Real estate tokenization is rapidly emerging in Singapore as a game-changing trend in the property market. By leveraging Web3 blockchain technology, real estate tokenization converts property ownership into digital tokens, enabling fractional ownership of high-value assets and unlocking new levels of liquidity. Singapore’s advanced fintech ecosystem backed by supportive regulations and robust digital infrastructure makes it an ideal hub for this innovation.

In this article, we explore the top 5 opportunities that Web3 tokenization brings to Singapore’s real estate sector. From fractional ownership and increased liquidity to compliance-friendly blockchain property investment platforms, we highlight how these opportunities can transform real estate and how businesses can leverage them.

1. Fractional Ownership Democratizes Real Estate Investment

One of the most powerful opportunities of real estate tokenization is fractional ownership, which dramatically lowers investment barriers. Instead of needing millions to buy an entire property, investors can purchase small fractions (tokens) of a property with just a few hundred or thousand dollars.

- Breaks down high-value properties into digital tokens.

- Enables fractional ownership with small capital (hundreds instead of millions).

- Opens access to younger investors and global participants.

- Property owners can raise capital by tokenizing portions without selling full control.

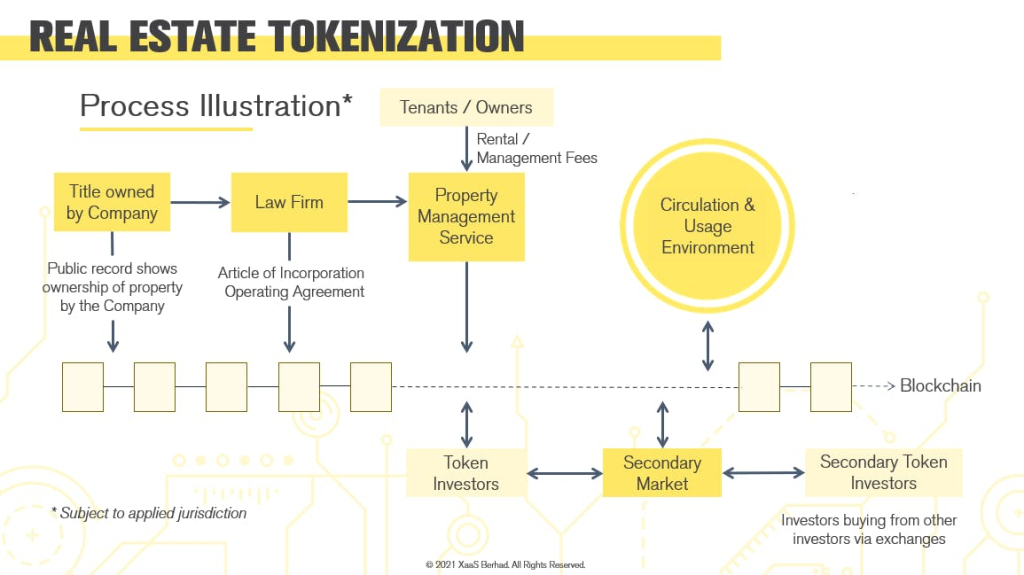

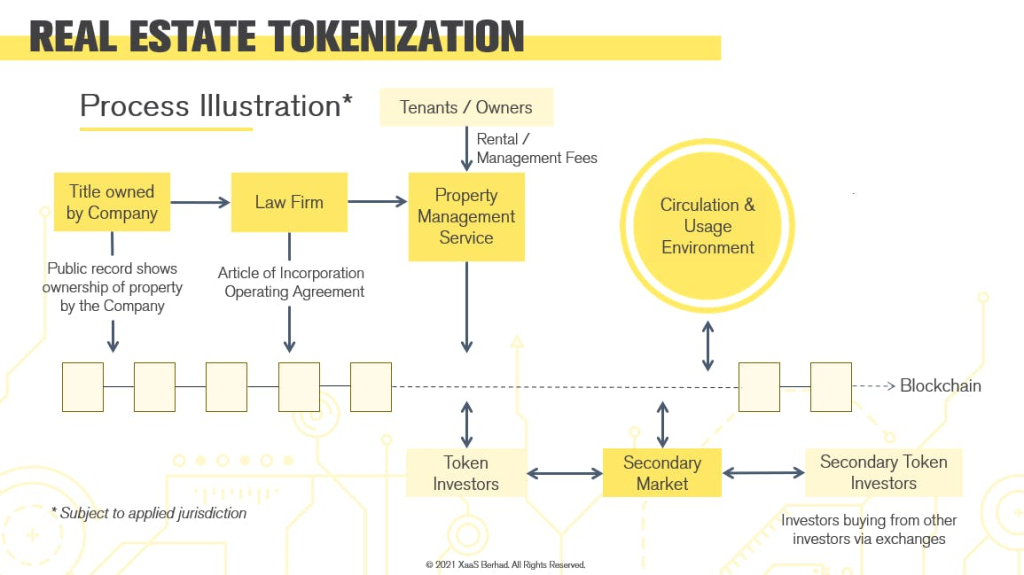

Process illustration of real estate asset tokenization, showing how a property is converted into digital tokens representing fractional ownership, making high-value assets divisible and accessible (Source: NinjaPromo)

