Peer-to-peer (P2P) payment apps are no longer a novelty in 2025, they’re core infrastructure for mobile-first financial ecosystems. With the continued rise of e-wallet usage, digital KYC standards, and real-time payments, the competition in this space has shifted from who can launch to who can deliver secure, compliant, and seamless UX at scale.

This guide offers a deep dive into how to build a P2P payment app in 2025 from backend architecture to biometric security, from real-time transaction engines to regulatory readiness. Whether launching a regional wallet or a cross-border remittance product, this blueprint ensures your fintech app is designed for speed, scale, and safety.

What Powers a Successful P2P App in 2025?

In 2025, a P2P payment app is more than a tool, it acts as a trust layer connecting users, financial institutions, and regulators. As digital payments become a default behavior, users now expect performance, simplicity, and compliance to be built-in from the start.

A successful P2P app must deliver four core strengths:

- Instant, intuitive UX: Transfers need to feel as effortless as sending a message. Smart contact syncing, one-tap payments, and biometric authentication are no longer extras. They’re the minimum users expect.

- Interoperability at scale: Users increasingly send money across wallets and national borders. Supporting wallet-to-wallet flows like MoMo to VNPay or PayNow to PromptPay, and preparing for remittance cases, is essential for long-term growth.

- Progressive KYC onboarding: Top-performing apps avoid friction during sign-up by allowing basic access first, then prompting identity verification only when required. This improves completion rates and reduces drop-off.

- Built-in regulatory compliance: Each target market introduces unique licensing and audit requirements. Integrating AML screening, transaction logs, and user consent management from the beginning ensures faster approval and smoother expansion.

These four capabilities define how a P2P app should function, but also influence its underlying architecture, user flow, and operational strategy. The following section breaks down how to build this foundation, step by step.

Step-by-Step: How to Build a P2P Payment App

1. Define Scope, Market & Compliance First

Building a P2P payment app starts with clearly identifying the regulatory environment and market requirements. Each country enforces its own framework for digital payments, and overlooking these differences can delay or block your launch entirely.

In the United States, developers must secure Money Transmission Licenses (MTLs) in individual states and comply with federal-level FinCEN guidelines. The European Union imposes PSD2 directives, GDPR data protection rules, and mandates Strong Customer Authentication for all transactions. In Vietnam, licensing from the State Bank and strict eKYC protocols are required for any e-wallet operations. Singapore regulates payment services under the Monetary Authority of Singapore (MAS), which demands both licensing and adherence to AML/CFT obligations.

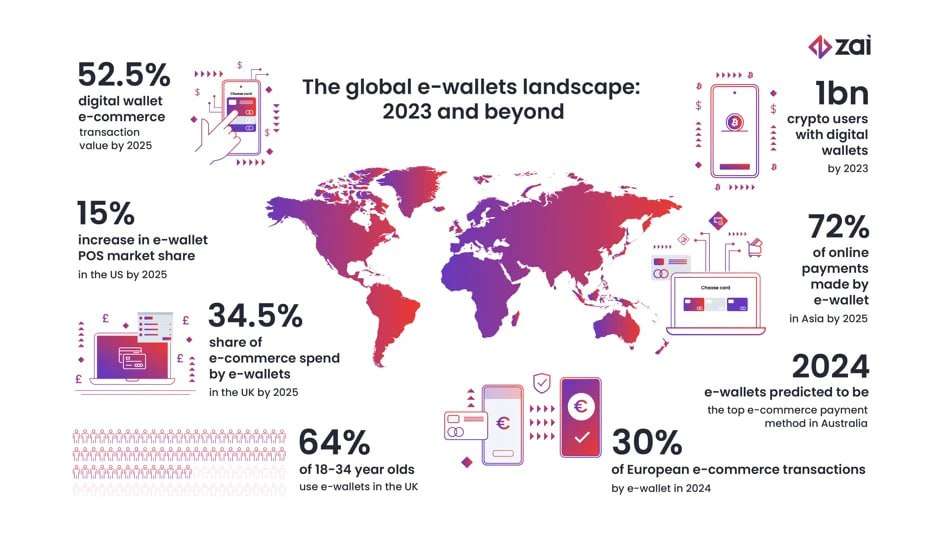

Global map showing e-wallet adoption trends and statistics by region from 2023 to 2025, including projections like 72% of online payments in Asia via e-wallets and 52.5% of e-commerce value globally using digital wallets (Source: Zai)

Beyond regulation, the technical model of your app also matters. On-network models support transactions between users within the same wallet ecosystem. Off-network systems connect with banks, card rails, or external remittance infrastructure. Choosing the right structure affects everything from transaction flow to KYC procedures and partnership strategy.

