Stablecoin payments are emerging as a game-changer in finance, offering near-instant settlement and low fees for cross-border transactions. For technology leaders and innovators, the allure of stablecoins is hard to ignore: they combine the stability of fiat currency with the efficiency of blockchain networks. However, building a compliant stablecoin payment system requires careful planning. It is about regulatory compliance, robust security and a seamless user experience.

In this guide, we break down how to create a stablecoin payments platform that meets AML/KYC regulations and unlocks cheaper, faster international payments.

Benefits of Stablecoin Payments for Cross-Border Transactions

Before diving into the “how,” it’s important to understand why stablecoin payments are gaining traction, especially for global and cross-border use cases:

- Faster Settlements: Traditional cross-border bank transfers can take 2-5 days to clear, whereas stablecoin transactions typically settle within seconds or minutes. This real-time capability is invaluable for businesses operating across different time zones.

- Lower Transaction Fees: Intermediaries in the banking system often charge hefty fees (5-10% or more) for international transfers. In contrast, stablecoin payments usually cost a fraction of that, significantly reducing fees on cross-border transactions and saving money.

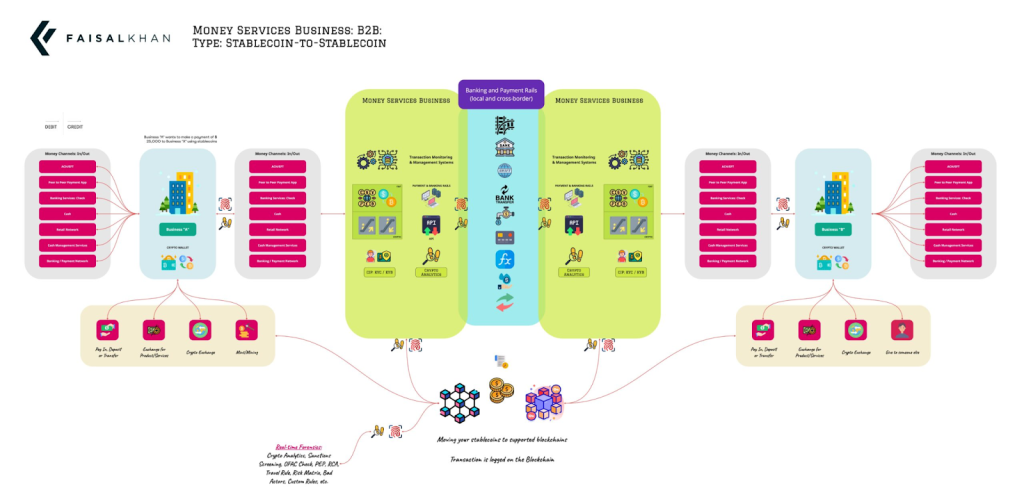

Diagram explaining how stablecoin payments streamline cross-border remittances and settlement networks (Source: Faisal Khan)

- 24/7 Availability: Stablecoin networks run on blockchain, meaning payments can be sent 24/7, including weekends and holidays. There’s no waiting for banks to open – value moves anytime, which is crucial for round-the-clock global operations.

- Borderless and Inclusive: Anyone with an internet connection can send or receive stablecoins without needing a traditional bank account. This opens up financial access in regions with limited banking infrastructure and makes worldwide business payments more inclusive.

- Transparency and Security: Blockchain transactions are recorded on a public ledger, providing a clear audit trail. This transparency can enhance compliance by making it easier to track and verify payments. Additionally, cryptographic security guards against fraud.

