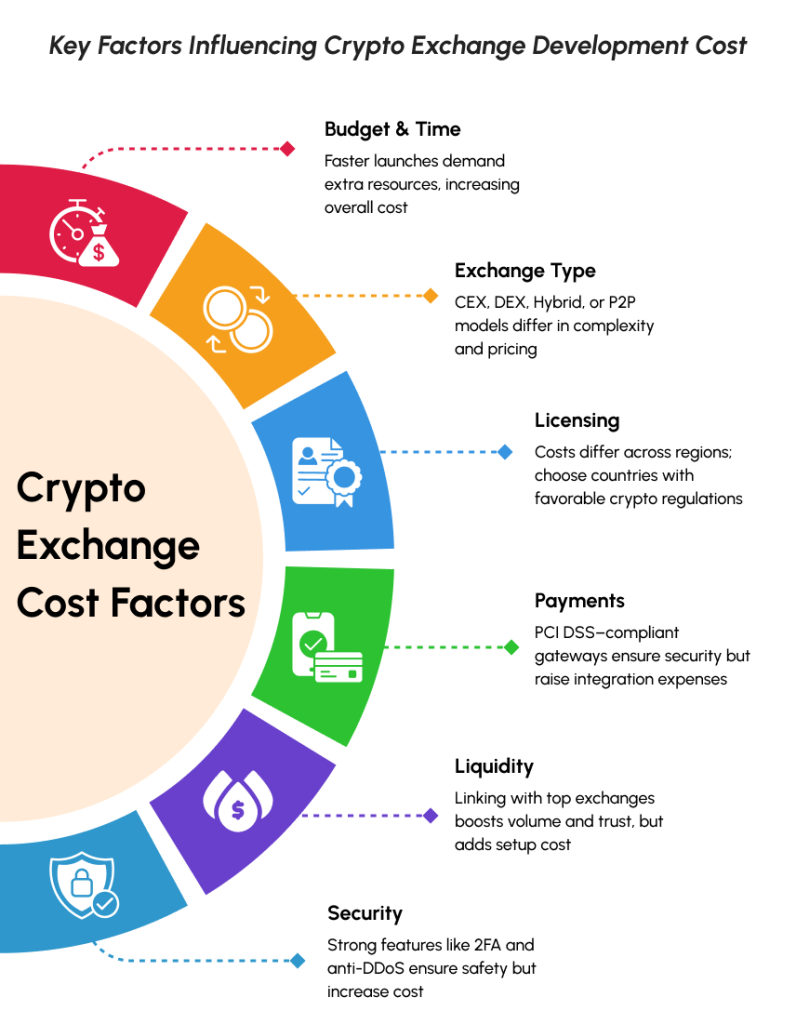

Building a cryptocurrency exchange from scratch in 2025 is a major undertaking, and one of the first questions any founder or investor will ask is: How much will it cost? The short answer is that the crypto exchange development cost can vary widely from a few hundred thousand dollars for a basic platform to well over a million for a full-featured, compliant exchange. This broad range is because the total cost depends on several critical factors, including technology, security, regulatory compliance and liquidity needs.

In this blog, we’ll break down the major cost components of building a crypto exchange in 2025. By examining each area, from development of the trading engine to regulatory licensing, you’ll get a clearer picture of where your budget will be allocated.

Major Cost Components of Crypto Exchange Development

When calculating the budget for a crypto exchange, founders should pay special attention to a few key areas that drive most of the expenses:

- Core Matching Engine Development: The trading engine that matches buy and sell orders is the heart of any exchange. Building a fast, scalable matching engine requires significant expertise and resources. It’s often one of the most expensive parts of development due to the complexity of ensuring low-latency, high-throughput trade execution.

- Security & Custody Infrastructure: Exchanges must implement top-tier security to protect user funds and data. This includes secure custody solutions for storing crypto assets (hot and cold wallets), encryption, multi-factor authentication, and regular security audits. Investing in strong security infrastructure (and the team to maintain it) is a substantial cost that cannot be skipped.

