Bandwidth has always been a sunk cost – paid for monthly, barely considered, and mostly wasted. But that’s beginning to change. A new class of Web3 protocols is reframing bandwidth not as a utility, but as an asset.

Through decentralized infrastructure networks (DePINs), individuals can now earn by contributing underused internet capacity to distributed services. The result? A quiet but important shift toward user-driven Web3 networks — where participants don’t just use the network. They become it.

What It Really Takes to Monetize Bandwidth

Before users can turn bandwidth into income, decentralized networks must meet strict protocol-level requirements. This isn’t about tokenizing connectivity for its own sake – it’s about building systems that can validate, utilize, and reward network participation securely and efficiently.

To truly enable bandwidth monetization, a Web3 infrastructure must include:

- Cryptographic metering Smart contracts must verifiably measure throughput, uptime, and latency – making performance-based rewards trustless and tamper-resistant.

- Integrated demand flows Node operators need to serve actual traffic – VPN, dCDN, encrypted routing – not artificial data. Monetization only works if the bandwidth has downstream utility.

- Automated, rules-based incentives Compensation should be tied to verified delivery – not staking size or central approval – and must be distributed automatically by protocol logic. User-controlled, privacy-safe design Contributors shouldn’t hand over credentials or risk exposure. Systems must encrypt traffic, anonymize endpoints, and keep users in control of permissions.

These are not plug-and-play requirements. They call for full-stack coordination – from protocol architecture to service integration – which is why only networks purpose-built for this logic can unlock monetized infrastructure at scale.

Why User-Driven Web3 Networks Are Growing

The surge in user-driven Web3 networks is not just a technical evolution, it’s a response to macroeconomic, infrastructure, and investment dynamics converging at the same time.

For two decades, centralized cloud platforms and telecom providers controlled internet infrastructure. They determined pricing, access, routing, and value capture. But rising costs, compliance friction, security failures, and data sovereignty concerns are creating space for decentralized alternatives to grow — fast.

Several key forces are accelerating the shift:

- Wasted bandwidth is everywhere Residential broadband operates at just ~15% utilization (Sandvine, 2023). That’s billions in unused capacity sitting idle – a massive underleveraged asset class.

- Centralized cloud models are reaching systemic limits Vendor lock-in, unpredictable outages, rising storage and compute costs, and restrictive data localization laws are pushing developers and enterprises to seek distributed, borderless solutions.

