Stablecoins are emerging as the infrastructure layer for payments, moving far beyond speculative trading. Their ability to combine blockchain speed with price stability makes them especially effective for cross-border transfers and microtransactions, where traditional rails remain inefficient.

Cross-border remittances still cost an average of 6.4% in fees and often take days to settle. Meanwhile, card networks impose fixed charges that make payments under a dollar uneconomical. Stablecoins compress both costs and settlement times, enabling transactions from $500 remittances to $0.50 digital tips. The following seven projects illustrate how issuers and infrastructure providers are shaping this transition.

1. Tether (USDT): Liquidity Without Borders

Tether remains the backbone of the stablecoin sector, underpinning much of the liquidity infrastructure across crypto markets. Beyond exchanges, it has become a remittance lifeline in Asia, Latin America, and Africa, where workers use OTC networks to convert USDT into local currencies within minutes. Its ubiquity ensures that most DeFi pools and trading pairs benchmark against USDT, reinforcing its role as the market’s reference currency.

As of August 2025, Tether accounts for over 60% of the global stablecoin market, with a market cap surpassing $165 billion. This dominance illustrates unmatched scale but also systemic vulnerability: if regulatory pressure intensifies or reserves are questioned, the shock would cascade across exchanges, DeFi protocols, and informal payment networks. The paradox of USDT is that it thrives where regulation is weakest, but that very reliance may block its integration into mainstream financial systems.

Global stablecoin market cap with USDT dominance above 60% (Source: DeFiLlama via Bitcoin.com)

Why it matters:

- Powers remittance networks and OTC cash-out corridors at scale.

- Functions as the base currency for most DeFi liquidity pools.

- Remains exposed to transparency debates and potential regulatory shocks.

2. USD Coin (USDC): Compliance as a Competitive Edge

USDC is Circle’s compliance-first stablecoin: audited 1:1 reserves, clear disclosures, and integrations with major payment networks make it the natural fit for enterprise settlements and B2B invoicing. Its differentiator isn’t just trust, it’s operational fit. With instant FX settlement on-chain, finance teams can compress cash cycles, reconcile faster, and reduce counterparty exposure without waiting on legacy rails. Because USDC lives across multiple high-throughput chains, it also supports low-fee, API-driven microtransactions that traditional card economics can’t sustain.

Still, USDC’s policy-driven design creates limits. It dominates in regulated markets, but lags USDT in informal corridors where OTC liquidity matters more than compliance. Its challenge is whether Circle can expand USDC’s influence into regions where stablecoins are most urgently needed.

USDC’s clarity with regulators gives fintechs confidence to build services that support international payrolls, B2B invoices, and microtransaction-based business models. Its compliance-first design helps reduce friction when scaling cross-border services into regulated markets.

