Multi-chain wallets are rapidly gaining traction in 2025 as the crypto industry demands solutions that operate across multiple blockchains. We are witnessing a surge in both multi-chain wallets and cross-chain tools from cross-chain bridges to DeFi tools and Web3 payment solutions all aimed at seamless blockchain interoperability.

This trend reflects an urgent need to break down silos between blockchains, enabling users and businesses to transact and innovate without being confined to a single network. In fact, as more blockchains emerge and ecosystems expand, the ability to move assets and data across chains has become a core requirement rather than a luxury.

This blog will explore why multi-chain wallets and cross-chain tools are on the rise in 2025, how they work, and what this means for the future of decentralized finance and commerce.

Understanding Multi-Chain Wallets and Cross-Chain Tools

Multi-Chain Wallets: A multi-chain crypto wallet is a wallet that supports multiple blockchain networks in one interface. Unlike traditional single-chain wallets tied to only one blockchain (e.g. only Bitcoin or only Ethereum), multi-chain wallets let users manage assets on various blockchains from a single platform. For example, a single multi-chain wallet app might allow you to hold Ether on Ethereum, BNB on Binance Smart Chain, and SOL on Solana simultaneously. This interoperability offers great convenience: instead of juggling separate wallets for different networks, users can securely store, send, and receive cryptocurrencies across multiple chains in one place. Advanced multi-chain wallets even enable in-app token swaps between chains, eliminating the need for third-party exchanges. By removing the fragmentation of assets across disparate wallets, multi-chain wallets empower users to engage with DeFi protocols, NFTs, and dApps across ecosystems without barriers.

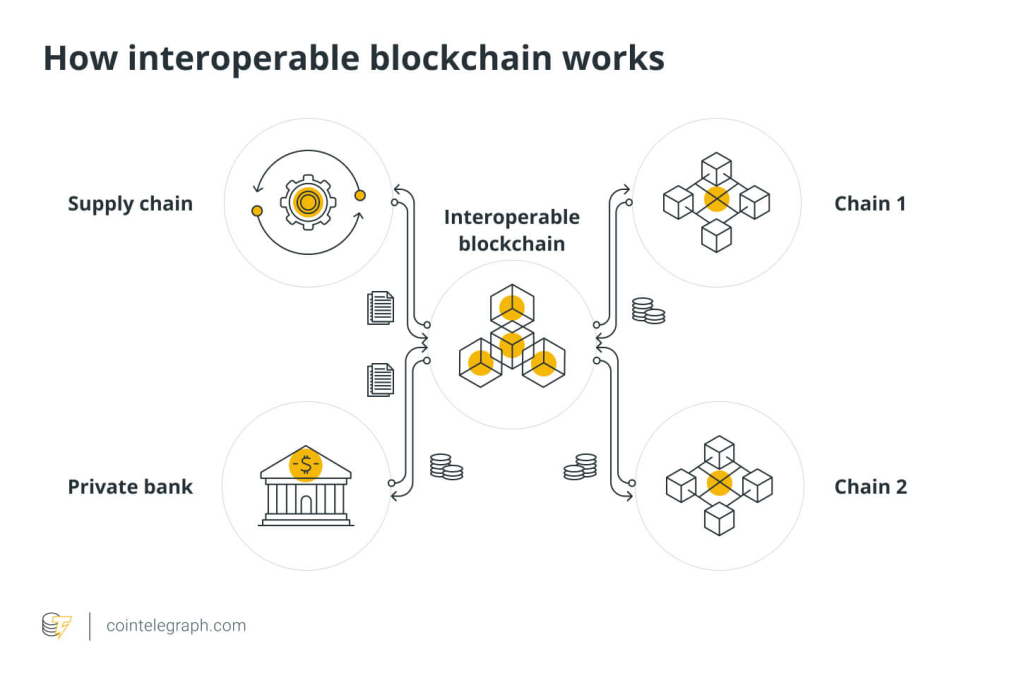

Interoperable blockchain connecting multiple chains and industries (Source: Cointelegraph)

Cross-Chain Tools: Complementing multi-chain wallets are cross-chain tools – technologies that make different blockchains work together. Chief among these are blockchain bridges, which are protocols enabling the transfer of assets or data from one blockchain to another. For instance, a bridge can allow you to lock Bitcoin on the Bitcoin network and mint an equivalent wrapped Bitcoin on Ethereum, effectively moving value across chains. Other cross-chain tools include atomic swaps (direct exchanges of one blockchain’s token for another without intermediaries) and cross-chain messaging protocols that let smart contracts on different networks communicate. These tools form the infrastructure of interoperability: they connect siloed networks into a more unified ecosystem. Industry-wide initiatives like Polkadot and Cosmos have also emerged as interoperability frameworks – Polkadot acting as a “blockchain of blockchains” for connecting custom chains, and Cosmos as an “Internet of Blockchains” linking independent chains. Even oracle providers are contributing; for example, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is expanding to facilitate cross-chain data and token transfers. Together, multi-chain wallets and these cross-chain tools are breaking down walls between blockchains, bringing us closer to a connected Web3 future.