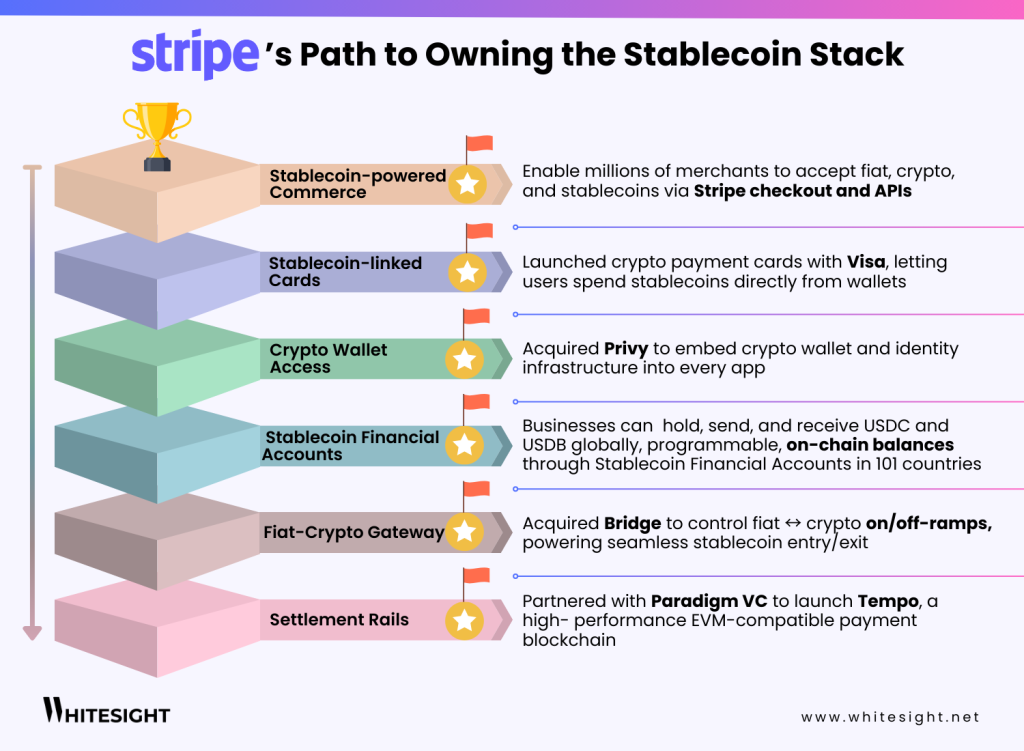

Infographic showing Stripe’s roadmap for building a full-stack stablecoin payments infrastructure from settlement rails to fiat–crypto gateways and wallet integrations (Source: Whitesight)

These benefits explain why even major payment networks like Visa and Mastercard have started exploring stablecoin settlements. Businesses that leverage stablecoins can gain a competitive edge with quicker, cheaper payments but only if they also manage the accompanying risks and obligations.

Ensuring Regulatory Compliance in Stablecoin Payments

Speed and cost mean nothing if your stablecoin payment system can’t pass regulatory muster. Regulatory compliance is the cornerstone of any stablecoin payments platform. Financial authorities worldwide are increasingly treating stablecoin transactions with the same scrutiny as traditional bank transfers.

