Web3 startups often stumble not because of weak technology, but because new users never make it through the door. Wallet setup, seed phrase management, and the need to buy volatile tokens just to participate create friction that feels risky and overwhelming for most people. At the same time, payments inside Web3 remain far from mainstream standards, with high gas fees, long settlement times, and unstable values making small transactions impractical.

Stablecoins are changing this dynamic. By acting as a familiar fiat bridge and powering seamless, low-cost transactions, they are becoming the foundation for Web3 onboarding and microtransactions, offering startups a path to real adoption.

Why Stablecoins Are Becoming the Gateway for Web3 Onboarding

For many users, entering Web3 today feels like navigating a maze: acquiring volatile cryptocurrency (like ETH) just to onboard, setting up and safeguarding seed phrases, securing wallets and only then can they begin interacting with any dApp. This multi-step, complex process leads to high dropout rates, particularly among new users who neither understand the tech nor trust the ecosystem yet.

Here’s where stablecoins reshape the narrative:

- Rapid, Real-Time Adoption Trends

In July 2025, McKinsey reported that stablecoin issuance has doubled in just 18 months, now supporting approximately $30 billion in daily transaction volume. Though still under 1% of global money flows, this growth signals a profound shift in payment infrastructure. - Superior Speed, Cost Efficiency, and Accessibility

Stablecoins, as “tokenized cash,” transcend the limitations of legacy financial systems. They operate 24/7 with near-instant settlement, cut costs by eliminating intermediaries, enable transparent tracking, and expand access globally many users only need a digital wallet, not a full bank account. - An Inflection in Payments

Industry leaders see 2025 as a turning point. Stablecoins are emerging as credible, scalable alternatives to traditional rails, especially for cross-border, remittance, and treasury use cases. Early adopters include institutional players like JPMorgan (via JPM Coin) and frameworks like Singapore’s Project Guardian.

Yet the case for stablecoins isn’t just about macro trends, it’s also about fixing the broken reality of today’s onboarding funnel.

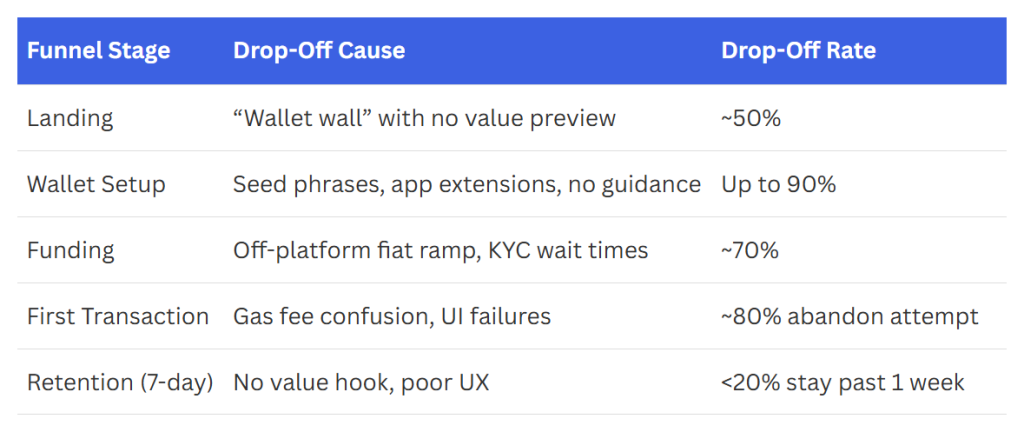

Drop-off rates across the Web3 onboarding funnel highlight why user retention remains a challenge stablecoins help compress these failure points into a seamless, fiat-like experience. (Source: ICODA Agency – Medium)

The data shows just how steep the funnel drop-offs are: 50% quit at the landing page, up to 90% abandon wallet setup, and 80% fail their first transaction due to gas fee confusion. By integrating stablecoins with fiat on-ramps, startups can bypass these pain points no off-platform funding, no volatile asset purchase, no overwhelming technical barriers. In short, stablecoins compress multiple points of failure into a simple, fiat-like entry that feels familiar to mainstream users.

