Building a crypto exchange app has become far more complex than it was even a few years ago. In 2025, developing a Binance-level platform isn’t just about writing code — it’s about building an entire regulated financial infrastructure. Between evolving global regulations, liquidity challenges, and rising security demands, pricing estimates often range wildly.

This article breaks down where the real costs emerge, what founders and CTOs should expect when budgeting, and how 2025’s market conditions reshape the economics behind crypto exchange app development.

The 4 Biggest Cost Drivers Behind Crypto Exchange App Development

1. Trading Engine Performance: The Core Technology Cost

The trading engine is where all crypto exchange transactions are executed and matched in real time. The performance of this engine directly affects the platform’s ability to compete with established players like Binance or Coinbase.

- Throughput expectations have shifted sharply. In 2025, high-performance exchanges target 500,000 to 1,000,000 orders per second to handle market surges during volatile periods.

- Even smaller regional exchanges must be able to process 10,000–100,000 orders per second to ensure stability under peak loads.

- Building such an engine requires expert-level developers experienced with low-latency architectures, in-memory databases, and event-driven processing frameworks (e.g., Erlang, Rust, Golang).

Estimated cost impact: Matching engine development can represent 20% to 30% of total development cost, often requiring $200,000 to $600,000 depending on whether it supports derivatives, margin, futures, or options trading in addition to spot.

Without real-time matching accuracy, any exchange will quickly lose both retail and institutional users due to slippage, latency, or execution failures.

