off-chain compliance processes with on-chain enforcement.

- Custody and Settlement Proofs: Oracles can confirm when real-world transactions occur. For example, when a real-world asset is sold or a physical settlement happens (like a property ownership transfer outside the platform), an oracle can relay that information so the smart contract can update or retire the corresponding tokens. Similarly, if your platform interfaces with traditional payment systems, an oracle might signal that a fiat payment was received in a bank account, allowing the on-chain part of a transaction to execute.

Secure Oracle Integration with Asset Chain: Real-World Data for Smart Contracts (Source: Medium)

When implementing oracles, prioritize data integrity and reliability. Use decentralized oracle networks (to avoid single point of failure) and choose providers with strong track records and institutional partnerships. It’s wise to build fallback mechanisms – e.g., pulling data from multiple independent sources and using median values, or pausing certain operations if oracles fail. In 2025, next-gen oracle solutions (from providers like Chainlink and others) have become more sophisticated, offering cryptographic proofs of data authenticity and lower latency. Integrating such oracle infrastructure ensures your platform’s smart contracts always act on accurate, real-time information, which is essential for trust. After all, a tokenized asset platform is only as good as the data it operates on.

6. Marketplace and Settlement Flows

One of the core promises of tokenization is improved liquidity and more efficient settlement of asset trades. To deliver this, your platform should provide a seamless marketplace and modern settlement infrastructure:

- Trading Marketplace: Create a user-friendly marketplace or exchange module where investors can buy, sell, or trade tokenized assets. This marketplace ensures price discovery and liquidity by matching buyers and sellers, much like a stock exchange or an online trading platform. It can be an integrated exchange on your platform or connectivity to external exchanges/DeFi markets where the tokens can be listed. By offering an intuitive trading interface (order books, instant swaps, etc.), you lower the barrier for investors to participate. A marketplace provides the environment for liquidity – without it, tokens may remain hard to trade, defeating the purpose of tokenization.

- 24/7 Global Access: Unlike traditional markets that have limited hours, a blockchain-based platform ideally allows trading 24/7 across borders. Ensure your settlement and custody processes can support continuous operation. This global, always-on access is a major selling point, as it democratizes investment opportunities beyond geographic or time constraints.

- Efficient Settlement Mechanism: Implement instant or atomic settlement for trades. On-chain settlement using blockchain’s atomic transfer capability means transactions finalize in seconds, with payment and asset delivery happening simultaneously. This is a leap from traditional finance where trade settlement can take 2-3 days. Atomic settlement (Delivery-versus-Payment on-chain) eliminates counterparty risk – either both token and payment swap hands successfully, or nothing happens, so parties aren’t exposed to each other’s default. Faster settlement also frees up capital (no need to wait days for funds to clear) and reduces operational overhead from reconciliations.

- Integration with Payment Rails: To attract a broad user base, consider integrating fiat on-ramps/off-ramps or stablecoin support for settlement. For example, allow users to purchase tokens with fiat currency via bank transfers or credit card (through a payment gateway) and receive proceeds from sales back in fiat. Many platforms pair token trades with stablecoins (like USDC) to represent fiat value on-chain, making it easier to handle payouts instantly. Integration with banking APIs or stablecoin issuers can smooth this process, ensuring users can seamlessly move money between traditional bank accounts and the token marketplace.

- Settlement Finality and Record: Once a trade is executed, both parties’ balances should update immediately on the ledger. Provide trade confirmations and receipts. Because blockchains provide an immutable record, each trade’s details (price, timestamp, parties’ wallet addresses) are transparently logged. This gives investors and auditors a real-time audit trail of all activity. Additionally, design the system to handle high throughput if you anticipate frequent trading; using scalable blockchain networks or layer-2 solutions can help maintain low latency and fees for settlements.

By building a smooth marketplace and leveraging blockchain’s settlement advantages, your platform can offer a far superior trading experience over legacy systems. Investors gain liquidity – they can enter or exit positions on demand – and benefit from near-instant settlement which reduces risk. This combination of liquidity + fast settlement is a key driver behind why major financial institutions are embracing tokenized assets (for example, tokenized bonds settling T+0 instead of T+2 days). Ensure your platform’s architecture supports these flows efficiently, as they will be central to your value proposition for users.

