The gap between Web3 product vision and market victory continues to challenge even the most well-funded teams. In 2024, venture funding poured $9.2 billion into blockchain startups (PitchBook), yet more than 80% of these projects fail to achieve sustainable adoption within 18 months. Those who survive share a consistent pattern: they master Web3 product development as a staged execution journey not just a technical build, but a full business system architecture.

Web3 product development for startup success in 2025

Unlike traditional software, Web3 startups are not just shipping code, they are architecting economies, governance systems, and decentralized communities. The only way to move from vision to victory is to treat Web3 product development as an end-to-end execution framework where every stage logically sets up the next.

Illustration of core Web3 ecosystem layers including NFTs, DeFi, and decentralized protocols. (Source: bdtask)

From Idea to Product Blueprint

Every journey starts with a simple but dangerous assumption: that blockchain is the right solution. In Web3 product development, founders must first validate that decentralization truly creates competitive advantage compared to centralized alternatives.

Friend.tech succeeded by identifying a real gap in social platform monetization. Web2 incumbents could not easily enable creator-fan ownership structures due to platform risks. Friend.tech’s blueprint was built around programmable token access — solving a real coordination problem that required Web3 infrastructure.

For early-stage founders, blueprinting means listing user actions that directly benefit from on-chain transparency, censorship resistance, or programmable incentives. If decentralization adds complexity without meaningful advantage, it will only slow product-market fit later.

Architecture Decisions That Define Success

Once the product blueprint is clear, infrastructure choices lock in key trade-offs that ripple across the product lifecycle. Web3 product development here means architecting not just for initial launch, but for sustainable governance, composability, and security.

Ethereum mainnet remains dominant for trust-critical protocols like DeFi, as Curve Finance demonstrates with its $4 billion in total value locked (TVL). Users tolerate higher fees in exchange for liquidity depth and security assurances. Yet Layer 2 solutions such as Arbitrum and Optimism have proven that lowering average transaction costs below $0.50 dramatically improves onboarding and daily usage growth.

Beyond chain selection, founders must design their contract upgrade paths carefully. Immutable contracts create rigidity, while overly centralized upgrade keys undermine trust. The best teams implement progressive decentralization, starting with admin-controlled upgrades during early product iteration, then transferring control to DAO governance as both product maturity and community readiness evolve.

