In 2025, RWA tokenization is turning traditional finance on its head. By converting real-world assets, from real estate and bonds to commodities, art, and infrastructure into blockchain-based tokens, investors can now access and trade what were once illiquid, capital-heavy markets. Fractional ownership allows global participation, while smart contracts automate settlements, compliance, and payouts.

As institutional adoption grows and regulation matures, tokenization is shifting from experimentation to execution. Market projections suggest RWA-based tokens could exceed hundreds of billions in value within the decade. Below are the 10 asset classes leading this transformation, each redefining how value is owned, managed, and exchanged and how companies like Twendee are helping build this new digital economy.

1. Real Estate

RWA tokenization began with real estate, the world’s most valuable yet illiquid asset class. Tokenizing property divides ownership into digital tokens, allowing investors to purchase fractions of a building, earn rent, and trade anytime without traditional barriers.

- Use case: A $10M commercial tower divided into tokens lets global investors co-own and earn rental income.

- Benefits: Lower entry costs, instant liquidity, and transparent ownership records secured on-chain.

- Impact: Developers raise capital faster; investors diversify portfolios with smaller stakes.

Asset tokenization process flow, showing asset identification, verification, minting, and smart contract integration (Source: Techopedia)

Twendee’s role: Building tokenization platforms with compliance, fractional ownership logic, and automated revenue distribution.

2. Government and Corporate Bonds

Tokenized bonds from U.S. Treasuries to corporate debt are among the fastest-growing RWA segments. By issuing debt as blockchain tokens, institutions cut settlement from days to minutes and open bond investing to retail holders.

- Use case: A digital treasury bond token pays interest automatically to thousands of investors worldwide.

- Benefits: Instant settlement, transparent tracking, and fractional participation in global debt markets.

- Trend: Stable yields and trust-backed assets make tokenized bonds a gateway for traditional investors entering DeFi.

Twendee’s role: Developing token issuance systems with smart contract coupon payments and full KYC/AML compliance.

3. Commodities

Tokenizing commodities like gold, silver, and oil bridges the physical and digital economies. Each token represents a verified quantity stored in custody, enabling 24/7 trading without logistics or storage hurdles.

