Stablecoins have progressed from a transactional convenience to a foundational element of the Web3 payment stack. By combining price stability, instant settlement, and cross-border accessibility, they address many of the challenges that have limited blockchain’s role in everyday commerce. Their function as a Web3 UX layer ensures that onboarding new users is faster, simpler, and far less dependent on the volatility of native crypto assets.

As stablecoin infrastructure continues to mature with deeper integration into merchant systems, stronger compliance frameworks, and increasingly seamless fiat-onchain bridges, their position within blockchain payments will only strengthen. For businesses, the ability to operate within this stable, interoperable environment is becoming a defining factor in capturing Web3 market opportunities.

Stablecoin Payment: Unlocking Frictionless Web3 Onboarding

The onboarding challenge in Web3 is not only about educating users, it’s about eliminating the technical and economic frictions that stop them from making their first transaction. Volatile tokens, unpredictable gas fees, and complex swap processes often cause drop‑offs before a user ever engages with a product.

Stablecoins solve this at the protocol and UX layer.

- Price stability reduces cognitive load – When the in‑app currency is pegged to a known unit of value (e.g., USD, EUR, or local fiat), users don’t need to track exchange rates or account for price swings. This familiarity builds trust in the first interaction.

- One‑step onboarding through fiat‑onchain bridges – Integrated payment gateways let users top up in stablecoins directly from their bank card or mobile money account, bypassing centralized exchanges and token swaps. This creates a “click‑to‑fund” experience that feels like Web2 payments.

- Gas‑abstracted transactions – Platforms can sponsor network fees or use meta‑transactions, letting the user complete an action without holding the network’s native token. This removes the confusing step of buying ETH, SOL, or MATIC just to transact.

- Instant settlement across geographies – Users can join a DAO in New York, purchase an NFT in Lagos, or subscribe to a dApp in Manila without multi‑day banking delays or high remittance fees.

From a business perspective, this translates into shorter conversion funnels, higher activation rates, and reduced churn in the critical first 72 hours of a user journey. Platforms like Magic Labs and Coinbase Wallet have reported significant improvements in activation rates when stablecoin payment rails are integrated into onboarding flows.

