In a world where Bitcoin has grown from a fringe asset to a trillion-dollar market force, the idea of the U.S. government acquiring 1 million BTC is no longer science fiction, it’s strategic calculus.

Whether branded the U.S. Bitcoin Act or integrated silently through Federal Reserve balance sheet entries, such a move would mark Bitcoin’s transition from speculative investment to monetary infrastructure. The implications for startups? Nothing short of transformative.

This shift would signal not only government confidence in Bitcoin but also a push for mainstream integration across treasury systems, regulatory frameworks, and national narratives. Just as gold once defined sovereign trust, Bitcoin could become the digital equivalent programmable, borderless, and politically potent. For crypto startups, it’s time to stop treating BTC as a passive asset and start treating it as a macro layer of policy and commerce.

1. Reconsidering Treasury Strategy in a BTC-Backed Economy

If the U.S. begins accumulating BTC, the narrative around “safe” corporate reserves will change overnight. Startups especially in Web3 will need to look beyond fiat and stablecoins. Bitcoin, backed by the largest economy on Earth, would become a new benchmark for long-term financial resilience.

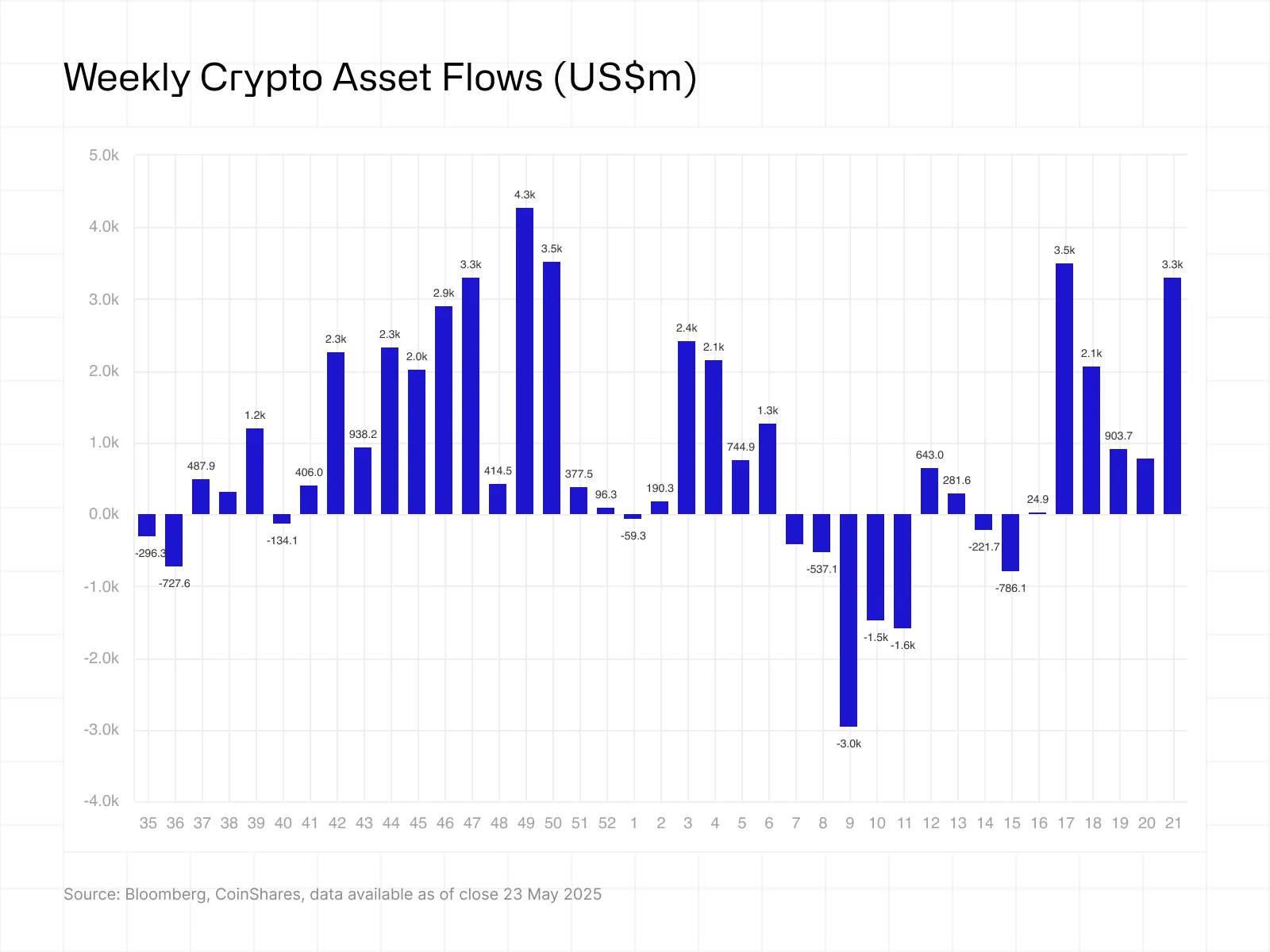

This isn’t theory. According to CoinShares’ 2025 Q1 report, over $5.6 billion flowed into Bitcoin-based funds in the first three months of the year – a record driven largely by institutional confidence after U.S. policy shifts signaled increasing tolerance for crypto in sovereign portfolios.

