Tokenized real-world assets (RWAs) are no longer theoretical—they’re becoming foundational to institutional finance. In 2025, global banks, asset managers, and regulators have shifted from exploration to deployment, embedding tokenized assets into operating models. From tokenized bonds and real estate to blockchain-enabled private equity, tokenization is reshaping ownership, liquidity, and access to capital.

For financial leaders, the challenge isn’t simply tracking tokenization’s rise—it’s assessing how quickly, under what conditions, and through which models this shift will reshape investment strategies. This article explores the momentum driving tokenized assets, their impact on investment structures, and the operational realities shaping their adoption.

Why Tokenized Assets Are Accelerating Institutional Integration

Tokenized assets have moved beyond proof-of-concept to strategic implementation, driven by three reinforcing factors: regulatory clarity, operational deployment, and competitive positioning.

1. Regulatory Momentum Is Reducing Barriers

The EU’s MiCA framework (effective since late 2024) has provided a harmonized legal structure for digital assets, while U.S. regulators have advanced pilot programs and draft guidelines for tokenized securities. Deloitte’s 2025 financial outlook describes tokenization as “a transition from innovation to compliance-standardized issuance.” While global frameworks remain uneven, regulatory sentiment is shifting toward enablement.

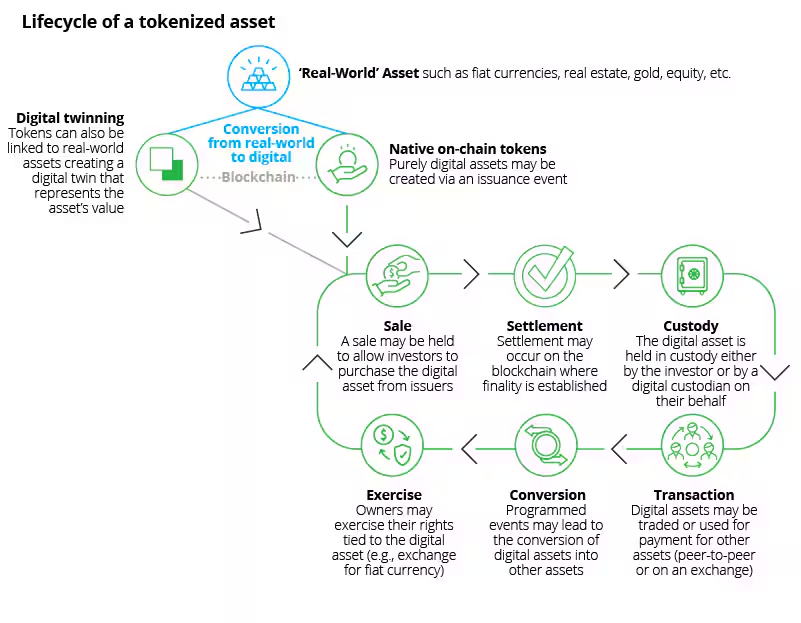

Process flow of real-world asset tokenization (Source: Deloitte)

Key regulatory milestones include:

- MiCA’s implementation of a unified licensing regime for crypto-asset service providers across the EU

- SEC pilot programs exploring compliant issuance of tokenized funds under existing securities law

2. Operational pilots are scaling into production

Institutions like HSBC, JPMorgan, and Goldman Sachs are migrating tokenization from proofs-of-concept into transactional platforms. The Canton Network—backed by Goldman Sachs, Microsoft, and Deloitte—enables privacy-preserving, interoperable tokenized transactions for syndicated loans, bonds, and money market funds. Meanwhile, Kin Capital’s $100 million tokenized real estate debt fund on Chintai signals institutional confidence expanding into private credit markets.

