Getting your crypto token listed on a major exchange in 2025 is more challenging than ever. Crypto exchange listing requirements have tightened dramatically, reflecting higher regulatory scrutiny and the need for exchanges to protect their users. In particular, centralized exchanges (CEXs) now enforce rigorous due diligence before listing new tokens, raising the bar for aspiring projects. Listing a cryptocurrency on a top exchange in 2025 requires meeting stringent compliance, security, and liquidity standards. From comprehensive token compliance checklists to strict liquidity requirements and even market-making agreements, today’s listing process leaves no stone unturned.

This article will guide you through these exchange listing standards and show how to prepare a strong application, helping shorten the approval timeline. By knowing exactly what top exchanges expect and how to satisfy those expectations, you can navigate the centralized exchange (CEX) listing process with confidence and set your project up for a successful launch.

Understanding Crypto Exchange Listing Requirements in 2025

Major exchanges are selective about which tokens they list, prioritizing projects with strong fundamentals, compliance, and community support. They assess factors like a well-defined use case, robust tokenomics, an experienced doxxed team, and audited smart contracts.

In 2025, regulators worldwide are tightening oversight of crypto, so exchanges demand thorough legal and security checks before approving a listing. As one 2025 industry guide notes, exchanges “offer massive liquidity and exposure but demand strict compliance, hefty listing fees, and technical integrations.” In practice, that means if you want access to a top-tier exchange’s user base, you must play by the rules, providing detailed disclosures and proof that your project is legitimate, secure, and in good standing.

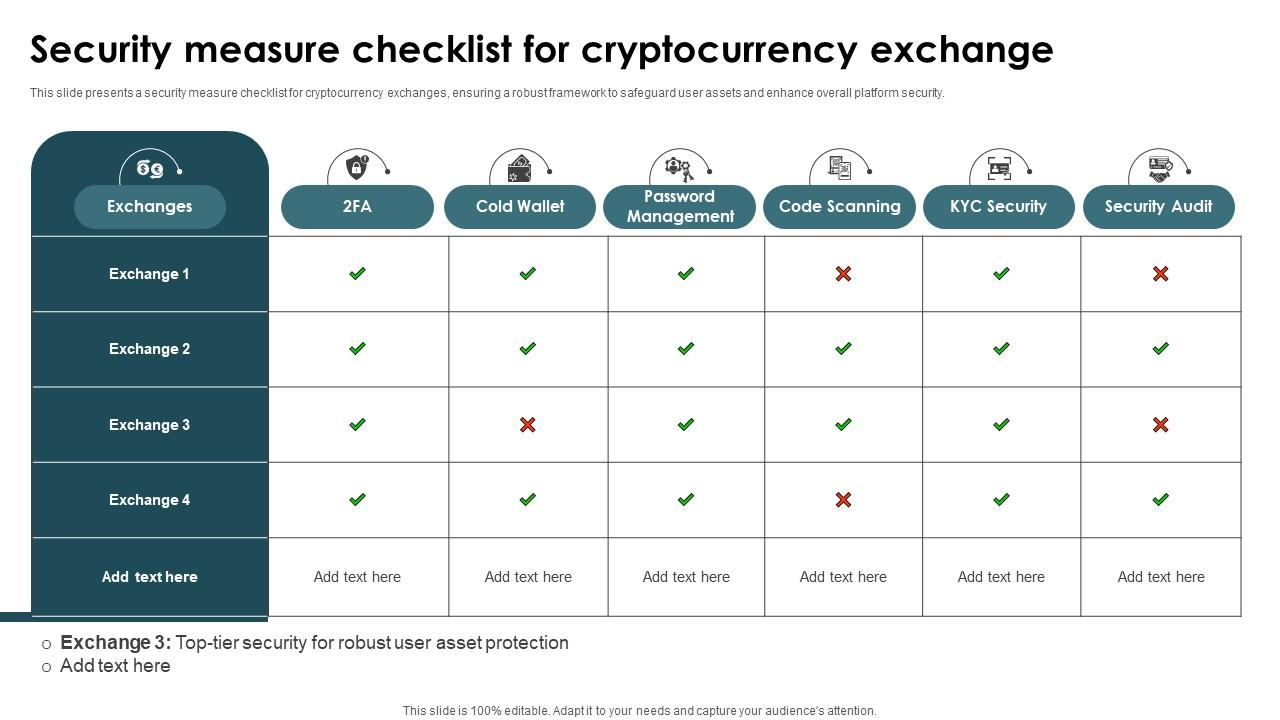

Key areas of scrutiny include regulatory compliance (KYC/AML, securities law), technical security (smart contract audits), team credibility, and market readiness. Exchanges want assurance that listing your token will not pose legal risks or reputational damage. They also look for evidence that the token will attract trading interest rather than languish with low volume.

