The year 2025 marks a turning point in digital finance. With the U.S. introducing the GENIUS Act and Europe enforcing MiCA compliance, cryptocurrency regulation has entered a new era. These frameworks aim to standardize stablecoin regulation, enforce stricter exchange KYC requirements, and mandate regular token audits.

This shift is more than just a compliance exercise – it reshapes how exchanges and issuers operate, consolidates market players, and signals a long-term convergence toward a unified global crypto framework.

Stablecoin Regulation: From Flexibility to Full Accountability

Stablecoins are at the center of 2025’s regulatory shift, with the U.S. GENIUS Act and Europe’s MiCA compliance both introducing stringent oversight. These frameworks are designed to prevent de-pegging risks, strengthen market trust, and align stablecoins more closely with traditional financial rules.

The GENIUS Act establishes a dual licensing regime:

- Federal Path – Direct oversight from federal regulators such as the OCC, open to banks, credit unions, and nonbank entities.

- State Path – Issuers may operate under a Treasury-approved state framework deemed “substantially similar.” However, any issuer with more than $10 billion in circulation must transition to the federal path, a safeguard against systemic risk.

Equally important is the requirement for mandatory 1:1 reserves. Every stablecoin must be backed by segregated, high-quality liquid assets such as short-term U.S. Treasuries, cash deposits, or qualified repurchase agreements. The Act also explicitly prohibits algorithmic stablecoins and bans the rehypothecation of reserves, ensuring issuers cannot reuse or leverage customer-backed assets.

GENIUS Act framework showing dual licensing and mandatory 1:1 reserves (Source: GENIUS Act regulatory overview)

Case in point: Circle (USDC) has expanded its reserve attestations to align with these requirements, publishing detailed monthly reports and structuring its backing to meet both U.S. and EU standards. This proactive compliance positions USDC as one of the few stablecoins expected to thrive under the stricter regime.

Together, these measures enhance transparency and trust but also raise the compliance bar. Smaller issuers lacking the infrastructure for audits and reporting may face delistings, leading to a more consolidated but stable market.

Exchange KYC and Operational Burdens

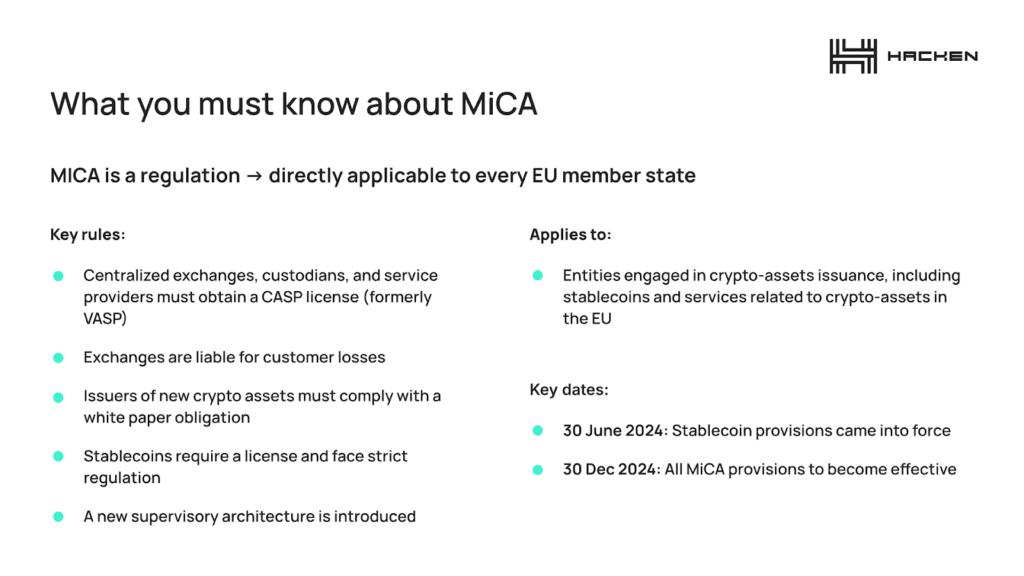

For exchanges, 2025 regulation is more than a compliance checklist, it redefines their business models. Both the U.S. GENIUS Act and Europe’s MiCA compliance frameworks are closing the gap between crypto platforms and traditional finance, demanding the same accountability as banks.

The shift creates three immediate burdens:

- KYC as banking-standard: Exchanges must implement identity verification processes that rival commercial banks, closing loopholes once exploited for anonymous trading.

- Licensing as a survival test: In the U.S., a federal or state charter is mandatory; in Europe, the CASP license replaces the looser VASP regime.

- Liability for customer losses: MiCA provisions make exchanges directly responsible for client protection, a move that raises insurance and governance costs.

MiCA compliance rules for exchanges and service providers, including CASP license and liability requirements (Source: Hacken)

This new regulatory reality forces exchanges to become risk managers as much as trading facilitators. Technology investments now extend beyond trading engines to compliance automation, data reporting, and governance systems. To operate under GENIUS and MiCA, exchanges must prove they can meet security standards every new exchange must pass, covering everything from KYC procedures to resilience against financial crime.