Weekly inflows into crypto assets surged above $4B in May 2025, with Bitcoin leading institutional demand (Source: CoinShares, Bloomberg).

As shown in the chart below, weekly crypto inflows reached over $4.3 billion in recent weeks, with Bitcoin leading the surge. This aligns with the narrative of institutional accumulation and startups can no longer afford to ignore it.

Startups should consider dual treasury models that combine fiat for operational liquidity with BTC as a strategic reserve hedge. Managing volatility will remain important, but ignoring BTC as a core part of treasury strategy would, in this context, be a larger risk.

2. Building BTC-Native Product Infrastructure

When nations endorse Bitcoin at scale, product expectations change just as quickly. Founders can’t afford to delay adding BTC-native functionality whether through Lightning Network integration, Taproot-based applications, or hybrid custody models.

This shift toward sovereign-level BTC legitimacy will inevitably raise user expectations for Bitcoin-native product experiences. Startups that continue to treat BTC as a passive holding rather than an interactive, programmable layer risk being left behind.

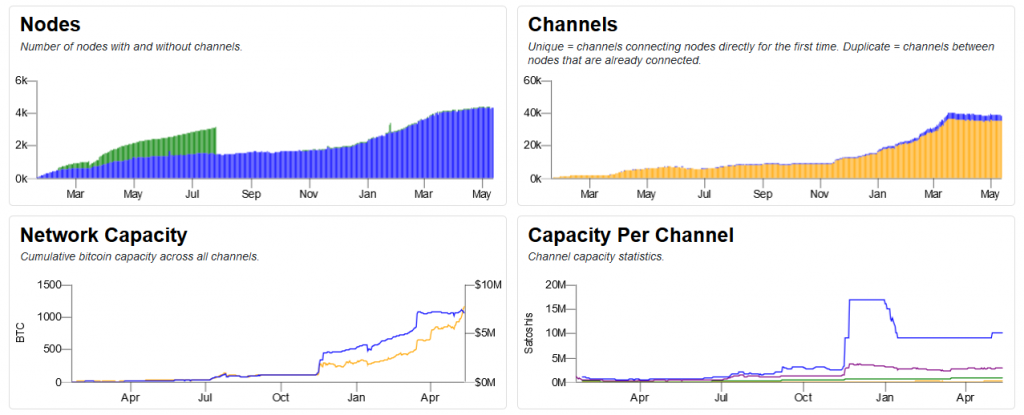

Recent data backs this urgency. By May 2025, the Lightning Network has reached nearly 1,500 BTC in total capacity, supported by over 6,000 active nodes and a rapidly growing number of payment channels. These technical foundations are not just symbolic, they represent a live, expanding infrastructure that enables real-time, low-cost Bitcoin transactions across the globe.