Engaging legal and compliance experts at the planning stage helps align your architecture with market demands, avoid licensing setbacks, and shorten the path to launch.

2. Design the Mobile Wallet UX Users Expect

In peer-to-peer finance, the interface is the product. Users judge a payment app not by its backend logic but by how effortlessly it helps them move money. In 2025, effective UX is no longer about aesthetics, it’s about removing friction at every point of interaction.

- The journey starts with navigation. Users should immediately understand where to tap to send or request money. A bottom navigation bar focused on primary actions such as “Send,” “Receive,” “Scan,” and “History” reduces decision fatigue and shortens the path to transaction.

- Next comes recipient handling. Instead of typing phone numbers or account details, users expect automatic syncing with their contact list. Apps that surface recent recipients or allow users to favorite contacts create a sense of personalization and speed.

- Contextual payment methods enhance usability. QR code scanning and one-click payment links are now standard, particularly in markets where face-to-face and chat-based transactions are frequent. These features reduce typing and make the act of paying feel natural.

- Onboarding must balance ease with compliance. Forcing users to complete full KYC before seeing app value often leads to drop-offs. A progressive approach allowing low-risk activity with limited verification and unlocking higher limits as trust builds—improves retention without compromising regulation.

- Trust is reinforced through biometric login and clear feedback. Users feel safer when Face ID or fingerprint is available, but fallback flows must also be secure. Animations, loading indicators, and confirmation messages play a subtle but critical role in making users feel in control.

- Finally, accessibility and localization drive inclusivity. Language options, readable font scaling, and responsive design across devices ensure the app remains usable in diverse environments and demographics.

A well-structured mobile wallet UX doesn’t just increase user satisfaction. It reduces support queries, accelerates habit formation, and positions the app as reliable infrastructure in users’ financial routines.

3. Build a Real-Time Transaction Engine

A reliable transaction engine is the backbone of any P2P payment app. In 2025, users expect money to move instantly, with no errors and no lag. Meeting that demand requires a system built for speed, accuracy, and transparency.

Start with a double-entry ledger to ensure every debit matches a credit. This structure prevents data loss and supports auditability across the system.

Use event-driven architecture to decouple processes. When a payment is triggered, let services like balance update, fraud detection, and user notification run in parallel through message queues.