2. Security & Compliance: The Cost of Long-Term Survival

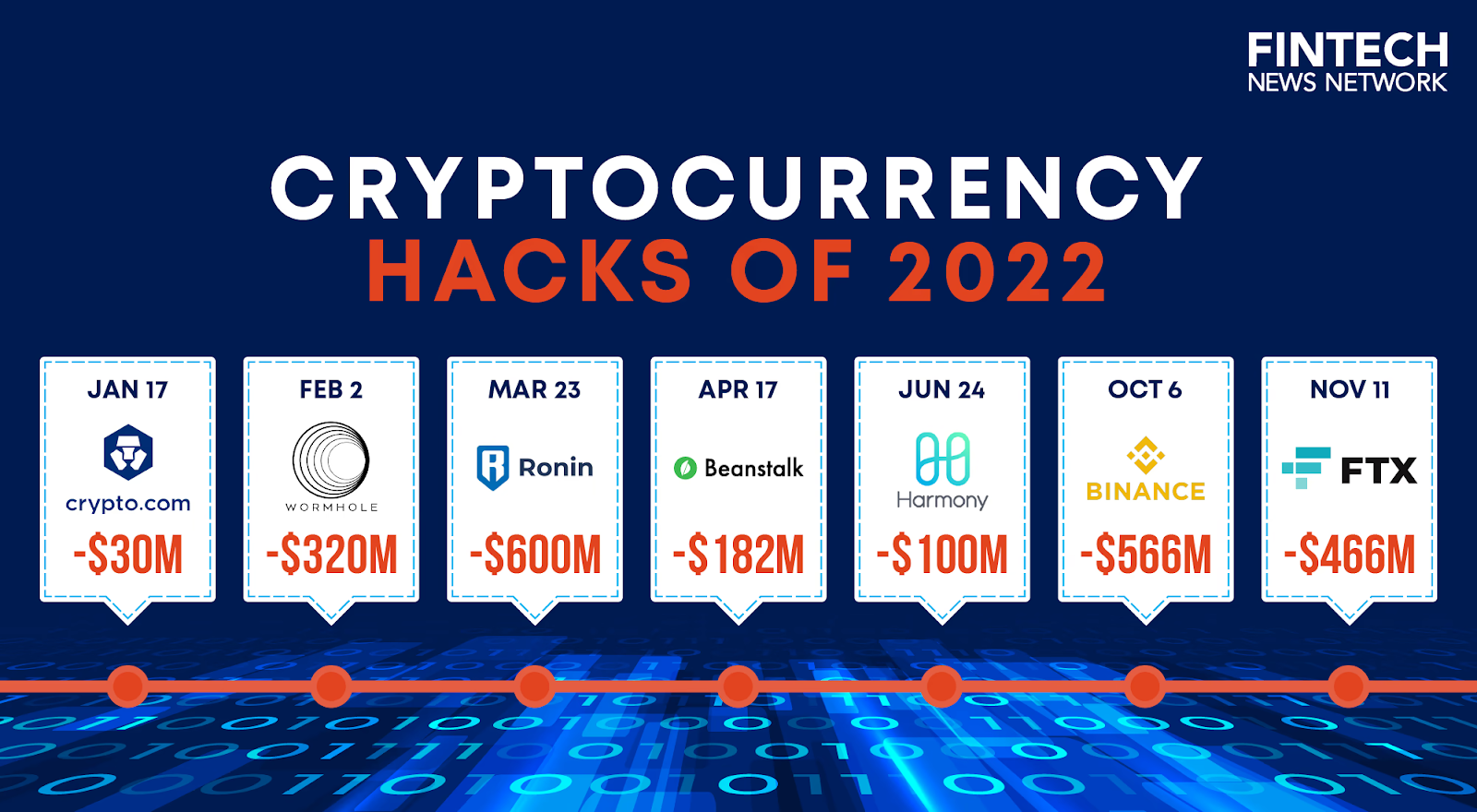

Security no longer serves as an optional add-on, it’s foundational. Following collapses like FTX, Celsius, and numerous hacks in 2022-2023, regulatory bodies now treat crypto platforms as financial institutions with full legal accountability.

Major crypto exchange hacks highlight security risks. (Source: Fintech News Singapore)

- KYC verification (identity verification): Vendors such as Jumio, Onfido, and Sumsub typically charge $1.50–$3 per verified user depending on volume and verification level.

- AML transaction monitoring: Companies like Chainalysis, Elliptic, and TRM Labs offer real-time risk scoring for on-chain transactions and fiat operations, often charging $10,000–$30,000 annually, depending on transaction volume.

- Penetration testing & smart contract audits: Full-scope security audits from top firms cost between $30,000 and $150,000 per audit cycle, especially if DeFi integrations or smart contract layers are involved.

- Cyber insurance & custody partners: For institutional-grade platforms, cyber insurance policies may cost $50,000–$500,000 annually, with custodial partnerships adding further layers of cost.

In heavily regulated jurisdictions, total compliance-related costs can consume 25% to 40% of the exchange’s initial launch budget — and that cost often grows annually as user volume and jurisdictional complexity increase.

3. Liquidity, Market Access & Partnerships

A crypto exchange without liquidity is essentially unusable. Traders expect tight spreads, deep order books, and instant execution — regardless of market conditions. Without sufficient liquidity, even a technically flawless platform will struggle to retain users or attract trading volume.

Liquidity doesn’t build organically at launch. New exchanges typically rely on third-party liquidity providers or market makers to inject volume. These providers may charge:

- Onboarding fees between $50,000 to $300,000, depending on the size and depth of liquidity required.

- Revenue-sharing agreements or monthly trading volume guarantees.