Why the Surge in 2025? Key Drivers of the Multi-Chain Trend

The rapid surge of multi-chain wallets and cross-chain tools in 2025 is driven by several converging factors in the blockchain space:

- Diversification of the Crypto Ecosystem: The crypto landscape has grown far beyond Ethereum and Bitcoin. With many Layer-1 blockchains (Ethereum, BNB Chain, Solana, Avalanche, Polkadot, etc.) and Layer-2 networks thriving, users now hold assets and participate in dApps across multiple chains. Managing this diverse portfolio has fueled demand for wallets that can seamlessly navigate multiple blockchains – a demand which has surged in the Web3 era. In 2025, multi-chain wallets are no longer a convenience but a necessity, empowering users to transact and interact across networks without friction.

- Decentralized Finance (DeFi) Across Chains: DeFi activity is spread across various networks, and users chase opportunities on each. Yield farming might be cheaper on one chain, while an NFT marketplace is active on another. Multi-chain wallets coupled with cross-chain bridges let investors move value to where the best opportunities are. Indeed, over $10 billion in assets are now locked in cross-chain bridges, underscoring how much the DeFi world relies on cross-chain functionality. Daily bridge volumes regularly reach hundreds of millions of dollars, indicating that moving assets between chains has become routine for traders and protocols. Users expect cross-chain functionality – if a DeFi platform is confined to a single chain, it’s increasingly seen as limiting, both for users and the project’s growth. By integrating trusted bridges (e.g. LayerZero, Wormhole), projects can meet user expectations and expand their reach across ecosystems.

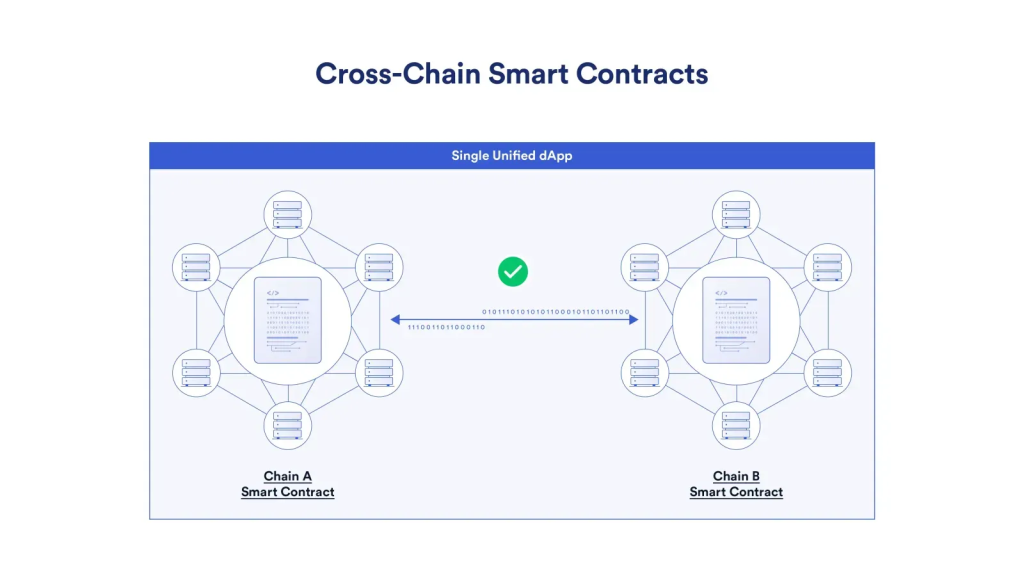

Smart contracts communicating across blockchains via interoperability frameworks (Source: Chainlink)

- Web3 Payments and Commerce: As cryptocurrency adoption grows, more businesses and individuals are using crypto for payments and transfers. Crucially, they don’t want to be limited to one network’s coin. Web3 payment gateways in 2025 are emphasizing multi-chain and cross-chain support, enabling merchants to accept multiple cryptocurrencies (Bitcoin, Ethereum, Solana, etc.) and settle in their currency of choice. The ability to handle transactions across chains greatly reduces friction in cross-border payments and e-commerce. In fact, about 90% of merchants using crypto payment providers now demand support for multi-currency and multi-chain tokens – a striking statistic that highlights interoperability as a must-have feature in payment solutions. This demand in the payments sector further propels the development of cross-chain tools and wallets that can cater to any token on any chain.

