The global financial sector is accelerating in institutional blockchain adoption, with asset tokenization emerging as a key frontier. From private equity to green bonds, tokenizing real-world assets (RWAs) unlocks liquidity, faster settlement, and efficiency. Yet banks remain cautious, slowed by regulatory uncertainty, fragmented systems, and security concerns.

The Canton Network answers these challenges with institution-ready infrastructure combining blockchain’s programmability with built-in compliance, privacy, and interoperability. Rather than disrupting traditional finance, it bridges it with regulated DeFi, enabling secure, scalable, and standards-aligned asset markets.

Compliance-First Design in Canton Network Asset Tokenization

Canton Network asset tokenization starts from an institutional truth: regulatory trust is the currency of market access. For banks and asset managers, every step of an asset’s lifecycle from onboarding clients to settling trades is governed by stringent rules that vary across jurisdictions. Failure to meet them risks not just fines, but loss of license and reputational damage.

Most public blockchains handle compliance reactively, layering on KYC/AML checks or transaction filters after the fact. Canton reverses this approach, embedding compliance at the protocol level. This compliance-by-design architecture ensures that regulatory alignment is not an add-on, but an operational baseline:

- Integrated identity and onboarding native KYC/AML for exchanges means only verified, permissioned entities can transact.

- Configurable privacy layers institutions can control what data is visible, enabling selective disclosure to regulators while maintaining confidentiality with counterparties.

- Enforceable governance rules and reporting obligations are encoded into smart contracts, creating a tamper-proof audit trail without manual reconciliation.

Where this matters most is in digital asset issuance. Whether tokenizing a sovereign bond, a syndicated loan, or an alternative investment product, issuers can structure and distribute assets within a fully compliant environment from day one. This removes weeks or months from the legal review process, accelerates time-to-market, and reduces the uncertainty that often delays institutional blockchain adoption.

Placed at the center of this framework is Canton’s Global Synchronizer enabling atomic cross-chain transactions without sacrificing regulatory safeguards. By combining privacy, interoperability, and governance in a single architecture, it offers banks a path to tokenization that does not force them to compromise on their compliance obligations.