7. User Experience and Administration Tools

Even the most advanced tokenization platform needs an intuitive user interface and powerful admin tools. A diverse user base – from retail investors to institutional participants – will interact with your platform, so focusing on UX and admin functionality is important:

- Investor Portal: Design a clean, easy-to-navigate web or mobile interface for investors. Through this dashboard, users should be able to browse available tokenized assets, view detailed information (asset description, valuation, compliance disclosures, etc.), and execute trades or transfers with a few clicks. Include portfolio tracking so investors can see their token holdings, current valuations, and transaction history. Given the complexity of RWA tokenization, educational tooltips or help sections can guide new users (e.g., explaining terms like NAV, yield, or the process to redeem tokens for the underlying asset). A smooth UX builds trust and encourages more activity on the marketplace.

- Admin Dashboard: Develop a secure administration dashboard for the platform operators (and asset issuers) to manage the system. From the admin console, authorized personnel should be able to onboard new assets (input asset details, upload legal documents, initiate token issuance), review and approve user KYC documents, and monitor transactions for compliance. The dashboard can also provide controls for emergency actions – for instance, if required, an admin could pause trading of a specific asset token or freeze certain wallets (in line with legal orders). Rich analytics and reports for the admin are useful: e.g., monitoring trading volume, investor geographic distribution, compliance flags, etc. Having all these tools in one place streamlines platform management.

Example of Product Management Tool (Source: UX Studio)

- Notifications and Communication: Implement notification systems to keep users informed. Investors might receive alerts for important events (such as an asset paying out a dividend, or a token sale going live). Likewise, the team should get alerts for any abnormal system behavior or compliance alerts (e.g., large transactions that might need review). Clear communication channels (support chat, email support) should be in place to handle user inquiries – remember, many users might be new to blockchain, so proactive customer support can set your platform apart.

- Performance and Scalability: A user-facing platform must load quickly and handle high traffic. Optimize your frontend and backend to minimize latency (especially important for active trading). As more assets and users come on board, the system should scale horizontally (adding more server or node capacity) to maintain a responsive experience. Nothing will turn away users faster than a sluggish interface or downtime during critical token sale moments.

- Security in UX: While focusing on ease-of-use, don’t compromise security. Employ robust authentication (multi-factor authentication for user logins, biometric options on mobile) and encryption for data. Clearly prompt users about safety (like reminding them to safeguard private keys if non-custodial, or warning before sending tokens out of the platform). The goal is to make participating in RWA tokenization as simple as online banking, without users worrying about the underlying blockchain complexity.

By marrying a great user experience with powerful admin capabilities, you ensure that the sophisticated machinery (compliance, smart contracts, etc.) operates behind the scenes while users and operators interact with a polished, human-friendly interface. This significantly lowers adoption barriers and helps position your tokenized asset platform as a professional, trustworthy solution in the eyes of CEOs, CTOs, and investors alike.

Conclusion

Building a tokenized asset platform in 2025 is undeniably a complex endeavor – it sits at the crossroads of cutting-edge technology and stringent financial regulation. Yet, by systematically addressing these core requirements – from asset onboarding and legal compliance to secure custody, smart contracts, oracle integration, and efficient settlement flows – you lay the groundwork for a platform that can transform illiquid assets into transparent, tradeable, and compliant digital securities. The reward for getting it right is substantial: access to global capital, streamlined operations, and a frontrunner position in the coming RWA tokenization wave that is reshaping finance.

However, you don’t have to navigate this journey alone. Twendee stands ready as a partner in bringing such a platform to life. With deep expertise in blockchain and fintech development, our team can architect and implement a full-stack tokenized asset platform tailored to your needs – covering everything from asset onboarding modules and compliance layers to smart contract logic, oracle integrations, an intuitive admin dashboard, and seamless settlement engines. We understand the technical nuances and regulatory hurdles, and we build solutions that satisfy both Silicon Valley and Wall Street standards.

If you’re a visionary founder, executive, or investor looking to unlock real-world assets on blockchain, now is the time to act. Let Twendee help you build a tokenized asset platform that is secure, compliant, and primed for success in this new digital economy. Contact our team today to start your journey – and transform your asset infrastructure for the future.

Contact us: Twitter & LinkedIn Page

Read latest blog: Multi-Chain Wallets & Cross-Chain Tools Surge in 2025