AI in banking has evolved from experimental innovation to core business infrastructure. In 2025, it’s not just enhancing workflows, it’s fundamentally redefining how banks operate, compete, and serve. Traditional models built on product silos, manual decisions, and batch processing are being replaced by intelligent, adaptive systems that respond in real time to customers, markets, and risks.

This transformation is driven by a new generation of AI capabilities: large language models that converse, orchestration engines that learn, predictive analytics that simulate, and copilots that personalize finance at scale. Banks that adopt these tools are not simply digitizing old processes, they are reshaping their operating models, moving from static organizations into learning systems.

1. GenAI for Credit Scoring

Traditional credit scoring systems reliant on structured financial data like loan history, income, and payment behavior have long excluded a significant segment of the population: gig workers, young adults, informal laborers, and the unbanked. In 2025, banks are rapidly replacing these outdated models with AI-driven credit scoring systems that are more inclusive, dynamic, and adaptive to the complexities of modern financial behavior.

What makes this transformation truly groundbreaking is the integration of generative AI (GenAI) and large language models (LLMs) into underwriting processes. These models allow financial institutions to move beyond fixed numeric inputs and instead interpret unstructured, qualitative, and behavioral data in real time. For instance, LLMs can analyze the language patterns in loan applications, detect tone and intent from customer service chats, and cross-reference inconsistencies in submitted income proofs all while ensuring compliance with regulatory standards.

At the core of this shift is data democratization. AI systems can now incorporate alternative data sources such as:

- Mobile phone usage patterns

- Digital payment behavior (e.g., ride-hailing, e-commerce frequency)

- Social media reputation and network trust metrics

- Location and mobility stability

- Device fingerprinting and time-of-day usage habits

Together, these signals enable multi-dimensional borrower profiling, which is particularly powerful for thin-file or credit-invisible applicants. Instead of denying them access outright, banks can dynamically assess risk based on real behavioral proxies allowing for more personalized and risk-adjusted credit offerings.

According to McKinsey’s 2024 Financial Services AI Benchmark, early adopters of AI-based credit decisioning:

- Reduced non-performing loan (NPL) ratios by 25–30% in unsecured lending,

Increased credit approval rates for previously unqualified applicants by 35%, - And achieved faster loan decisioning turnaround from several days to under 10 minutes in many consumer lending scenarios..

Crucially, these GenAI systems are built with embedded explainability (XAI), allowing risk managers and regulators to audit decision flows. This mitigates the traditional “black-box” concern in AI credit scoring and ensures fairness and transparency, key issues as regulators increasingly scrutinize automated decision-making under AI Act and FATF guidance.

GenAI-based credit scoring is not just a better algorithm, it’s a paradigm shift. It reframes the idea of trust in lending, expanding credit access to underserved populations while improving portfolio performance. Banks that adopt it are positioning themselves at the frontier of financial inclusion, profitability, and regulatory readiness.

2. Real-Time Behavioral Fraud Detection

As cyber threats evolve in speed and sophistication, fraud detection in banking has shifted from pattern recognition to behavioral interpretation. In 2025, AI-driven fraud prevention systems don’t just scan for red flags, they actively learn and anticipate malicious behavior, often before it manifests.

Modern fraud is not an isolated anomaly; it’s dynamic, distributed, and often indistinguishable from legitimate activity. A fraudulent transaction may mirror the timing, geography, and amount of a typical customer’s habits. That’s why rule-based systems, which flag known behaviors, are increasingly ineffective.

AI in banking now leverages graph analytics, anomaly detection, and real-time machine learning to understand subtle behavioral shifts such as device usage, login velocity, mouse movement, GPS anomalies, or changes in digital footprint. These systems are able to construct customer behavioral baselines and detect micro-deviations within milliseconds. Importantly, these insights are contextual: a $500 purchase might be normal on payday, but suspicious at midnight in another timezone.

Graph-based AI also maps relationships across accounts, devices, and transaction nodes — revealing hidden fraud networks that would elude siloed detection engines. Fraud is no longer about isolated transactions but coordinated webs of activity, and AI is the only scalable way to make sense of it all in real time.

According to BCG’s 2025 Digital Trust in Banking Report:

- Banks using AI behavioral fraud models cut fraud-related losses by 60–72%.

- Average false positives dropped by 40%, reducing customer churn from account locks.