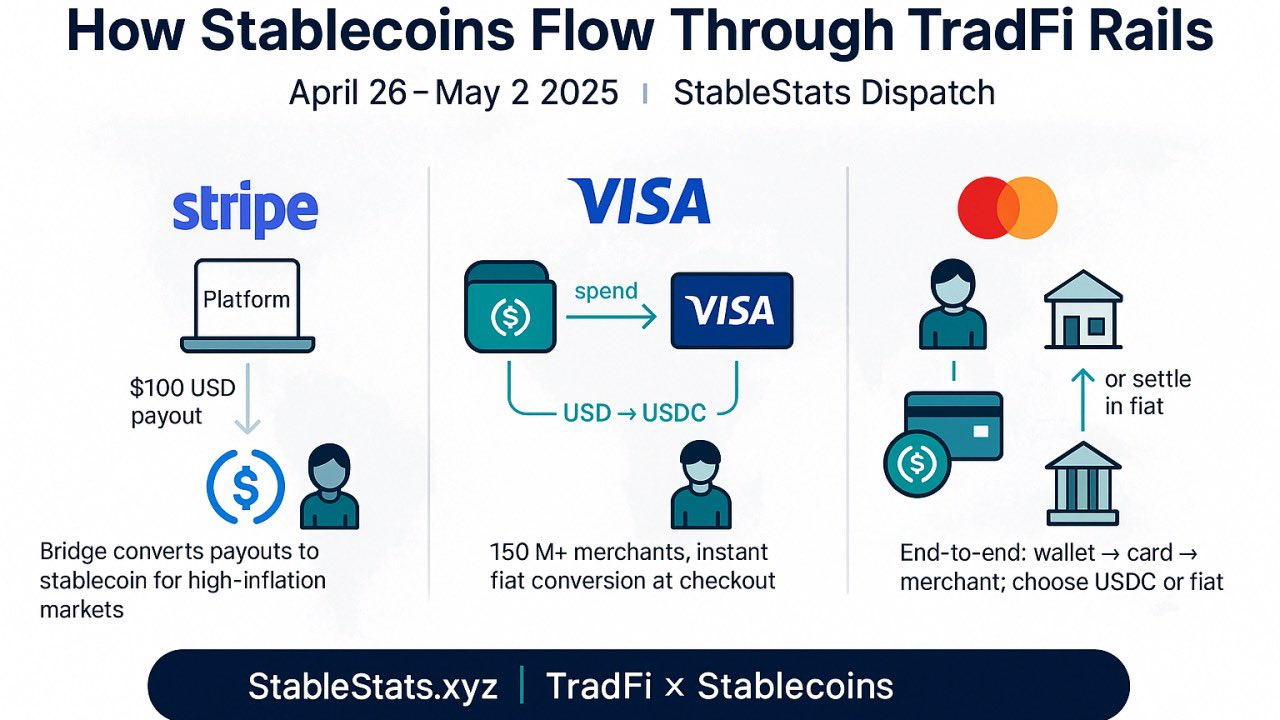

Flow of stablecoin payments through Stripe, Visa, and Mastercard showing USD payouts converted to USDC, instant merchant acceptance, and optional fiat settlement. (Source: StableStats.xyz)

This is why infrastructure‑level projects from NFT marketplaces to crypto exchanges are now treating stablecoin payment as a core design requirement, not an optional feature. As seen in projects like How Much Does It Cost to Build a Crypto Exchange Like Binance in 2025?, stablecoin integration is embedded from the earliest architectural phase, ensuring both regulatory compatibility and a low‑friction user experience from day one.

How Stablecoin Payment Powers Microtransactions and New Digital Economies

The ability to process small-value transactions instantly and at minimal cost is transforming how digital services are delivered. Stablecoin payment systems make this possible in ways traditional payment rails cannot match.

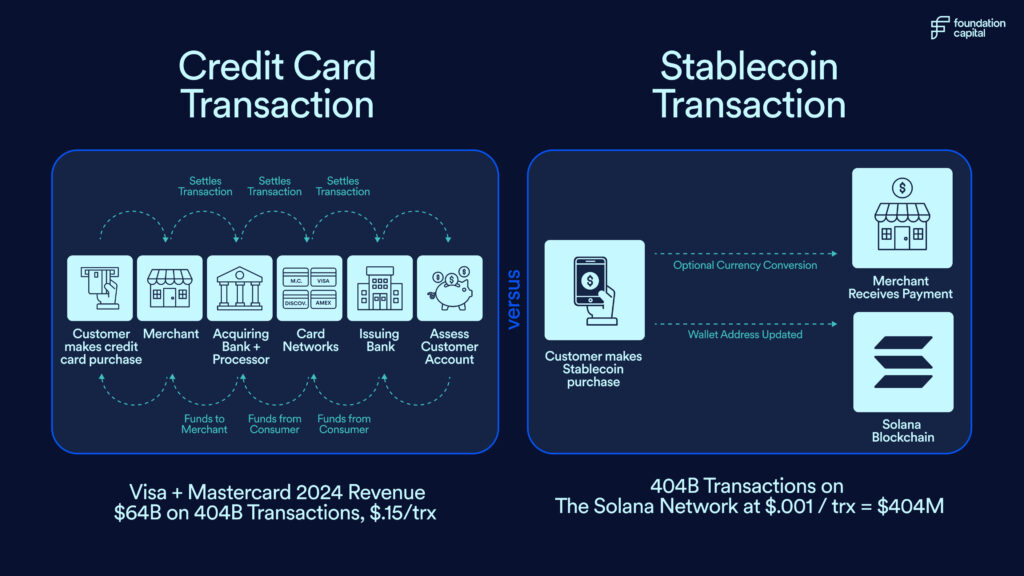

Credit card networks typically involve multiple intermediaries merchant processors, acquiring banks, card networks, and issuing banks each adding cost and latency to the transaction. Even microtransactions under $1 often incur fees higher than the transaction value, making them economically unviable for creators, developers, and small merchants.

In contrast, stablecoin payment flows operate on blockchain rails where settlement is near-instant and transaction costs are measured in fractions of a cent. This enables entirely new economic models:

- Pay‑per‑use content without forcing subscription commitments.

- Real-time royalties for NFT creators and musicians.

- In-game asset purchases that remain economically feasible across borders.

- Streaming payments for services billed by the minute or per session.

In emerging markets, where traditional processors often fail to support micro‑commerce, stablecoin payment rails bypass high remittance fees and banking delays, enabling cross‑border transactions to settle as easily as local payments. This expands revenue opportunities for small merchants and accelerates blockchain‑based commerce adoption.