This democratization opens the market to a much broader pool of investors who previously could not afford to participate in prime real estate. It’s now possible for a young tech professional or a global investor to own a slice of a Singaporean commercial building or condo, benefiting from rental yields and capital appreciation proportional to their token share. At the same time, property owners can unlock capital by selling tokenized portions of their assets without giving up full control, raising funds for development or other investments.

By making real estate investment more accessible, fractional ownership via tokenization stands to bring fresh liquidity and diversity into Singapore’s property market.

2. Enhanced Liquidity and 24/7 Secondary Market Trading

Liquidity – the ease of buying and selling an asset has long been a challenge in real estate. Traditionally, property is an illiquid asset that can take months to transact. Web3 tokenization presents a major opportunity to inject liquidity into the real estate sector.

- Converts illiquid property into tradable blockchain tokens.

- Supports 24/7 secondary trading on regulated digital exchanges.

- Reduces lock-in period for investors; faster entry and exit.

- Supported by Singapore’s fintech ecosystem with security token exchanges like Propine and ADDX.

When real estate is represented by blockchain tokens, those tokens can be traded on digital exchanges or peer-to-peer marketplaces far more quickly than selling a physical property. Investors aren’t locked in for years; they can buy or sell tokenized property shares in a matter of minutes on regulated platforms, potentially 24/7.