- Transaction clearance time remained within 1–2 seconds for 94% of flagged cases, maintaining service fluidity.

Critically, AI fraud systems are also becoming self-updating ingesting global threat intel, regional fraud typologies, and internal pattern shifts to retrain themselves with minimal human supervision. Some institutions now pair these models with GenAI-driven threat explainers, helping compliance teams understand and document detection logic for regulators.

AI has transformed fraud detection from a compliance necessity into a competitive edge. It empowers banks to balance real-time user experience with proactive, precision-level threat management. In a climate where customer trust and digital confidence are everything, this shift is not just technological, it’s strategic.

3. Hyper-Personalized Finance with AI Copilots

In 2025, personalization in banking is no longer about targeting broad customer segments with pre-set products. It’s about delivering real-time, hyper-individualized financial advice as if each customer had a personal CFO in their pocket. This shift is driven by the rise of AI copilots: intelligent agents that learn from and act on personal financial behavior at scale.

These AI copilots are built using a combination of reinforcement learning, real-time transaction analytics, LLMs, and predictive models. They monitor a user’s financial activities, spending patterns, income cycles, lifestyle goals and generate tailored suggestions in natural language. These can range from nudging a user to reduce discretionary spending this week, to optimizing cash flow across accounts, or reallocating micro-investments based on market conditions.

Unlike traditional budgeting tools or PFM apps, AI copilots in 2025 are conversational, context-aware, and continuously adaptive. They integrate across banking apps, voice assistants, and wearables delivering advice in the flow of life, not just at login.

Strategic impact: This evolution reshapes customer relationships. Banks no longer sell products and hope for relevance, they curate financial journeys, building daily engagement and emotional loyalty. AI copilots also drive cross-sell and up-sell by identifying timing and context where new services are not just available, but actually helpful.

Accenture’s 2024 Global Banking Consumer Study found:

- Customers using AI-powered financial assistants report a 3x higher likelihood to remain loyal to their primary bank.

67% of Gen Z and Millennials said they would switch banks for better financial guidance powered by AI. - Personalized financial nudges increased long-term savings by 22% on average in early pilots.

Beyond financial planning, these copilots are increasingly integrated with mental health, sustainability goals, and family planning tools, creating a broader life-centric banking experience.

AI copilots redefine the value proposition of banking from reactive service delivery to predictive, real-time financial empowerment. In the age of customer autonomy and digital overload, relevance is currency and AI personalization is the engine that delivers it.

4. Document Intelligence and Zero-Touch Onboarding

Paperwork remains one of the banking industry’s most persistent bottlenecks. Despite digital transformation efforts, many institutions still rely on manual review of documents from loan applications and pay stubs to KYC files and corporate tax records. In 2025, this friction is being dismantled by AI-powered document intelligence, a combination of OCR, NLP, and adaptive learning models that interpret unstructured content with human-level accuracy.

What distinguishes the 2025 approach is the use of context-aware AI that doesn’t just extract data, but understands it. These systems validate information against internal databases and regulatory standards in real time. They can identify missing or contradictory fields, detect document tampering through digital forensics, and even understand nuances in multilingual forms all while flagging anomalies for human review when necessary.

IDP combines OCR, NLP, and validation to fully automate onboarding documents. Source: Binariks

This evolution has birthed the concept of “zero-touch onboarding” end-to-end automation where customers submit documents via app or scan, and AI handles intake, verification, classification, and decisioning without human involvement. In a competitive landscape, this capability is no longer optional, it’s core infrastructure.

Operational impact:

- Turnaround time for onboarding or credit approvals drops from days to minutes.

- Operational costs fall by up to 40%, as manual workload is reallocated or eliminated.

- Regulatory accuracy improves, as AI models track rule changes and update validation logic autonomously.

This transformation doesn’t just improve internal efficiency it reshapes customer experience. A fast, seamless onboarding or approval process builds immediate trust and reduces drop-off rates, especially among digital-native users. In B2B finance, it also accelerates the credit cycle, giving banks first-mover advantage in lending relationships.

AI document intelligence compresses bureaucratic drag into real-time action, making onboarding, compliance, and approval workflows as fast as the customer expects without compromising accuracy or oversight. It signals the end of paperwork as friction and the rise of paperwork as data.