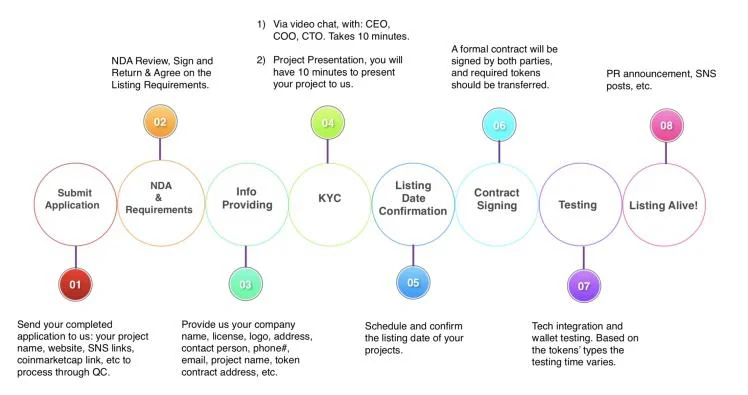

A simplified flowchart outlining key steps in the exchange listing process – such as NDA, KYC, documentation, and contract signing, mirroring how exchanges evaluate projects across compliance, legal, and technical domains (Source: Reddit)

In short, meeting the crypto exchange listing requirements in 2025 means checking every box: compliance, security, transparency, and market demand. The next section provides a checklist of specific criteria you should prepare for.

Token Compliance Checklist for CEX Listing

Before you apply to any centralized exchange, make sure your project can tick off all the items on a typical token listing compliance checklist. Here are the key requirements and how to meet them:

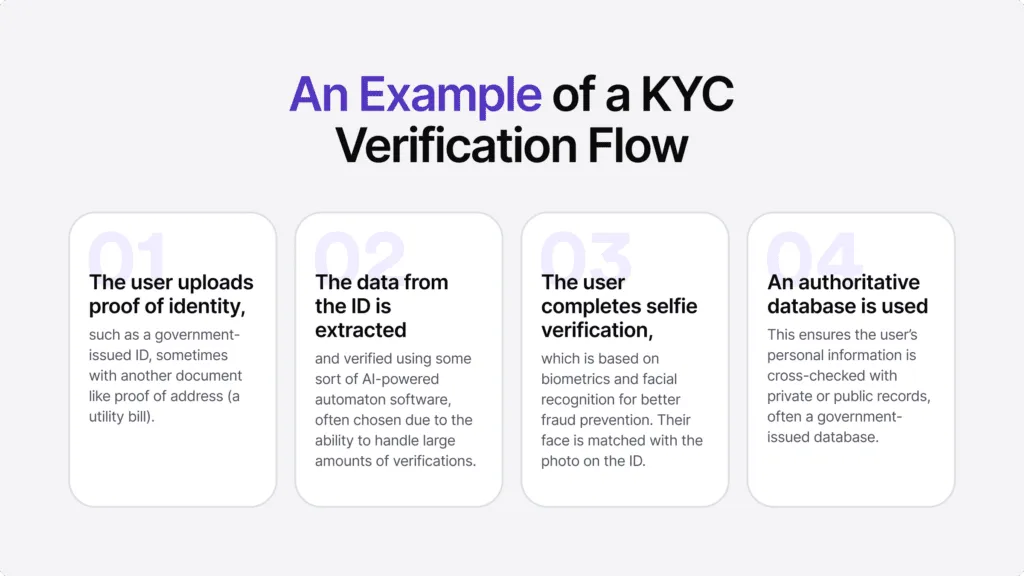

- Verified Team Identity and Background: Top exchanges insist on a fully doxxed team with verified identities and credible track records. Be prepared to undergo KYC checks for founders and key team members, exchanges will verify that your team members are real, experienced, and have no history of fraud. Demonstrating a professional, transparent team instills confidence that your project isn’t a scam.

Example flow of KYC verification for crypto exchange listings, including ID upload, data extraction, selfie verification, and database cross-check (Source: Sumsub)

- Regulatory Compliance & Legal Documentation: Ensure your project complies with all relevant laws in the jurisdictions where the exchange operates. This means having robust KYC/AML procedures and legal opinions ready. Prepare documents like business registrations, legal entity info, and tax compliance data. Being proactive about regulation significantly smooths the path to listing.

