In the volatile world of digital assets, the numbers are stark: 70–90% of newly listed tokens lose most of their value within weeks due to uncontrolled liquidity. Without well-designed token liquidity strategies, order books become thin, spreads widen, and early price surges collapse under sell pressure. Sustainable liquidity does not appear by chance, it requires a coordinated mix of technical execution and strategic foresight.

This article provides a step-by-step framework to guide projects from the moment of listing (“zero”) to maintaining healthy, predictable trading volumes (“sustainable volume”). By applying robust token liquidity strategies that combine automated market-making, liquidity pool optimization, and risk management tools, teams can avoid destructive pump dump cycles and position their token for long-term adoption.

Phase 1 – Initial Listing: Building the Foundation

The initial listing phase sets the tone for a token’s market trajectory. Missteps here whether in liquidity structure, risk preparation, or execution often result in pump–dump cycles, widening spreads, and a rapid loss of market confidence. A disciplined approach anchored in proactive risk management, well-designed AMM integration, and precise pre-listing liquidity planning is essential.

Anticipate common risks

Newly listed tokens are prime targets for opportunistic traders and bots seeking to exploit early inefficiencies. Without safeguards, the market can experience sharp upward spikes followed by aggressive sell-offs, eroding early investor trust. Excessive bid–ask spreads make it costly for traders to enter or exit positions, while shallow order books amplify price impact from even moderate trade sizes. Recognizing these vulnerabilities before launch allows teams to prepare countermeasures such as setting spread limits, deploying depth buffers, and monitoring trading patterns in real time so volatility can be contained from day one.

Design liquidity pools with AMM integration

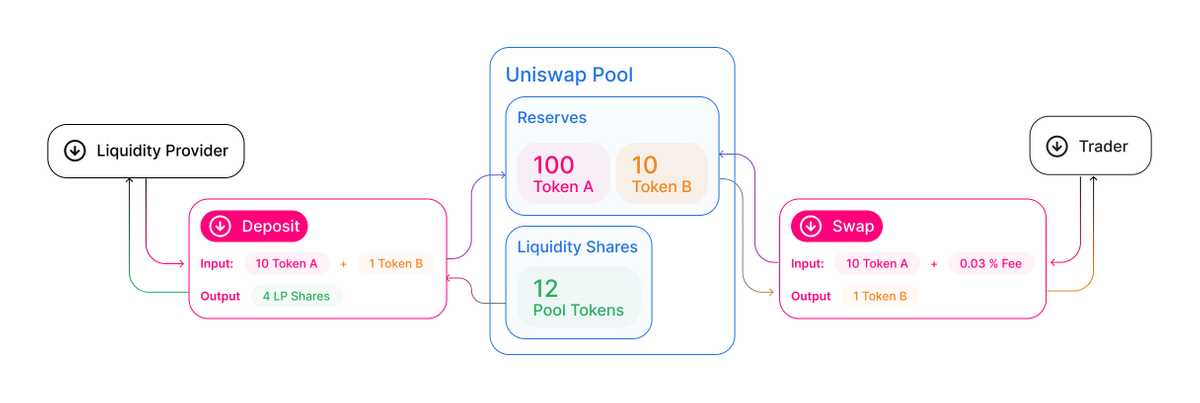

Liquidity pools are the backbone of price discovery during the early market phase. Selecting the right trading pairs is crucial: a token–stablecoin pool serves as a price anchor for stability, while a token–ETH or similar risk-on pair can capture speculative flow. Integrating automated market makers (AMMs) with dynamic fee models encourages liquidity providers to contribute depth even during volatile periods, without incentivizing short-term “mercenary” capital that disappears when conditions shift. AMM parameters such as concentrated ranges and fee tiers should be set to create dense liquidity where most trades occur, while leaving less capital in zones vulnerable to manipulation or unnecessary exposure.

Uniswap liquidity pool diagram showing deposit of token pairs, LP share issuance, and trader swaps with transaction fees (Source: Uniswap)

Pre-listing liquidity planning

Effective liquidity management starts before the first trade is executed. Teams should establish clear, quantifiable targets for spreads, depth, and daily trading volume. For example, setting a maximum allowable spread (e.g., ≤80 bps), defining minimum depth at ±1% of the mid-price, and identifying a baseline daily volume threshold ensures both human operators and automated systems have clear benchmarks to maintain. This planning should also include inventory allocation for market makers, liquidity pool seeding amounts, and a rapid-response protocol for early anomalies. By entering the market with these guardrails in place, teams create a structured environment that supports orderly price discovery and protects against destabilizing forces.

