Global business leaders are taking notice: stablecoin cross-border payments are emerging as a game-changer for international B2B transactions. In the past, sending funds overseas involved slow, costly bank transfers that could take days.

Today, stablecoin settlement layers, blockchain-based networks using fiat-pegged digital currencies are enabling near-instant, 24/7 payments worldwide.

Why Cross-Border B2B Payments Need Disruption

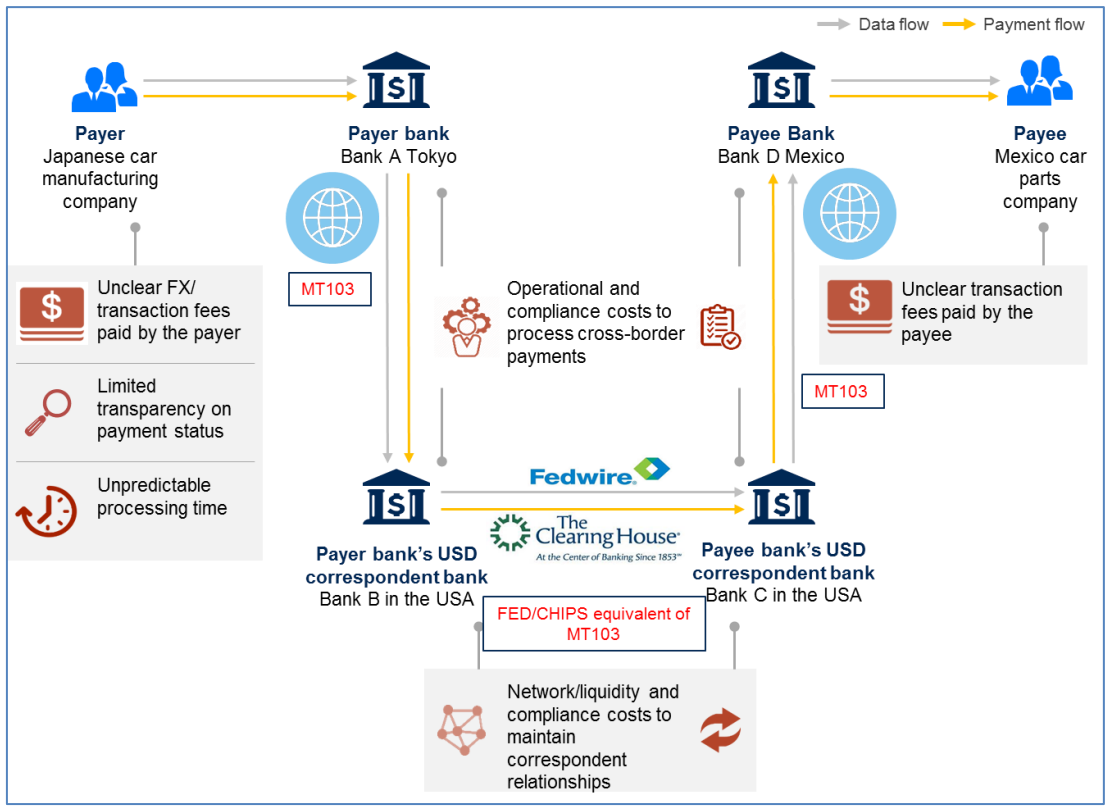

Traditional cross-border payment rails like SWIFT and correspondent banks are notoriously slow and expensive. A wire transfer from one country to another often passes through multiple intermediaries, incurring fees and delays. Settlement can average 2–5 business days and sometimes more, with typical fees around 4–6% of the transaction. In fact, SWIFT transfers average about 2.7 days to settle, and nearly a quarter of transactions face extra compliance checks that push them beyond 5 days. These delays and high costs create friction for time-sensitive business deals and supply chain payments.

In contrast, stablecoins are streamlining B2B payments by eliminating many of these intermediaries. Stablecoins are digital tokens (like USDC or USDT) pegged 1:1 to fiat currencies (such as the US dollar) and transacted on blockchains. They move at internet speed, not bank speed. By leveraging blockchain, stablecoin transactions don’t depend on banking hours or legacy networks, which means they can clear and settle nearly instantly across borders. This new approach addresses the pain points of traditional systems: speed, cost, transparency and accessibility.