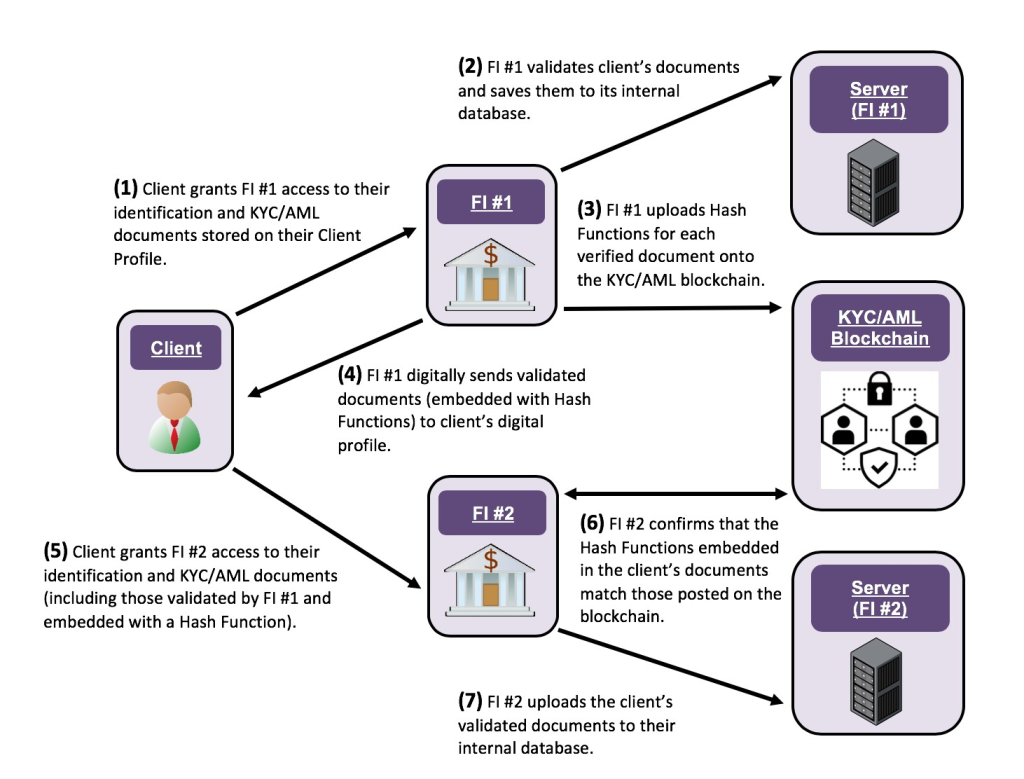

Illustration of blockchain-based KYC/AML workflow where verified customer data is securely shared among financial institutions using hash validation (Source: ResearchGate)

Here’s how to make sure your system meets key compliance requirements:

- Know Your Customer (KYC): Implement a robust KYC process to verify each user’s identity. This involves collecting official IDs, confirming personal details, and screening users against watchlists. Strong KYC procedures prevent anonymous usage of your platform, deterring fraudsters and money launderers.

- Anti-Money Laundering (AML) Monitoring: Deploy continuous AML monitoring for all transactions. Set rules to flag suspicious patterns such as unusually large transfers, rapid movement of funds between wallets, or activity from high-risk regions. Automated tools can perform real-time sanctions screening and raise alerts for any transaction that might indicate money laundering or illicit finance.

- FATF Travel Rule: Comply with the FATF “Travel Rule” by securely transmitting required sender and recipient information for large transactions. Ensuring traceability of who is sending and receiving funds (similar to bank wire data requirements) helps authorities and keeps your platform in line with global standards.

- Licensing and Legal Requirements: Obtain all necessary licenses to operate in each jurisdiction you serve. This could include money transmitter licenses, virtual asset service provider registration, or other regulatory approvals. Work with legal experts to ensure your business has the green light everywhere it operates.

- Reporting and Audits: Maintain detailed records of transactions and user activity, and be prepared to report suspicious activities to regulators. Regular audits of your compliance program whether by internal teams or external reviewers will demonstrate that your controls are effective and build trust with financial partners.

