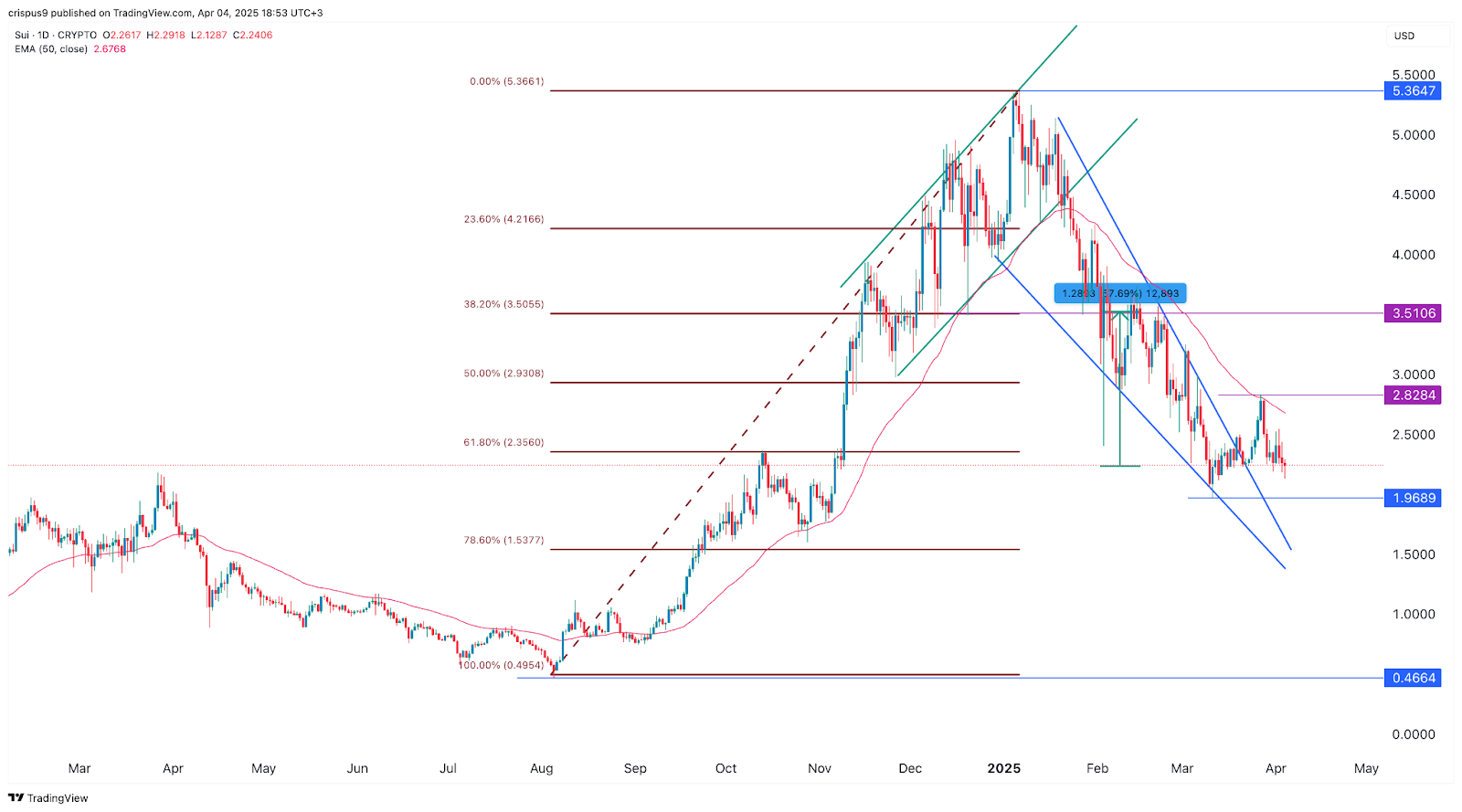

In early 2025, SUI token experienced a staggering 60% surge, propelling it from $2.20 to $3.55 in just one week. Rumors of an upcoming Pokémon SUI blockchain partnership sparked this rally, capturing the imagination of Web3 gaming 2025 enthusiasts worldwide. For CEOs, CTOs, developers, and investors, understanding the drivers behind this move and what it implies for play-to-own gaming and layer-2 gaming solutions is key to capitalizing on the next wave of decentralized entertainment.