This diagram illustrates the multi-step nature of legacy international payments using SWIFT, where funds pass through multiple correspondent banks, causing delays and compounding fees (Source: PaymentsJournal)

Key Benefits of Stablecoin Cross-Border Payments

Integrating stablecoins into B2B payment flows unlocks several compelling advantages:

- Instant Settlement: Transactions finalize within seconds or minutes, 24/7 – nights, weekends, and holidays included. No waiting until banks open; a payment on Friday evening arrives by Friday evening.

- Lower Costs: With no intermediaries taking cuts, fees drop dramatically. Stablecoin transfers typically cost only 0.2–0.5% of the amount (about an 85% reduction vs. traditional methods). Businesses save on wire fees, correspondent bank charges, and unfavorable FX markups.

- Lower Costs: With no intermediaries taking cuts, fees drop dramatically. Stablecoin transfers typically cost only 0.2–0.5% of the amount (about an 85% reduction vs. traditional methods). Businesses save on wire fees, correspondent bank charges, and unfavorable FX markups.

Top: Traditional cross-border payments involve multiple intermediaries – Bottom: Blockchain-based stablecoin settlement bypasses middlemen, enabling faster and lower-cost transfers. (Source: MPC Event)

- Global Reach: Stablecoins operate over the internet, not closed banking networks, enabling payments to underbanked regions and emerging markets with equal ease. A startup can pay a contractor in a developing country in stablecoins without needing local bank arrangements.

- Transparency & Security: Every stablecoin transaction is recorded on the blockchain, providing an immutable audit trail. This transparency increases trust and allows real-time verification of payments, a huge upgrade from today’s opaque bank wires. Cryptographic security also reduces fraud risk (no chargebacks or unauthorized reversals once settled).

- Programmability: As digital tokens, stablecoins can embed business logic. Companies can automate escrow releases, milestone payments, or multi-party transactions via smart contracts, something impossible with static bank transfers. This opens the door to innovative financial workflows and integration with other Web3 services.

In short, stablecoin cross-border payments offer faster settlement, significant cost savings, greater accessibility, and new capabilities compared to legacy systems. It’s a 21st-century upgrade to how businesses settle accounts globally.

Building Web3 Payment Infrastructure with Stablecoins

Stablecoins are becoming the foundation of Web3’s open financial infrastructure, offering real-time, global, and decentralized value transfer, unlike traditional banking systems that are closed, slow, and country-specific.

Acting as digital cash, stablecoins let value move across borders as easily as information flows on the internet. Already, they’re used for faster, cheaper remittances in regions underserved by banks, and they offer a path to financial inclusion for over 1 billion unbanked people worldwide.

For businesses, this means access to global payments without negotiating entry into each country’s financial system. Companies can hold digital USD, send instant cross-border payments, and convert to local fiat as needed, simplifying international trade and treasury operations.