- Improved User Experience: Early crypto users often had to maintain separate wallets for each blockchain (one for ETH, one for BSC, one for Solana, etc.), which was cumbersome and confusing. Multi-chain wallets vastly improve user experience by providing a unified interface. This is especially important for newcomers and executives (like CEOs or CTOs exploring blockchain) who value simplicity. A single dashboard to view and use assets across all chains lowers the barrier to entry. It also reduces security risks – fewer wallets and private keys to manage means fewer chances of user error. As a result, both retail users and enterprise users are gravitating towards solutions that make blockchain usage more straightforward.

- Enterprise & Institutional Adoption: Enterprises venturing into blockchain (for example, for supply chain or payments) increasingly require their solutions to be chain-agnostic. No company wants to be locked into a platform that might become obsolete; they prefer interoperability so they can leverage different blockchains’ strengths. Likewise, institutional investors with diversified crypto holdings need custody solutions that cover multiple chains. These professional demands contribute to the rise of multi-chain enterprise wallets and custody platforms. Interoperability frameworks like Polkadot’s parachains or Cosmos’s IBC are often evaluated in enterprise blockchain strategies to ensure different systems can integrate. The surge of cross-chain tools in 2025 is partly fueled by this top-down adoption: businesses are seeking interoperability solutions to future-proof their blockchain initiatives.

Notable Cross-Chain Solutions and Tools

As the push for interoperability grows, several key cross-chain technologies and tools have come to the forefront in 2025. Below are a few notable examples shaping the multi-chain ecosystem:

- Blockchain Bridges: Protocols that connect two blockchains to enable asset transfers or data exchange between them. For example, Wormhole and Multichain bridge assets across networks like Ethereum, Solana, and others. Bridges are fundamental to DeFi; by mid-2025, bridges held over $10B in locked assets, evidencing the trust and reliance the community places on them. They effectively serve as highways connecting liquidity between otherwise isolated economies. (Users should still exercise caution, as security of bridges is vital – these have been targets for exploits, reinforcing the need for securely engineered bridges.)

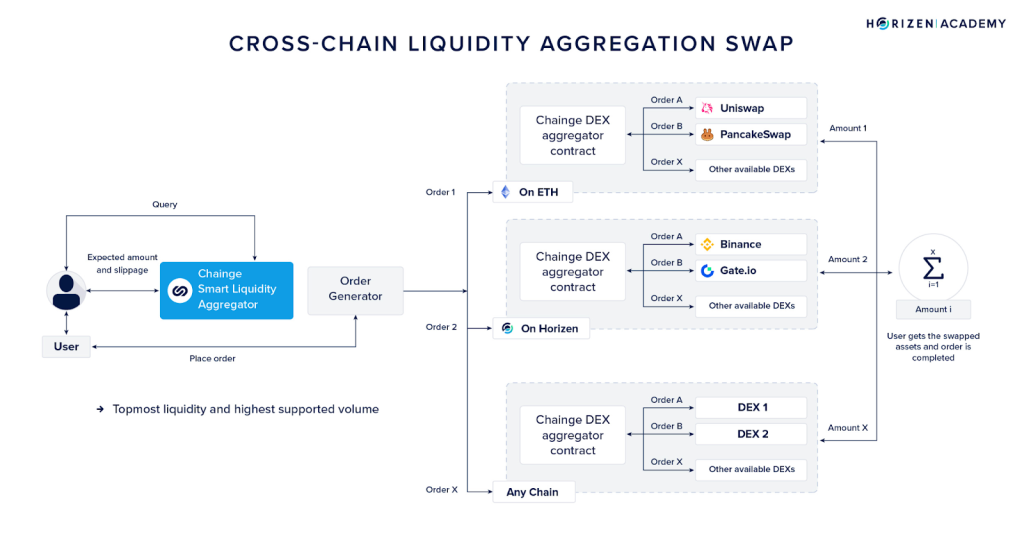

- Cross-Chain Swap and DeFi Platforms: These tools allow users to trade or lend assets across chains in one place. For instance, decentralized exchanges and aggregators now route trades via cross-chain liquidity pools. Some platforms use atomic swaps or innovative liquidity networks to swap tokens from one chain to another without a centralized exchange. This enables a truly chain-agnostic DeFi experience – you could swap a token on Ethereum for one on Avalanche in one transaction. Such capabilities expand users’ investment options dramatically.