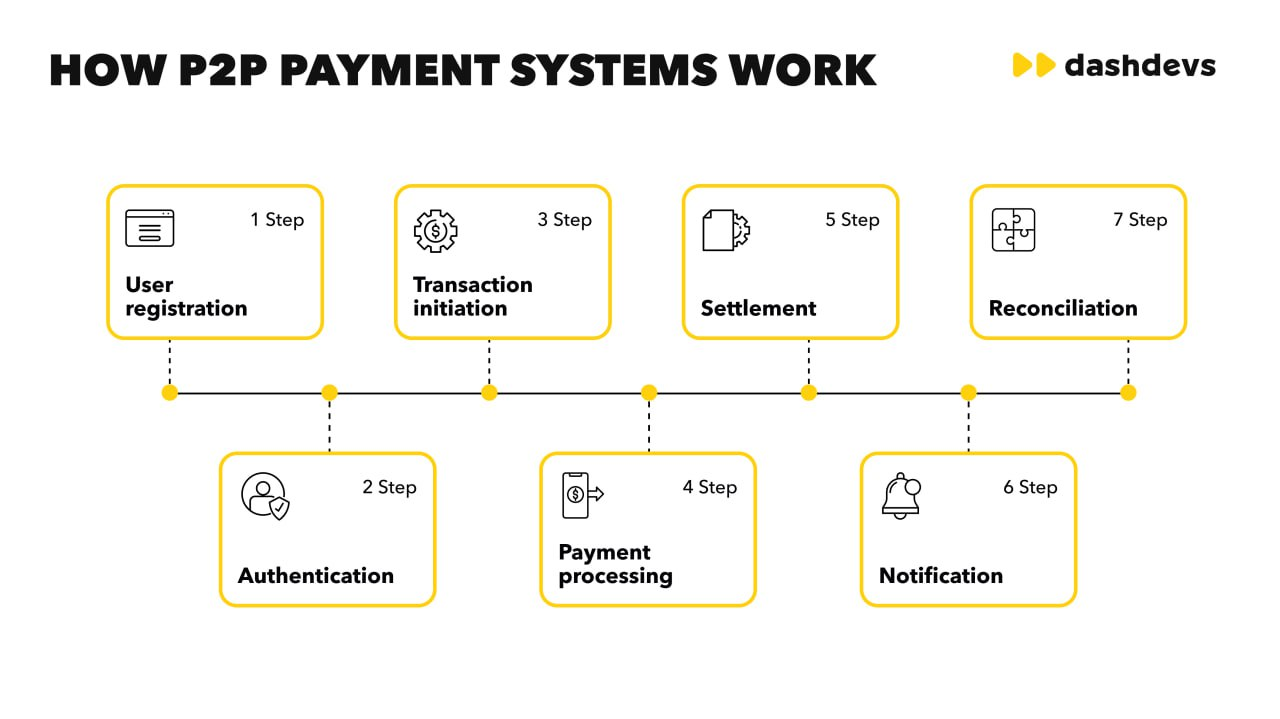

How P2P Payment Systems Work Behind The Scenes (Source)

Keep latency under 300ms by optimizing queries, using in-memory caching, and scaling horizontally. Even under peak load, transactions must complete without delay.

Build in rollback logic for partial failures. If one step fails such as a third-party KYC check, the system should reverse the operation and notify the user without manual intervention.

Track every transaction through clear statuses like pending, completed, or failed. This helps resolve disputes and reduces customer support volume.

Finally, layer in real-time anomaly detection to stop fraud before it settles. Flag unusual behavior based on velocity, device fingerprinting, or location mismatch.

4. Set Up the Backend Infrastructure (Cloud-Ready)

A P2P app’s infrastructure must be secure, modular, and ready to scale. In 2025, backend design isn’t just about performance, it’s about enabling compliance, observability, and fast iteration.

Adopt a microservices architecture to isolate key functions like user accounts, transactions, KYC, and notifications. This separation simplifies updates and improves fault tolerance.

Use a secure API gateway to manage traffic, authenticate requests, and throttle usage. Combined with proper token management, this protects against unauthorized access and misuse.

Store sensitive data in PCI-DSS compliant systems. Apply tokenization and encryption for wallet credentials, user IDs, and transaction logs. Never store raw PII without protection.

Automate deployment using Infrastructure as Code tools such as Terraform or Pulumi. This ensures consistent environments and speeds up recovery if infrastructure fails.

Build in observability from day one. Centralized logging, real-time metrics, and distributed tracing help you catch issues before they impact users or compromise compliance.

Well-structured infrastructure reduces operational risk, simplifies audits, and ensures your app grows without breaking under pressure.

5. Integrate Modern KYC & AML Workflows

Identity verification is a critical layer in P2P finance, both for user trust and regulatory approval. In 2025, smart KYC design helps apps scale faster without adding friction.

Use trusted eKYC providers like Onfido or Sumsub to verify documents, perform liveness checks, and return decisions in seconds. Real-time onboarding keeps users engaged and reduces drop-off.

