In Vietnam’s fast-growing Web3 ecosystem, the line between breakthrough and collapse often comes down to one word: compliance. While the country offers a fertile ground for blockchain startups with its tech-savvy population, government pilots, and rising institutional interest, many ventures fail not because of poor technology or weak market fit, but because compliance was treated as an afterthought.

For founders, building a compliant foundation from day one is not optional. Web3 startup compliance Vietnam is the gateway to scaling sustainably, attracting institutional investors, and earning long-term user trust. Startups that address regulatory risks early gain a decisive edge, those that don’t often face audits, shutdowns, or investor retreat just as momentum begins.

What Founders Need to Get Right from Day One

1. Legal & Structural Foundation

The foundation of any compliant Web3 venture begins with selecting the appropriate legal entity structure. Many founders make the critical error of establishing shell companies or choosing structures that don’t align with their business model or regulatory requirements. In Vietnam’s evolving legal framework, startups must navigate multiple layers of regulation, including fintech sandbox requirements, data governance rules, and emerging token regulations.

Smart founders establish clear corporate structures that can both satisfy compliance requirements and provide operational flexibility as regulations shift. A rigid or poorly chosen structure may comply initially but later prevent the startup from scaling, raising capital, or joining pilot programs. For instance, several fintech startups applying to Vietnam’s sandbox have been rejected simply because their legal entity type did not qualify, despite strong technology and market potential.

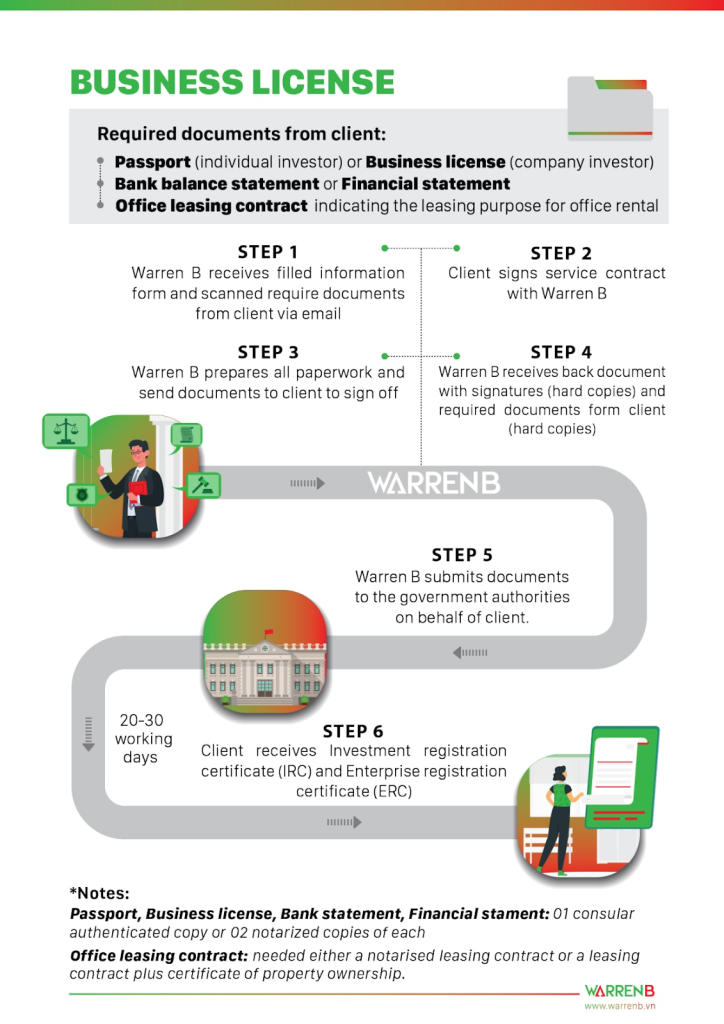

Documents and process to obtain a business license in Vietnam (Source: WarrenB)

This is why working with local legal counsel who understand both traditional business law and blockchain-specific regulations is essential. Vietnam’s fintech sandbox program, overseen by the State Bank of Vietnam, offers pathways for compliant experimentation, but participation requires proper legal structuring from the start.

Building relationships with legal advisors and industry associations early provides founders with ongoing regulatory intelligence and networking opportunities that become invaluable as regulations evolve. These relationships also demonstrate to regulators and investors that the company takes compliance seriously, which can prove crucial during regulatory reviews or funding rounds.

