In 2025, launching a crypto exchange isn’t about stitching together open-source tools, it’s a complex, high-stakes initiative demanding robust infrastructure, strict compliance, and enterprise-grade scalability.

Building something on the scale of Binance means more than deploying a trading interface. It’s creating a full financial ecosystem: multi-jurisdictional, high-volume, and asset-rich. This article breaks down the development cost by core modules, compares centralized and decentralized models, and offers real-world estimates from MVP to Binance-level platforms.

What Defines a Tier-1 Crypto Exchange in 2025?

Before estimating costs, it is important to define what separates a Tier-1 crypto exchange from a basic trading platform. When teams say they want to build “like Binance,” they are referring to infrastructure that must operate at the intersection of scale, compliance, liquidity, and resilience.

A Tier-1 exchange is typically defined by four core dimensions:

1. Functional Breadth

Basic exchanges may offer only spot trading. A Tier-1 platform supports advanced services such as margin and futures trading, staking, launchpads, P2P markets, and fiat integration. Each additional feature introduces new backend logic, regulatory exposure, and cross-functional dependencies.

2. Technical Scalability

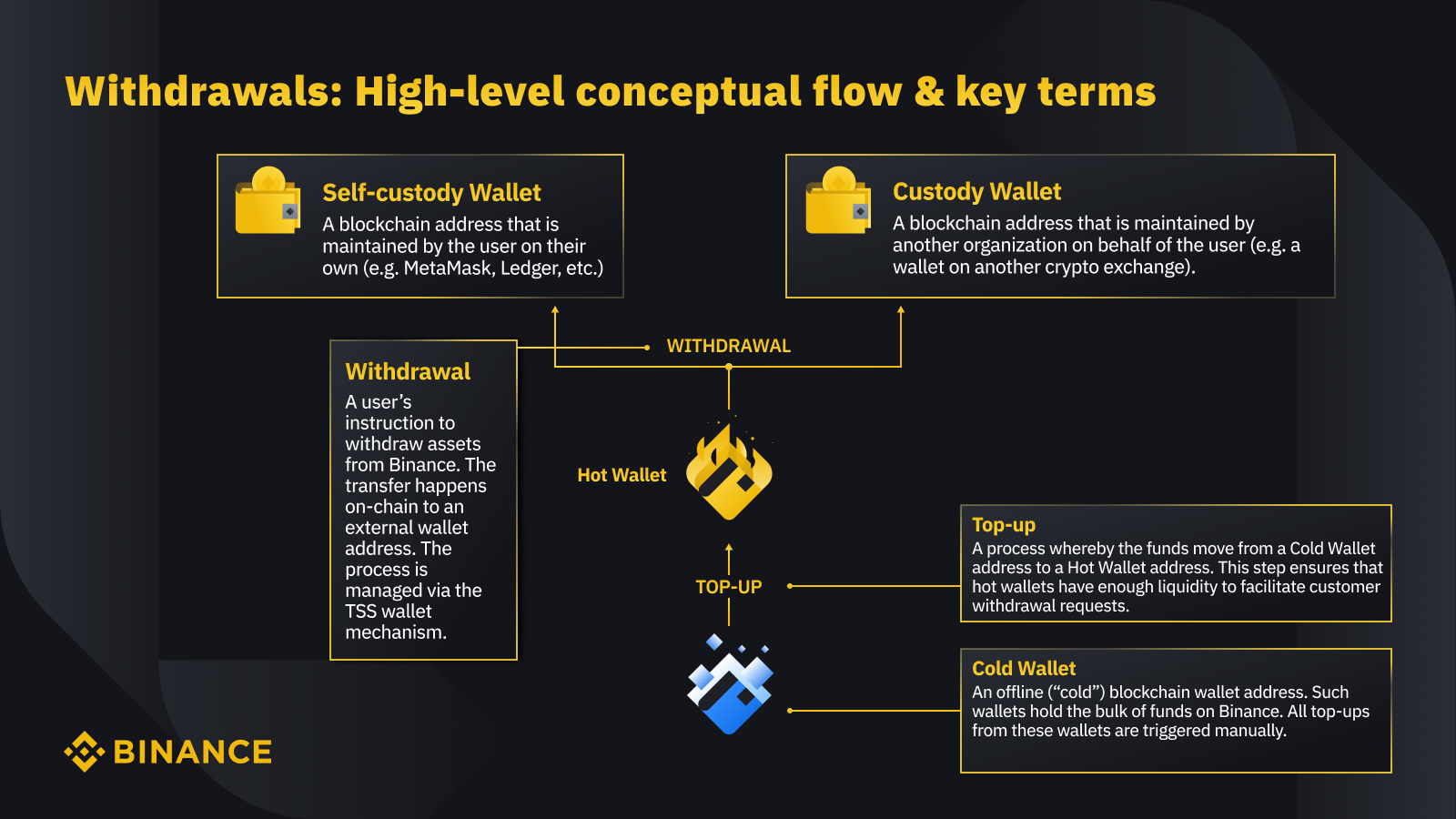

Handling high trading volume requires more than a fast matching engine. A scalable exchange manages wallet operations across hot and cold storage, ensures real-time asset reconciliation, and delivers low-latency execution for both retail and institutional users. DevOps readiness, CI/CD pipelines, and rollback systems are foundational at this level.

Binance wallet architecture showing hot wallet, cold wallet, self-custody, and withdrawal flow. (Source: Binance)

3. Regulatory Readiness

Serving multiple regions involves navigating diverse and often conflicting compliance frameworks. Tier-1 platforms implement multi-tiered KYC flows, enforce jurisdictional access restrictions, monitor transactions for suspicious activity, and maintain audit-quality records. These compliance requirements impact product design, infrastructure, and data policy at every level.

4. Liquidity and Market Trust