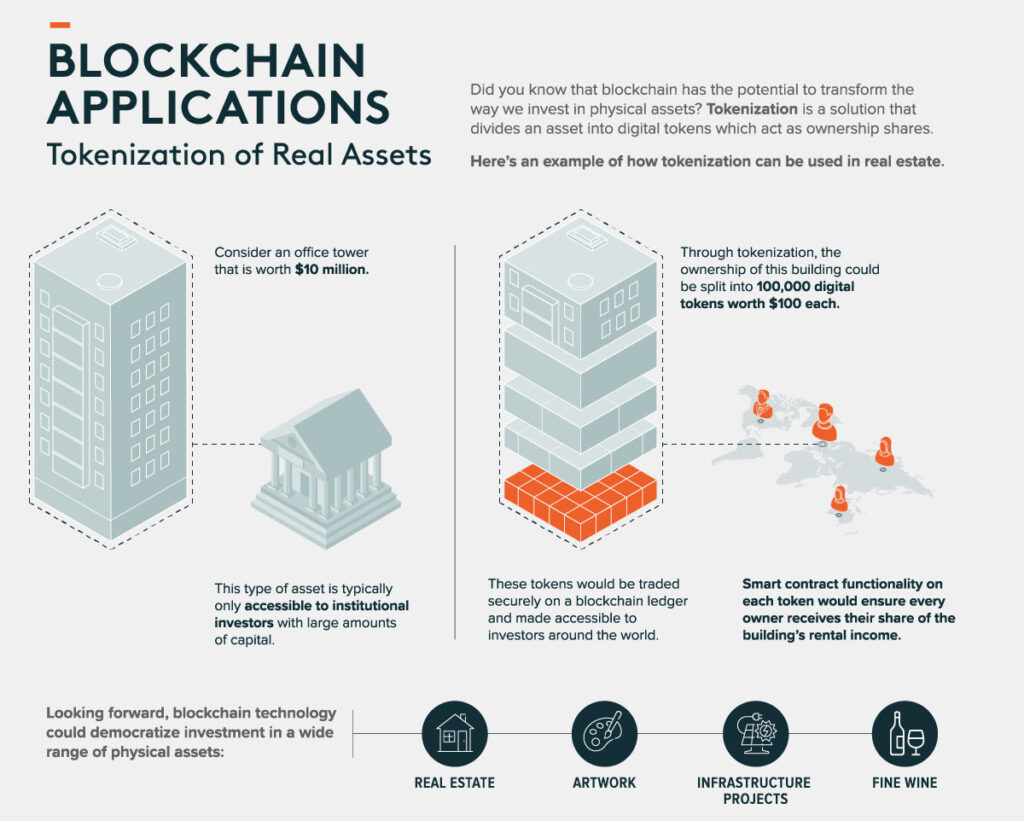

Diagram showing how a high-value asset is split into many digital tokens, enabling trading and liquidity through smart contracts (Source: Token Asset Group)

Singapore’s fintech scene has already given rise to security token exchanges (for example, startups like Propine and ADDX facilitate trading of tokenized securities), indicating that a secondary market for real estate tokens is becoming a reality.

Increased liquidity means investors can rebalance their portfolios or exit positions with greater ease, and property owners benefit from higher asset liquidity, which can make the real estate market more dynamic and responsive. With robust trading platforms and sufficient investor participation, tokenized real estate could approach levels of liquidity previously seen only in stocks or REITs.

3. Global Investor Access and Portfolio Diversification

Tokenization also globalizes Singapore’s real estate market, allowing global investor access and easier diversification. By using blockchain, investors from anywhere in the world can directly invest in Singaporean properties through tokens, without navigating complex cross-border legal or banking systems. This means a tech entrepreneur in San Francisco or a family office in Europe can easily add a slice of Singapore’s real estate to their portfolio.