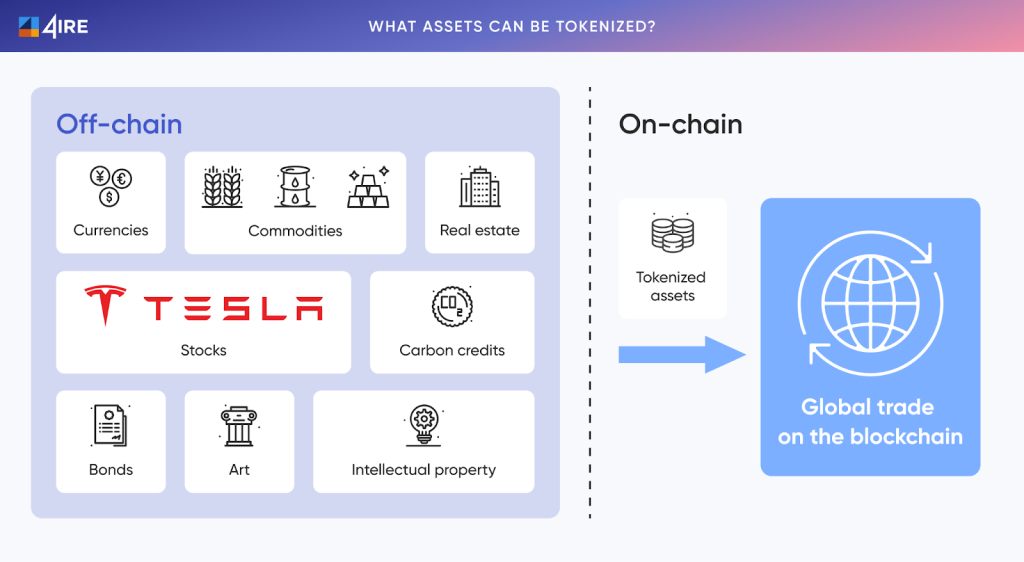

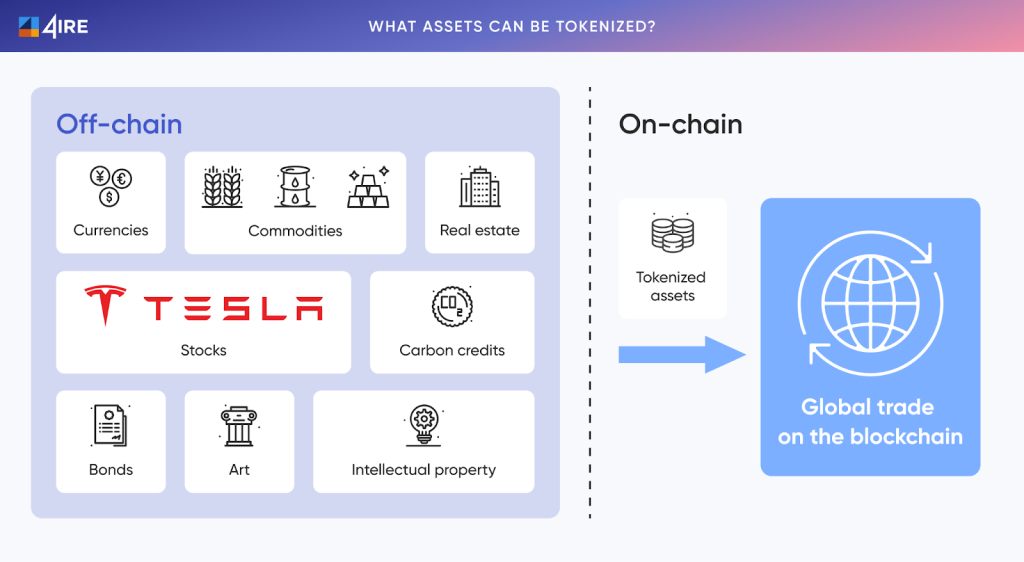

Infographic of “what assets can be tokenized” including real estate, commodities, art, carbon credits, … (Source: ire4labs)

- Use case: Gold-backed tokens pegged 1:1 to grams of gold simplify access to a traditionally complex asset.

- Benefits: Real-time liquidity, transparent reserves, and integration into DeFi markets as stable collateral.

- Trend: Tokenized commodities hedge inflation while opening access to emerging investors.

Twendee’s role: Linking physical vault systems to blockchain architecture for secure, auditable, asset-backed tokens.

4. Art & Collectibles

Fine art and luxury collectibles historically illiquid and elite are now accessible to retail investors through tokenization. A single artwork can have thousands of co-owners, each holding a digital share that appreciates with the piece’s value.

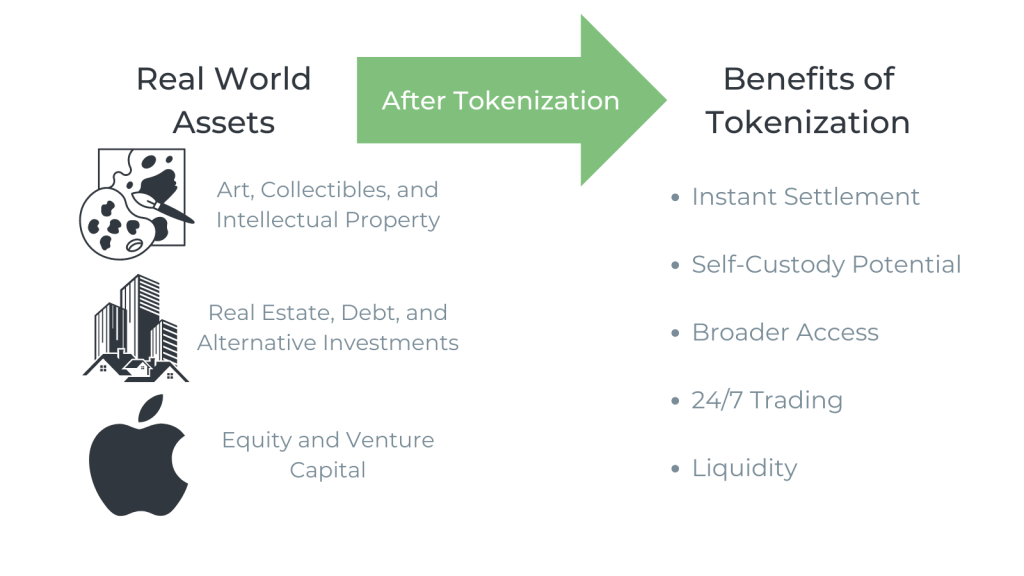

Illustration of real-world assets (real estate, debt, art) moving into tokenized form (Source: Avax)

- Use case: 1,000 investors co-own a $5M painting through fractional art tokens.