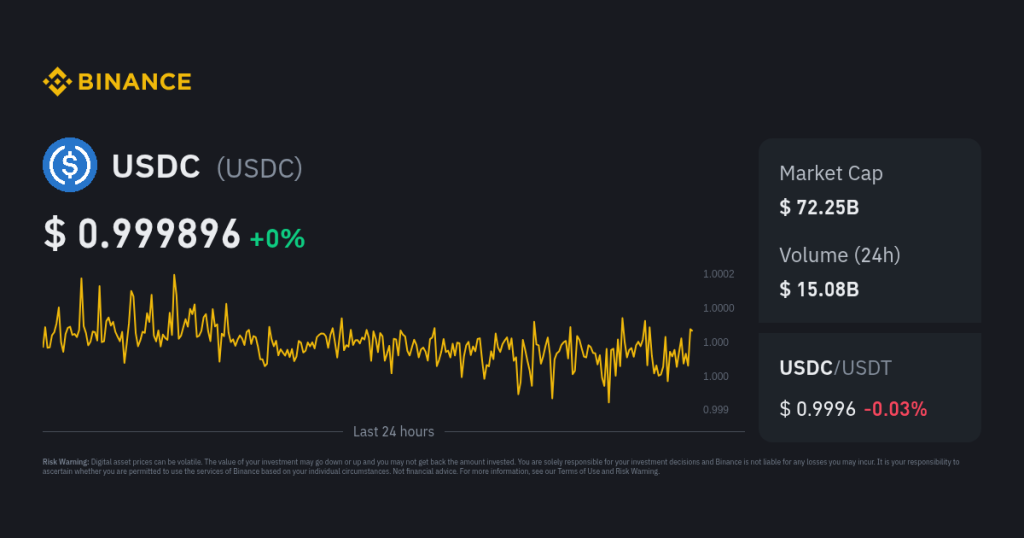

USDC market cap and trading stability chart showing tight $1 peg and $72B capitalization (Source: Binance)

What sets it apart:

- Provides enterprise-grade rails for treasury, payroll, and invoices.

- Enables programmable settlement like milestone-based or automated payments.

- Runs on multichain infrastructure, supporting high-frequency, low-cost transactions.

3. Ethena USD (USDe): The Synthetic Experiment

Ethena USD is pioneering a synthetic stablecoin model that doesn’t rely on fiat reserves. Instead, it uses a delta-neutral mechanism: ETH collateral combined with perpetual futures contracts that hedge out volatility. This makes USDe attractive for DeFi-native adoption, as it bypasses the need for banking intermediaries and offers strong censorship resistance.

The model, however, is still experimental. Its peg stability depends heavily on the liquidity of derivatives markets. In a black swan event where funding rates spike or liquidity evaporates, the hedge could break, leaving USDe exposed. For now, its market cap of nearly $13B highlights DeFi’s appetite for alternatives to fiat-backed stablecoins but its long-term credibility will only be proven through extreme market conditions.

By avoiding reliance on banks, USDe can support permissionless cross-border transfers in regions underserved by fiat rails. If its peg mechanism holds under stress, USDe could emerge as a foundation for high-frequency DeFi payments, including micro-lending and in-app transactions.

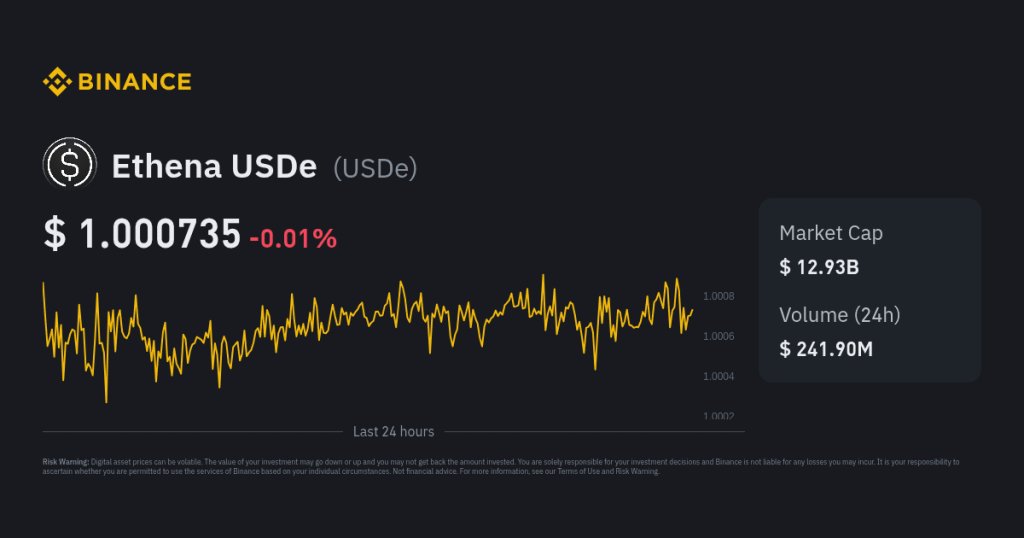

Ethena USDe price chart showing tight $1 peg with $12.93B market cap (Source: Binance, September 2025)

Points to watch:

- Serves as a case study for whether synthetic hedging can sustain a stable peg.