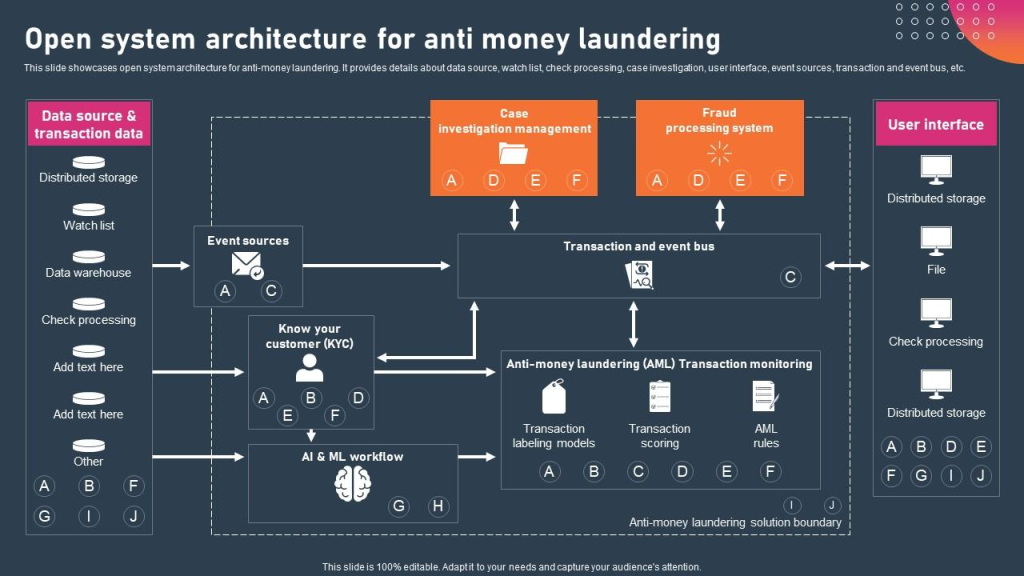

System architecture for anti–money laundering (AML) showing data sources, AI transaction monitoring, KYC modules, and fraud investigation layers (Source: SlideTeam)

By embedding compliance measures into your stablecoin platform, you build trust and longevity. Keep in mind that compliance is not a one-time task; regulations evolve continually. Stay proactive about updating your policies and technology as laws change. Prioritizing compliance not only avoids legal trouble but also reassures partners and customers that your platform is safe and above-board.

Building the Stablecoin Payment Infrastructure

With compliance under control, the next step is building a secure and efficient infrastructure for stablecoin payments. Key components of a stablecoin payment system include:

- Stablecoin Selection & Blockchain Integration: Choose which stablecoin(s) and blockchain network(s) to support, and integrate your platform accordingly. Base your choice on factors like transaction speed, network fees, and scalability. Make sure you have reliable connections to the blockchain (by running nodes or using a trusted service) for real-time transaction processing. If you plan to issue your own stablecoin, ensure it’s fully backed by reserves and compliant with relevant regulations.

- Digital Wallets (Custody Solutions): Determine how users will store and access their stablecoins. You can offer custodial wallets (where your system manages private keys for users) or integrate with non-custodial wallets (where users hold their own keys). In either case, implement strong wallet security—use encryption and multi-factor authentication for user accounts, and consider hardware security modules or multi-signature schemes to protect private keys and prevent unauthorized access.

- Payment API & User Interface: Develop easy-to-use APIs and interfaces for your system. A well-documented API enables other platforms (fintech apps, e-commerce sites, etc.) to integrate stablecoin payments into their services. Likewise, provide a user-friendly dashboard or app so clients can view balances, send/receive payments, and monitor transactions. This serves as the gateway connecting your stablecoin rails to end users and merchants.

- Compliance Automation: Embed compliance checks into your platform’s backend. Integrate identity verification services for quick KYC processing and blockchain analytics tools for AML tracking. Your system should automatically screen transactions for risks (like blacklisted addresses or abnormal patterns) before approving them. By automating these checks, you maintain a fast user experience while ensuring every transaction is vetted and legal.

- Security and Resilience: Apply bank-grade security practices across your infrastructure. Conduct thorough testing and smart contract audits to eliminate vulnerabilities. Secure servers and databases with best practices (firewalls, encryption, intrusion detection) and enforce strict access controls. Ensure high availability with redundant systems so the platform runs 24/7 without downtime. And have an incident response plan ready to quickly address any security breaches or technical issues if they arise.

Leveraging Stablecoins for Cross-Border Transactions

A primary reason to use stablecoins is to improve cross-border transactions. To maximize global payment efficiency, consider the following:

- Multi-Currency Support & Conversion: Support multiple currencies and easy conversion. While USD-pegged stablecoins dominate, you can also support other major currencies or at least ensure recipients have off-ramps to convert stablecoins into local currency. Integrating with exchanges or banking partners in each region ensures that a payment sent in stablecoin can seamlessly arrive as local currency for the recipient.

- Global Compliance Standards: Configure your compliance program for a worldwide user base. Each country has its own crypto rules, so meet or exceed the strictest KYC/AML standards across your markets. For example, automatically block transactions involving sanctioned regions and adapt identity verification to satisfy different national requirements. A unified high-bar approach keeps cross-border transfers legal and worry-free wherever you operate.

- Optimized Costs and Speed: Design your system to minimize fees and delays. Take advantage of less congested blockchains or layer-2 networks to keep transaction costs low. Also leverage stablecoins’ real-time settlement – provide users with immediate transaction status updates. Showing payments confirm within minutes (instead of days) boosts user confidence in your system.