2. Tokenomics & Fundraising Setup

Token design represents one of the highest-risk areas for Web3 startups, particularly regarding securities classification. Founders must architect tokenomics with transparency and regulatory compliance as core principles, ensuring their tokens don’t inadvertently fall under securities regulations without proper authorization.

The key lies in designing utility tokens with clear, demonstrable use cases within the platform ecosystem, while avoiding features that could classify them as investment contracts. This includes careful consideration of token distribution mechanisms, vesting schedules, and governance rights that could trigger securities scrutiny. A flexible structure also matters: tokenomics should be adaptable to future regulatory updates without requiring a complete overhaul of the project’s model. Startups in Singapore, for instance, have faced setbacks when rigid token allocations forced them to redesign entire ecosystems once regulators tightened classification standards.

In parallel, fundraising strategies increasingly integrate stablecoins for cross-border payments and settlement efficiency. As highlighted in Twendee Labs’ review of top stablecoin projects, properly structured stablecoin usage not only reduces volatility in token sales but also aligns projects with evolving global payment trends.

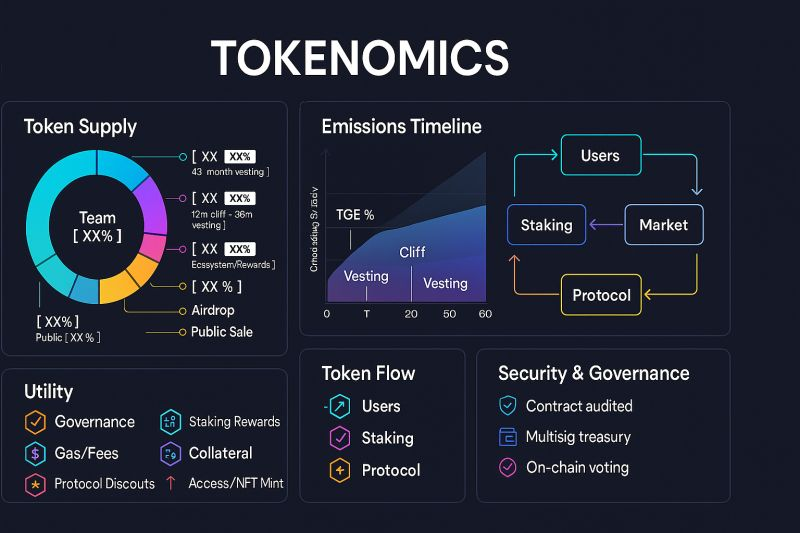

Tokenomics design covering supply, vesting, token flow, and governance” (Source: Tokenomics Dashboard)

Fundraising activities must comply with Vietnam’s Anti-Money Laundering (AML) regulations and maintain complete investor transparency. This means implementing robust Know Your Customer (KYC) procedures for all token sales and private funding rounds, maintaining detailed records of all transactions, and ensuring activities comply with local and international sanctions requirements. Projects that skipped this step have seen token sales suspended mid-offering after regulators flagged non-compliant fundraising processes as an expensive and reputation-damaging mistake.