- Regulatory Compliance (KYC/AML) & Legal Fees: To operate legally, a crypto exchange needs to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Integrating robust KYC/AML systems and obtaining necessary licenses can be costly. Legal expenses for counsel and ongoing compliance (such as reporting and audits) often form a large portion of the budget.

- Liquidity Integration and Market Making: A new exchange with empty order books won’t attract users, so you must ensure liquidity. This may involve integrating with external liquidity providers or networks, or allocating capital for market making. Whether you partner with a liquidity provider (who may charge fees) or seed your own liquidity, this is a critical cost factor to enable smooth trading on your platform.

- Fiat On/Off-Ramp Setup: Allowing users to deposit and withdraw fiat currency (e.g. USD, EUR) adds another layer of complexity and cost. Building fiat on/off-ramp capability requires integrating with banking APIs or payment processors, adhering to financial regulations, and often maintaining reserve funds. The technical integration plus the compliance work (and possible banking partner fees) make fiat gateways a notable expense for any exchange.

An example Guide On How Much Does It Cost to Build a Crypto Exchange (Source: Coinsclone)

1. Matching Engine and Core Platform Development

Developing the core trading platform especially the matching engine that processes trades is a significant part of a crypto exchange’s upfront cost. This engine must handle large volumes of orders and execute trades in milliseconds. Achieving such performance and reliability requires specialized development skills, rigorous testing, and often a sizable development team.

Cost considerations: If you build the matching engine from scratch, expect to invest heavily in software architecture and optimization. Some estimates show that the trading engine development alone can cost anywhere from around $20,000 to $50,000 (for a basic engine) and more for a high-performance engine with advanced features. In many cases, the matching engine and related backend systems account for a large percentage of the total development budget. Using a pre-built or open-source engine can reduce costs, but it may still require customization and carries licensing considerations.

The matching engine is not a place to cut corners any downtime or errors here can derail the entire exchange. It’s worth allocating the necessary budget to get it right. Twendee’s development team, for example, focuses on building a robust core system from the outset, ensuring your exchange can scale as user demand grows.

