As digital finance rapidly evolves, the demand for secure, scalable, and intuitive e-wallet apps has never been higher. By 2033, the global digital payment market is projected to hit $712 billion in value, with mobile wallets driving a significant portion of that growth. In this landscape, businesses aren’t just using e-wallet apps — they’re building them.

Whether for fintech platforms, retail loyalty programs, or blockchain-integrated payment systems, organizations are turning to top e-wallet developers to bring customized wallet experiences to life. This blog highlights 12 companies leading the market in 2025, each trusted for their technical expertise, fintech compliance, and ability to deliver secure, modern wallet applications.

What Defines a Leading E-Wallet Developer

In today’s market, a wallet isn’t just a feature — it’s a fintech backbone. The developers on this list were selected based on four business-critical capabilities:

- Security with Compliance Built-In

Top-tier firms don’t just encrypt data — they architect for PCI-DSS, KYC, and AML from the start. With regulators tightening oversight in APAC, EU, and the US, embedded compliance is no longer optional — it’s operational survival. - UX That Drives Activation, Not Abandonment

A wallet’s success is tied to how quickly users can trust and transact. The best developers build flows that cut KYC friction, localize interfaces, and reduce onboarding time — translating directly into higher completion and retention rates. - Integration That Future-Proofs Growth

Beyond card processors and banking APIs, leading developers now support Web3 rails, stablecoins, and tokenized rewards. This flexibility allows businesses to adapt fast — whether entering new markets or launching crypto features. - Scalability Without Refactoring

With rising concurrency loads and feature rollouts, scalability isn’t about adding servers — it’s about modular infrastructure. Top developers use cloud-native stacks that support multi-region deployment and product iteration without downtime.

These aren’t technical preferences — they’re the architectural decisions that shape whether a wallet platform can survive its own growth.