5. Predictive Risk Management Through AI Simulations

Risk management in banking has historically been a backward-looking function focused on tracking past defaults, enforcing controls, and satisfying regulatory requirements. But in 2025, AI has elevated risk oversight into a forward-looking, scenario-driven capability. Banks now deploy predictive models that simulate future risk exposures with a level of speed and granularity once unimaginable.

These AI systems ingest real-time streams of internal and external data including borrower behavior, market signals, macroeconomic indicators, and geopolitical events. Through Monte Carlo simulations, reinforcement learning, and causal modeling, banks can run thousands of “what-if” scenarios per hour, proactively identifying vulnerabilities across portfolios and business units.

This approach transforms risk from a reactive audit exercise into a core input for strategic planning. Rather than waiting for a crisis, banks can pre-position capital, adjust product terms, or alert clients before risk materializes.

Key organizational shifts:

- Credit decisions are made with forward visibility, not just historical scoring.

- Treasury and risk teams integrate AI forecasts into dynamic ALM models.

- Regulators increasingly expect predictive capabilities under IFRS 9 and evolving Basel IV guidance.

Deloitte’s 2025 Risk Management Survey found:

- 64% of global banks now use predictive AI in at least one risk domain.

- Banks that integrated AI into early warning systems reduced major credit losses by 22% on average over two years.

- 71% of surveyed CROs said AI insights were actively shaping product design and market strategy, not just regulatory reporting.

Importantly, AI-based risk modeling also enhances transparency. With built-in explainability modules, these systems produce narrative risk justifications that can be understood by boards, clients, and auditors, a crucial step in demystifying AI decision-making under increasingly stringent oversight.

AI has redefined risk as a strategic instrument, enabling banks to model volatility, anticipate systemic stress, and move before markets do. In 2025, the competitive edge lies not in reacting faster but in seeing what others can’t yet see.

6. Autonomous Operations

Despite years of digital investment, many banks in 2025 still suffer from fragmented operations, manual handoffs between teams, ticket-based processing, and siloed decisions that delay customer service and inflate costs. Enter autonomous operations, where AI doesn’t just automate tasks, but orchestrates entire workflows across functions, learning and adapting as it goes.

Unlike traditional RPA (robotic process automation), which automates fixed rule-based tasks, autonomous AI systems handle complex, event-driven processes that span departments — from loan underwriting and disbursement, to real-time payment reconciliation and exception handling. These systems ingest structured and unstructured data from core banking systems, CRMs, compliance logs, and customer interactions and make decisions in real time based on business rules, context, and outcomes.

Key to this shift is the rise of decision intelligence platforms, where AI agents evaluate multiple workflow paths, simulate trade-offs, and dynamically allocate actions to the right humans, bots, or external services. This allows for continuous optimization of processes without constant IT reprogramming.

Strategic transformation:

- Manual effort is no longer the constraint: routine approvals, verifications, and compliance checks are handled without human touch.

- Customer journeys become fluid and invisible, as back-end workflows self-adjust to intent and data in real time.

- Operating models evolve from siloed functions to horizontal value streams, enabled by real-time orchestration layers.

KPMG’s Global Operations Benchmark 2025 reports:

- Banks with AI-based orchestration systems reduce average end-to-end processing time by 35–55%.

- Operating cost ratios improved by 12–18%, especially in credit ops and payments.

- 78% of surveyed COOs said AI workflow intelligence had a material impact on NPS and churn reduction.

What’s more, these systems are self-healing. If a rule fails, a dataset lags, or an approval logic becomes outdated, the AI can rewire the flow temporarily, alert operators, and even suggest permanent design fixes based on impact.