Microtransactions Prove the Value of Stablecoins in Web3 Onboarding

Web3 has long promised new digital economies, but the economics of small payments have been broken. Gas fees that exceed the value of the transaction, confirmation delays that make instant actions impossible, and volatile tokens that distort pricing have all conspired to keep microtransactions theoretical. For startups, this means even if they succeed in onboarding users, they often fail to keep them active, there is no economic logic to spending $2 when the cost of payment is $10.

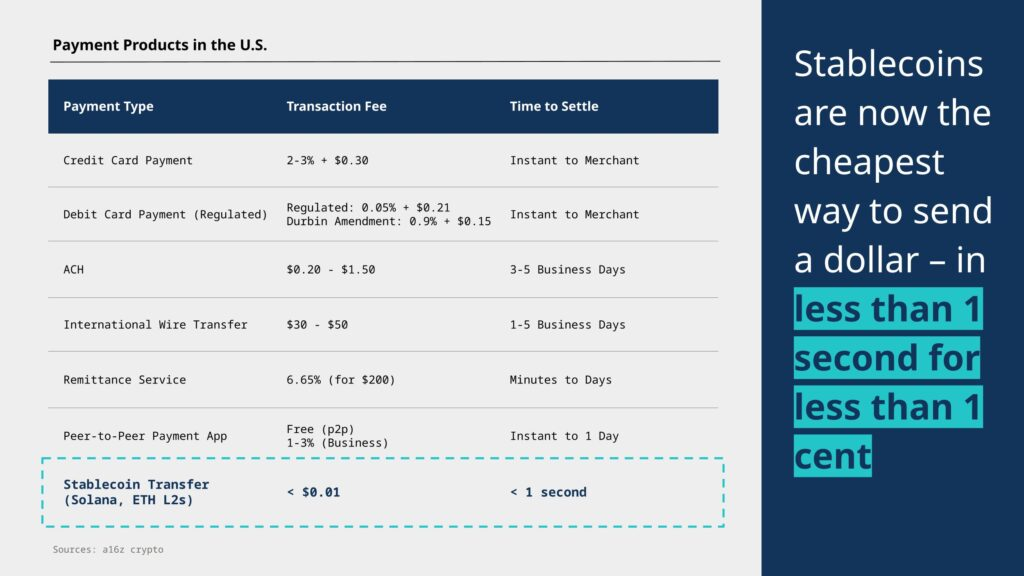

Stablecoins flip this equation. By delivering sub-cent fees and near-instant settlement, they don’t just make transactions cheaper, they redefine what kinds of business models become viable. Games can sell low-value digital items profitably, streaming platforms can support tipping and micro-subscriptions, and cross-border services can charge in fractions of a dollar without losing margin to intermediaries. The comparison is stark: where credit cards take 2–3% plus $0.30 per payment and ACH can take up to five business days, a stablecoin transfer can move instantly for less than a cent.

Stablecoin transfers settle in <1 second for <$0.01 far below the cost and latency of legacy payment rails. (Source: a16z crypto)