1. Appinventiv

Location: India

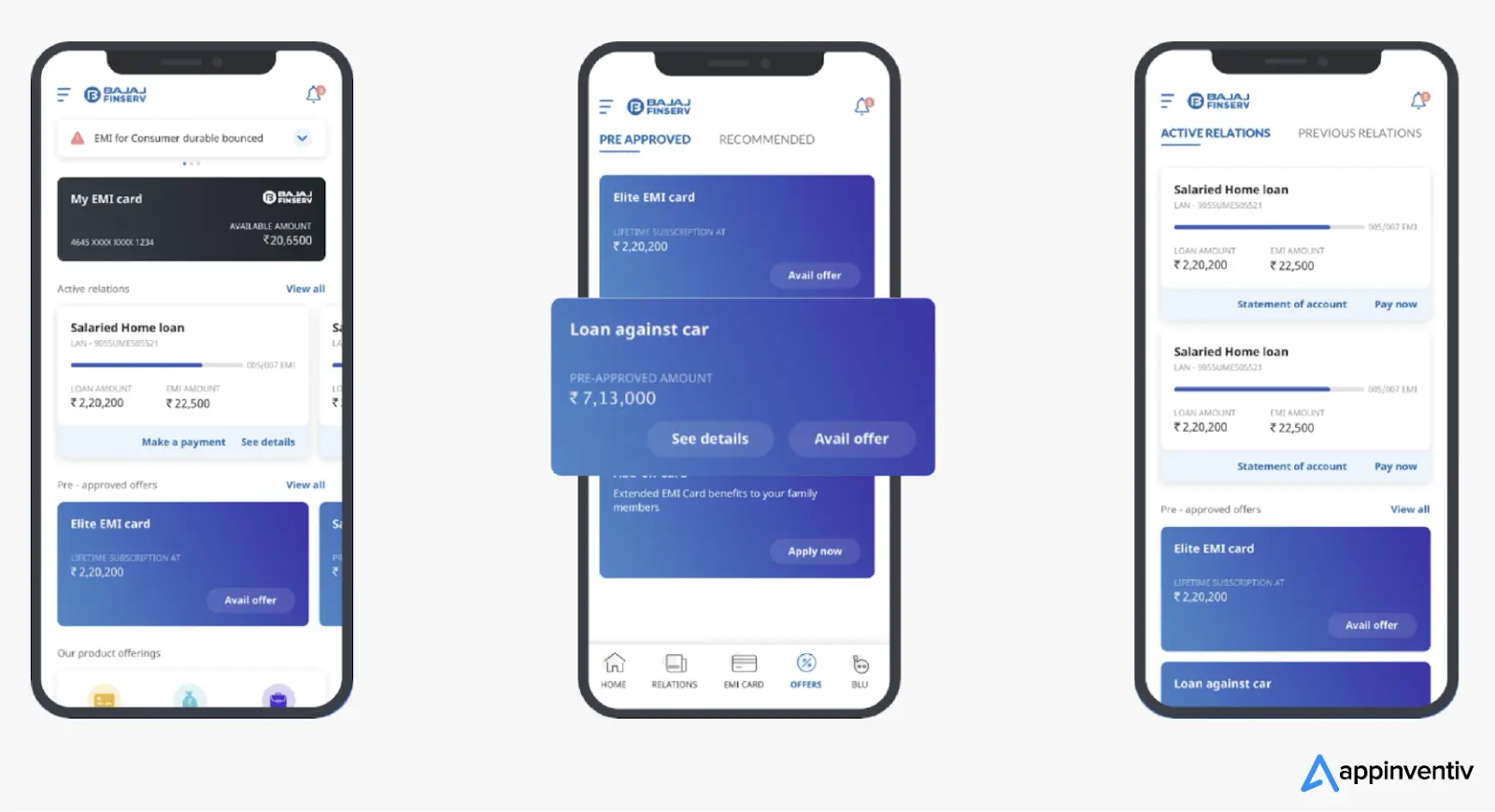

Appinventiv is a leading digital product agency that delivers e-wallet solutions at scale for banks, telecoms, and fintech challengers. Known for balancing speed and compliance, they’re especially strong in regulated environments requiring localization, eKYC, and multi-platform orchestration.

Bajaj Finserv app developed by Appinventiv, showcasing loan and EMI wallet functionalities (Source: Appinventiv)

Main Services:

- Custom wallet app development for mobile and web

- KYC/AML system integration

- Scalable backend systems with real-time transaction layers

Key Industries:

- Digital banking

- Telecom payments

- Mobility and transport

Appinventiv’s ability to manage full product rollouts — from agent dashboards to end-user wallets — sets them apart. They’ve executed national wallet launches with biometric access, multi-language UX, and secure API layers, making them a trusted partner for institutions prioritizing scale and regulatory alignment.

2. ScienceSoft

Location: USA / Eastern Europe

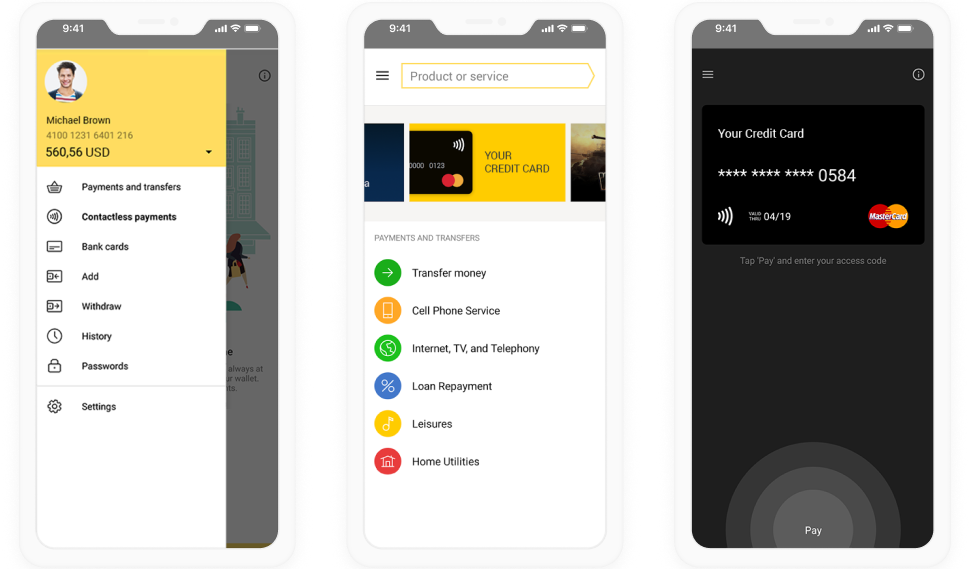

ScienceSoft applies decades of enterprise software engineering to fintech infrastructure, delivering secure and resilient wallet platforms. Their solutions are built to handle the backend complexity of banking-grade apps — with long-term support baked into the architecture.

Mobile wallet UI developed by ScienceSoft featuring payment transfers, credit card integration, and service categories (Source: ScienceSoft)

Main Services:

- Custom wallet backend and infrastructure

- Blockchain and mobile banking integrations

- Payment gateway engineering

Key Industries:

- Banking and insurance

- Financial services

- Enterprise platforms

They’re often selected by institutions looking to modernize or extend their digital finance stacks while maintaining strict control over performance, data flow, and security compliance. ScienceSoft’s modular architecture and lifecycle management make it a reliable choice for scaling wallets in complex operational environments.