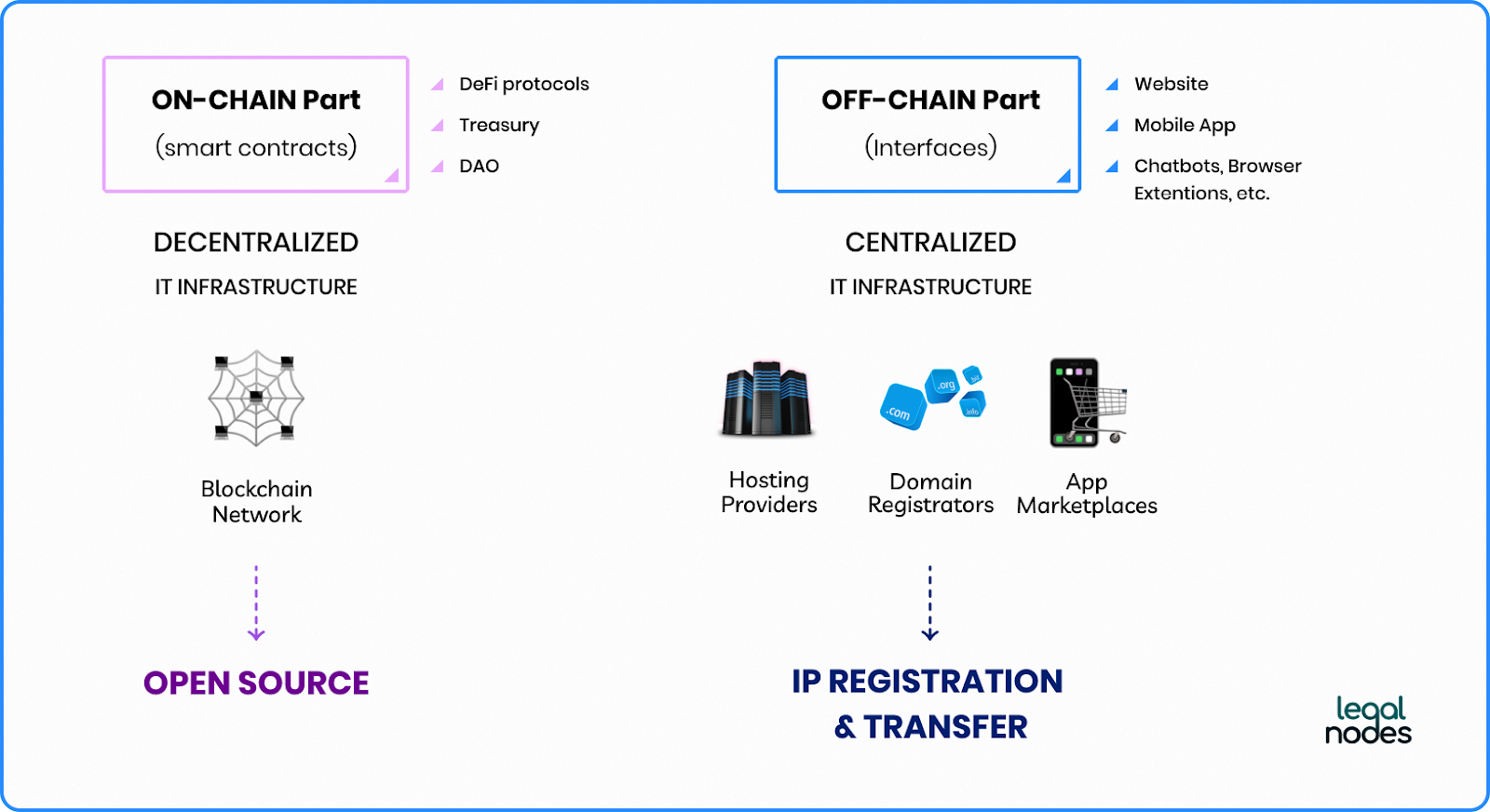

Web3 product architecture involves balancing on-chain decentralized infrastructure (smart contracts, DAOs) with off-chain centralized components (Source: LegalNodes)

Tokenomics as Product Infrastructure

Token design is not a side project — it is product infrastructure that directly influences user behavior. This is where many blockchain startups silently fail.

According to Messari’s 2024 analysis, 70% of token projects suffer severe inflation pressure within 6 months due to poorly structured emission models built for bull market assumptions. The common pattern: early liquidity mining attracts mercenary capital, not loyal users.

Sustainable tokenomics requires multi-scenario modeling across both bull and bear cycles. Web3 product development demands tokens that serve native product utility:

- Governance power that genuinely shapes protocol rules (like Uniswap’s UNI).

- Security staking that underwrites protocol risks (as Aave’s AAVE does).

- Access privileges that reward active participation beyond speculative holding.

The goal is alignment: token incentives must encourage behavior that strengthens long-term protocol health rather than simply extract short-term yield.

User Adoption Through Progressive Experience

Even with sound tokenomics, many dApps fail because they underestimate how difficult Web3 product development becomes when real users interact with the system.

Web3 onboarding friction remains one of the industry’s highest drop-off points. Wallet creation, seed phrase management, gas fee uncertainty, and confusing transaction flows routinely cause users to abandon platforms at first interaction.

Friend.tech’s 2023 rapid growth came from simplifying this flow — delaying full exposure to complex blockchain mechanics while onboarding creators and users through familiar Web2-like interfaces.