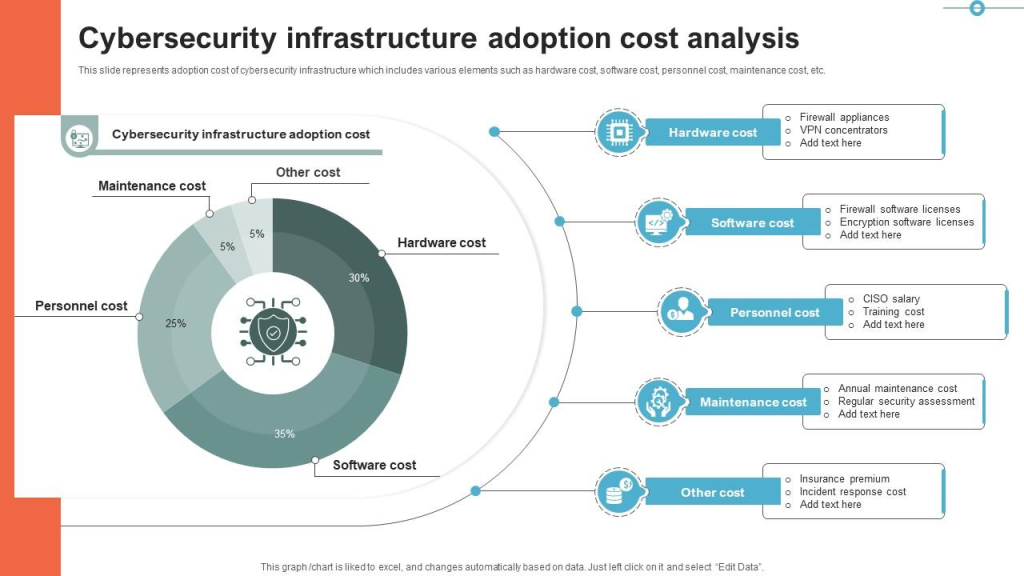

2. Security Measures and Custody Solutions

Security is absolutely paramount in a crypto exchange both for regulatory reasons and to build user trust. Security & custody costs encompass everything needed to safeguard user funds and data. This includes implementing secure user authentication (e.g., 2FA), encryption of sensitive data, protection against hacking attempts (firewalls, DDoS protection), and setting up multi-signature custody solutions for crypto assets. Most exchanges store the majority of assets in cold (offline) wallets for safety, while keeping some in hot wallets for liquidity managing this balance securely requires careful system design.

Cybersecurity infrastructure adoption cost analysis, illustrating how hardware, software, personnel and maintenance drive total security expenditure (Source: Internal slide)

Cost considerations: Building a secure exchange involves upfront development costs for security features and ongoing expenses for monitoring and updates. Integrating hardware security modules (HSMs) or third-party custody services can add to costs, but are often necessary for strong protection. Security audits and penetration testing by external firms are another important expense, these can run tens of thousands of dollars but are critical to identify vulnerabilities. In total, a significant chunk of your budget should be devoted to security infrastructure. As recent industry events have shown, investing in robust security is far cheaper than dealing with a major breach or loss of funds later.

Twendee approaches exchange development with a “security-first” mindset. We ensure that best practices (from smart contract audits to secure key management) are in place, so that your exchange’s security and custody setup is solid from day one. This proactive investment in security can save enormous costs (and headaches) down the line.

3. Regulatory Compliance (KYC/AML) and Legal Costs

No matter how great your technology is, a crypto exchange cannot operate long-term without meeting regulatory requirements. KYC/AML compliance refers to the processes of verifying user identities and monitoring transactions to prevent illicit activity. Implementing a KYC/AML system means integrating identity verification services (for example, document verification and biometric checks) and building workflows to review flagged transactions. Many exchanges use third-party KYC providers, which charge either per user verification or a monthly fee – this is an important ongoing cost to budget for.

Beyond the technical integration, you’ll need to account for legal costs and licensing fees. Depending on the jurisdictions you plan to operate in, obtaining the proper licenses can be both time-consuming and expensive. For instance, exchanges targeting U.S. customers might need Money Transmitter Licenses in multiple states, which can collectively cost hundreds of thousands of dollars in fees and bond requirements. In the EU, complying with regulations like MiCA or securing an e-money license also involves substantial legal work. Even in crypto-friendly jurisdictions, you should plan for legal counsel to ensure you remain compliant with evolving laws.

Cost considerations: Setting up compliance processes and legal structures often rivals the technical development cost. You may need to hire specialized lawyers or compliance officers early on. Budget for costs such as:

- KYC/AML software integration and vendor fees (this could be several thousand dollars per month depending on user volume).

- License application fees and associated costs (which can range from a few thousand in smaller jurisdictions to six figures in major markets).

- Ongoing compliance management (reporting, audits, regulatory updates).

While compliance doesn’t directly generate revenue, it’s not optional regulatory penalties or forced shutdowns are far more costly. Twendee’s team can advise on pragmatic compliance solutions, helping you implement KYC/AML effectively and choose jurisdictions or licensing strategies that align with your budget and growth plans.