Lightning Network growth metrics as of May 2025: increasing node count, active channels, and network capacity indicate accelerating BTC-native infrastructure adoption across the ecosystem – (Source: Bitcoin Visuals, May 2025)

Instead of bolting Bitcoin on as an optional feature, forward-thinking teams should embed BTC directly into their product architecture. Lightning-based micropayments, Taproot-enabled privacy options, or BTC-denominated user balances aren’t just technical upgrades, they’re alignment with the next monetary era.

Customers and investors alike will begin viewing BTC compatibility not as a feature, but as a default. This is already observable in Asia and LATAM, where Bitcoin payment rails are expanding thanks to mobile-first, AI-powered infrastructure.

For example, firms are embedding AI models to optimize payment flows using XRP and Bitcoin rails, achieving faster and more cost-efficient settlement. Twendee Labs explores this convergence in their recent deep dive on payment efficiency using XRP and AI, a preview of how automation will pair with BTC-native systems for global scale.

In this context, startups should ask: Is our stack prepared to treat BTC as a first-class citizen, not a plugin?

3. Repositioning Toward Institutional Trust

As Bitcoin moves from speculative asset to sovereign reserve, institutional standards not just innovation become the benchmark for credibility. Startups in crypto must evolve beyond the narrative of disruption and position themselves as long-term infrastructure providers: reliable, auditable, and regulation-aligned. This shift isn’t just philosophical, it’s quantifiable.

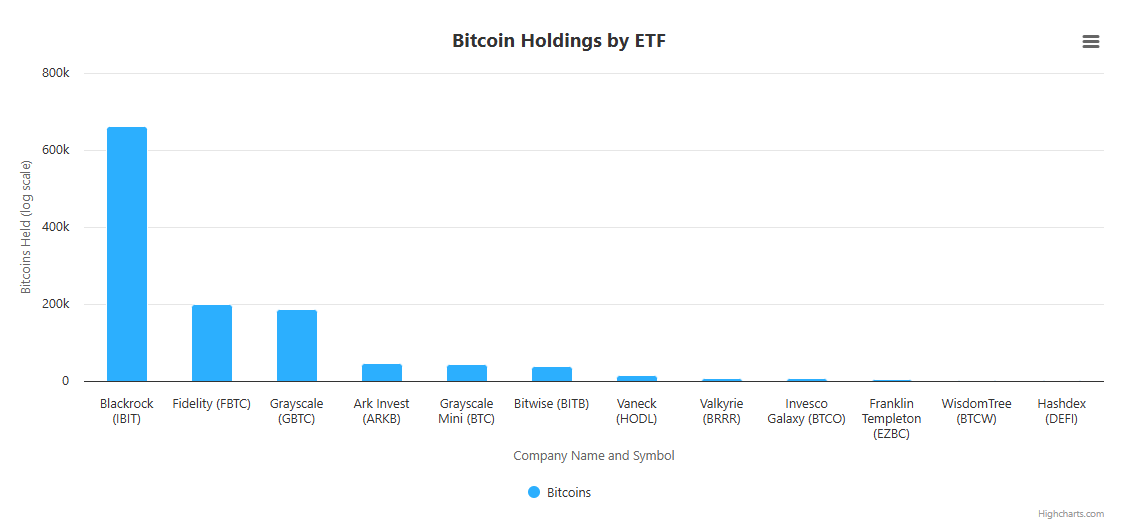

As of June 2025, over 1.2 million BTC are held by U.S.-regulated spot Bitcoin ETFs, with a combined AUM exceeding $126 billion, according to Bitbo. BlackRock alone commands over 660,000 BTC, while Fidelity and Grayscale each manage holdings above 180,000. This is no longer a fringe trend. It’s capital concentration at scale, driven by compliance, custody standards, and institutional-grade operational frameworks.

Table of U.S. Bitcoin ETFs by holdings and market value as of June 2025, showing institutional accumulation of over 1.2 million BTC – (Source: Bitbo.io, June 2025)

This trend carries major implications for crypto startups. Brand equity must now be built not just on community engagement or tokenomics, but on trust signals that resonate with enterprise and regulatory stakeholders:

- Custody & asset segregation standards

- SOC 2 or ISO/IEC 27001 compliance

- Smart contract audit transparency

- Self-assessments aligned with MiCA or equivalent frameworks

Startups that successfully project this level of operational maturity will stand at the front of the queue when governments, fintechs, and global banks seek Web3 partners.