SUI’s 60% Surge: Data & Drivers

Behind SUI’s rally lies more than market momentum, it’s a signal of growing ecosystem confidence and major IP speculation.

1. Price & Volume Dynamics

61% Rally (April 18-25): SUI jumped from $2.20 to $3.55, outpacing Bitcoin (+8%) and Ethereum (+12%) over the same week. This sharp ascent placed SUI in the top 10 performing crypto assets by market cap.

DEX Volume +177%: 24‑hour decentralized exchange volume surged to $600 M, driven by heavy trading on Raydium, Orca, and Jupiter. Liquidity pools experienced 90% utilization rates, indicating strong buy‑side pressure.

NFT Activity Spike: SUI-based NFT marketplaces saw a 210% increase in trade count and a 145% rise in floor prices, signaling robust interest in digital collectibles.

Sui Price Is On The Verge Of A 60% Surge As DEX Volume Rockets (Source: Global Financial Market Review)

2. Pokémon Partnership Rumors

Privacy Policy Edit: A hidden update on Pokémon HOME app mentioned Parasol Technologies – Mysten Labs’ development arm-fueling speculation of limited-edition Pokémon NFTs or mini-games on SUI.

FOMO & Social Sentiment: SUI’s social volume on Santiment spiked 80%, while Google Trends showed a 120% increase in SUI-related searches. Investor forums saw record mentions of “SUI + Pokémon”.

3. Ecosystem Growth Metrics

TVL +38%: Total Value Locked climbed from $1.19 B to $1.64 B, with new yield vaults on Cetus, Suilend, Scallop, and Artemis driving the uptick.

Active Addresses +25%: Daily unique wallets rose to 150 K, up from 120 K. On‑chain interactions – smart contract calls, token transfers, and NFT mints – jumped 32%.

Developer Activity +45%: GitHub commits across top SUI repos grew by 45%, and the number of new dApps in the SUI Explorer increased by 30%, evidencing a surge in ecosystem innovation.

SuiPlay0X1 Web3 handheld console (Source: Blockonomi)

Why This Matters for Web3 Gaming

SUI’s rapid rise is not just a market anomaly. It reflects deeper structural changes in the Web3 gaming landscape, where infrastructure, ownership, and economic models are evolving in parallel. This shift revolves around three core pillars:

1. Play-to-Own Becomes Tangible When Backed by Real IP

The concept of play-to-own has long been promoted as a fix to the speculative flaws of play-to-earn. However, without recognizable brands or high user trust, it remained abstract. The situation changes when major intellectual properties like Pokémon begin to experiment with Web3 networks such as SUI.

Official Pokémon NFTs issued on-chain could establish a new benchmark for digital ownership. Gamers would be able to buy, sell, and stake characters or items with on-chain proof of authenticity. Unlike Web2 games, where assets are locked within closed ecosystems, Web3 allows users to truly own and transfer their digital assets.

Guild of Guardians, despite being a relatively new IP on Immutable X, has already enabled over 20 million dollars in peer-to-peer NFT sales. With a global franchise like Pokémon, the economic potential is significantly greater. This move would also legitimize Web3 games in the eyes of traditional players and IP holders.

This is not just about NFTs. It is about building interoperable, tradable, and stakeable game assets that hold real-world value and persist across titles or ecosystems.

In-game NFT avatars with ownership IDs in a pixel-art blockchain game world (Source: Pixels Online)

2. High-Performance Infrastructure Is No Longer Optional

Blockchain gaming is not viable if responsiveness and scalability cannot match user expectations. Many chains have failed to support fast-paced, multiplayer games because of throughput limitations and high gas fees.

SUI addresses these pain points with a combination of Move-based programming and parallel execution. The result is sub-second finality and transaction fees consistently below $0.01. This performance layer is essential for games that involve live trading, real-time combat, or user-generated economies.