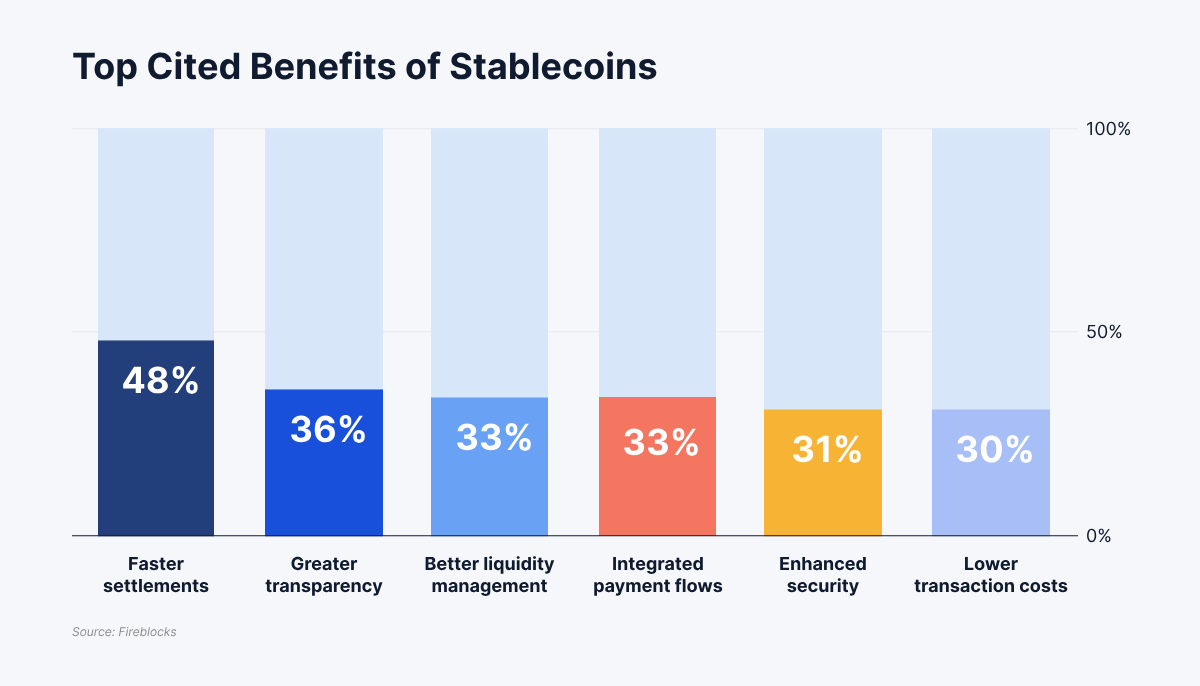

Top benefits of stablecoin payments, highlighting speed, transparency, liquidity, and seamless integration (Source: Fireblocks’ “State of Stablecoins 2025” report)

Meanwhile, enterprise-ready platforms are emerging with stablecoin on/off ramps, multi-currency wallets, and compliance tools via APIs, allowing businesses to integrate Web3 payments without deep crypto expertise. In short, stablecoins are powering a new layer of global finance: faster, more accessible, and open to all.

Challenges and Considerations

While the advantages are clear, companies considering stablecoin-based B2B payments should be mindful of a few challenges:

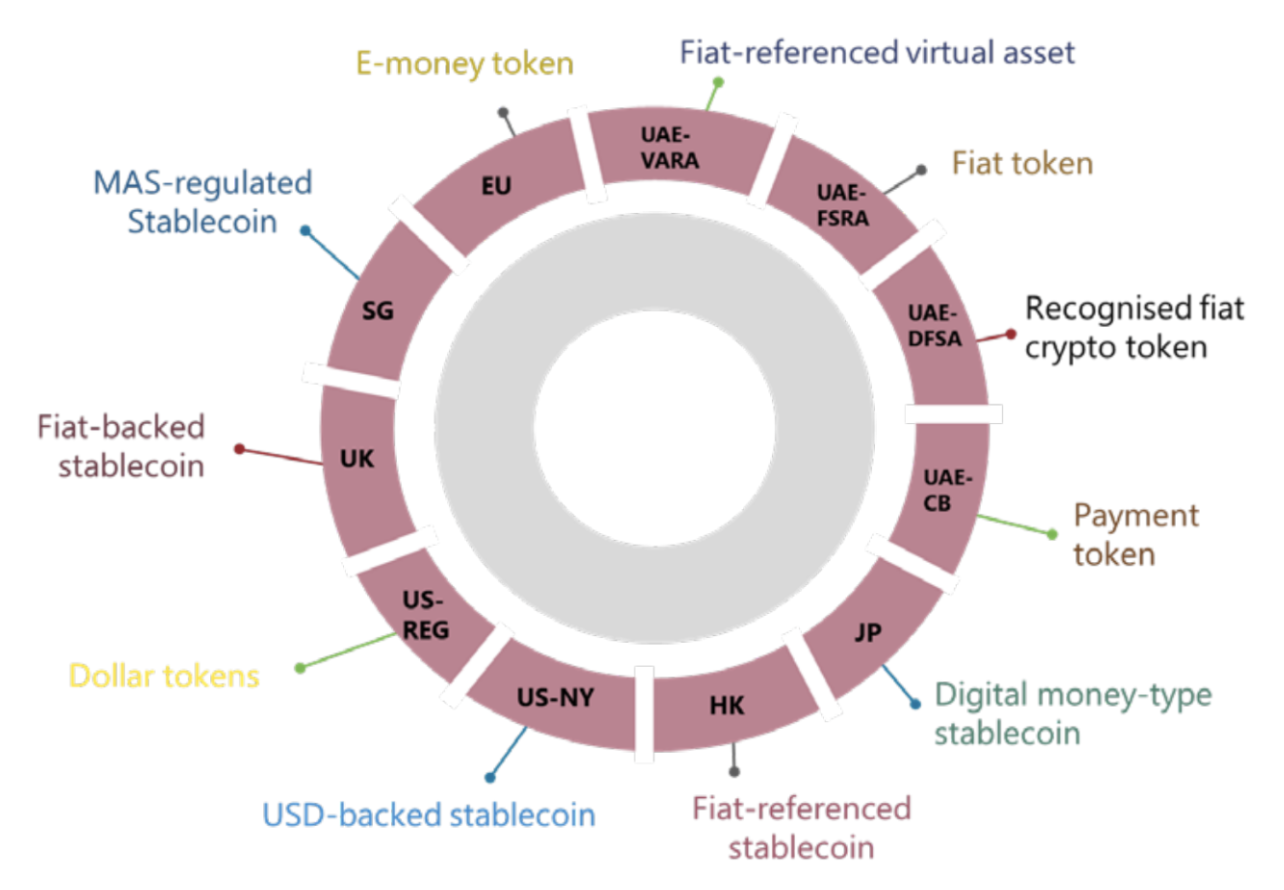

- Regulatory Compliance: The regulatory environment for stablecoins is evolving. Different countries have different rules (over 40 jurisdictions have introduced specific stablecoin regulations as of 2024). Businesses must ensure compliance with relevant laws on digital assets, money transmission, and foreign exchange. The good news is that clarity is improving. Still, staying up-to-date on regulations and using licensed stablecoin issuers is essential. Many stablecoins today undergo regular audits and are issued by regulated entities to address these concerns.

- KYC/AML and Security: Just like traditional payments, stablecoin transactions must comply with Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) requirements. Fortunately, these checks can be integrated into stablecoin platforms, for instance, through on-chain analytics and permissioned wallets. Enterprises should use platforms that enforce strong KYC/AML, sanctions screening, and fraud monitoring to prevent illicit activity. Additionally, secure custody of digital assets (using institutional-grade wallets or custody services) is critical to prevent unauthorized access or loss of funds.

A visual overview of global stablecoin regulatory frameworks and terminology across jurisdictions (Source: Binance Research)

- Market and Liquidity Risk: Reputable fiat-backed stablecoins (like USDC, USDT, etc.) are designed to hold a stable value, but companies should ensure they are using trusted stablecoins with transparent reserves. There have been instances of lesser-known stablecoins losing their peg or facing liquidity issues. Stick to well-capitalized stablecoins that publish audits. Also, liquidity on the “last mile” is a factor, converting stablecoins into local currency. In major currencies this is seamless, but in some exotic currencies or smaller markets, local liquidity can be limited. This could lead to slippage or delays when off-ramping large amounts. Engaging with reliable exchange partners or payment processors in target regions is key to mitigating this risk. Fortunately, liquidity is improving as more banks and brokers join the stablecoin ecosystem.

- Integration Effort: Adopting stablecoins may require integrating new software or working with a fintech provider. Businesses need a platform that bridges fiat and stablecoin worlds, providing on-ramps (to convert fiat to stablecoins) and off-ramps (stablecoins to fiat). This might involve some upfront technical work – whether that’s building on top of an API from a provider, training staff on using digital wallets, or updating treasury policies. The effort is often modest, but it’s a necessary step. Working with experienced blockchain solution partners can greatly smooth this process.

Most of these challenges are being rapidly addressed by industry advancements and clearer regulations. With robust planning and the right partners, even compliance-focused enterprises can implement stablecoin payments safely and many already are. As one payments expert noted, using stablecoins for transactions is no longer a wild gamble; it’s becoming “infrastructure, not a gamble” in modern finance.

Conclusion

Cross-border B2B payments no longer need to be slow, expensive, or complicated. With stablecoin-powered infrastructure, businesses can now send instant global payments with lower fees, better transparency, and greater efficiency. From paying international vendors to managing global treasury in real time, stablecoins unlock massive advantages for companies ready to modernize. The tech is mature, secure, and already used at scale, making this the right moment to act.

At Twendee, we help enterprises adopt stablecoin payments with tailored solutions, seamless fiat integration, and secure infrastructure. Don’t let outdated systems limit your global growth.

Get in touch and let’s build your next-gen payment rails: fast, transparent, and borderless.

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page

Read latest blog: MiniApps on Telegram Are Becoming the Default UX for Web3 Users