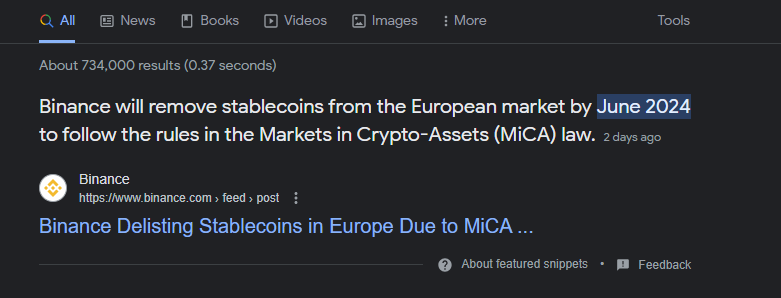

Case in point: Binance announced it would delist certain stablecoins from the European market to comply with MiCA’s June 2024 stablecoin provisions. This decision reflects a strategic trade-off: preserve regulatory access to Europe, one of the world’s largest crypto markets even if it means sacrificing liquidity options and frustrating retail users.

Binance announces delisting of stablecoins in Europe to comply with MiCA law by June 2024 (Source: Binance)

Across the Atlantic, Coinbase has signaled readiness to align with the GENIUS Act by exploring a federal charter. This move isn’t just legal housekeeping, it positions Coinbase to become a first-mover beneficiary if institutional capital flows toward compliant exchanges.

The result is a clear industry trajectory: regulation accelerates consolidation. Smaller exchanges may exit or merge, while global players leverage compliance as a moat, converting short-term costs into long-term trust advantages.

Global Convergence: Toward a Unified Crypto Market

The most profound shift in crypto regulation 2025 is that the U.S. and EU are no longer moving in isolation. The GENIUS Act and MiCA compliance are converging toward shared principles full reserve requirements, stricter licensing, and cross-border accountability. This creates both institutional confidence and systemic pressure on the global market.

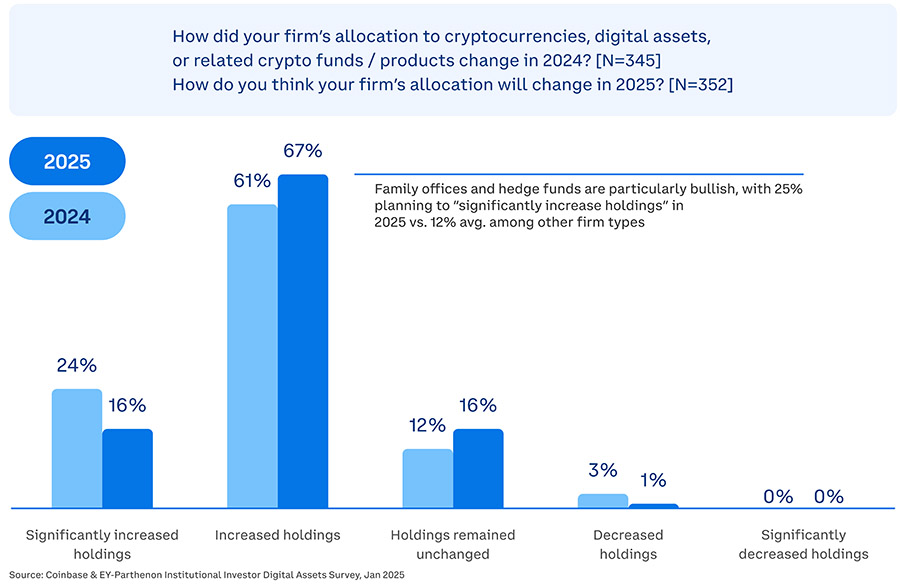

Institutional Capital Accelerates

For investors, clarity is confidence. A January 2025 Coinbase–EY Parthenon survey found that 67% of institutional investors plan to increase crypto holdings in 2025, up from 61% in 2024. More strikingly, 24% expect to “significantly increase” allocations, led by family offices and hedge funds.

Survey showing 67% of institutions plan to increase crypto holdings in 2025, with 24% expecting significant increases (Source: Coinbase/EY Parthenon, Jan 2025)

This institutional momentum is fueled by regulation: GENIUS and MiCA reduce legal uncertainty, making it easier for funds like BlackRock’s tokenized products to expand within compliant frameworks.

Compliance Rising, But Uneven

On the policy side, FATF data shows that by April 2025, 40 jurisdictions (29%) were “largely compliant” with crypto asset standards, up from 32 the year before. While progress is clear, 68 jurisdictions (49%) remain only partially compliant, and 21% are still non-compliant.

Global FATF compliance with crypto standards as of April 2025, showing 29% largely compliant and 21% not compliant (Source: FATF assessment)

This uneven adoption highlights both the momentum and the gaps: while the U.S. and EU converge, many emerging markets lag, creating a two-speed world of “compliance hubs” and “regulatory grey zones.”

Strategic Outlook

The convergence of GENIUS and MiCA is narrowing the field. For institutions, it’s a catalyst boosting allocations and legitimizing tokenization. For exchanges and issuers, it’s a filter: only those with compliance infrastructure can scale across markets. For policymakers, it’s proof that global frameworks are slowly aligning, even if gaps remain.

The message is clear: compliance is no longer just regulation, it’s the entry ticket to institutional capital and international relevance.

Conclusion

The landscape of crypto regulation in 2025 is defined by accountability, transparency, and consolidation. Stablecoin regulation demands full reserves and continuous reporting, while exchanges face heightened KYC and licensing requirements. The convergence of the GENIUS Act and MiCA is reducing arbitrage and creating a unified foundation for institutional trust.

For startups and enterprises, this stricter regime poses challenges but also opens doors to credibility and scale. Discover how Twendee Labs helps clients build compliant exchanges, conduct token audits, and design legal-ready tokenization services — and stay connected with us on X and LinkedIn.