The initial listing is not a marketing milestone, it is an operational stress test. By anticipating risks, designing resilient AMM liquidity pools, and setting precise pre-listing targets, projects can ensure their token launches into a market built for stability rather than speculation. This solid foundation paves the way for the more advanced automation, cross-venue alignment, and adaptive strategies implemented in the stabilization phase.

Phase 2 – Stabilization: Maintaining Consistent Liquidity

Once trading begins, the focus shifts from launching the token to maintaining a market that is both orderly and resilient. Effective token liquidity strategies in this phase hinge on three coordinated pillars: disciplined market-making automation, cross-venue liquidity alignment, and adaptive incentive structures that reward genuine participation without encouraging artificial volume.

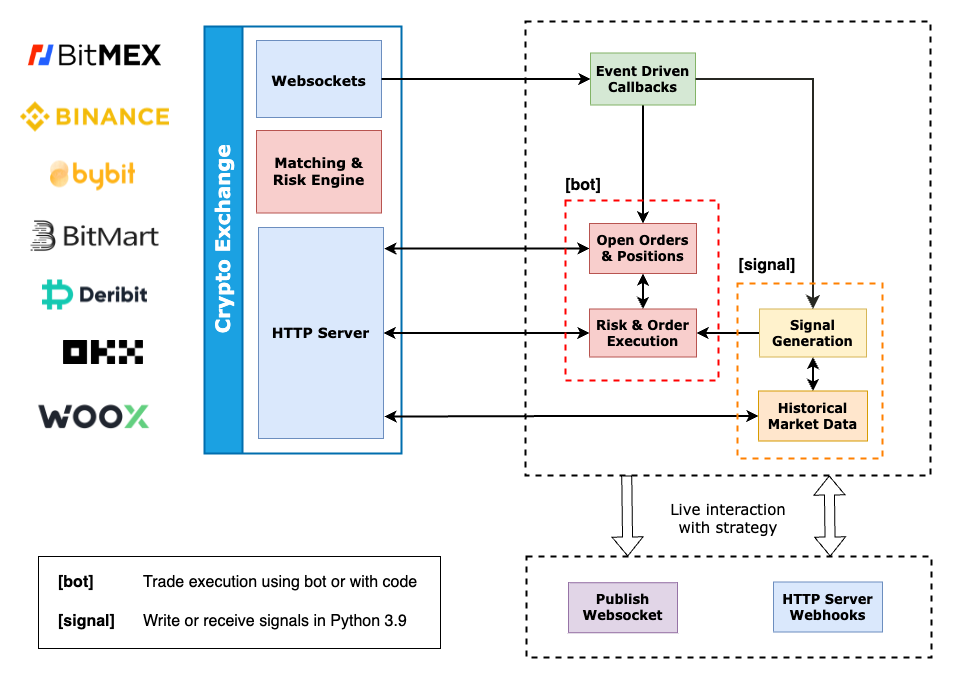

Market-making bots

A well-tuned market-making bot ensures that price discovery remains smooth and controlled. Quoting discipline is critical: core trading pairs should maintain a top-of-book spread between 30 and 80 basis points, with layered size positioned every 25–50 basis points from the mid-price. Inventory must remain balanced within a 45–55% range for both base and quote assets, with automatic rebalancing triggered when deviations exceed 5%. Mid-prices should be calculated from a weighted blend of the deepest DEX pool and the primary CEX, ensuring resistance to manipulation on any single venue. Risk safeguards, such as kill-switches on abnormal slippage spikes, automated quote refreshes in the event of oracle desynchronization, and minimum quote lifetimes to reduce flicker, help maintain market integrity during volatile periods.

Architecture diagram of a crypto market-making bot connecting to multiple exchanges, processing market data, generating trading signals, and executing orders to maintain liquidity. (source)

DEX–CEX liquidity bridge

Price alignment between decentralized and centralized venues is essential for trader confidence. Cross-venue basis the price difference between DEX and CEX should remain within 10–20 basis points for at least 95% of trading intervals. When discrepancies occur, rebalancing should be executed via TWAP or partial fills to avoid creating exploitable single-transaction moves. A smart order router can further enhance efficiency by dynamically selecting between AMM pools and order books based on expected slippage for standard trade sizes. Each venue should maintain reserves equivalent to at least one to two times its median hourly volume to absorb sudden demand without triggering emergency transfers.