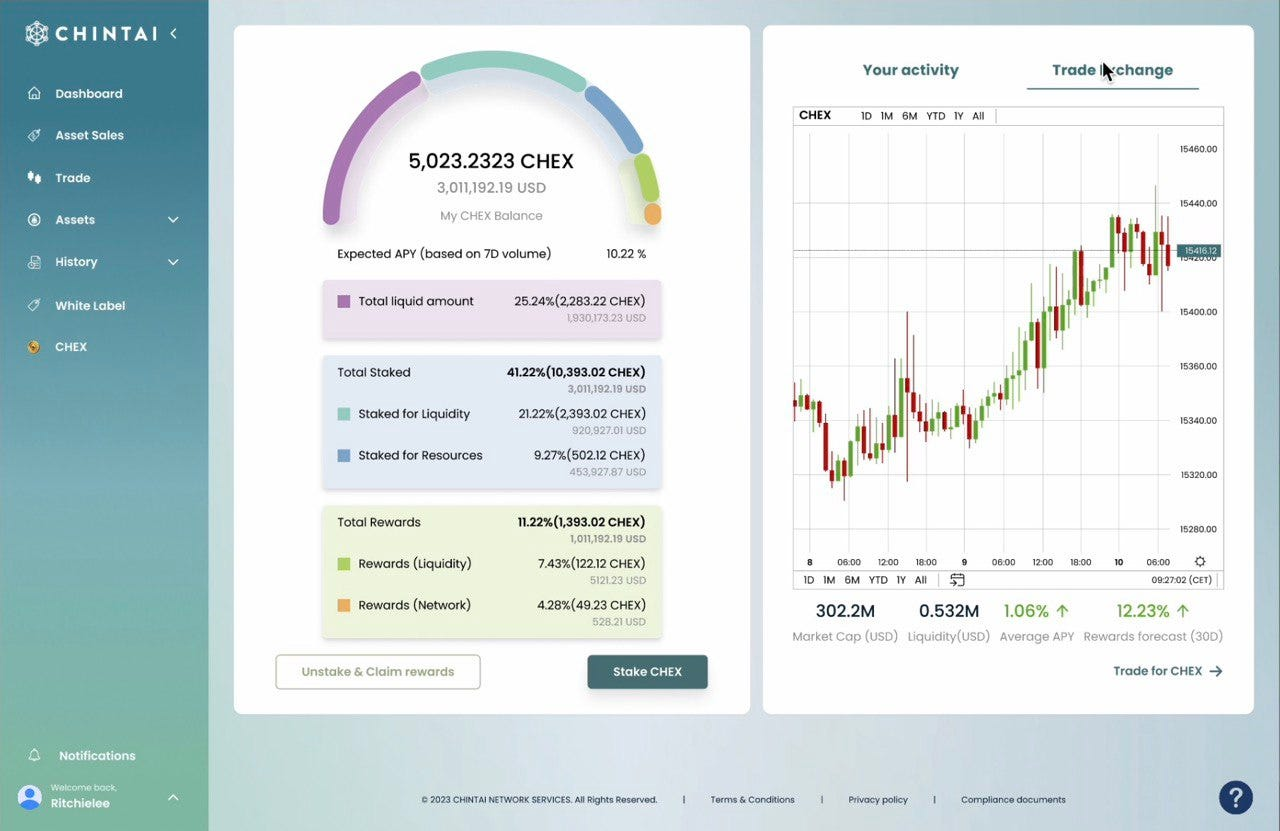

Dashboard view of Chintai tokenized asset platform (Source: Chintai)

Notable institutional use cases:

- HSBC’s Orion platform tokenizing bond issuances for institutional clients

- Kin Capital’s fund enabling fractional access to real estate debt assets for qualified investors