For founders who want to understand where this trust shift is headed, the data speaks for itself:

Bar chart of Bitcoin holdings by major U.S. ETFs as of June 2025, showing BlackRock’s IBIT leading with over 660K BTC (Source: Bitbo.io / Highcharts, June 2025)

In this environment, startups must learn to speak the language of policy, audit, and institutional interoperability. Because when Bitcoin becomes macroeconomic infrastructure, trust isn’t just a value, it’s a prerequisite.

4. Operational Hedging in a Volatile BTC-Backed World

Even if Bitcoin becomes a reserve asset, its defining trait volatility will not simply vanish. In fact, as more institutions integrate BTC into their financial systems, price fluctuations will shift from being a trading risk to an operational one. Startups that price services in BTC, pay salaries, or engage vendors across jurisdictions will be especially vulnerable.

The solution isn’t to eliminate BTC exposure. It’s to operationalize it safely. That means embedding systems that can hedge risk in real-time:

- BTC-indexed contracts that reset based on exchange rates

- Dynamic smart contracts that adjust pricing within volatility bands

- Treasury dashboards powered by AI to simulate cross-currency impacts in seconds

Recent market data supports this urgency. Despite relative maturity, Bitcoin’s volatility compared to traditional equity indices remains significant. The chart below shows the 30-day moving average of BTC vs NASDAQ volatility ratio, with noticeable spikes as recently as late May 2025 underscoring that BTC is still far from predictable.

30-day volatility ratio between Bitcoin and NASDAQ, showing persistent fluctuations despite a general downward trend by late May 2025 – (Source: VanEck / TradingView composite, May 2025)

This volatility is especially relevant in emerging markets like Argentina and Nigeria, where startups already experiment with AI-driven currency hedging and BTC-denominated pricing models. These early adopters are not speculators, they’re survival-driven. Their experiments offer a blueprint: deploy AI to monitor sentiment, macro signals, and order book shifts, then feed that into your smart contract logic or treasury risk models.

In this new economy, startups that master BTC-denominated operations with embedded hedging will hold a competitive advantage. Not because they avoided risk, but because they made it calculable, containable, and strategically aligned.

5. Keeping Pace with Regulatory Acceleration

No major move like the U.S. Bitcoin Act would exist in a vacuum. Regulation would accelerate on all fronts from tax policy to custodial obligations to cross-border flows.

According to SEC memos from early 2025, new frameworks are being drafted to accommodate state-held BTC, including potential reporting thresholds for crypto treasuries and standardized audit requirements for BTC reserves. Startups that pre-emptively align with this emerging structure or at least monitor it closely will avoid being blindsided.