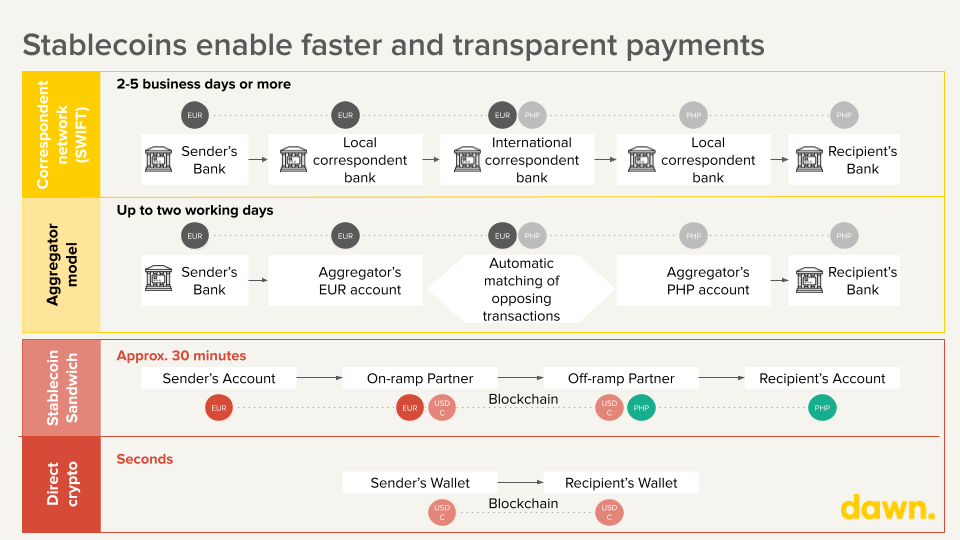

One of the key reasons stablecoin payment can unlock these new models is settlement speed. Traditional rails for cross‑border transfers often take days to complete, especially when routed through correspondent banking networks. Even aggregator models while faster still rely on multiple intermediaries and matching processes. In contrast, blockchain‑based stablecoin transactions can settle in minutes, or even seconds in direct wallet‑to‑wallet transfers.

Comparison of SWIFT, aggregator, stablecoin sandwich, and direct crypto payment speeds, showing stablecoin settlement from minutes to seconds. (Source: Dawn)

This speed advantage is more than a convenience, it directly changes the economics of microtransactions. Faster settlement reduces reliance on pre‑funded accounts, improves cash flow for merchants, and ensures that even low‑value cross‑border payments can be processed without eroding margins. Combined with minimal transaction costs, it’s what makes stablecoin payment viable for creators, small businesses, and platforms serving global audiences.

Traditional credit card transactions involve multiple intermediaries, each adding cost and delay, while stablecoin payment flows settle directly on blockchain networks. This streamlined process removes unnecessary middlemen, reduces processing costs to a fraction, and makes even the smallest transactions economically viable.

Comparison of traditional credit card transactions and stablecoin payment flows, showing reduced intermediaries, lower fees, and faster settlement with blockchain rails. (Source: Foundation Capital)

This efficiency opens the door for new economic models such as pay‑per‑use content, real‑time royalties, in‑game asset purchases, and streaming‑based billing. For emerging markets, it means bypassing high remittance fees and banking delays, making cross-border microtransactions as seamless as local cash payments.