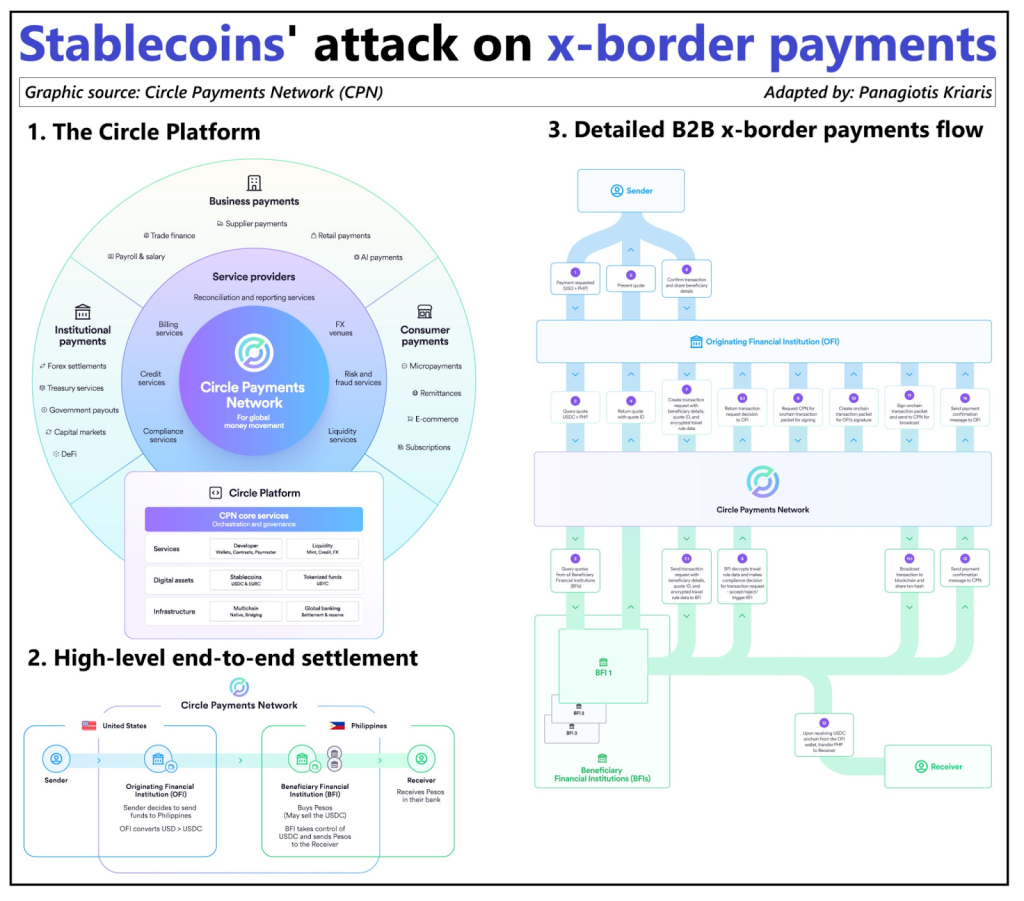

Comprehensive visualization of how stablecoins streamline cross-border payments through the Circle Payments Network, illustrating institutional, consumer, and B2B settlement flows (Source: Circle Payments Network (CPN)

By tailoring your platform for cross-border efficiency, you eliminate many pain points of international payments. Paying an overseas supplier or sending money to family abroad can become as simple as sending an email – with funds arriving faster and at a fraction of the cost of traditional methods. This powerful value proposition is why incorporating stablecoins into global payments is so attractive.