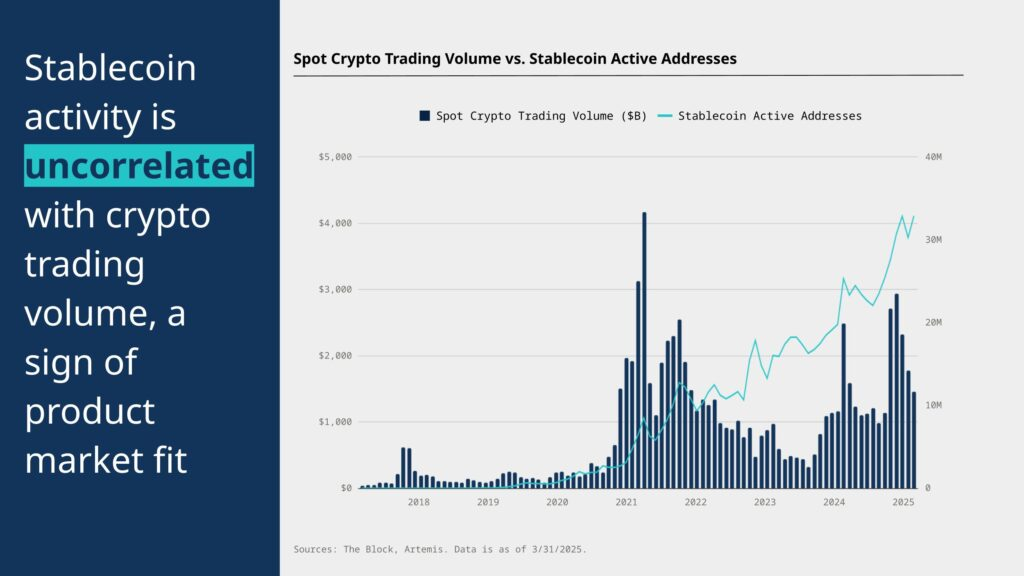

What makes stablecoins even more compelling is that their adoption is not tied to crypto speculation. Data shows that stablecoin active addresses continue to grow even during bear markets, while trading volumes for volatile tokens collapse. This uncoupling signals product-market fit in the real economy. People are not using stablecoins to gamble; they are using them to pay, to remit, to earn, and to transact globally at a scale that legacy systems cannot match.

Stablecoin activity is uncoupled from crypto trading, proving they are used as money, not just speculation. (Source: a16z crypto)

For startups, however, building this capability is not automatic. Even if the advantages of stablecoins are clear, they still require integration into onboarding flows, fiat on-ramps, and payment APIs to become seamless for end users. This is why specialized providers step in. By building stablecoin rails integration solutions, helping startups deploy onboarding and instant payments while reducing barriers to adoption – firms like Twendee Labs make it possible for stablecoins to power real user engagement instead of remaining an abstract advantage.

Building Infrastructure That Makes Stablecoins Web3 Onboarding Scalable

Stablecoins have already proven their value as fast, low-cost settlement assets, but their future hinges on infrastructure. The question is no longer whether stablecoins can move money efficiently, it’s who controls the rails and whether those rails can scale without recreating the bottlenecks of Web2 finance.

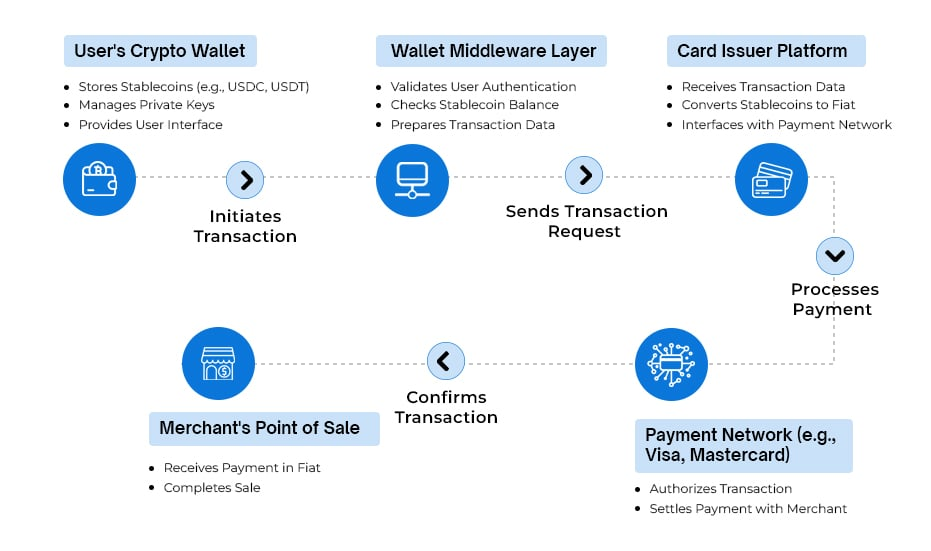

At the transactional level, every stablecoin payment still passes through multiple layers: wallets that manage custody, middleware that authenticates users, fiat gateways that connect to banks, and payment networks that merchants already trust. This creates a structural trade-off. If startups rely on centralized intermediaries (MoonPay, Coinbase, Circle’s APIs), they gain speed but reintroduce chokepoints and compliance risks. If they pursue decentralized rails, they face liquidity fragmentation, regulatory uncertainty, and slower merchant adoption.