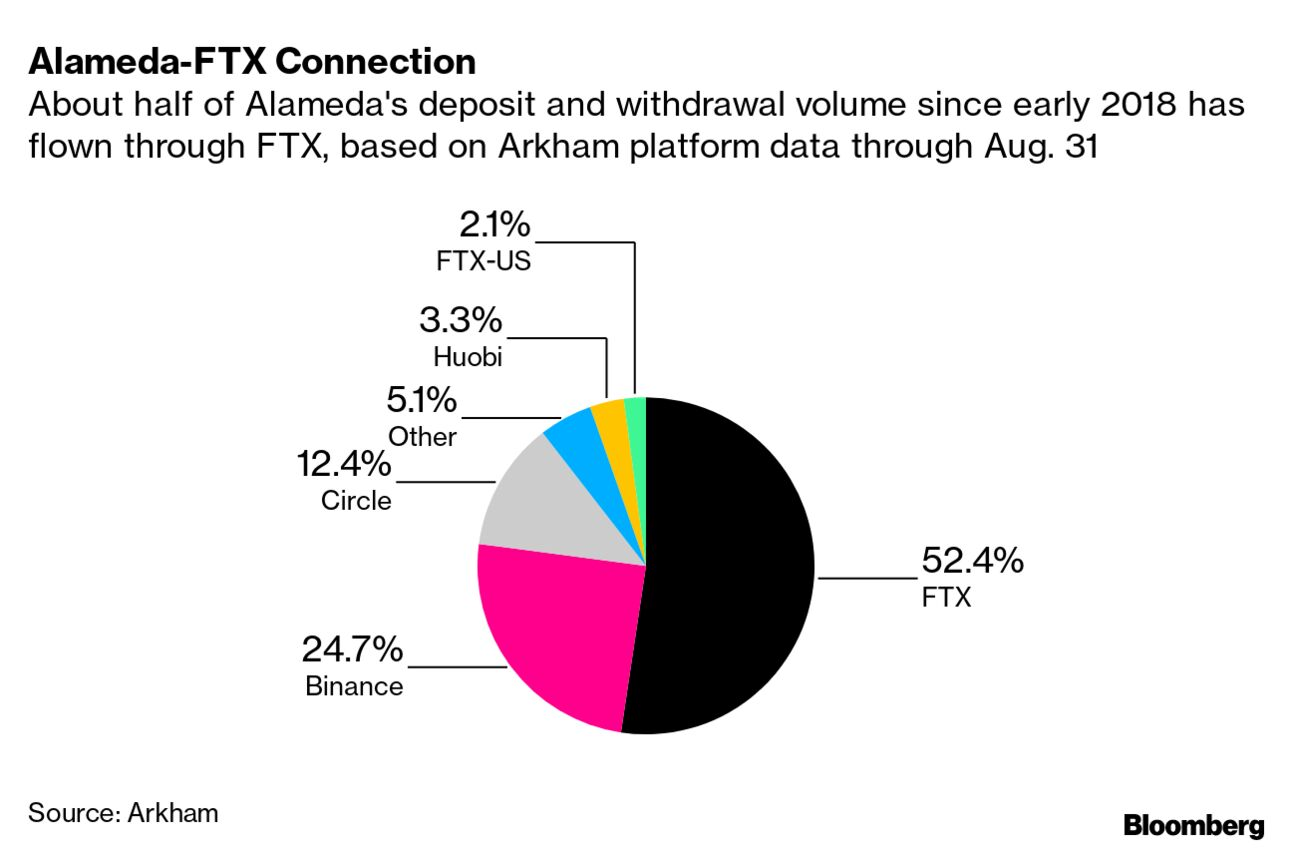

Real-world case: When FTX first launched in 2019, it secured early partnerships with Alameda Research (its affiliated trading firm) to act as both liquidity provider and initial market maker. This allowed FTX to offer extremely tight spreads and instant fills from day one, quickly building trust among high-frequency traders and retail users. Without this liquidity backing, FTX likely would have struggled to scale as rapidly, regardless of its platform features.

FTX-Alameda internal liquidity volume share breakdown (Source: Bloomberg)

For most startups without affiliated trading desks, accessing institutional liquidity requires both capital and long-term partner commitments.

4. Infrastructure & Long-Term Operations

After launch, crypto exchanges enter a phase where operational costs scale fast — and these often exceed initial development budgets.

- Cloud hosting for multi-region, low-latency trading typically costs $20,000 to $50,000 per month, depending on user load and trading volume.

- Technical operations grow as new chains are integrated, each requiring node maintenance, security patches, and constant monitoring to avoid downtime.

- Customer support & compliance teams expand with user growth, handling KYC escalations, withdrawal verifications, fraud detection, and ongoing regulatory audits.

By year two, most mid-tier exchanges face annual operational costs exceeding $1M–$3M, with larger global platforms spending significantly more.