3. AML/KYC & Data Governance

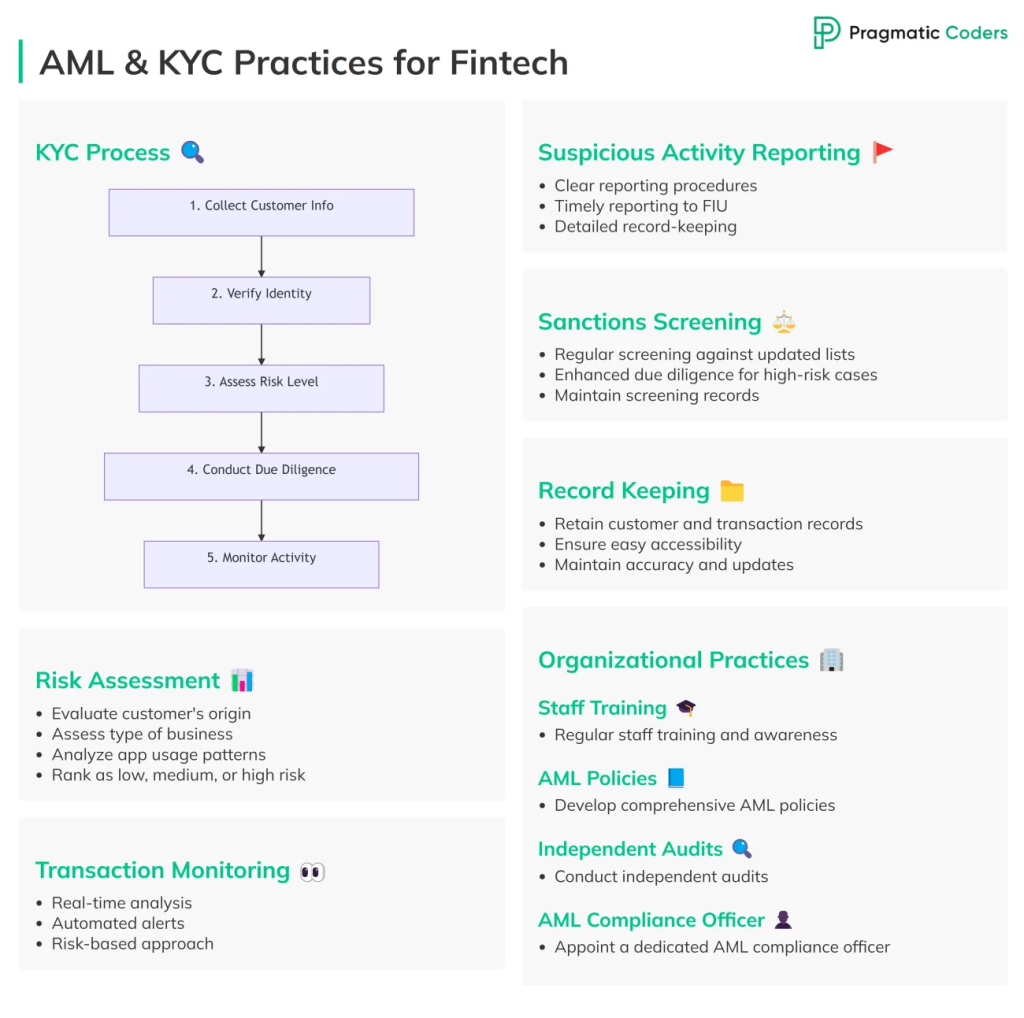

Implementing comprehensive AML/KYC procedures from the MVP stage, rather than bolting them on later, ensures smoother operations and regulatory compliance. This early integration not only satisfies regulators but also provides valuable user data insights that can inform product development and market strategy. Projects that delayed KYC onboarding have often faced sudden user account freezes or forced rollbacks when regulators intervened. A standard AML/KYC framework typically includes customer due diligence, risk assessment, transaction monitoring, and record-keeping, as illustrated below:

AML & KYC framework covering KYC process, risk assessment, transaction monitoring, and reporting (Source: Pragmatic Coders).

Vietnamese data privacy laws require careful attention to data localization and cross-border transfer requirements. Web3 startups must design their data architecture to comply with local regulations while maintaining the decentralized nature of their applications. Hybrid solutions such as localizing sensitive user data while still enabling blockchain transactions allow startups to remain compliant without compromising functionality. Building this flexibility into system design is essential, since stricter data controls are likely to emerge in the near future.

Data governance frameworks should address not only privacy and localization but also data retention, user consent management, and regulatory reporting requirements. These frameworks must be documented, regularly updated, and embedded into all product development processes. Ignoring this step has led several Southeast Asian startups to lose investor trust after failing audits triggered by incomplete or outdated data governance protocols.

4. Technical Compliance

Smart contract audits represent a non-negotiable requirement for any serious Web3 project. However, the timing and scope of these audits can significantly impact both costs and compliance outcomes. Early-stage audits, even for MVP contracts, establish security practices and identify vulnerabilities before they become embedded in the platform’s architecture. Startups that delayed audits until launch have faced catastrophic exploits losing millions in user funds and facing regulatory probes for negligence.

Smart contract auditing process highlighting verification, expert review, and security reporting (Source: 4IRE Group)

Building transparent logging and audit trails into the technical infrastructure from day one supports both internal monitoring and regulatory compliance. These systems should capture all relevant transactions, user actions, and system changes in immutable formats that satisfy regulatory scrutiny and support compliance reporting. Designing compliance features with adaptability in mind also ensures startups can quickly adjust reporting outputs if regulators expand disclosure requirements. Without this foresight, projects may find themselves retrofitting expensive, inefficient solutions under tight regulatory deadlines.