- Benefits: Democratized access, secondary-market liquidity, and verified provenance through blockchain records.

- Trend: Art tokenization merges finance and culture, turning collectibles into tradeable investment assets.

Twendee’s role: Creating NFT and fractional ownership infrastructures that track provenance and manage secure custodianship.

5. Infrastructure Projects

Infrastructure tokenization is revolutionizing how large projects roads, power plants, telecom networks are financed. Token holders fund development and earn revenue from long-term cash flows like tolls or energy sales.

- Use case: Renewable energy projects raise capital globally by tokenizing future revenue streams.

- Benefits: Broader funding access, real-time transparency, and community participation in sustainable projects.

- Trend: Green and ESG-linked infrastructure tokens are drawing institutional capital.

Tokenization flow diagram showing infrastructure project financing through digital asset issuance (Source: Chainlink Blog)

Twendee’s role: Designing compliant crowdfunding platforms for large-scale projects with automated revenue-sharing smart contracts.

6. Private Equity & Startup Shares

Private equity and startup ownership are no longer exclusive. Tokenized equity lets startups sell small ownership fractions, giving investors early access and liquidity pre-IPO.

- Use case: A startup tokenizes 10% of its shares for investors, tradable on a regulated platform.

- Benefits: Liquidity in private markets, fractional participation, and faster fundraising cycles.

- Trend: Tokenized equity is reshaping venture capital and early-stage investment models.

Twendee’s role: Structuring compliant equity tokens with integrated investor verification and real-time cap table updates.

7. Investment Funds & ETFs

Tokenized funds and ETFs make diversified portfolios more inclusive. Fund managers can issue tokens representing fund shares, allowing smaller investors to access institutional-grade assets.

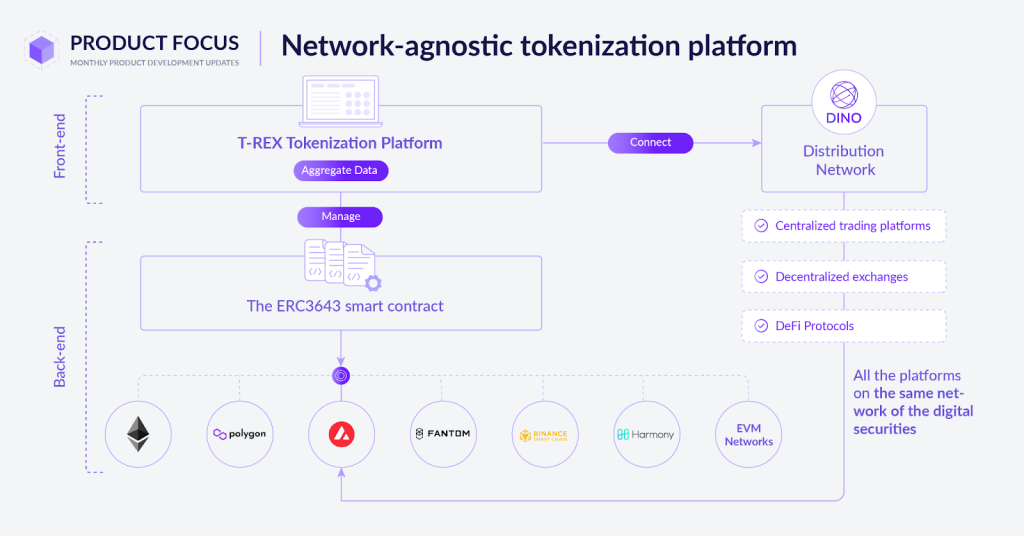

Network-agnostic tokenization platform linking smart contracts with multiple EVM networks (Source: Tokeny Solutions)

- Use case: A $100M real estate fund issues tokens with $1,000 minimum investment.

- Benefits: Lower barriers, instant liquidity, and transparent profit distributions.