3. Antier Solutions

Location: India

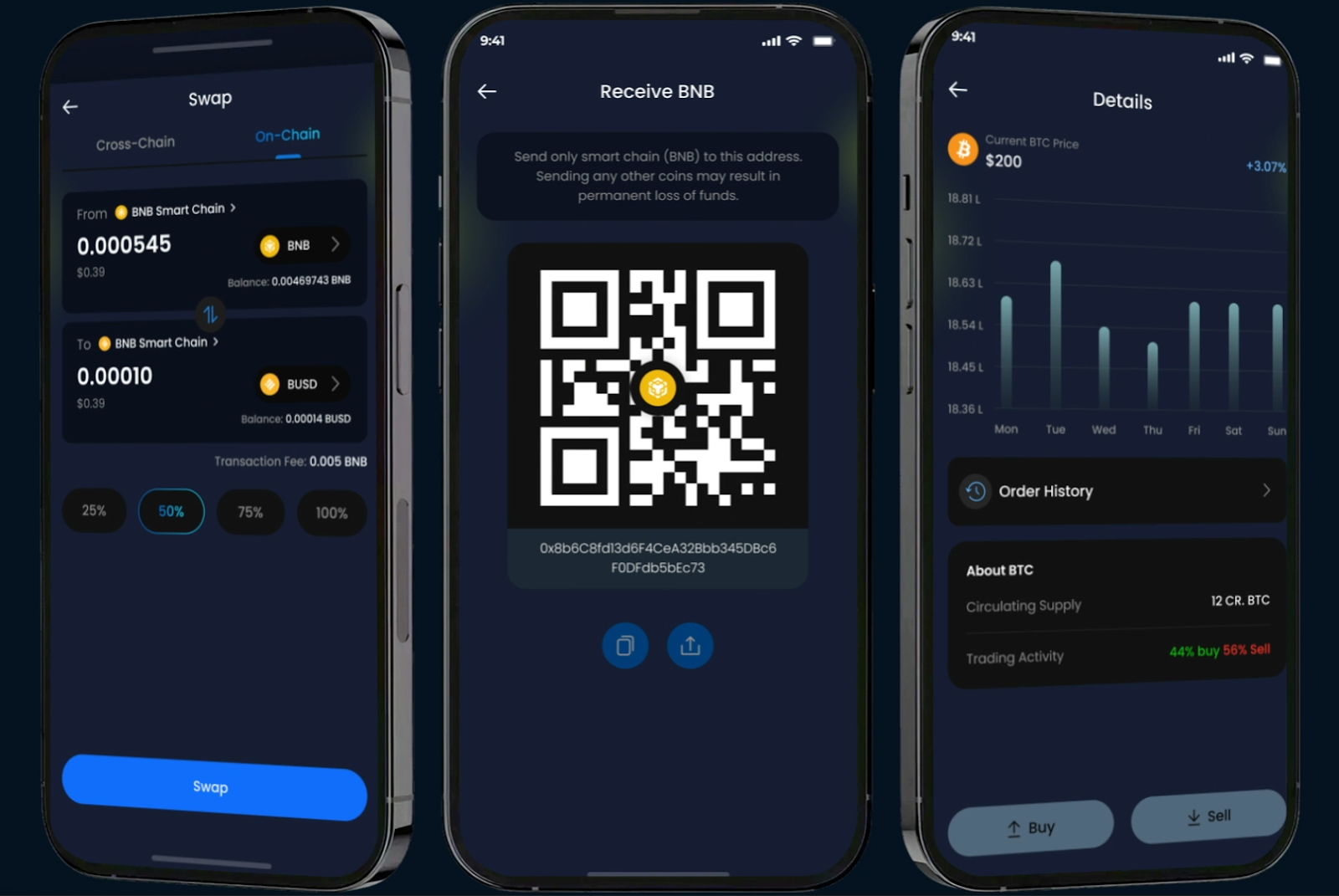

Antier Solutions is a Web3-focused engineering partner for companies building multi-asset crypto wallets, staking dashboards, and tokenized payment layers. Their ability to deliver fast, composable wallet stacks has made them a go-to for early-stage DeFi ventures and NFT marketplaces.