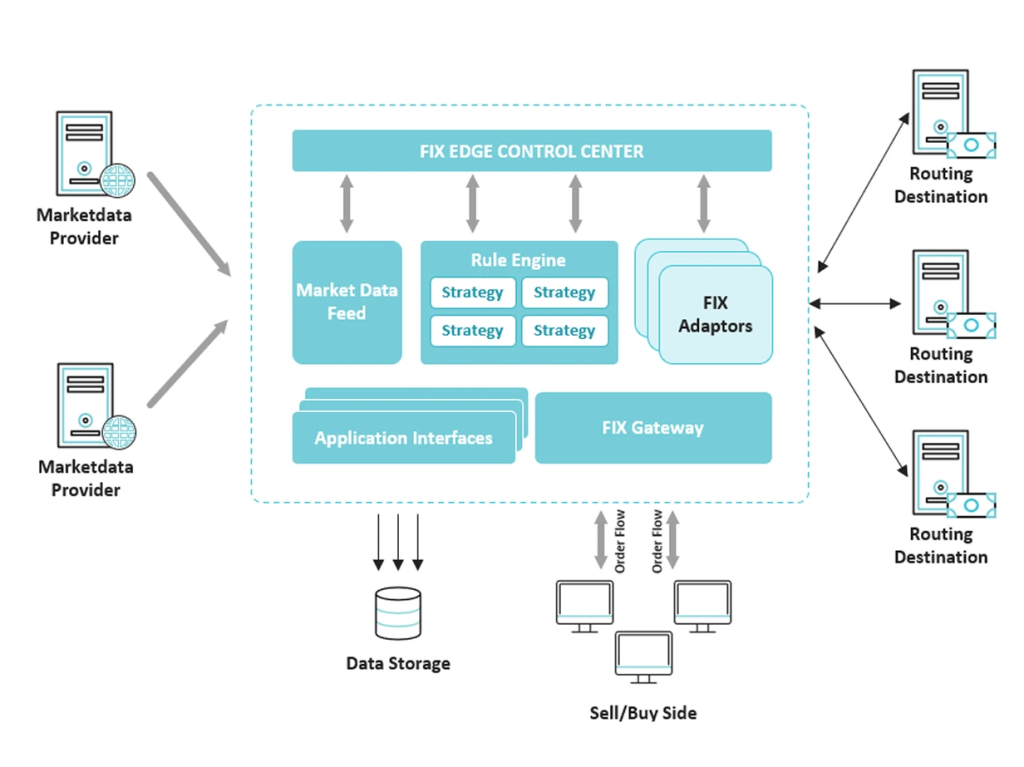

4. Liquidity Integration and Market Making

Launching an exchange is futile if traders arrive to find no liquidity (i.e., no active orders to trade against). Achieving liquidity in a new exchange typically requires connecting with external markets or investing capital in market making. Liquidity integration can mean integrating your exchange’s trading engine with larger exchanges or liquidity provider platforms to source orders and price feeds. There are technical solutions where your exchange can mirror the order books of established exchanges for certain trading pairs, ensuring your users always have something to trade against. Setting up these integrations involves development work and often partnership agreements.

Alternatively or additionally, many new exchanges allocate a budget to market making essentially providing your own capital (or hiring a firm) to create buy and sell orders on your exchange to stimulate activity. If you partner with a liquidity provider or market maker service, they might charge a retainer or a share of trading fees. These costs can add up, but they are critical to avoid the “empty marketplace” problem that can drive early users away.

Liquidity integration architecture illustrating how market data feeds, FIX engines, and routing destinations connect to support real-time order flow and market making (Source: FIX protocol liquidity workflow diagram)

Cost considerations: The development effort for liquidity integration might cost on the order of $15,000 to $30,000 or more, based on complexity and the number of external connections. Beyond development, consider the operational costs:

- Liquidity provider fees: Some charge monthly fees or require revenue sharing.

- Capital for liquidity: If you’re seeding initial liquidity yourself, you’ll need a significant reserve of funds for the trading pairs you support.

- Ongoing market making expenses: This could involve paying in-house traders or algorithms, or contracting third-party market makers.

Twendee has experience integrating exchanges with global liquidity networks and can help design a solution that balances cost with the need to offer a fluid trading experience. By leveraging existing APIs and frameworks, we help you kickstart liquidity on your platform without wasting resources.

5. Fiat On/Off-Ramp Infrastructure

Providing fiat on-ramps (letting users convert fiat currency to crypto) and off-ramps (crypto back to fiat) greatly expands your exchange’s appeal – but it’s also one of the more complex features to implement. To support fiat transactions, you will need to integrate with payment gateways, banks, or financial service APIs. This could involve things like bank transfer integrations (ACH, SEPA, wire transfers), credit/debit card processing for buying crypto, or working with third-party services (e.g. an embedded fiat purchase widget). Each method comes with integration challenges and compliance requirements (e.g., adhering to anti-fraud and banking regulations).