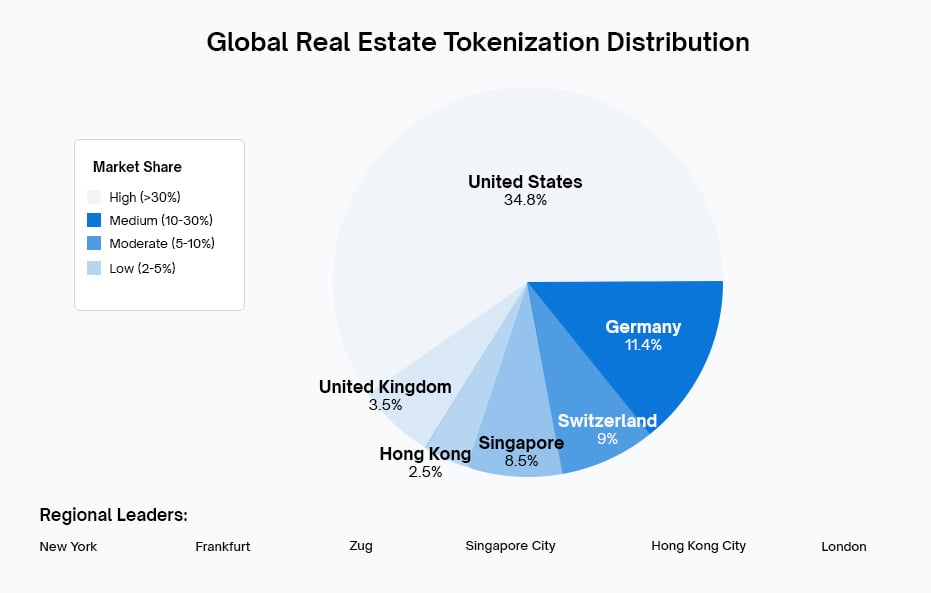

Pie chart showing global distribution of real estate tokenization activity, highlighting how Singapore (at 8.5%) ranks among other global hubs like the U.S., Germany, and the UK, visually reinforcing global accessibility of tokenized real estate (Source: Antiér Solutions)

For Singapore’s property sector, this wider investor pool brings in more capital and international interest. Conversely, local investors gain exposure to overseas real estate markets if foreign properties are tokenized, all through the same digital interfaces. As noted by experts, tokenization allows investors to allocate funds into various property types (residential, commercial, even real estate funds) with great flexibility.

- Cross-border investment simplified: global investors can access Singapore’s real estate.

- Local investors can diversify into foreign tokenized properties.

- Capital can be spread across residential, commercial, industrial segments.

- Investors can allocate smaller amounts across different assets, improving risk management.

This flexible diversification helps reduce risk and tailor investment strategies in ways that were impractical for individual investors before. Overall, Web3 tokenization turns real estate into a globally accessible asset class, fostering an interconnected market where capital can flow more freely to high-quality projects regardless of geographic boundaries.

4. Transparency and Security Through Blockchain Technology

Another key opportunity of Web3 tokenization is the transparency and security afforded by blockchain. Real estate transactions and ownership records, when managed via blockchain, become tamper-proof and easily auditable.

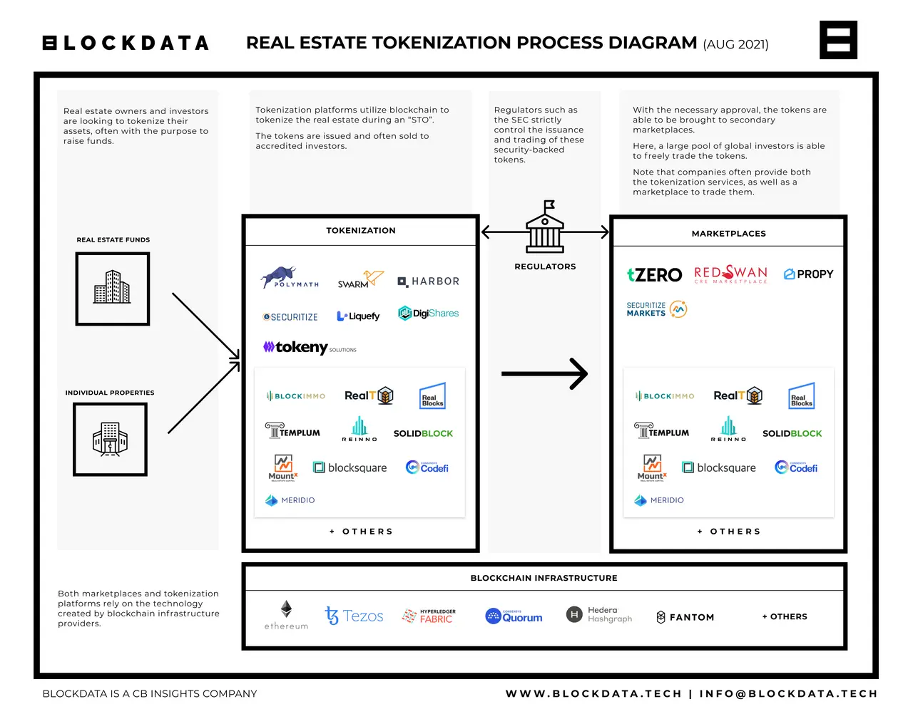

A structured real estate tokenization process diagram, showing connections between token issuers, marketplaces, regulators, and blockchain infrastructure, ideal for conveying transparency and security in tokenized property ownership (Source: Blockdata)