Stablecoin Infrastructure: Strategic Enablement of the Fiat‑OnChain Economy

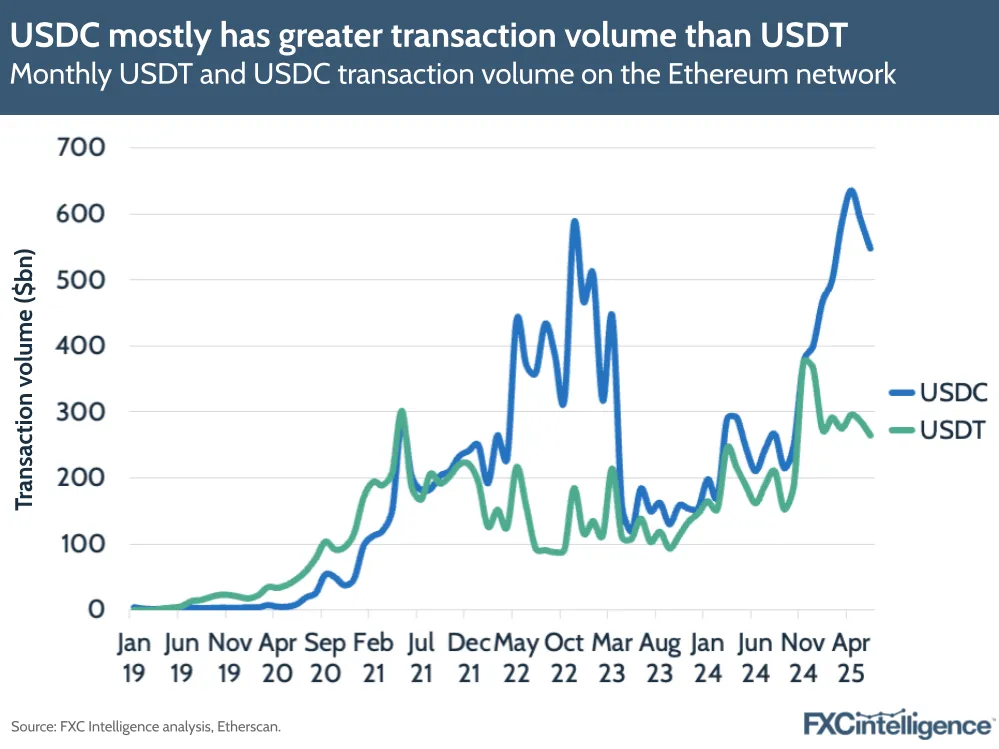

The rise of stablecoin payment isn’t just a convenience, it’s a structural transformation. Total transaction volume across all stablecoins surpassed $5.7 trillion in 2024, with more than 1.3 billion transactions recorded before year‑end, demonstrating both velocity and confidence in these rails. Notably, USDC has consistently led USDT in transaction volume on the Ethereum network in recent years, underscoring its stronger adoption in regulated and institutional environments.

Monthly USDT and USDC transaction volumes on Ethereum, showing USDC’s consistent lead over USDT in recent years. (Source: FXC Intelligence)

Why It Matters Now

- Visa and Mastercard are integrating stablecoins into their core settlement systems. Mastercard, for example, now supports direct stablecoin flows such as USDC across its merchant base, signaling a shift from trial integrations to full operational adoption.

- Major institutional players, including PayPal (PYUSD), Shopify, Walmart, and Amazon, are piloting or preparing stablecoin initiatives aimed at cutting cross‑border fees and improving settlement efficiency changes that could save billions annually.

The Strategic Shift

Previously, merchants offered crypto payments only to niche user groups willing to handle volatility and manage wallets. Today, the infrastructure layer regulated issuers, merchant APIs, custody providers, and familiar ledger services allows platforms to offer stablecoin payment as seamlessly as fiat checkout. End‑users can transact without learning blockchain mechanics, while merchants avoid volatility exposure.

Modern wallet and analytics systems now bring enterprise‑grade reliability: multi‑party computation (MPC) custody security, automated audits, and integrated compliance tools. Together, these capabilities make stablecoin payment scalable for both retail and enterprise adoption.

Who Gains and Who Risks Falling Behind

- First movers: Platforms adopting stablecoin infrastructure early can deliver globally accessible payment experiences with faster settlement, lower costs, and broader reach.

- Late adopters: Companies that remain tied to legacy rails risk losing customers to competitors offering frictionless, stablecoin‑enabled checkout.

The fiat‑onchain bridge is no longer just a supporting layer, it is becoming the operating backbone that transforms stablecoin payment from a promising innovation into a competitive, mainstream alternative to legacy payment systems.

Conclusion

Stablecoins have moved from a trading convenience to a foundational layer of digital commerce. As a Web3 UX layer, they streamline onboarding, enable viable microtransactions, and connect seamlessly with both blockchain and traditional finance.

With faster settlement, lower costs, and stronger compliance, stablecoin payment is becoming a core element of global payment systems. Early adoption is no longer experimental, it’s a strategic step toward staying competitive in blockchain‑enabled commerce.Discover how Twendee Labs helps leading teams launch stablecoin‑enabled platforms, and stay connected via X and LinkedIn.