Adaptive incentives without creating fake volume

Incentive systems must evolve with market conditions, encouraging liquidity provision without fueling speculative wash trading. Linking AMM fees to realized volatility ensures that liquidity providers are adequately compensated during turbulent markets and that fees naturally compress as conditions stabilize. Maker rebates and LP rewards should be capped, gradually reduced over time, and contingent on minimum active days to filter out opportunistic capital. Tracking the Cost of Liquidity (CoL) the total incentives paid per dollar of depth at ±1% provides a clear measure of efficiency, with the goal of reducing this cost consistently over time.

A stabilization phase built on these three pillars ensures that liquidity remains consistent, prices stay aligned across venues, and incentives drive sustainable participation rather than inflated statistics. Meeting key benchmarks such as tight spreads, healthy liquidity-to-volume ratios, low slippage, and balanced cross-venue pricing signals that the market has matured beyond launch volatility and is ready for the disciplined, long-term management of the sustainability phase.

Phase 3 – Sustainable Volume: Minimizing Extreme Volatility

After the initial listing and stabilization phases, liquidity management evolves from a launch-time priority into an ongoing discipline. In this stage, the objective is to create a market environment where trading volumes are predictable, price swings are contained, and liquidity remains deep enough to support both retail activity and institutional participation.

Optimizing liquidity depth

Liquidity should be concentrated where the majority of trading occurs, typically within ±10% of the rolling VWAP. For AMM pools, this means periodically rebalancing concentrated ranges to maintain efficient pricing while reducing exposure in less active zones. On order books, depth should be consistent across the first three to five levels on both sides, avoiding “empty ladders” that create false market confidence. During known high-impact events such as major announcements or token unlocks additional depth should be provisioned in advance to absorb the expected surge in activity, then scaled back once volatility normalizes.

Managing circulating supply

Even with strong market-making and liquidity provisioning, unmanaged token supply can trigger sharp price drops. A well-structured vesting and unlock schedule ensures that large token releases coincide with periods of enhanced liquidity support. Staking programs should offer yields funded by real transaction fees or protocol revenues, not unsustainable emissions, and should include locking mechanisms to keep a stable float. In addition, treasury-held tokens can be deployed strategically to reinforce liquidity pools or order books during periods of market stress, with transparent post-event reporting to maintain community trust.

Proactive risk monitoring

Maintaining sustainable volume demands early detection of stress signals. On-chain analytics and monitoring tools should track metrics such as sudden increases in spread, a drop of more than 25% in depth at ±1%, or unusual wallet concentration among top holders. For cross-venue trading, persistent basis deviations above 25 basis points should trigger rebalancing and, if needed, adjustments to AMM fees or routing logic. Regular stress tests simulating shock sales at 1%, 2%, and 5% help confirm depth resilience, with adjustments made immediately if pass rates decline.

At this stage, liquidity management is no longer reactive, it becomes a core governance function. By continuously optimizing depth, managing token supply with discipline, and intervening proactively when risk signals emerge, projects can keep markets attractive for both day-to-day traders and long-term holders. When spreads remain consistently tight, depth meets or exceeds predefined thresholds, and interventions are rare, the market reaches true sustainability, a state where volatility is managed, confidence is high, and liquidity supports growth rather than speculation.

Conclusion

Engineering token liquidity from zero to sustainable volume demands more than isolated tools, it is a structured journey that blends technical execution with adaptive market strategy. By building a robust foundation at listing, maintaining liquidity discipline through automation and cross-platform alignment, and actively managing supply and risk, projects can avoid the fate of rapid post-listing decline.

For teams looking to further integrate sustainable liquidity into broader tokenization strategies, exploring the evolving real-world asset (RWA) tokenization market offers valuable lessons. Our recent insights on top RWA platforms for institutional adoption highlight how institutional-grade token models manage liquidity over the long term.

At Twendee Labs, we help Web3 projects turn this discipline into a competitive advantage. From designing liquidity pools and configuring market-making bots, to implementing DEX–CEX bridges and supply management frameworks, our approach ensures your token maintains stability, depth, and relevance long after listing day. Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page