3. Competitive positioning is driving early adoption

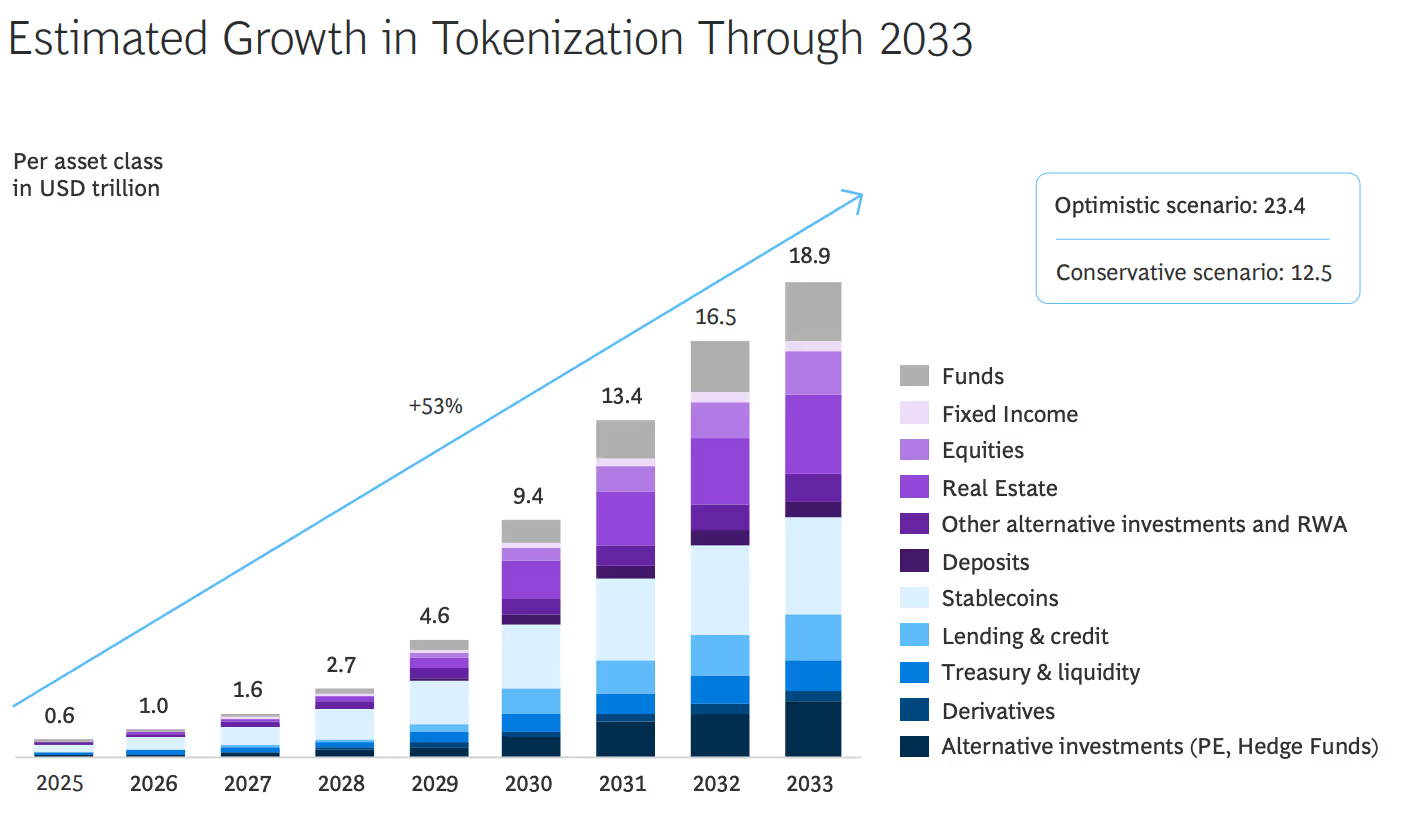

As early movers establish operational footholds, laggards risk liquidity exclusion or reliance on less favorable infrastructure. BlackRock’s BUIDL fund on Ethereum, Citigroup’s private blockchain pilots, and Blocksquare’s tokenization of over $1 billion in U.S. commercial properties illustrate how first movers are embedding tokenization into product offerings—not just as innovation, but as a liquidity and client-access strategy. Forecasts like Ripple and BCG’s projection of an $18.9 trillion tokenized RWA market by 2033 further reflect accumulating institutional commitments.

Tokenized asset market growth chart by asset class (Source: CoinDesk)

Competitive dynamics shaping early adoption:

- Major asset managers racing to pre-position for liquidity and client distribution advantages

- Institutional pressure to avoid dependence on external tokenization platforms as markets mature

“The tokenization of real-world assets has shifted from optional pilot to structural imperative,” Keyrock’s 2025 report notes.

For institutional strategists, the signal is clear: tokenized assets are converging from discretionary experiments into operational infrastructure—and the window to pre-position is narrowing.

How Tokenized Assets Are Reshaping Investment Strategy

Tokenized assets aren’t merely replicating traditional securities on digital rails—they’re redefining ownership, liquidity, and governance mechanics in institutional portfolios.

For financial strategists, three critical shifts are emerging:

1. Fractional ownership at institutional scale

Tokenization enables traditionally illiquid assets—such as real estate, private equity, and infrastructure—to be divided into smaller, tradable units while preserving governance rights. This unlocks new investor segments and liquidity options without requiring full asset sales or restructuring.