What Changes in 2025: Why Exchange Compliance Costs Keep Growing

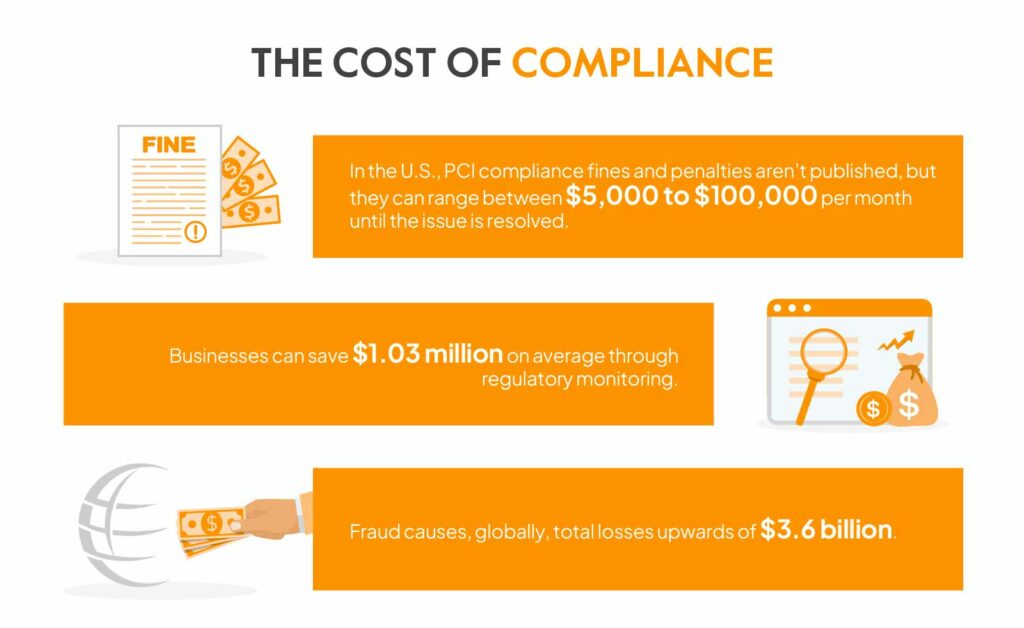

One of the most important pricing shifts in 2025 comes from the rising cost of regulatory compliance. As crypto integrates more deeply into traditional finance, exchanges must meet increasingly strict standards.

In the EU, MiCA (Markets in Crypto-Assets Regulation) is now fully enforced, requiring platforms to secure licenses, enforce capital reserve requirements, and implement rigorous consumer protection mechanisms. In the US, ongoing SEC enforcement has forced even global players to rethink entity structures, adding multiple layers of legal advisory fees.

Globally, FATF guidelines are also pushing stricter Travel Rule adherence, forcing exchanges to verify customer information across transactions.

In this climate, compliance can account for 20–35% of total launch cost depending on the jurisdictions served.

Compliance cost breakdown highlighting rising regulatory burden. (Source: Sprinto)

The rising popularity of tokenized real-world assets is also contributing to this compliance burden. As more exchanges prepare to list tokenized securities, real estate, and commodities, regulatory oversight grows heavier. See how tokenization is reshaping exchange complexity in 2025.

Cost Models: How Much Should Founders Actually Budget?

While many public sources throw around simplistic price tags, real-world projects show that crypto exchange app development costs follow a wide spectrum depending on product scope:

MVP Model: $150,000 – $300,000

- Supports limited spot trading pairs, regional user onboarding, and basic order matching.

- Off-the-shelf KYC modules with no deep compliance customization.

- Minimal liquidity partnerships; spreads and depth may remain shallow.

- Single-region cloud hosting and basic mobile/web apps.

Suitable for founders targeting initial proof-of-concept launches or niche markets, but will require significant reinvestment to scale globally.

Mid-Tier Regional Exchange: $500,000 – $1.5M

- Expanded asset class support, fiat ramps, and improved UI/UX optimization.

- Integrated KYC/AML onboarding, transaction monitoring, and early-stage Travel Rule compliance.

- Establishes relationships with liquidity providers to stabilize spreads.

- Penetration testing and third-party security audits become mandatory.

At this stage, regulatory filings may be required depending on jurisdiction (EU MiCA, Hong Kong VASP, or US MSB licenses), adding legal advisory and reporting costs.

Binance-Level Global Exchange: $3M – $7M+

- High-throughput trading engine capable of institutional order volumes.

- Full-stack global compliance architecture across multiple regulatory regimes.

- Deep liquidity integrations with market makers, OTC desks, and liquidity aggregators.

- Custodial partnerships (BitGo, Fireblocks) and insurance coverage for institutional clients.

- 24/7 multilingual support teams, ongoing legal audits, and disaster recovery infrastructure.

This level positions the exchange to attract both high-net-worth traders and regulated institutions — but operating at this tier requires full commitment to long-term licensing, financial reserves, and audit transparency.

Conclusion

Crypto exchange app development in 2025 is no longer a simple engineering problem. It’s a multi-layered build that involves technology, legal compliance, financial operations, and security architecture. Cutting corners may lower short-term spend but often creates structural weaknesses that block scale later.

At Twendee Labs, we help startups, institutional builders, and venture funds design exchange architectures that balance innovation with regulatory stability. Our solutions combine technical expertise with real-world operational planning — reducing long-term risk while building platforms that are ready for institutional trust.

Let Twendee help you architect scalable crypto exchange platforms — Twendee Labs | LinkedIn | X.