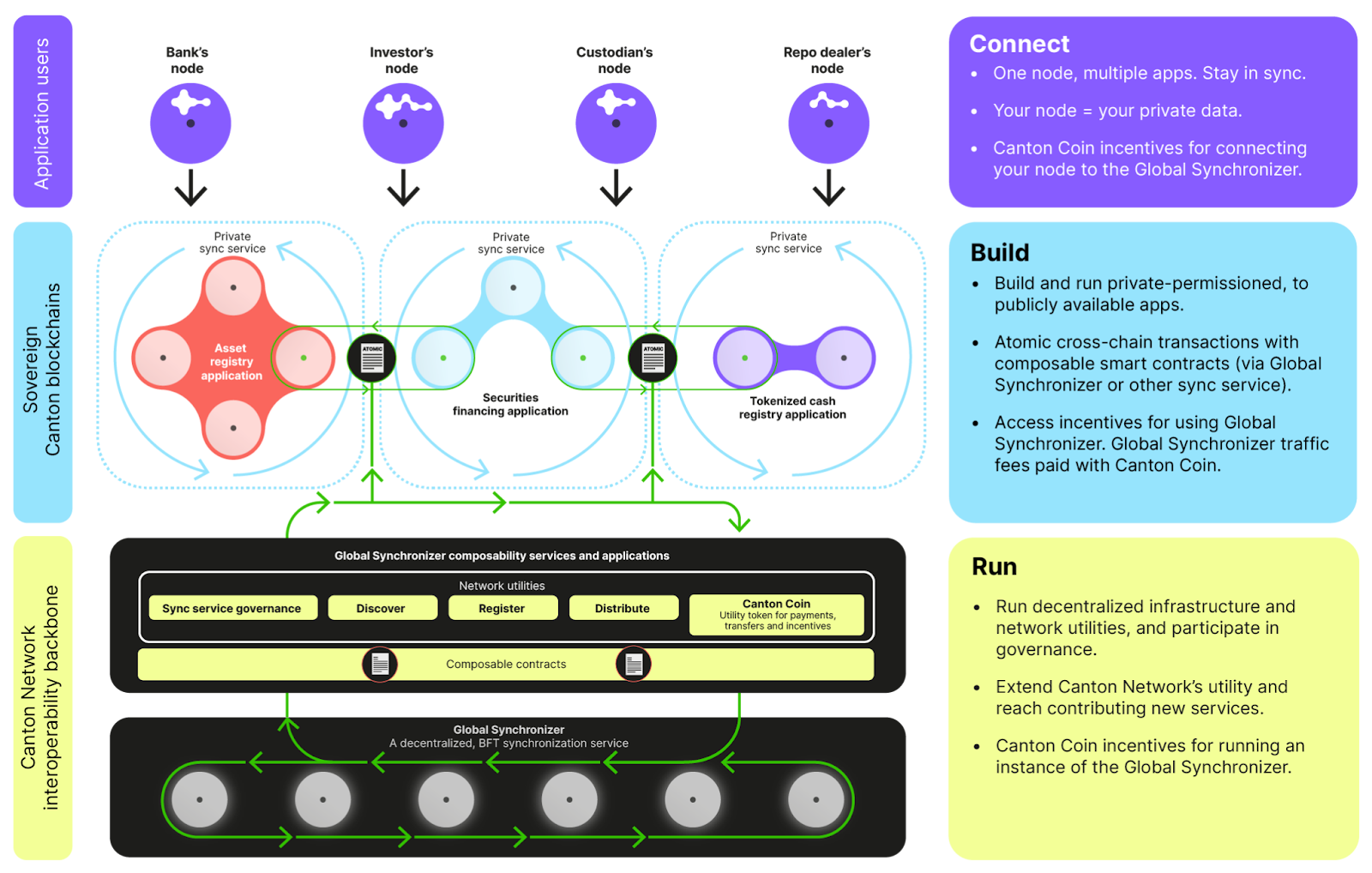

Canton Network architecture showing private blockchains, atomic cross-chain transactions, and compliance-ready synchronization. (Source: The Canton Network)

This architectural model (see above) is a visual representation of why Canton is attractive to institutions: each private-permissioned blockchain remains sovereign, yet is able to transact securely with others via synchronized, composable smart contracts. In practice, this means a bank can maintain total control over its client data and regulatory compliance processes, while still participating in cross-market asset transactions that are instant, verifiable, and regulator-friendly.

Interoperability Driving Canton Network Asset Tokenization

For most financial institutions, the challenge in adopting blockchain for asset tokenization is not the lack of technology, it’s the fragmentation of existing infrastructure. Today, each asset class, jurisdiction, and counterparty often runs on separate systems with bespoke APIs and messaging standards. This leads to “walled gardens” of data and functionality, manual reconciliation processes, and settlement delays that can span days.

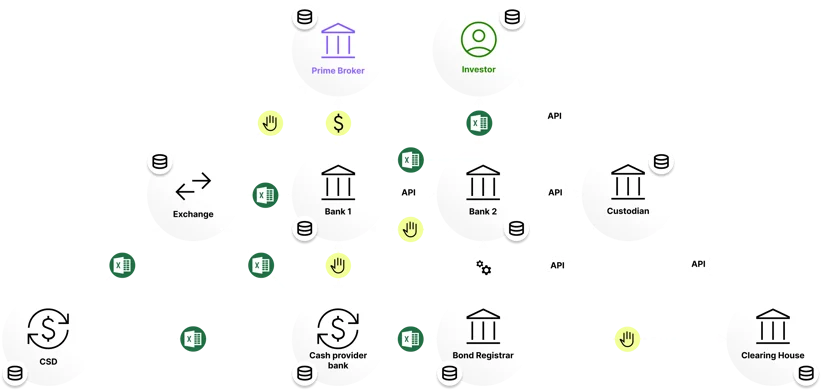

Traditional fragmented financial infrastructure showing isolated institutions and manual integration points. (Source: The Canton Network)

In the current market structure (see above), banks, custodians, registrars, and clearing houses are connected through point-to-point integrations. While functional, this model makes cross-asset transactions cumbersome. Each intermediary must reconcile records, verify counterparties, and manage its own compliance processes slowing down innovation and increasing operational costs.

Canton’s interoperability model changes this equation. Instead of building one monolithic network, Canton enables interoperable blockchain networks that connect sovereign, permissioned applications while preserving their autonomy. Institutions can maintain control over their own data, compliance, and operational rules — yet still transact seamlessly with others through synchronized smart contracts.