- Offers scalability without dependency on traditional banks.

- Future resilience depends on robust, liquid derivatives markets under stress.

4. Dai (DAI): Decentralization With Staying Power

Dai, created by MakerDAO, is the longest-running decentralized stablecoin. It was originally backed solely by ETH, but today its collateral mix includes other crypto assets and tokenized real-world assets (RWAs) like U.S. Treasuries. This shift has made Dai more resilient but also sparked debate: is it still a pure DeFi stablecoin, or a hybrid edging closer to centralized finance?

Despite these trade-offs, Dai’s track record speaks for itself. It has maintained peg stability through multiple crises including the 2020 “Black Thursday” crash and the 2022–23 market downturns while algorithmic competitors like TerraUSD collapsed. In today’s market, Dai’s importance lies not just in payments but in being the backbone collateral of many DeFi lending protocols and DAO treasuries.

Dai’s resilience has made it popular for peer-to-peer payments in DeFi gaming, marketplaces, and global lending platforms. Its decentralized design also ensures censorship-resistant value transfer, vital for cross-border payments in restricted financial environments.

Dai (DAI) price stability chart showing $1 peg with $5.36B market cap (Source)

Why it endures:

- Serves as a DeFi-native unit of account trusted across lending, trading, and gaming.

- Anchored by a diversified collateral base, including crypto assets and RWAs.

- Survived multiple stress events, making it the benchmark decentralized stablecoin.

5. PayPal USD (PYUSD): Stablecoins for Retail Rails

Launched by PayPal, PYUSD represents one of the strongest bridges between Web2 fintech and Web3 payments. Its competitive edge lies in PayPal’s existing 430M+ active accounts and 30M+ merchants. Even modest adoption inside this closed-loop network can generate meaningful volumes, particularly for sub-dollar digital transactions where card networks struggle due to fee structures.

PYUSD’s sweet spot is sub-dollar digital payments tips, creator monetization, or micro-subscriptions where traditional card fees are uneconomical. If PayPal extends PYUSD beyond its ecosystem, it could also support retail cross-border transfers at scale.

By June 2025, circulating supply crossed $1B, a sign that PYUSD is gaining real traction. However, its adoption remains concentrated within PayPal’s own ecosystem. The challenge ahead is whether PYUSD can break out of this walled garden and become a liquid asset across exchanges, DeFi platforms, and cross-border corridors. Its regulatory clarity gives it credibility, but true success will depend on whether it transitions from being a PayPal-native token to a Web3-native currency.

PYUSD circulating supply chart showing $1B milestone reached in June 2025 (Source: DeFiLlama)

Adoption potential:

- Positions PayPal as a Trojan horse for onboarding millions of non-crypto users.

- Unlocks microtransactions in digital content, tipping, and subscription models.

- Regulatory clarity makes it a test case for consumer-facing stablecoins.

6. Euro Coin (EURC): Europe’s Digital Anchor

Circle’s Euro Coin (EURC) is the leading euro-backed stablecoin, designed to bring the efficiency of dollar-based stablecoins into European markets. Its role is particularly important for cross-border settlements within the eurozone, where SWIFT and SEPA still dominate but often introduce delays and fees.