Stablecoins, CBDCs and Future-Proofing Your System

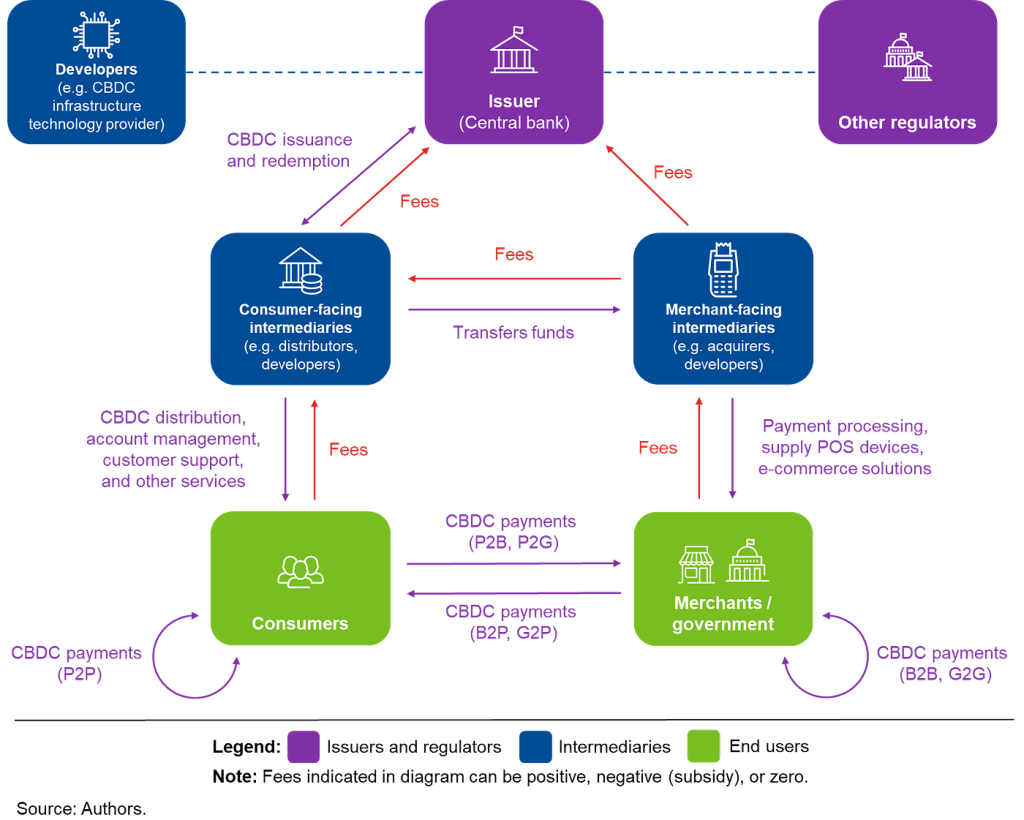

The digital currency landscape is evolving rapidly. Many central banks are developing Central Bank Digital Currencies (CBDCs) official digital versions of national currencies which may soon coexist with private stablecoins. As you build your stablecoin payment system, keep an eye on these developments and aim to future-proof your platform:

Build with flexibility so you can support new digital currencies alongside stablecoins when they emerge. Designing a modular, interoperable architecture now will save you effort later.

CBDC ecosystem flow showing how central banks, intermediaries, and merchants interact in a regulated digital currency environment, including P2P, B2B, and G2G stablecoin-like payments (Source: International Monetary Fund (IMF)

Additionally, stay informed on regulatory changes and industry standards. If new rules or CBDCs roll out, update your compliance measures and technology accordingly. By staying adaptable, you’ll keep your platform compliant and competitive as digital finance evolves.

Conclusion

Creating a compliant stablecoin payment system is a strategic investment in the future of finance. By combining the innovation of blockchain technology with the rigor of financial compliance, you can offer a payment solution that is fast, low-cost, and trusted by users and regulators alike. It requires careful planning and the right expertise to succeed.

While this task may seem complex, you don’t have to do it alone. Twendee can be your partner in the journey. We specialize in building secure blockchain infrastructure, integrating stablecoin rails, and delivering custom payment APIs for fintechs and enterprises. With our expertise, your stablecoin payments platform will be secure, seamless, and fully compliant.

Ready to transform your payment systems with stablecoins? Contact Twendee today to discover how our blockchain development services can help you launch a compliant, cutting-edge stablecoin payment solution and propel your business into the future of global finance.

Contact us: Twitter & LinkedIn Page