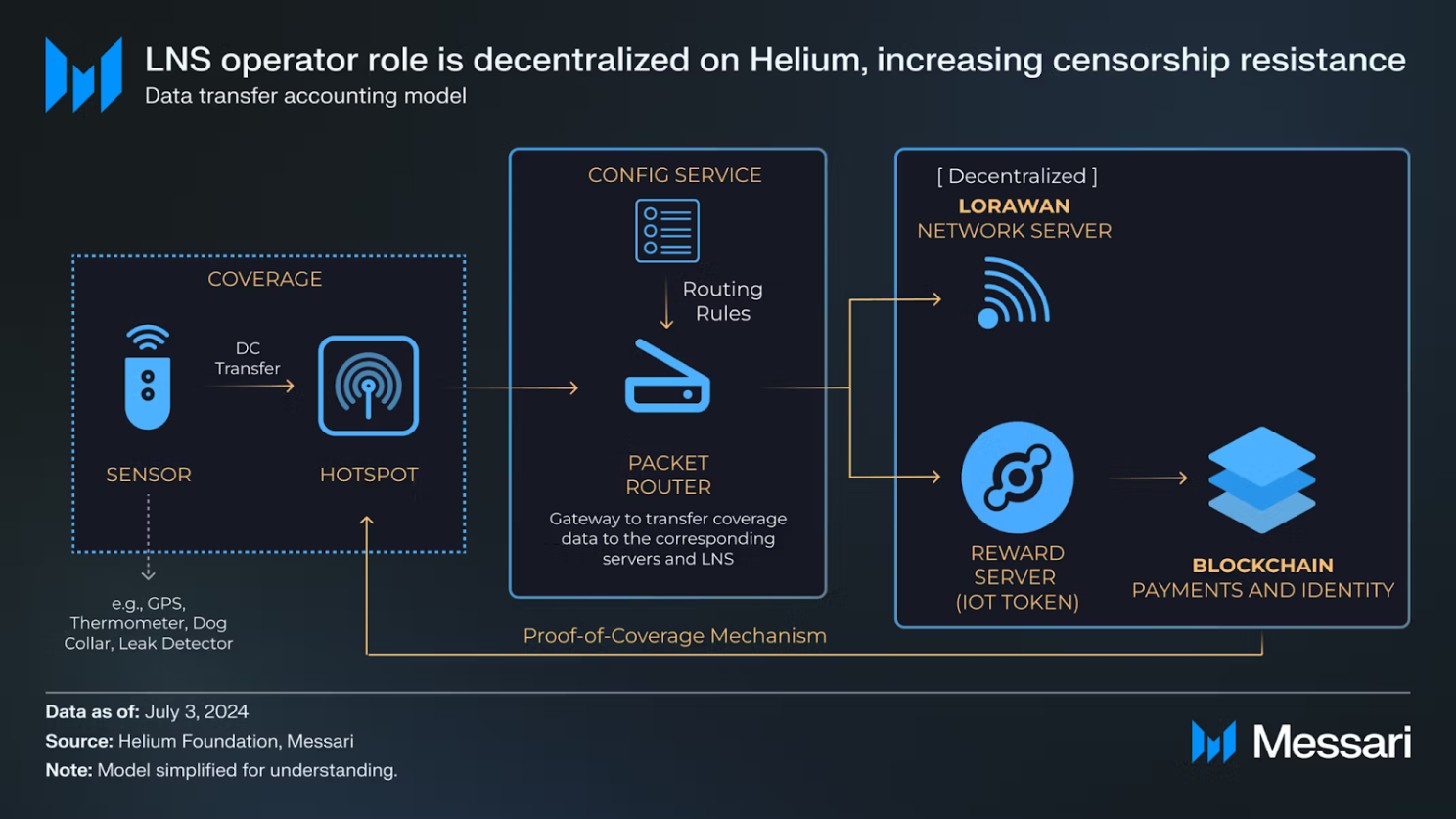

- Web3 protocols offer scalable, permissionless participation Unlike traditional cloud infrastructure, user-driven networks like Helium, Pocket Network, and Filecoin allow anyone – anywhere – to contribute and earn. These networks self-scale horizontally with each new participant, without requiring capital-intensive server farms.

- Proven real-world adoption Helium’s wireless network grew to nearly a million hotspots globally in under three years. Filecoin secured over 16 exabytes of decentralized storage capacity. These aren’t theoretical experiments – they’re operating at real-world scale.

Helium decentralized data transfer and reward system diagram (Source: Messari)

Capital and Developer Momentum Are Fueling Growth

User-driven infrastructure is also gaining serious attention from venture capital and institutional investors. According to Messari’s DePIN Sector Report 2023, investment into decentralized infrastructure projects increased by over 170% year-over-year, signaling a broader confidence in infrastructure monetization models.

Major crypto-native funds like a16z Crypto, Multicoin Capital, and Borderless Capital have all allocated dedicated strategies around DePIN – betting not just on bandwidth, but on decentralized storage, compute, energy grids, and connectivity layers.

At the same time, developer activity is shifting. Open-source contributions to decentralized infrastructure projects have outpaced DeFi growth since mid-2022, indicating that the next frontier of Web3 innovation is likely to emerge from the infrastructure layer – not just financial applications.

Case Study: How Frostbyte Enables Bandwidth Monetization

Among these emerging DePIN projects, Frostbyte zeroes in on one of the most underutilized resources on the internet: home bandwidth.