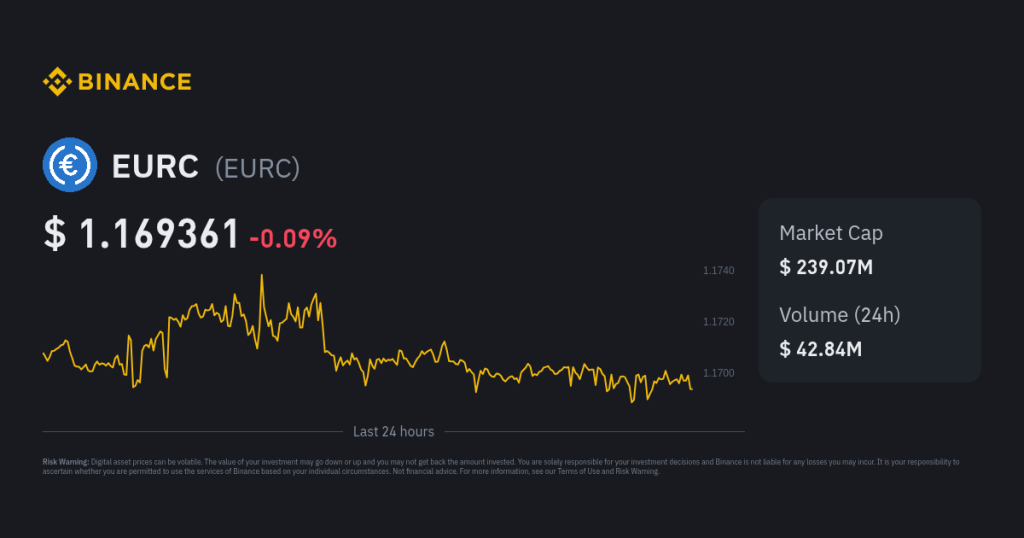

As of September 2025, Binance data shows EURC with a market cap near $239M while maintaining a steady peg close to €1. Its importance lies less in size and more in strategy. Europe’s policymakers are pushing for digital sovereignty in payments, and EURC provides a private-sector complement or competitor to the planned European Central Bank (ECB) digital euro. Adoption will depend on whether European fintechs, SMEs, and regulators treat EURC as an innovation-friendly settlement layer or as a rival to public initiatives.

EURC provides SMEs with a faster and cheaper way to settle cross-border invoices within the eurozone, bypassing SWIFT and SEPA delays. For microtransactions, it reduces conversion costs in intra-European commerce, such as online marketplaces or SaaS billing.

Euro Coin (EURC) price chart showing $239M market cap and stable peg near €1 (Source: Binance)

Strategic role:

- Offers a euro-denominated hedge in a dollar-dominated stablecoin market.

- Potentially aligns with Europe’s digital sovereignty initiatives.

- Adoption may hinge on its coexistence or competition with the ECB’s digital euro.

7. TrueUSD (TUSD): Carving Out a Niche

TrueUSD has never aimed to compete with the giants in scale. Instead, it has positioned itself as a compliance-first stablecoin where real-time reserve attestations act as its strongest differentiator. This transparency model has won it adoption on exchanges and in regulated pilots where certainty over backing is more important than network effects.