Guidance for Local Projects: Avoiding Risks & Preparing for Growth

1. Avoiding Regulatory Risk in Web3

Regulatory risk Web3 startups face in Vietnam often stems from three primary areas: unauthorized fundraising activities, misleading marketing practices, and improper data handling. ICO or IDO launches without proper regulatory approval carry significant risk of classification as illegal fundraising, potentially resulting in criminal liability for founders. Regional precedents are sobering—several Southeast Asian ICOs were forced to return investor funds after being reclassified as unlicensed securities offerings, causing reputational collapse.

Marketing claims that guarantee profits or suggest investment returns can trigger securities regulations and consumer protection enforcement. Founders must ensure all marketing materials focus on utility and platform benefits rather than potential financial returns. Startups in Korea and Singapore have faced fines and bans for advertising “guaranteed yields,” a warning that Vietnamese projects cannot afford to ignore.

Unauthorized cross-border data transfers represent another significant risk area, particularly for startups working with international partners or users. Understanding and complying with data localization requirements while maintaining platform functionality requires careful technical and legal planning. Companies in Indonesia, for example, saw operations suspended when they failed to keep sensitive data within local borders, a scenario that could easily repeat in Vietnam.

2. Building a Compliant Blockchain in Vietnam

Creating a compliant blockchain Vietnam operation requires active engagement with regulatory bodies and participation in official programs where possible. The State Bank of Vietnam and Ministry of Information and Communications offer sandbox programs that allow qualified projects to experiment in a controlled legal environment, shielding them from being prematurely labeled non-compliant. Startups that ignored these pathways have seen their applications rejected outright, losing valuable time and investor confidence.

Working with local legal and audit advisors who understand Vietnamese regulatory nuances ensures compliance strategies align with local enforcement priorities and regulatory interpretations. These relationships also provide early warning of regulatory changes that could impact operations, giving founders the flexibility to adjust business models before issues escalate.

Establishing comprehensive governance documents, including corporate bylaws, operational procedures, and compliance policies, creates the organizational framework necessary for regulatory compliance and investor confidence. These documents should address decision-making processes, risk management procedures, and compliance monitoring systems. When designed with flexibility, they enable startups to adapt smoothly as new rules emerge rather than being forced into disruptive restructuring.

3. Preparing for Long-Term Growth

Seed stage preparation should focus on assembling qualified legal and technical advisory teams and implementing compliance checklists that ensure all major risk areas are addressed before product launch. This foundation prevents costly retrofitting of compliance measures later, a problem that has sunk otherwise promising fintechs across Asia.

Growth stage companies must develop comprehensive compliance playbooks that can scale with the organization, implement staff training programs that maintain compliance culture, and establish partner onboarding procedures that extend compliance requirements throughout the business ecosystem. This not only reduces immediate regulatory exposure but also builds operational resilience, making it easier to pivot or expand under shifting policies.

Expansion stage preparation requires alignment with international standards including FATF guidelines, GDPR requirements, and MAS Singapore frameworks for companies planning cross-border operations. Projects that anticipated these requirements early have accessed institutional capital and global partnerships more smoothly, while those that ignored them faced sudden entry barriers abroad. Embedding flexibility into compliance at this stage ensures long-term growth is not just legally possible, but strategically sustainable.

Conclusion

Compliance is not just a legal safeguard, it is the cornerstone of sustainable Web3 startup growth in Vietnam’s shifting regulatory environment. Founders who embed compliance into their business model from day one create strategic advantages that compound over time, while those who neglect it often face costly retrofits, investor hesitation, or even shutdowns.

The message is simple: proactive compliance builds resilience, trust, and long-term scalability. Startups that treat it as a strategic investment consistently attract higher-quality investors, form stronger partnerships, and position themselves as leaders in an increasingly competitive ecosystem.

At Twendee Labs, we help Web3 founders turn compliance into a growth enabler integrating regulatory strategy with technology execution from day one. Discover how Twendee Labs can guide your project through Vietnam’s evolving legal landscape and unlock sustainable success by still connected with us via X and LinkedIn.