Frostbyte offers a lightweight, decentralized bandwidth-sharing protocol. Users can install a node – on a laptop, router, or even dedicated low-power hardware – and begin contributing their excess bandwidth to the network. That bandwidth then helps power privacy-first services like VPNs, encrypted relays, or even decentralized CDN routes.

What makes Frostbyte compelling isn’t just the service – it’s the structure:

Frostbyte app interface showing bandwidth earnings dashboard (Source: Ice Open Network)

- Real-time metering. Bandwidth usage is cryptographically measured through smart contract-logged traffic signatures, ensuring contributors are only paid for actual data served.

- Quality enforcement. Nodes are scored based on uptime, latency, and packet integrity — with underperformers slashed or downranked.

- Token alignment. Contributors receive native tokens based on weighted proof-of-service, not staking or reputation. It’s programmable micro-incentivization.

- Non-custodial payouts. There’s no centralized intermediary or approval process. Earnings flow directly from protocol contracts, removing counterparty risk.

This model flips the bandwidth economy. Instead of paying ISPs and centralized VPNs, users tap into a global, trustless bandwidth layer – where contributors like residential node operators are compensated in near-real time for routing traffic.

It’s infrastructure from the edge – built for resilience, paid in proof.

This evolution in user participation reflects a broader trend: even services like AI-driven blockchain chatbots — which require scalable, decentralized bandwidth layers — are benefiting from the shift toward DePIN-style architecture.

The Market Signals Are Clear

Bandwidth monetization isn’t arriving in a vacuum. Macro forces are aligning to accelerate it.

- Demand is real. VPN use has surged globally, with 31% of internet users relying on VPN services regularly.

- Supply is available. Terabits of excess capacity sit idle in homes and businesses every day.

- DePIN infrastructure is expanding. Projects like Helium, Akash, and Filecoin have validated that user-contributed infrastructure can scale reliably.

- Cost and regulatory pressures are intensifying. Data privacy laws and cloud cost inflation are driving companies toward decentralized, user-powered alternatives.

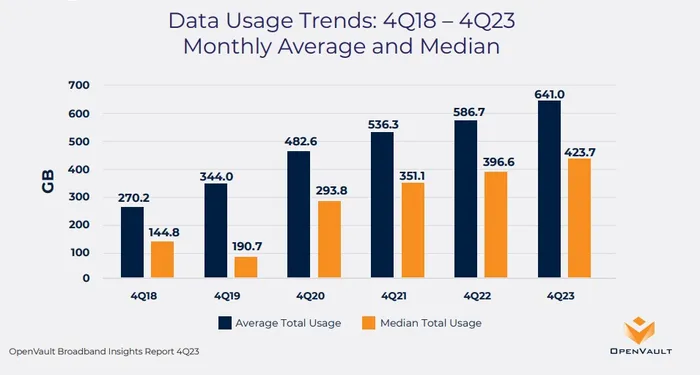

In parallel, broadband data consumption continues to climb sharply. According to the OpenVault Broadband Insights Report 4Q23, the average residential data usage reached 641 GB per month by late 2023 — nearly doubling since 2018.

Residential broadband data usage growth from 2018 to 2023 (Source: OpenVault)

As consumption grows, unlocking underutilized capacity at the edge becomes even more critical for future-proofing decentralized networks.

Firms like Twendee Labs are helping clients rethink infrastructure from the ground up, designing systems that tap into these latent resources, with scalable architecture and token-aligned business models.

Conclusion

If Web1 gave users access, and Web2 turned them into content, Web3 offers something different: participation at the base layer. Projects like Frostbyte are not just enabling monetization; they’re redefining who owns and operates the network layer.

This shift represents more than a new earning model, it signals a broader movement toward decentralized, resilient systems where value accrues at the edges, not just the center. In the next evolution of the internet, idle bandwidth isn’t wasted – it works.

Twendee Labs provides Web3 consulting and tailored infrastructure solutions for fintech vendors, DePIN projects, and enterprises. From trading systems to decentralized networks, we combine technical expertise with strategic insight to help clients build resilient, audit-ready systems. Follow Twendee Labs on LinkedIn and X for more.