Crypto wallet interface developed by Antier Solutions with features for token balance, transaction history, referral rewards, and real-time crypto analytics (Source: Antier Solutions)

Main Services:

- Multi-chain wallet development

- DeFi integrations and smart contract systems

- Web3 infrastructure consulting

Key Industries:

- DeFi and crypto exchanges

- Tokenized real estate and loyalty

- NFT and gaming platforms

Antier’s technical edge lies in their pre-audited smart contract modules, cross-chain integration (ETH, BNB, Solana, L2s), and experience working in regulatory gray zones. This allows startups to go live faster without building every infrastructure component from scratch.

4. Itexus

Location: USA / Belarus

Itexus is a custom software development company with strong expertise in fintech solutions, including personal finance apps, digital wallets, and wealth management platforms. The firm offers end-to-end development for e-wallet apps, including biometric security, AI-based insights, and cross-platform interfaces.

Mobile wallet app interface designed by Itexus featuring account balance, transaction feed, signup form, and a circular financial insights chart (Source: Itexus)

Main Services:

- Fintech app development (wallets, investment, insurance)

- UX/UI design for financial platforms

- AI-based analytics integration and KYC systems

Key Industries:

- Banking and digital finance

- Wealth management and robo-advisory

- Insurtech and mobile payments

Itexus excels at turning complex finance logic into sleek, easy-to-use mobile products. Their custom dashboards and modular architecture allow startups and financial institutions to scale services while maintaining compliance and usability. Their hybrid agile team ensures tight delivery even on high-regulation markets like the U.S. or Europe.

5. Twendee Labs

Location: Vietnam

Twendee Labs delivers AI- and blockchain-powered wallet platforms for fintechs operating in emerging markets. They specialize in building smart contract-based wallet systems integrated with AI-driven automation for fraud detection, user scoring, and operational scaling.

Main Services:

- Web3 wallet infrastructure (DeFi, NFT, DAO)

- AI modules for transaction analysis and internal workflows

- Backend systems and consulting for emerging fintech apps

Key Industries:

- Decentralized finance and crypto lending

- Loyalty apps, social miniapps

- Tokenized retail and smart contract marketplaces

Twendee Labs stands out for its sharp execution in crypto-native engineering, blending deep blockchain expertise with real-time trading logic and scalable DeFi infrastructures. The team delivers robust platforms like multi-chain wallets, P2P exchanges, and IDO launchpads with built-in compliance and localization layers for APAC markets. What makes Twendee Labs different is its ability to work across early-stage ideas and production-grade ecosystems — from protocol integration to AI-enhanced tokenomics. With strong experience in security audits and UX-critical flows, the firm bridges Web2 familiarity with Web3 innovation.

📌 Explore: How Much Does It Cost to Build a Crypto Exchange Like Binance in 2025

6. Innowise

Location: Europe

Innowise builds wallets that bridge traditional and decentralized finance. Their engineering focuses on wallet extensibility — helping businesses create secure, modular systems that support fiat transfers, crypto transactions, and programmable access layers.

Main Services:

- Fiat and crypto wallet development

- Backend payment infrastructure

- UI/UX for multi-role financial products

Key Industries:

- Fintech and crypto exchanges

- Payroll and invoicing systems

- DAO and governance tools

Their wallet builds often support multiple access levels, granular KYC workflows, and blockchain-native modules — ideal for finance platforms looking to move beyond static user roles or single-purpose wallets.

FinTech dashboard interface by Innowise with crypto balance and exchange tools (Source: Innowise Group)

7. SoluLab

Location: USA / India

SoluLab focuses on building multi-asset wallets with NFT, staking, and payment features for high-growth sectors like gaming, collectibles, and tokenized commerce. Their experience with token standards, wallets, and transaction flows makes them a strong fit for experiential apps.

Main Services:

- NFT and DeFi wallet development

- Blockchain integration and product scaling

- Token economy design and audit support

Key Industries:

- GameFi and collectibles

- Healthcare loyalty

- Retail and travel rewards

Their technical agility allows for complex feature inclusion — such as gasless transactions, token swap modules, and staking pools — inside polished, mobile-first interfaces. SoluLab balances crypto-native innovation with mobile usability.

8. Hyperlink InfoSystem

Location: India

Hyperlink InfoSystem supports e-wallet projects across retail, telecom, and healthcare sectors — particularly for clients who need fast turnarounds and multi-platform readiness. Their offerings include both standalone wallets and wallet-enabled extensions to existing apps.