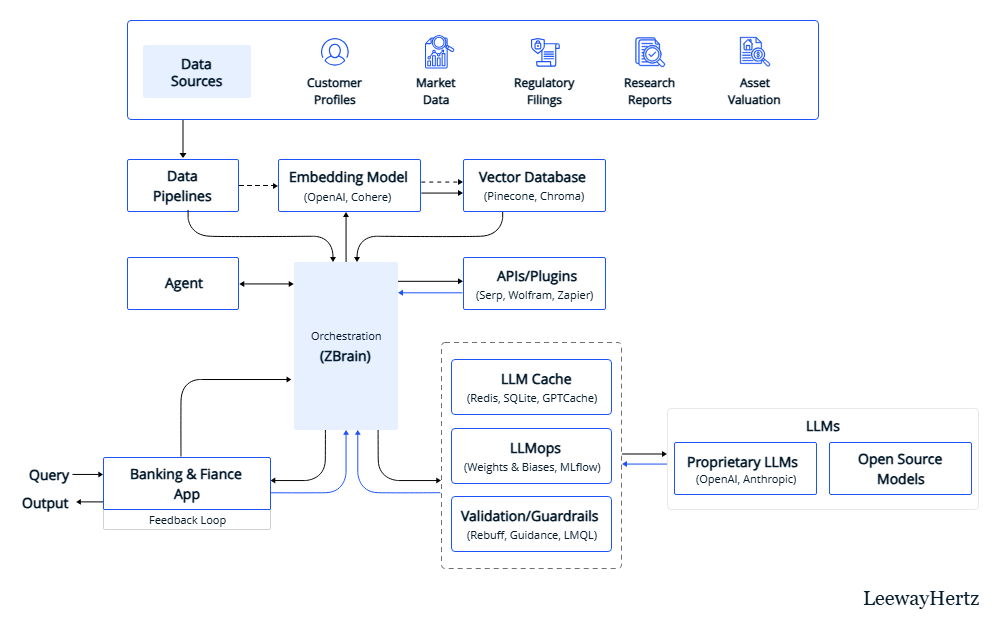

Architecture of LLM orchestration system in banking (ZBrain). Source: LeewayHertz

AI-powered autonomous operations shift banks from static processes to intelligent systems that evolve with the business. The result is not just faster execution — it’s operational resilience, scalability, and the ability to adapt in real time to customers, markets, and regulators alike. More on this internal trust dynamic in banking: AI Must Prove Its Value Internally Before It Can Earn Trust Externally

7. Conversational GenAI

In 2025, AI in banking is not just predicting what customers need, it’s speaking their language. The emergence of conversational GenAI, built on domain-trained large language models (LLMs), is transforming the way banks interact with customers. No longer confined to static menus or scripted chatbots, these systems engage in fluid, contextual, and deeply personalized conversations across voice, text, and even in-app interfaces.

These GenAI agents do more than respond to questions. They interpret intent, decode sentiment, and navigate complex financial topics like mortgage options, investment strategies, or cross-border payments explaining them in plain language, with patience and clarity. More importantly, they remember context: past interactions, preferred tone, financial history, and life goals. This continuity creates a truly human-like engagement experience that builds trust and efficiency simultaneously.

Strategic shift: Banks are no longer just transaction enablers, they are becoming intelligent financial companions. Conversational GenAI enables 24/7 availability without sacrificing nuance or quality. It offloads basic service volume, reduces escalation rates, and creates new value opportunities through invisible cross-sell within a natural dialogue.

IBM’s Institute for Business Value 2025 survey shows:

- 72% of Gen Z and Millennial customers say they prefer conversational banking interfaces over static app menus or phone calls.

- Banks deploying LLM-powered assistants reduce call center volume by 45–60%, while increasing customer satisfaction scores (CSAT) by over 30%.

- 63% of surveyed banks now use fine-tuned LLMs for financial dialogue rather than generic models improving accuracy, security, and tone matching.

Crucially, the latest GenAI models integrate financial compliance logic, explainability layers, and real-time regulatory updates ensuring that advice is not only helpful but legally defensible. Some banks now offer an AI-generated “audit trail” of advice provided, which customers can review, dispute, or share with financial advisors.

Conversational GenAI redefines the digital banking interface from transactional UI to relationship-driven UX. In 2025, the banks winning market share aren’t those with the most features, but those with the most fluent, trusted, and intelligent conversations.

Conclusion:

The 2025 banking landscape belongs to institutions that treat AI not as a layer but as an operating core. These seven applications illustrate how AI is no longer confined to labs or pilots. It is now running credit decisions, orchestrating operations, detecting fraud in motion, and advising millions of users in their language, in real time.

As AI continues to evolve, the real question for banks is no longer whether to adopt it, but how deeply and how fast. Those who move decisively will not only meet the demands of 2025 they’ll shape the expectations of the decade beyond.

At Twendee Labs, we help forward-thinking financial firms turn AI strategy into reality from GenAI copilots to autonomous operations. Follow our insights on X and LinkedIn