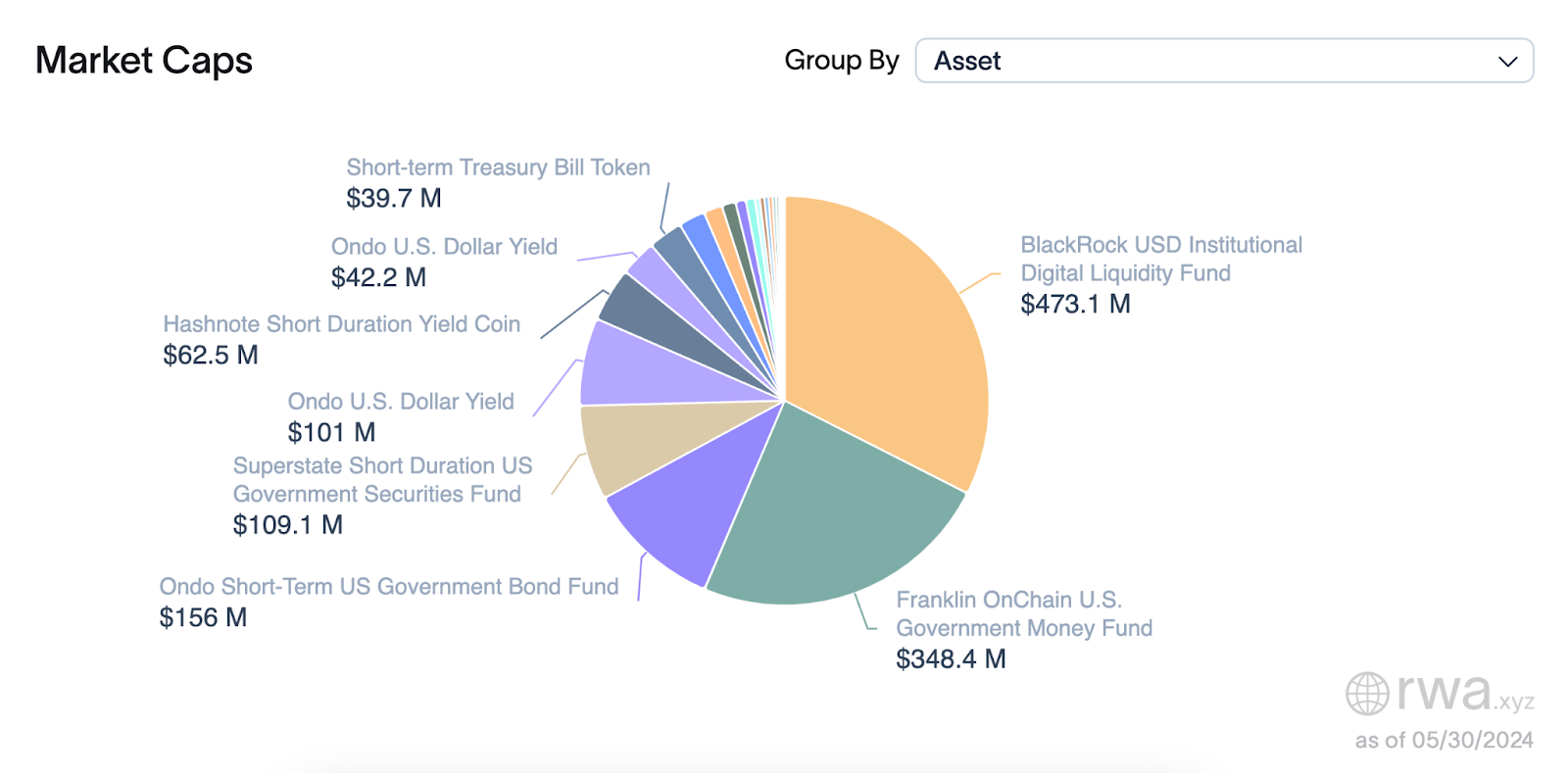

A leading example is BlackRock’s BUIDL fund, which tokenized U.S. Treasuries on Ethereum to create a liquid, blockchain-native wrapper for fixed-income exposure. By fractionalizing treasuries, the fund offers institutional investors flexibility to rebalance portfolios or meet liquidity demands without liquidating underlying holdings.

Pie chart showing tokenized asset market caps by fund as of May 2024 (Source: RWA.xyz)

For institutional investors, this goes beyond democratization:

- Partial liquidity sleeves: enabling liquidity access within locked structures without unwinding

- Dynamic rebalancing: adjusting exposures in real estate, private credit, or infrastructure without triggering large-scale transactions

- New fund structures: blending private market access with open-ended fund liquidity mechanisms

Managers are increasingly leveraging tokenized units to balance liquidity flexibility against long-term allocation constraints—designing hybrid models that blur public-private market divides.