From wallet to merchant, stablecoin payments depend on middleware and network layers infrastructure that decides whether user experiences feel like Web2 fintech or clunky crypto flows. (Source: Antier Solutions)

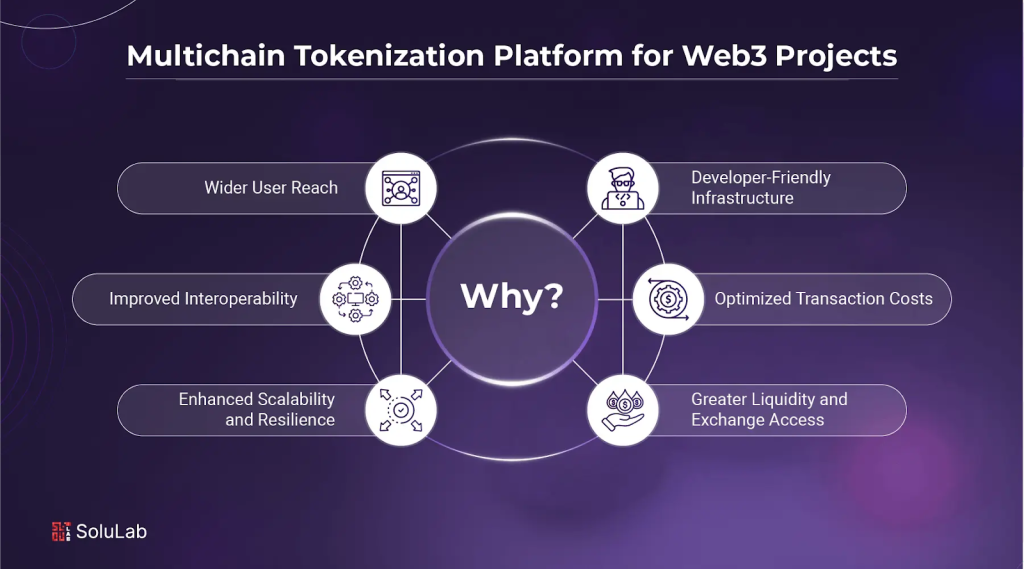

The deeper challenge is interoperability. Web3 users and dApps span multiple chains, but most stablecoin settlement today remains siloed. Without multichain tokenization platforms, startups risk building closed ecosystems that can’t scale beyond niche communities. That’s why infrastructure discussions are shifting from “cheap transactions” to resilience, liquidity, and developer accessibility.

Multichain tokenization expands reach and lowers costs, ensuring stablecoins don’t remain trapped in isolated ecosystems. (Source: SoluLab)

This is where Twendee Labs plays a different role than in onboarding. Beyond helping startups integrate fiat on-ramps, Twendee Labs focuses on building settlement architectures that work across chains and compliance regimes. That means designing middleware layers that validate transactions instantly while meeting regulatory standards, enabling cross-chain liquidity for stablecoin flows, and ensuring developers can plug into these systems without reinventing the wheel. In practice, this reduces fragmentation and future-proofs startups against the risk of being locked into a single chain, provider, or region.

For a deeper dive, see Stablecoin Settlement Layers Are Powering Instant B2B Payments Across Borders. It illustrates how settlement design is becoming the true competitive frontier not issuance, but the rails that make stablecoins usable at scale.

Infrastructure, in short, decides whether stablecoins remain a financial tool for traders, or evolve into the invisible backbone of mass Web3 onboarding.

Final Thoughts

Stablecoins are no longer an experiment, they are the entry point that makes Web3 usable. By compressing onboarding friction and powering microtransactions, they have become the strongest bridge between digital economies and everyday users.

The decisive question now is whether the rails beneath them can scale. This is where Twendee Labs play distinct roles: one at the onboarding layer, the other at settlement and interoperability. Together, they help transform stablecoins from a promising tool into the backbone of Web3 adoption.

Discover how Twendee Labs helps leading teams integrate stablecoin solutions, explore deeper insights at Twendee Labs, and stay connected via X, and LinkedIn.