Effective adoption strategy means progressive decentralization in UX design:

- Start with embedded wallets or social login flows.

- Use fiat onramps that allow direct stablecoin purchases.

- Abstract chain selection — users shouldn’t care whether they are on Arbitrum, zkSync, or Polygon.

- Introduce advanced features (staking, governance participation) as engagement deepens.

Security-First Engineering Implementation

No amount of user growth can offset a catastrophic exploit. Security failures are unforgiving in Web3. The 2022 Mango Markets oracle manipulation, which drained $100 million, remains one of the clearest lessons: smart contract risk is existential.

Web3 product development teams must invest 15–20% of total build resources into multi-layered security:

- Formal verification of core contract logic.

- Comprehensive test coverage targeting >95% of code.

- Multiple independent audits (from firms like Trail of Bits or ConsenSys Diligence).

- Pre-launch fuzz testing and bug bounty programs.

Emergency response planning is also critical. Timelock upgrade mechanisms provide community oversight but require balancing responsiveness to potential vulnerabilities discovered after deployment.

Launch Strategy and Community Activation

In Web3 product development, launch is not a single event — it’s a phased sequence that aligns technical readiness with real community activation.

Founders should follow a 3-phase deployment:

- Private beta with core testers simulating governance and token flows.

- Public alpha testing protocol limits under real user behavior.

- Full mainnet launch with activated DAO governance, treasury controls, and incentivized community participation.

Key early metrics include:

- Weekly active user growth.

- Governance proposal submission and participation rates.

- DAO treasury utilization patterns.

- Token velocity stability.

Teams that optimize for steady utility growth over hype-driven token price spikes are more likely to achieve sustained adoption.

DAO Operations and Governance Maturation

Victory in Web3 product development requires robust DAO governance frameworks that balance decentralized community participation with operational efficiency.

Compound’s DAO model remains a useful reference: proposals require minimum thresholds, while specialized working groups execute approved mandates — allowing agility without sacrificing decentralization.

Data from DeepDAO shows successful DAOs maintain at least 24 months of treasury runway while engaging communities actively in development decisions. Yet governance conflicts like Curve DAO’s 2023 disputes over CRV emissions reveal how poor rule design can paralyze technical evolution.

Founders must design DAO governance with:

- Flexible quorum thresholds that evolve with token distribution.

- Emergency safeguards for proposal hijacking risks.

- Fork-resilient upgrade frameworks that protect long-term protocol alignment.

Sustainable Growth and Protocol Evolution

The full Web3 product development execution flow from initial discovery, architecture design, smart contract prototyping, secure testing, to full deployment and DAO governance. (Source: Web3 Dev Agency)

Once DAO operations stabilize, Web3 product development transitions into continuous evolution:

- Revenue models rely on protocol fees rather than subscription pricing.

- Fee structures should reward user value creation instead of maximizing short-term protocol income.

- Composability with other protocols (Uniswap, Aave, Compound) expands ecosystem integration and sticky utility.

As AI continues to intersect with blockchain infrastructure, protocol evolution will increasingly involve automated governance, smart contract agents, and AI-powered decision frameworks that reshape the entire product lifecycle. This convergence is already redefining Web3 product development, as discussed in AI Meets Web3: Is This Blockchain’s ChatGPT Moment in 2025?.

Unlike traditional SaaS, Web3 products face ongoing regulatory ambiguity. Teams must proactively embed compliance flexibility into architecture, allowing jurisdictional adjustments without destabilizing the protocol or forcing full rebuilds.

Conclusion

The complete Web3 product development journey is too complex for most early-stage teams to navigate alone. Expertise across smart contract architecture, tokenomics modeling, secure engineering, governance design, and adoption strategy takes years to master.

Twendee Labs partners with ambitious blockchain startups to architect and execute full-stack Web3 product development from initial concept validation through secure governance deployment and DAO-driven growth. Follow our insights on X and LinkedIn