2. Liquidity windows extending beyond market hours

Tokenized assets expand liquidity access beyond the constraints of traditional exchange operating hours, offering more continuous trading and settlement cycles. This extension enables intraday collateral optimization, more flexible fund redemption processes, and faster settlement for private-market assets.

JPMorgan’s Onyx Digital Assets platform exemplifies this shift, having cleared over $900 billion in tokenized repo transactions. Its operations demonstrate how tokenized assets can function within institutional frameworks while decoupling settlement from traditional cut-off times.

This expanded liquidity window forces operational reevaluation:

- Intraday collateral optimization: accessing liquidity against tokenized assets even outside clearing windows

- Redemption governance: balancing investor rights when liquidity access extends beyond normal redemption cutoffs

- Funding strategies: redesigning treasury operations to align with new settlement possibilities

The shift challenges assumptions around how—and when—capital can be mobilized across portfolios, especially for strategies reliant on tight liquidity management.

3. Embedded compliance and programmable governance

Tokenization is shifting compliance from post-trade checks to embedded, automated enforcement at the asset level. Smart contracts can encode KYC, AML, investor eligibility, and payout rules—reducing manual processes while boosting auditability.

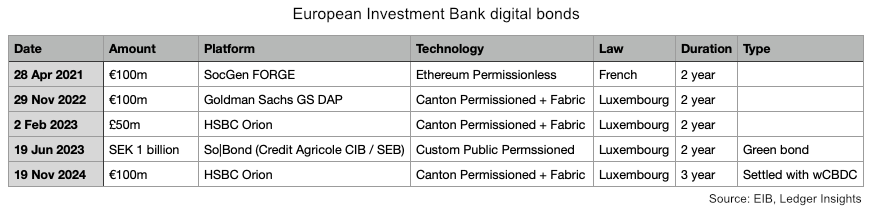

A landmark example was the European Investment Bank’s €100 million digital bond issued on Ethereum in 2021, embedding investor eligibility and coupon payments into the contract itself. Since then, EIB has expanded issuance across multiple blockchain platforms and regulatory frameworks—demonstrating growing institutional confidence in programmable compliance.

EIB digital bond issuance table 2021–2024 (Source: EIB, Ledger Insights)

While automation offers efficiency, it also raises governance questions:

- Audit accountability: who verifies smart contract logic over time?

- Regulatory agility: how are jurisdictional updates reflected once code is live?

- Liability clarity: who bears responsibility for compliance failures originating in software?

For institutional investors, tokenization introduces not just technical change but structural shifts in governance, oversight, and fiduciary responsibility. To explore how tokenized assets interface with trading systems and digital market infrastructure, see our guide to building a trading platform from scratch.

Building Infrastructure for Tokenized Asset Markets

Tokenization’s scalability hinges on institutional-grade infrastructure. In 2025, several developments are laying that groundwork:

- Permissioned blockchain networks like Canton are enabling private, regulated, interoperable tokenized transactions across institutions.

- Custody solutions are evolving to integrate tokenized RWAs alongside traditional assets within institutional custody, fund administration, and reporting systems.

- Cross-platform interoperability standards are emerging, ensuring tokenized assets issued on one platform can settle, clear, and serve as collateral across others.

However, structural gaps remain. Global interoperability is fragmented; integration with legacy systems poses friction; secondary liquidity for tokenized private assets remains nascent. As Keyrock’s report warns, “The pipes are still being laid for scalable secondary liquidity across tokenized private markets.”

In the meantime, institutions that invest in early operational readiness—across compliance, custody, and liquidity partnerships—will position themselves for competitive advantage as these infrastructure gaps close.

Conclusion

Tokenized assets are evolving from niche innovation to foundational infrastructure for modern capital markets. For institutional investors, the question is no longer if tokenization will reshape investment—but how quickly, at what scale, and under what operational models.

Those building capacity today—across compliance, liquidity, custody, and governance—will not only participate in tokenized markets, but help define them.

Twendee Labs works with financial institutions and technology leaders navigating tokenization, blockchain infrastructure, and capital market innovation. Our team helps bridge technical implementation with institutional compliance and operational realities. Explore recent projects and insights on LinkedIn and X, or connect to discuss collaborative opportunities in digital asset infrastructure.