Technology alone does not ensure user adoption. A Tier-1 exchange must attract liquidity, integrate with market makers, and implement routing logic for optimal execution. Over time, platform trust is built through transparency, uptime, and consistent security performance. Without this trust, liquidity cannot be sustained.

These four dimensions reflect what leading exchanges like Binance have achieved. They are not simply larger platforms. They are more complex systems, built to meet higher expectations across performance, risk management, and user trust.

This is also why the cost to develop at this level increases sharply. Every new product vertical or regulatory market adds architectural demands, operational overhead, and legal responsibility. A Tier-1 exchange cannot be treated as a scaled-up MVP. It must be engineered from the start with long-term scale and reliability in mind.

Key Systems That Shape Crypto Exchange Development Cost

The cost of building a crypto exchange depends not just on features, but on the systems beneath them. Every major decision from custody model to compliance depth shapes both the upfront investment and long-term operational footprint. Whether building a centralized exchange (CEX) or a decentralized one (DEX), three core system areas determine cost and complexity.

1. User and Asset Management Systems

This includes user onboarding, identity verification, and wallet infrastructure.

- Centralized platforms require multi-factor authentication, fraud monitoring, and KYC/AML integration. Third-party verification tools come with per-user costs and regional compliance differences.

- Wallet systems must handle real-time asset reconciliation, cold/hot storage, and support for multiple chains. Custodial models require internal ledgering and withdrawal queues. DEX models shift to non-custodial smart contracts but introduce gas fees and audit demands.

These systems form the foundation for security, trust, and regulatory clearance and are the first to affect both build time and per-user cost.

2. Trade Execution and Liquidity Infrastructure

This is where trading logic, performance, and market access converge.

- Matching engines vary widely. CEXs use high-speed, off-chain order books with advanced order types, while DEXs may use AMMs or on-chain books that rely on smart contracts.

- A true liquidity engine goes beyond code. It includes integrations with market makers, dynamic spreads, price feed logic, and tools for volume incentives.