- Security Audits of Smart Contracts: Exchanges will require proof that your token’s smart contract and related infrastructure have been rigorously audited for security. Prior to applying, invest in a third-party smart contract audit and be ready to submit the audit report. Exchanges highly value projects that can demonstrate their code is secure and free of critical vulnerabilities. Showing that professional external auditors have vetted your contracts gives the exchange and its users assurance that your token won’t introduce technical risks.

- Robust Tokenomics and Use Case: Projects with clear, strong fundamentals stand out. Make sure you have a well-defined use case and sustainable tokenomics model, and articulate these clearly in your documentation. Exchanges evaluate whether your token has long-term utility and real-world applicability, not just hype. Strong tokenomics (e.g. fair distribution, utility, governance features) and a viable business model will enhance your listing chances. Be prepared to explain what problem your project solves and why the token is essential to your product or platform.

- Transparent Whitepaper & Documentation: Assemble a comprehensive listing dossier with all the project documents an exchange might ask for. This typically includes an up-to-date whitepaper, the token’s technical specifications, roadmap and development updates, token distribution breakdown, team bios, and any legal disclaimers or opinions. Having a clear, professional whitepaper and documentation package signals credibility. In fact, exchanges will perform due diligence on these materials, providing a complete packet upfront (including things like your whitepaper, tokenomics, team info, and legal paperwork) can reduce back-and-forth questions and expedite review.

- Active Community and Market Traction: One way to convince exchanges that your token is worth listing is to show an existing community and demand. Exchanges look for evidence that the token will generate substantial trading volume once listed. Highlight the size and engagement of your community (social followers, active users) and any current trading activity (perhaps on DEXs or smaller exchanges). If your token already has a loyal user base or has meaningful volume on decentralized exchanges, it signals popularity and liquidity potential. At minimum, be ready to present metrics on community growth and token holders. A strong community reassures exchanges that there will be interest (and thus fees and liquidity) when your coin goes live.