Cross-chain liquidity aggregator enabling swaps across DEXs and chains (Source: Horizen Academy)

- Interoperability Networks (Polkadot, Cosmos): Polkadot facilitates a network of custom “parachains” that share security and can communicate with each other, earning it the moniker “blockchain of blockchains.” Cosmos connects independent blockchains through its Inter-Blockchain Communication (IBC) protocol, often called the “Internet of Blockchains,” to allow cross-chain token transfers and data sharing. These ecosystems provide a blueprint for scalability and interoperability by design. They are gaining momentum in 2025 as more projects launch interconnected chains (e.g., app-specific blockchains) that still need to interoperate with the wider crypto world.

- Cross-Chain Communication Protocols: Beyond moving tokens, protocols like Chainlink’s CCIP and LayerZero focus on passing messages and commands between chains. This can trigger smart contract actions across different networks (e.g., an action on Ethereum causes something to happen on Solana). Such protocols unlock advanced use cases like cross-chain lending (borrow on one chain using collateral on another) and unified governance across chains. They are the under-the-hood tools making the next generation of cross-chain dApps possible. Chainlink’s CCIP, for example, is expanding the role of oracles to securely facilitate cross-chain interactions.

- Multi-Chain Wallet Innovations: Wallet developers are integrating many of the above tools to enhance interoperability for users. Modern multi-chain wallets often come with built-in bridging or swap features. A noteworthy trend is that previously single-chain wallets are evolving into multi-chain wallets. For instance, Phantom Wallet, originally a Solana-only wallet, expanded support to Ethereum in 2025 to become a multi-chain wallet. Likewise, Trust Wallet (now supporting 70+ blockchains) and MetaMask have continuously added support for more networks over time. These developments ensure that users can manage an ever-diverse crypto portfolio from one app, and it signals that wallet providers recognize interoperability as the future.

Security and Challenges

With great power comes great responsibility – and in the context of cross-chain tools, security is paramount. Connecting blockchains introduces new vulnerabilities; many high-profile crypto hacks in recent years have targeted cross-chain bridges. Ensuring the security of multi-chain operations is therefore a major challenge. Projects are investing heavily in audits and innovative security architectures (like multi-party computation and threshold signatures in wallets) to protect users. It’s encouraging to note that industry best practices are maturing: for example, experts advise using well-audited bridges and unwrapping bridged assets when not in use.

Blockchain security threats: stolen keys, routing attacks, 51% attacks, phishing, and code exploits (Source: Norton)

Nonetheless, security remains a primary concern, as cross-chain solutions can introduce new attack surfaces. The surge in 2025 is not just about adoption, but also about hardening these systems against threats. Stakeholders from developers to investors – are keenly aware that robust security and trust are the linchpins of sustainable interoperability growth.

Conclusion

The rise of multi-chain wallets and cross-chain tools in 2025 signals a new era of blockchain innovation: one defined by interoperability and seamless user experiences across networks. Blockchain silos are dissolving. Whether you’re a DeFi user moving assets from Ethereum to an Avalanche yield farm, a gamer trading NFTs between Solana and Polygon, or a business implementing Web3 payments for global customers – the ability to cross chains is becoming baseline functionality. This trend is backed by tangible metrics and market sentiment: billions of dollars in bridge liquidity and the vast majority of crypto merchants and users expecting multi-chain support. In short, operating on a single chain is no longer enough; the future is undeniably multi-chain.

Ready to thrive in a multi-chain world? Now is the time to break free of one-chain limitations. By leveraging the latest cross-chain tools and partnering with experienced developers, you can ride the 2025 surge of interoperability to drive innovation and growth. Contact Twendee to explore how our blockchain development services can help you build the secure, interoperable solutions that tomorrow’s users will demand. Together, let’s embrace the multi-chain future and ensure your business remains ahead in the Web3 revolution!

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page

Read latest blog: Top 8 Blockchain Platforms Tokenizing Real-World Assets in 2025