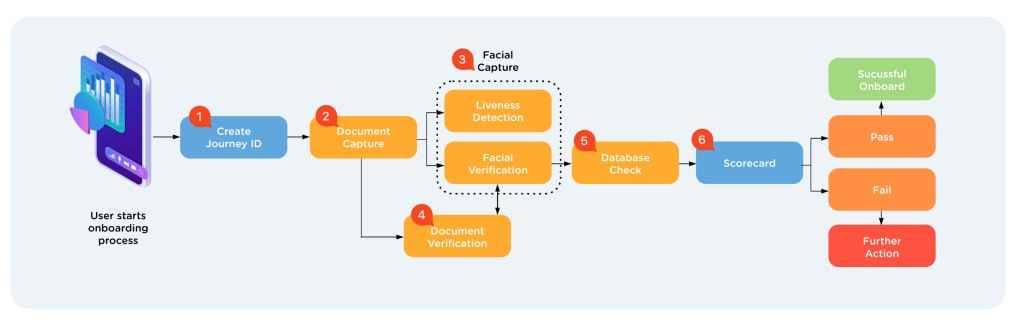

How Does eKYC Actually Work (Source)

Adopt a progressive KYC approach. Let users explore the app with basic functionality, then unlock full access once identity and risk thresholds are met. This keeps the funnel wide while staying compliant.

Embed AML screening directly into the flow. Screen users and transactions against global watchlists (PEP, OFAC, UN) using API integrations with services like ComplyAdvantage.

Log user consent and verification history for audits. Store timestamps, document hashes, and risk scores securely to satisfy regulatory checks.

A strong KYC and AML layer doesn’t slow growth, it supports it by reducing fraud, protecting user data, and speeding up licensing across regions.

6. Prioritize App Security from the Ground Up

Security is foundational in any P2P app. In 2025, users expect financial apps to protect their data and identity by default not as an optional layer.

Start by following OWASP Mobile Top 10. Secure storage using Keychain (iOS) or Keystore (Android) is essential for credentials and tokens. Implement certificate pinning to block man-in-the-middle attacks.

Use token-based authentication with short-lived access tokens and refresh mechanisms. Link accounts to specific devices and expire sessions after inactivity to limit attack surfaces.

Support biometric login backed by secure enclave validation. Always provide fallback flows that maintain both usability and integrity.

Control internal access with role-based permissions. Dashboards and admin panels should require strong authentication and be isolated from user-facing systems.

Security isn’t just about protecting users, it builds long-term trust and ensures smooth passage through audits, partnerships, and expansion plans.

7. Enable Observability & Fraud Detection Early

Visibility is essential to operate a P2P system at scale. Without real-time observability, even minor issues can escalate into downtime, data loss, or fraud.

Set up centralized logging and metrics from the start using tools like ELK, Datadog, or Prometheus. Track transaction latency, error rates, and system health to detect problems before users do.

Integrate behavioral monitoring and anomaly detection. Flag unusual patterns like rapid repeat transfers, location mismatches, or new device access. Combine rules-based thresholds with machine learning to reduce false positives.

Build fraud detection directly into the transaction flow. Use scoring models and automated blockers to stop suspicious transfers in real time. Pair this with alert systems that notify internal teams immediately.

A well-instrumented app protects users and reduces operational risk while giving you the data to improve performance and meet compliance expectations.

8. Test, Certify, and Launch in Sandbox Mode

Before launch, a P2P app must be proven stable under real-world pressure. Testing isn’t a final step, it’s part of the development lifecycle.

Run comprehensive user acceptance testing (UAT) across devices, networks, and edge cases. Simulate payment failures, duplicate transfers, and interrupted sessions to ensure graceful recovery.

Conduct penetration testing and third-party security audits to expose vulnerabilities. Fix weak points in authentication, session management, and API access before going live.

If operating in regulated markets, go through sandbox programs offered by central banks or fintech regulators. These controlled environments help validate compliance and speed up license approvals.

Use canary deployments and feature flags to release gradually. This limits impact from unseen issues and allows controlled scaling as feedback comes in.

A well-executed launch is not just a release, it’s a signal of technical readiness and product credibility.

Conclusion

Launching a P2P payment app in 2025 means operating at the intersection of speed, security, and regulatory precision. Success no longer depends on simply sending money from A to B, it depends on how well every part of the system is designed, from mobile UX to real-time infrastructure, from onboarding flow to compliance logic.

A high-performing P2P app must be fast, trustworthy, and flexible enough to scale across markets. That requires more than good code. It requires deep domain expertise, technical foresight, and an architecture built to evolve.If you’re ready to build a next-generation P2P platform that’s secure, scalable, and regulation-ready from day one, Twendee Labs is here to help. Reach out at twendeelabs.com or connect with us on X or LinkedIn to start building with confidence