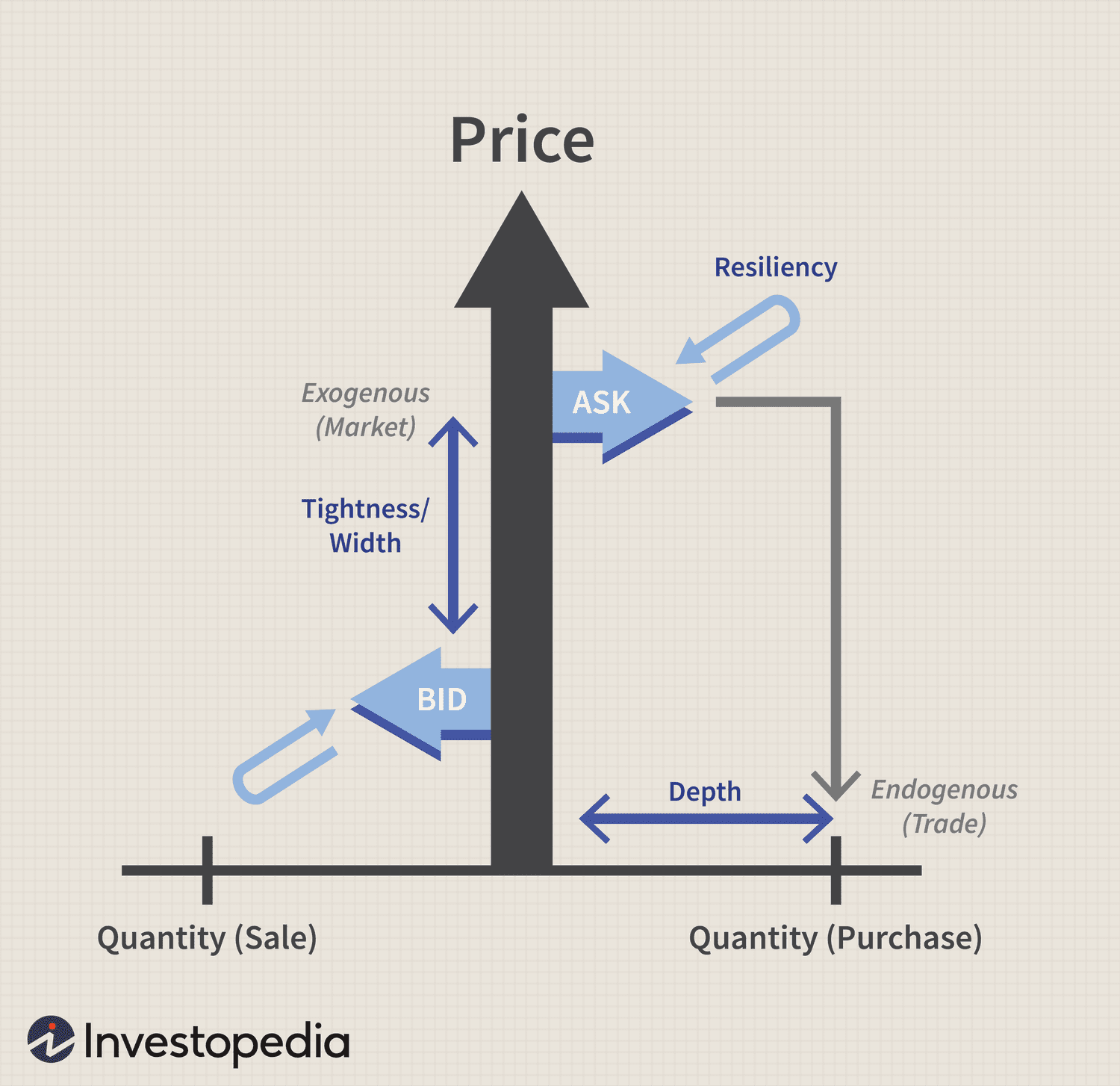

- Liquidity & Market Support Plan: Exchanges are very wary of listing illiquid tokens that might stagnate. Many will ask about your plans to support liquidity post-listing. This can include committing some of your treasury for exchange liquidity, setting up liquidity pools on DEXs, or – very commonly – engaging a market maker. Outline any market-making agreements or partnerships you have in place to ensure there will be tight bid/ask spreads and continuous trading on your token. We’ll discuss liquidity and market-making in more detail shortly, but make sure you proactively address how you will maintain healthy trading activity. Some exchanges may even require a formal liquidity commitment (or reserve) as part of the listing deal.

Key liquidity metrics for token listings, including bid-ask spread, depth, and market resiliency (Source: Investopedia)

By completing the above checklist, you’ll demonstrate to exchanges that your project is fully prepared and meets their strict standards. It’s wise to self-audit against these criteria before approaching any exchange. If you find gaps (e.g. no audit done yet, or legal unclear), resolve them first, it will save you time in the long run. A complete, compliance-ready project package can dramatically shorten the listing review time, because the exchange’s due diligence team will find everything in order and have fewer follow-up questions.

Navigating the Centralized Exchange (CEX) Listing Process

Once you’ve covered the bases with compliance and preparation, the next step is to actually approach the exchange and go through the listing process. Each exchange has its own specific procedures, but most CEX listing processes in 2025 follow a similar general flow. Here’s how to navigate it:

- Initial Application & NDA: Begin by submitting the exchange’s official listing application form (often available on their website or through a platform like Coinbase’s Asset Hub). Typically, the project’s founder or CEO must fill out the application with detailed info about the token. Many top exchanges will require you to sign a Non-Disclosure Agreement (NDA) early in the process, which means you cannot publicly reveal the listing discussions. Be prepared to also provide identification (KYC) for the team at this stage if requested. Ensure the application is thorough and professional – this is your project’s first impression.

- Due Diligence & Project Review: After receiving your application, the exchange’s listing committee or due diligence team will perform a thorough review of your project. They will examine your documentation, check regulatory compliance, evaluate technical robustness, and assess overall viability. Expect back-and-forth communication during this period, the exchange may ask additional questions or request further documents. It’s normal for this review phase to take several weeks or even months, as exchanges often have a queue of projects and a meticulous vetting process. Respond promptly and transparently to any inquiries. This is where having that complete documentation package and audits ready will pay off, because you can rapidly provide whatever they need.

Core steps to prepare for centralized exchange listing, from compliance to technical readiness (Source: BlockchainX

- Technical Integration & Testing: In parallel with the due diligence, you’ll work with the exchange’s technical team to ensure your token can be integrated seamlessly. This involves things like wallet integration, blockchain node setup, and testing deposits/withdrawals of your token on the exchange’s infrastructure. You might need to provide API endpoints or other technical details about your token’s blockchain. Some exchanges (e.g. KuCoin) even includes a testing phase as part of the formal process. It’s crucial to allocate development resources to support the exchange’s tech integration, any technical glitches or incompatibilities can delay your listing. Test everything rigorously in coordination with the exchange so that when the token goes live, trading will run smoothly.