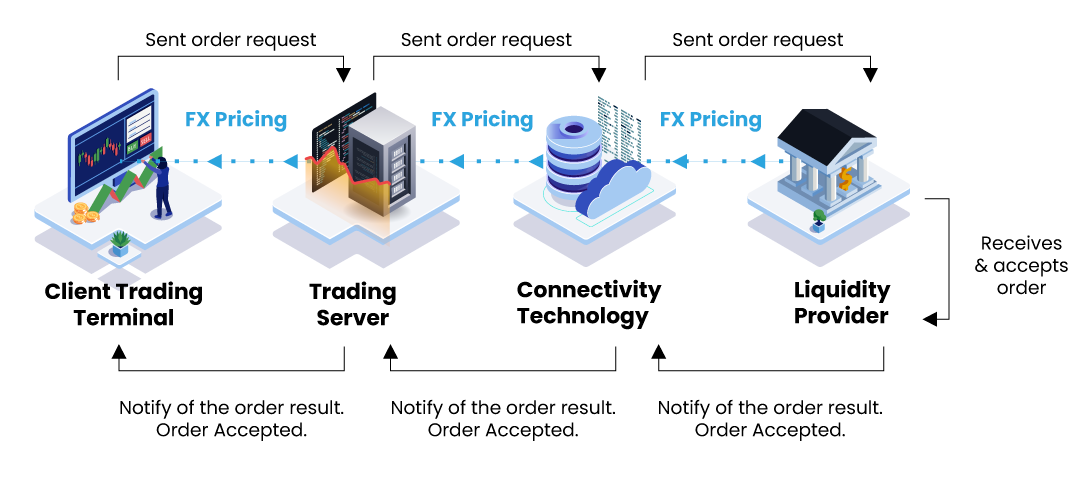

Trade execution architecture showing client terminal, trading server, connectivity, and liquidity provider in order flow. (Source: Centroid Solutions)

This diagram illustrates the execution flow from client to liquidity provider. While originally applied to FX markets, crypto exchanges follow a similar logic through token pricing engines, trading servers, and liquidity integrations.

Centralized trading systems cost more to build and maintain, but offer institutional-grade performance. Decentralized systems reduce backend load but face front-running, MEV risks, and slippage issues.

3. Compliance, Admin, and Platform Security

These are the invisible systems that define long-term sustainability.

- Compliance tooling involves KYC dashboards, jurisdictional controls, transaction monitoring, and automated flagging. These are especially critical for exchanges operating in or expanding to regions like the EU, Singapore, or the UAE.

- Admin systems include role-based dashboards, audit logs, and operational controls across wallets, trading, and user activity.

- Security measures depend on architecture: CEXs face API abuse and infrastructure attacks, while DEXs must defend against contract exploits and governance manipulation.

These systems do not scale gracefully if underbuilt. In most Tier-1 exchanges, security and compliance account for 30–50% of total development cost over time.

From Prototype to Full-Scale: What It Actually Costs to Build an Exchange in 2025

Development costs scale non-linearly as exchanges grow from internal proof-of-concept to public, multi-region infrastructure. Here’s how cost tiers typically break down not just in dollars, but in engineering expectations.

Key factors influencing crypto exchange development cost (Source: Innowise)

Prototype ($30,000–$50,000)

A prototype is designed for internal testing or investor demonstration. It may include:

- Simple trading UI with mock or testnet assets

- Basic wallet logic for a single blockchain

- No KYC, no real security, no scalability

This is not market-ready. It proves feasibility but must be replaced almost entirely for production.

MVP ($100,000–$250,000)

The minimum viable product includes:

- Live trading across 2–3 major assets

- Custodial wallet infrastructure with basic hot/cold logic

- Third-party KYC provider integration

- A simple admin panel for user management

At this stage, teams face trade-offs: build a lean, compliant spot exchange, or prematurely add features like fiat or staking without operational readiness. Many exchanges stall here due to liquidity gaps or unclear positioning.

Growth-Stage Exchange ($500,000–$1M)

Now the product shifts from functional to scalable. The platform supports:

- 100K+ users

- Multi-chain wallet automation

- Trading APIs and institutional access

- Fiat ramps, analytics, and tiered user roles

- Legal prep for multi-jurisdictional launch

This is where CEX vs DEX architecture decisions become defining. Centralized systems offer compliance and fiat integration, but carry higher ongoing security and legal overhead. Decentralized systems are lighter, but limited in regulatory clearance and fiat compatibility.

At scale, a Binance-level exchange becomes an infrastructure business, not just a product. Expect costs to shift from development to permanent investment in legal, security, and compliance operations.

For a more detailed estimation guide tailored to 2025 benchmarks, read:

How Much Does It Cost to Launch a Crypto Exchange App in 2025?

Conclusion

The cost of developing a crypto exchange in 2025 depends not only on features but on the depth of infrastructure behind them. An MVP might be delivered for $100K, but scaling into a Tier-1 platform like Binance often requires $5M or more. This leap in cost reflects a shift in what’s being built from an app to a globally compliant, high-performance financial system.

Exchanges at this level must operate with precision across wallet infrastructure, matching logic, regulatory integration, and security enforcement. Cutting corners early leads to constraints later. The most successful platforms invest in modular architecture and long-term readiness from day one.

Twendee Labs works with teams building at every stage from lean MVPs to globally scalable crypto infrastructure. To explore your options, visit twendeelabs.com or connect with us on LinkedIn and X.