Main Services:

- Mobile App Development (Android, iOS, Hybrid, Flutter, React Native)

- Blockchain Development

- Salesforce Solutions

Key Industries:

- Healthcare

- Fintech

- Retail

- Travel & Hospitality

Hyperlink InfoSystem has carved out a niche by combining rapid development capabilities with deep customization for sector-specific needs. Their strong suit lies in translating user-centric concepts into scalable mobile solutions, particularly for high-touch industries like healthcare and on-demand services. With a large offshore development team and proven delivery for Fortune 500 clients, they offer a competitive edge in fast-moving markets where execution speed and UX coherence are critical.

9. SDK.finance

Location: Lithuania

SDK.finance offers an out-of-the-box wallet engine designed for fintech teams building fast. Rather than building from zero, clients can deploy SDK’s API-based backend as the foundation for wallets with real-time payments, user tiers, and transaction logs.

SDK.finance dashboard and mobile app interface showing real-time transaction management (Source: sdk.finance)

Main Services:

- Core Digital Banking Software

- eWallet Platform Development

- Transaction Management System

Key Industries:

- Banking & Financial Services

- FinTech SaaS

- RegTech

SDK.finance delivers enterprise-grade fintech infrastructure with a modular, API-first approach. Known for its white-label digital wallet and transaction processing core, the platform enables banks, neobanks, and fintechs to accelerate time-to-market. Their back-office systems feature high configurability for roles, limits, KYC, and reconciliation, while the mobile interfaces are built for real-time financial actions across multi-currency environments. The solution architecture is highly scalable, enabling deployments across cloud and on-premise setups.

10. LeewayHertz

Location: USA

LeewayHertz delivers wallet solutions at the enterprise level, combining blockchain engineering with traditional finance system integration. Their focus is on building wallets that serve not just users, but compliance officers, administrators, and auditors.

Main Services:

- Secure crypto wallet development

- AI integration (fraud, behavioral risk)

- Enterprise finance infrastructure

Key Industries:

- Banking and insurance

- Government and identity

- Corporate digital asset platforms

Their approach aligns with organizations that require high-stakes governance, reporting, and risk management. From multi-sig wallets to integrated KYC/AML dashboards, LeewayHertz’s solutions are built to pass audits and scale securely.

11. Kindgeek

Location: Ukraine

Kindgeek works closely with early-stage fintech startups, turning wallet ideas into MVPs and productized platforms. Their lean process combines iterative prototyping with stable backend foundations — optimized for investor demos and pilot launches.

Main Services:

- MVP wallet development

- UX-first design and feature flows

- Core system scaling and DevOps

Key Industries:

- Peer-to-peer finance

- Investment apps

- Digital remittance

What makes Kindgeek effective is their deep involvement in product strategy — not just engineering. They help founders reduce risk, validate features, and deploy quickly — often acting as an outsourced product and dev team rolled into one.

12. Boosty Labs

Location: Ukraine

Boosty Labs provides fast wallet deployment through ready-made blockchain components and SDKs. Their clients benefit from customizable templates for crypto wallets, swaps, and custodial features — ideal for test pilots and early-market entry.

White-label e-wallet UI built by Boosty Labs (Source: boostylabs.com)

Main Services:

- White-label crypto wallet builds

- Blockchain SDK integration

- Cross-platform mobile apps

Key Industries:

- Web3 projects

- Fintech incubators

- Freelance platforms and tokenized payroll

Boosty Labs brings deep financial engineering to digital product delivery, particularly in the areas of e-wallets, payment processors, and neobank infrastructure. The company is known for its rapid MVP delivery and clean UI/UX, especially for B2C finance platforms. Their modular architecture enables fast customization while maintaining compliance with PSD2 and GDPR. Clients benefit from Boosty Labs’ ability to bridge blockchain with conventional finance — creating seamless wallet and ledger systems with fiat on/off ramps, card integrations, and embedded analytics.

Conclusion

The e-wallet space is no longer just about sleek interfaces or fast payments — it’s about building ecosystems. The top developers in 2025 combine secure architecture, scalable infrastructure, and embedded compliance into digital finance experiences that go far beyond basic transfers. Whether the goal is launching a neobank, integrating crypto rails, or enabling B2B payment logic, the right partner brings both domain fluency and executional depth.

Evaluate not just features, but how a firm delivers on product vision, adapts to evolving regulations, and supports long-term innovation. The 12 companies above reflect different specializations — but all prove one thing: strategic fintech development is no longer optional, it’s foundational.Explore how Twendee Labs supports global fintech scaling across blockchain, AI, and digital payment infrastructure. Connect via LinkedIn, Telegram, or X to learn more.