Every token trade or update in ownership is recorded on a distributed ledger that is immutable and transparent to authorized participants. This builds greater trust among investors and stakeholders. In fact, blockchain-based real estate platforms make all transactions safe, trackable, and non-alterable, which boosts investor confidence and minimizes the risk of fraud. For instance, rental income distributions or property management updates can be automated via smart contracts, with each payout or decision visible on-chain to relevant parties. Such transparency can improve due diligence processes and reduce disputes, because the single source of truth is the blockchain record.

Additionally, blockchain’s cryptographic security helps protect ownership data and token holder rights. Tokens can be programmed with specific rights (voting on certain decisions, dividend entitlements, etc.) and these rules are enforced automatically, further securing investor interests. In a sector where opaque deals and paper-based records have been common, the opportunity to bring blockchain-level transparency and security is a significant leap forward.

5. Strong Compliance Framework and Regulatory Support

Singapore’s regulatory environment provides a strong foundation for tokenization, turning compliance into a competitive advantage rather than an obstacle. The Monetary Authority of Singapore (MAS) has actively promoted fintech innovation including tokenized assets through initiatives like Project Guardian. This proactive stance means that companies exploring real estate tokenization in Singapore have clearer guidelines and a supportive regulator.

An opportunity here is to build tokenization platforms with built-in compliance layers (such as enforcing KYC/AML checks, whitelisting eligible investors, and coding in transfer restrictions to obey securities laws). In practice, compliance rules and investor eligibility can be coded directly into the smart contracts that manage the tokens, so that every transaction automatically checks for regulatory requirements. Ensuring strict adherence to legal standards is paramount, as any platform must follow established laws for blockchain property deals and security offerings.

Infographic illustrating the tokenization workflow, from title, legal setup, and property management to token issuance and investor access, emphasizing compliance layers in structuring real estate tokens (Source: Hackernoon)

Singapore’s advantage is that regulators are working alongside industry to enable secure tokenized trading with clear governance and legal clarity. For example, local platforms like Fraxtor have obtained MAS licensing to tokenize real estate for accredited investors, demonstrating that compliant tokenization models are not only possible but already underway.

The country’s blend of innovation and oversight instills confidence in investors and institutions, paving the way for broader adoption. Firms that seize this opportunity by developing compliance-first tokenization platforms will be well-positioned as the market grows and regulations evolve further in favor of blockchain solutions.

Conclusion

Web3-driven real estate tokenization presents transformative opportunities in Singapore’s property sector – from opening up fractional ownership to boosting liquidity, attracting global investors, increasing transparency, and leveraging a supportive regulatory framework. These five opportunities are converging to reshape how real estate is financed and traded in Singapore, making the market more inclusive, efficient, and innovation-friendly. Forward-thinking CEOs, CTOs, developers, and investors should view tokenization not just as a buzzword, but as a strategic avenue for growth and competitive advantage in the real estate industry.

As you consider riding this paradigm shift, it’s crucial to partner with experts who can navigate both the technical and regulatory complexities. Twendee – with our deep expertise in blockchain development and fintech consulting – stands ready to help you capitalize on these opportunities. We offer end-to-end consulting and development of blockchain-based tokenization platforms that incorporate robust compliance layers and secure architectures. Whether you aim to create a fractional property investment platform, integrate real estate assets into Web3 ecosystems, or simply explore the feasibility of tokenizing your real estate portfolio, Twendee can guide you through every step.

Don’t miss the chance to be a pioneer in the tokenized real estate revolution. Contact us today to discover how our IT services can turn these opportunities into tangible solutions for your business and help you lead the future of real estate tokenization in Singapore and beyond.

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page

Read latest blog: Layer-2 Costs Are Dropping, But Enterprise Integration Is Still a Challenge