On/off-ramp development costs include the engineering effort to build and test these payment flows securely, as well as the business effort to establish partnerships with payment providers or banks. Many payment processors will charge setup fees and take a percentage of each transaction. Additionally, supporting fiat may require your exchange to hold accounts with banks and maintain certain capital reserves or surety bonds as per regulators’ requirements.

Cost considerations: The initial development to integrate a fiat gateway might be in the range of $20,000 to $50,000 (depending on how many currencies and methods you support). However, much of the cost in this area comes from ongoing factors:

- Banking relationships: You might need to spend months (and legal fees) to secure a willing banking partner. Some banks may require minimum balance commitments or charge service fees for holding exchange funds.

- Payment processing fees: Expect to lose a few percent of each fiat transaction to payment processors; some of this cost can be passed to users, but it affects your pricing strategy.

- Compliance overhead: As soon as you deal with fiat, your regulatory burden increases. This can mean higher compliance costs (additional AML measures, reporting to financial authorities, etc.).

Despite these challenges, offering fiat access is often essential for growing your user base beyond crypto-native traders. Twendee can integrate reliable on/off-ramp solutions into your exchange, using established providers to shorten development time. We also guide you through the process of setting up the necessary banking and payment partnerships, ensuring this component is handled in a cost-effective manner.

Other Significant Costs to Consider

Beyond the major components above, there are additional expenses that crypto exchange founders should keep in mind when planning their budget:

- Infrastructure and Hosting: Running an exchange requires robust servers, cloud infrastructure, and possibly global content delivery to minimize latency. Cloud services or data center costs can range from a few thousand dollars per month for a small exchange to hundreds of thousands as you scale. Ensure your architecture is scalable to avoid costly re-engineering later.

- Ongoing Maintenance and Support: After launch, continuous expenses include technical support, customer support teams, and ongoing development for upgrades or new features. Security updates and system maintenance are recurring needs that must be budgeted for monthly.

- Insurance and Risk Management: Some exchanges invest in insurance policies to cover assets (in case of hacks or loss) or in establishing emergency reserves. While not mandatory everywhere, this adds confidence for users and can be a significant yearly cost.

- Marketing and User Acquisition: Even the best-built exchange won’t succeed without users. Marketing costs (branding, PR, promotions, referral programs) are outside the development scope but are important to include in overall planning. Early liquidity incentives like trading fee discounts or reward programs also count as a cost of launching.

Building a crypto exchange is not just a one-time development cost – it’s the beginning of an ongoing financial commitment to operate and grow the platform. However, understanding these cost components helps you plan wisely and avoid surprises.

Conclusion

How much does it really cost to build a crypto exchange in 2025? As we’ve seen, the answer depends on your approach and priorities. It could be a few hundred thousand dollars for a lean, compliant MVP or several million for a fully loaded platform in multiple markets. The key for founders and decision-makers is to identify the big-ticket items (matching engine, security, compliance, liquidity, fiat access) early and ensure those are properly accounted for in the budget.

Twendee’s role is to turn these challenges into a clear roadmap. We provide consulting on realistic cost estimates and offer end-to-end crypto exchange development services from architecting a high-performance matching engine to integrating liquidity, KYC/AML systems, and secure custody. Our experts will work with you to build an exchange that is not only feature-complete and compliant, but also optimized to minimize ongoing costs.

Ready to build your crypto exchange? Contact Twendee’s team today to discuss your project requirements and get a tailored quote. We’ll help you navigate the costs and create a crypto exchange that’s engineered for success in 2025 and beyond!

Contact us: Twitter & LinkedIn Page

Read latest blog: How Real-World Assets (RWA) Tokenization Is Creating New Investment Channels