While Ultra and Immutable X have made technical strides with rollups, they still face latency under certain network conditions. In contrast, SUI’s native design reduces execution bottlenecks and scales horizontally. Developers no longer need to compromise between performance and decentralization.

In essence, SUI provides Web2-like speed with Web3-native security and composability. This enables seamless gameplay without forcing players to worry about network congestion or prohibitive costs.

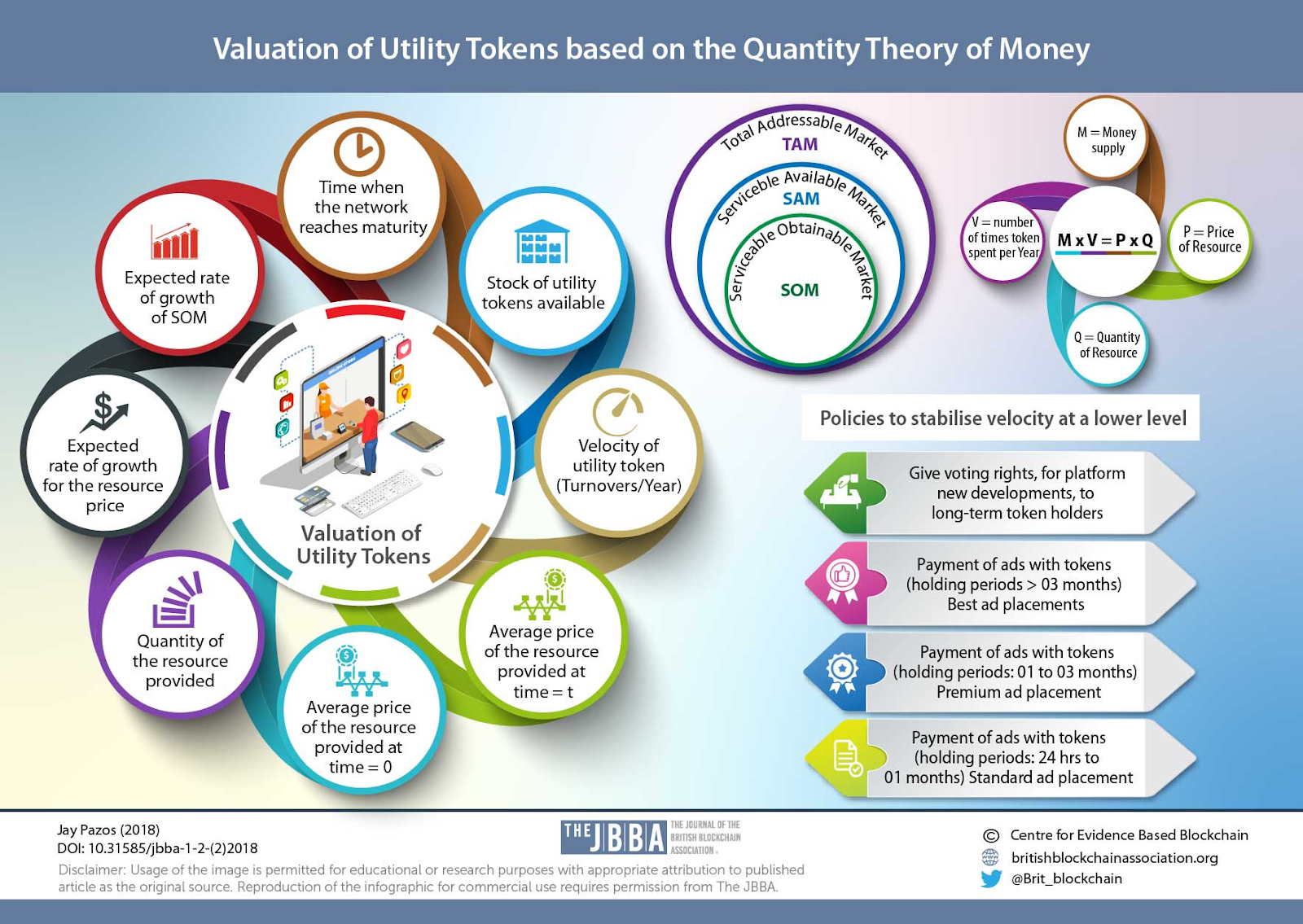

3. Token Utility Drives Long-Term Ecosystem Engagement

Many gaming tokens experience early hype and then lose relevance due to a lack of meaningful use cases. SUI’s approach offers more sustainable engagement through token-based incentives and governance.