- Liquidity Planning & Market-Making: Before final approval, many exchanges will discuss how initial liquidity will be provided for your token. You should be ready to negotiate liquidity support terms. In some cases, exchanges require an upfront liquidity guarantee or deposit – for example, there have been rumors that listing on top exchanges like Binance at one point required up to $1M in market-making capital. Whether or not a formal deposit is needed, you will likely need to either have a market maker on board or commit to providing liquidity yourself (via token pairs or funds for trading).

The goal is to ensure that once listed, your order books won’t be empty. Clarify with the exchange what their liquidity requirements are. (Often, they have preferred third-party market makers you can work with.) We cover more on market-making agreements in the next section, but make sure this piece is addressed now to avoid any last-minute surprises.

- Listing Agreement & Fees: If your project passes the exchange’s evaluations, the final step is to sign a formal listing agreement. This is a contract that outlines the rights and obligations of both parties, any listing fees, market-making commitments, ongoing reporting requirements, etc.. Negotiating fees is an important part of this stage, different exchanges have different fee structures. Some top exchanges charge substantial listing fees (often six-figure sums) to list a new token.

In other cases, the exchange might ask for a certain number of your tokens as part of the deal. Be prepared with a budget for these costs. Once terms are agreed, you’ll sign the contract and possibly pay the fee or allocate tokens as required. After the agreement, the exchange will coordinate with you on the launch details.

- Launch Preparation, Marketing & Announcement: With a signed agreement in hand, you’ll coordinate a listing date and prepare for the big announcement. Exchanges usually prefer to announce new listings shortly before trading opens. You should align your project’s marketing efforts accordingly. Plan a promotional campaign leading up to the listing: for example, tease the upcoming exchange listing on your social media (if allowed by the NDA), prepare press releases, and engage your community to build excitement. Many exchanges will also do their own promotions or feature your token in a “new listing” spotlight. Make sure all technical setups (wallets, liquidity, market maker) are in place by the launch date.

When the exchange officially announces and opens trading for your token, be ready to inform your community and encourage trading participation. The first few days of trading are crucial – high volume and a stable price can set a positive tone and attract more investors. After launch, maintain close communication with the exchange in case any issues arise and to continue any marketing collaboration.

Visual overview of the essential security components that exchanges often require when reviewing tokens for listing (Source: SlideTeam)

Every exchange’s process will have its quirks, but the above steps capture the typical journey. It’s essentially an application → due diligence → integration → agreement → launch sequence. Throughout this process, patience and professionalism are key. Exchanges handle hundreds of listing requests and will appreciate teams that are organized, responsive, and easy to work with. By preparing thoroughly (as per the checklist) and navigating the steps diligently, you’ll maximize your chances of a smooth and timely approval.

Liquidity Requirements and Market-Making Agreements

Liquidity is crucial for a successful exchange listing, as it ensures active trading and market stability. Exchanges often require certain trading volumes and a healthy order book, and may delist tokens with persistently low activity. To meet these requirements, projects typically engage market makers, firms that provide continuous buy and sell orders, maintain tight spreads, and boost trading volume.

Many exchanges mandate such agreements or require proof of liquidity arrangements, sometimes with minimum volume or capital commitments. Before listing, it’s wise to budget for market-making and work with professional providers to keep markets active. Strong liquidity attracts traders, prevents extreme volatility, and increases long-term listing success. Continuous monitoring and adjusting strategies help maintain exchange compliance and investor confidence.

Conclusion

Achieving a coveted exchange listing in 2025 is a pivotal milestone for any crypto project but as we’ve outlined, it requires strategic preparation and strict adherence to compliance and quality standards.

By understanding and meeting today’s exchange listing standards, from KYC/AML regulations and smart contract audits to liquidity provisioning and market-making, you position your project as a credible candidate that exchanges want to list. The process may be rigorous, but it’s also an opportunity to strengthen your project’s fundamentals. Completing due diligence, tightening security, and building a real community not only please exchanges, but also set you up for long-term success post-listing.

In navigating the listing journey, don’t hesitate to seek expert help. Twendee is here to support you at every step of this process. Contact us to learn how we can help streamline your exchange listing process, from polishing that token compliance checklist to establishing the technical and liquidity frameworks you’ll need on launch day. With the right preparation and the right partners, you can confidently navigate the exchange listing maze and unlock new growth for your project.

Ready to list your token? By following the guidance above and leveraging expert support, you can turn the complex listing process into a manageable project plan. In the high-stakes world of 2025 crypto exchanges, knowledge and preparation are your best allies. Good luck on your listing journey, and we at Twendee are excited to help you make it a success!

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page

Read latest blog: Stablecoins Are Now the Foundation of Web3 Onboarding and Microtransactions