- Trend: Major asset managers are piloting tokenized funds to reduce operational friction.

Twendee’s role: Building fund tokenization systems that handle investor onboarding, smart-contract payouts, and regulatory compliance.

8. Intellectual Property & Royalties

Music, film, and patents are becoming investable through royalty-backed tokens. Artists and inventors can monetize future earnings by selling fractional rights, while fans and investors gain direct exposure to creative assets.

- Use case: A musician tokenizes 20% of song royalties, distributing streaming revenue to token holders.

- Benefits: Transparent payouts, recurring income, and community-backed financing.

- Trend: Tokenized IP creates new income models and brings liquidity to creative industries.

Twendee’s role: Developing custom smart contracts for automated royalty distribution and verified ownership tracking.

9. Carbon Credits & ESG Assets

Tokenized carbon credits increase transparency in sustainability markets. Each token represents one verified ton of CO₂ offset, traceable from issuance to retirement.

- Use case: Reforestation projects issue verifiable on-chain carbon credit tokens.

- Benefits: Transparent carbon tracking, global trading access, and prevention of double counting.

- Trend: ESG tokens are attracting investors seeking measurable climate impact alongside financial returns.

Twendee’s role: Creating tokenized carbon platforms integrating registry APIs and IoT-based verification for real-time monitoring.

10. Loans & Receivables

Tokenizing debt instruments from business loans to invoices gives companies faster access to working capital while offering investors steady yields.

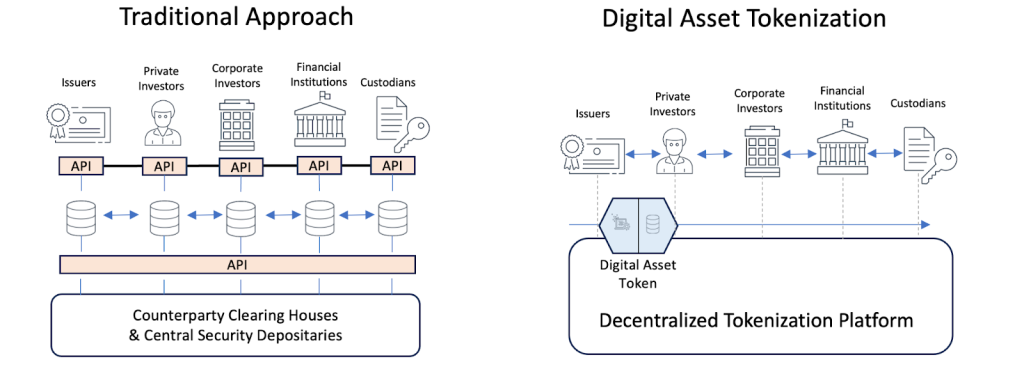

Visualization of Real-World Asset (RWA) tokenization, illustrating how traditional assets such as bonds, commodities, and real estate are digitized, verified on-chain, and integrated into DeFi ecosystems for liquidity and faster settlement (Source: Chainlink Official Blog)

- Use case: SMEs tokenize invoices to raise short-term funds; investors redeem tokens with interest at maturity.

- Benefits: Faster liquidity, transparent risk data, and diversified yield opportunities.

- Trend: DeFi platforms are bridging traditional credit with blockchain lending pools.

Twendee’s role: Powering tokenized lending systems with integrated KYC, credit scoring, and on-chain repayment automation.

Conclusion: The Digital Ownership Era

RWA tokenization is more than a trend but a structural evolution in finance. From real estate and infrastructure to art and IP, tokenization unlocks liquidity, transparency, and inclusion across asset classes. Investors gain access to global markets; asset owners unlock capital; and institutions achieve operational efficiency through blockchain-backed infrastructure.

We help enterprises and innovators design, issue, and manage compliant tokenized assets. With expertise in smart contracts, DeFi integration, and regulatory alignment, we enable businesses to turn real-world value into secure, scalable digital ecosystems.

Discover how Twendee transforms traditional assets into digital opportunities through its end-to-end blockchain development and consulting services: https://twendeelabs.com/

Contact us: Twitter & LinkedIn Page

Read latest blog: Crypto Regulation in 2025: How New Laws Are Reshaping Exchanges and Stablecoin Issuers