Beyond price speculation, the SUI token functions as a bridge between players and the ecosystem. It can be staked to receive yield, used to access exclusive NFT drops, or applied to influence governance decisions. For example, token holders might vote on new gameplay mechanics, economic updates, or which new IPs to onboard.

This model reinforces long-term participation. It encourages players to treat the token not as a trading instrument but as a utility asset within a broader digital society. It also opens up interoperability between games. A user who stakes SUI in one game could earn benefits or access features in another, creating cross-title incentive loops that few ecosystems currently offer.

The result is a network effect: as more games join the SUI ecosystem, the value of holding and using SUI increases.

Infographic showing the economic dynamics behind utility token valuation and engagement strategies

Broader Trends Shaping Blockchain Gaming 2025

Web3 gaming is no longer experimental. It is maturing – technologically, economically, and legally. The following trends are defining the next phase of development:

1. Layer-2 and Sidechain Innovations

As user demands grow, Layer-1 chains struggle to keep up with the transaction volume and latency required for interactive gaming. This has driven innovation across Layer-2 and sidechain ecosystems.

- Rollups for scalability: Networks such as Optimism, Arbitrum, Immutable X, and SUI are advancing both zk-rollups and optimistic rollups. These solutions drastically reduce gas fees while boosting throughput, making Web3 gaming infrastructure viable for mass adoption.

- Cross-chain bridges: Seamless asset transfer between chains (e.g., Ethereum, SUI, Ultra EVM) is becoming essential. Bridges enable players to carry their assets across games or ecosystems, encouraging interoperability and reducing fragmentation.

This technical evolution is critical for developers building games that require real-time actions, player-to-player economies, or on-chain asset minting without performance bottlenecks.

2. AI-Enhanced Gameplay

AI is reshaping how games respond to and evolve with players. In blockchain gaming, where persistent worlds and digital ownership matter, AI unlocks deeper immersion.

- Smarter, dynamic worlds: Procedural generation, AI-driven non-player characters (NPCs), and adaptive difficulty create experiences that feel alive and player-centric.

- Decentralized compute networks: Initiatives like those by Twendee Labs are exploring decentralized compute layers that support on-chain AI, enabling games to run AI logic without relying on centralized servers.

These advancements not only enhance gameplay but also ensure that AI-driven elements remain verifiable, tamper-proof, and composable across blockchain-native environments.

Venn diagram comparing Web2 and Web3 gaming models, highlighting the emerging convergence around user ownership, engagement, and economic utility (Source: NFX)

3. Regulatory and Compliance Landscape

As capital and IP enter Web3 gaming, legal clarity becomes indispensable. Without addressing compliance risks, scaling becomes untenable.

- Token transparency and governance: Projects are implementing transparent tokenomics and built-in governance frameworks to comply with securities regulations. This includes clear vesting schedules, voting rights, and protocol-level dispute resolution mechanisms.

- IP licensing and NFT royalties: Partnerships with major intellectual property holders (such as anime, entertainment, or game studios) now require robust legal structures. These frameworks must define licensing terms, royalty splits, and secondary-market control for NFTs.

Regulation is no longer seen as a blocker but as an enabler of sustainable growth. The emergence of compliant Web3 gaming studios signals a broader maturation of the space.

Conclusion

The momentum behind SUI – fueled by speculation around Pokémon’s potential entry into the blockchain space, is more than just market hype. It marks a pivotal shift toward scalable, high-performance play-to-own ecosystems, where digital assets, real-world value, and game interoperability converge.

As platforms like Ultra EVM, Immutable X, and SUI compete for dominance, the builders who act early will shape the future of Web3 gaming.

Twendee Labs empowers teams to lead that future. From smart contract engineering and Layer-2 scalability to tokenomics and cross-chain game logic, we help you build secure, high-engagement Web3 games optimized for growth.