After Canton:

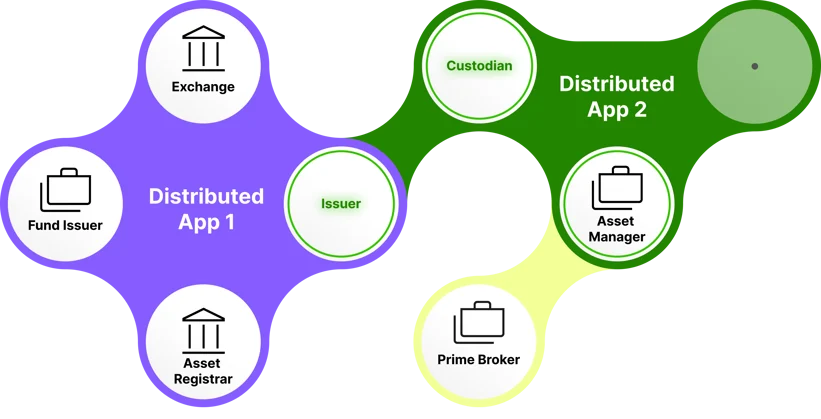

Canton-enabled interoperable applications connecting multiple financial institutions while preserving sovereignty. (Source: The Canton Network)

This “network of networks” approach delivers several strategic advantages for Canton Network asset tokenization:

- Atomic cross-chain transactions ensure that multi-party trades for example, exchanging tokenized bonds for tokenized cash settle simultaneously and without counterparty risk.

- Real-time reconciliation eliminates mismatches between ledgers, reducing back-office costs and settlement failures.

- Composable workflows allow new financial products to be built by combining services from different applications (e.g., an issuer on one network, an exchange on another, and a custodian on a third).

- Regulatory compatibility is preserved because each participating network can enforce its own jurisdictional rules, even while interoperating.

The result is an operational model where digital asset issuance is no longer confined to a single platform or limited by legacy integration bottlenecks. Institutions can collaborate across previously siloed markets, accelerating product innovation and expanding liquidity pools all without losing the privacy, compliance, and governance that regulators demand.

For broader context on how the institutional RWA landscape is evolving, see Top RWA Platforms Tokenizing Real Assets for Institutional Adoption. This positions Canton within a market that is moving from siloed pilots to interoperable, regulated issuance and secondary trading.

Secure Transaction Processing for Canton Network Asset Tokenization, Why Institutions Choose It

In institutional markets, adoption depends on whether a platform can deliver transaction integrity, settlement finality, and risk control without slowing down operations. Canton Network asset tokenization is engineered to meet those demands, combining advanced security with a structure that fits the realities of regulated finance.

Transactions on Canton are executed deterministically, with finality guaranteed by a fault-tolerant synchronizer. Asset and payment legs settle atomically under a delivery-versus-payment model, ensuring either both sides complete or none do virtually eliminating counterparty and funding risk. Confidentiality is enforced through selective disclosure, giving regulators full visibility without revealing sensitive deal terms to the broader market.

These technical capabilities translate into clear institutional advantages:

- Regulatory certainty through compliance controls embedded directly in execution, reducing legal review time and audit complexity.

- Lower operational and funding risk as atomic settlement and built-in reconciliation prevent mismatches between ledgers.

- Improved capital efficiency by reducing the need for liquidity buffers in case of failed trades.

- Scalable market participation where each participant retains control over its data and governance while transacting seamlessly across networks.

The result is an infrastructure where a bank can issue a tokenized bond, settle it instantly against tokenized cash from another network, and distribute to verified investors with an audit-ready record, all without manual intervention. For institutions, this combination of secure processing, compliance alignment, and interoperability offers a credible path to making asset tokenization part of everyday capital markets operations.

Conclusion

The evolution of Canton Network asset tokenization shows that institutional adoption hinges on more than just blockchain’s technical potential, it depends on meeting the core demands of regulated markets. By combining compliance-first architecture, interoperability across sovereign networks, and secure, atomic transaction processing, Canton offers financial institutions a way to scale asset tokenization without compromising on regulation, privacy, or operational control.

This is not about replacing existing capital market infrastructure; it’s about upgrading it into a connected, tokenized ecosystem where liquidity moves faster, settlement risk is minimized, and regulatory confidence is built in from day one. For banks, asset managers, and market operators, Canton provides a credible blueprint for making tokenization part of their day-to-day operations. Discover how Twendee Labs empowers financial institutions to innovate with Canton Network asset tokenization. Stay connected via X and Telegram for expert insights.