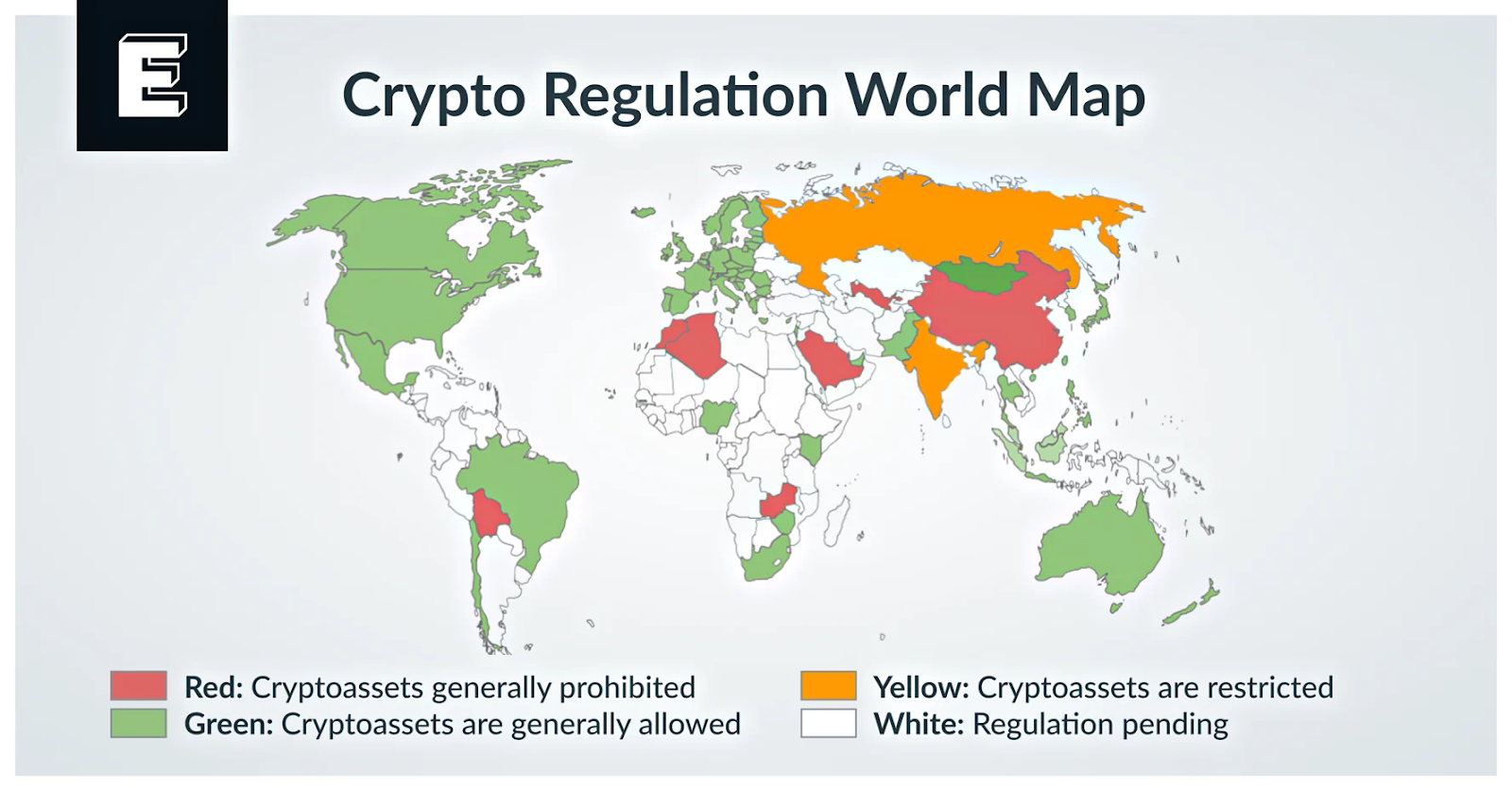

But the U.S. won’t act in a vacuum. Regulatory acceleration is a global phenomenon, and that context matters. In fact, countries like Singapore, the UK, and the EU are already advancing crypto frameworks with greater clarity and pace. The following map reflects this dynamic: while some jurisdictions remain restrictive or unclear, others including the U.S. are under growing pressure to clarify their stance.

Global map of crypto regulatory status in 2025, showing where crypto is allowed, restricted, or prohibited – (Source: Elliptic, May 2025)

Regulatory visibility should become a C-suite function, not just a compliance checkbox. Founders must treat regulation not as a blocker, but as a blueprint to build better.

Conclusion

Bitcoin’s next evolution is not technological, but geopolitical. If the U.S. treats BTC as part of its sovereign reserve, then startups must adapt as though Bitcoin has become a base layer of the global financial system not just a tradeable asset.

This means rethinking treasury, rebuilding infrastructure, rebranding for trust, hedging for operational reality, and monitoring every legal ripple. The winners in this new era won’t be the ones who move fast — they’ll be the ones who move first with clarity.

And if your startup is preparing for this future, Twendee Labs can help architect the infrastructure, compliance tools, and product strategy you need to thrive in a Bitcoin-aligned world.