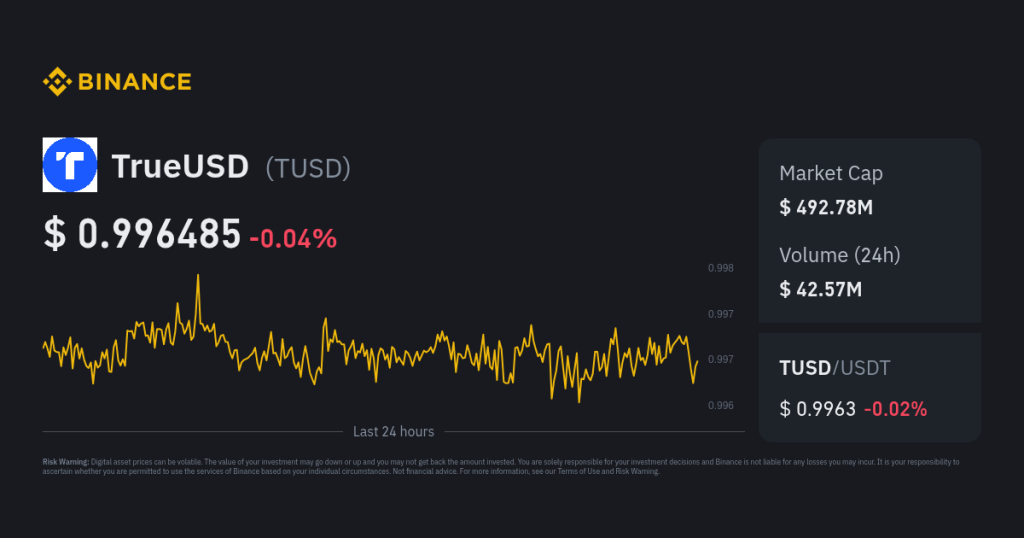

Unlike USDT, which thrives on liquidity, or USDC, which leverages institutional partnerships, TUSD’s role is quieter but strategic. As of September 2025, Binance data shows it holding a market cap of about $493M, reflecting steady but modest usage. Its strength lies in providing a trust anchor in specific corridors from fiat on/off ramps to enterprise pilots that require extra regulatory assurance.

TUSD’s focus on transparency makes it appealing for regulated remittance services that move smaller sums across borders and must satisfy compliance checks. Its stability also allows for low-value cross-border transactions where trust in backing is critical.

TrueUSD (TUSD) price chart showing $493M market cap and stable peg near $1 (Source: Binance)

Distinct role:

- Built its brand on transparency, pioneering real-time attestations.

- Fills a niche for regulated pilots and fiat gateways.

- Acts as a stability safeguard rather than a volume leader.

The Stablecoin Infrastructure Bottleneck

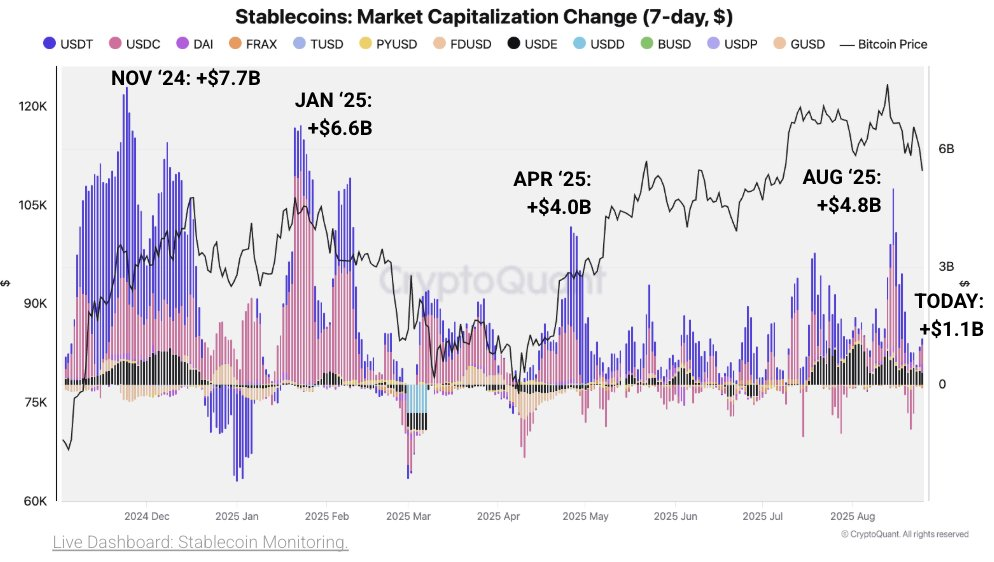

Stablecoins are no longer confined to trading desks; they are becoming essential in cross-border payments and microtransactions. Yet despite rapid growth, adoption still faces a serious infrastructure gap. CryptoQuant data up to August 2025 shows that while the sector added billions in capitalization with surges of +$7.7B in late 2024 and +$4.8B in August 2025, it also saw periods of contraction. These fluctuations highlight that the challenge is not just demand but the absence of reliable, scalable payment rails.

The bottleneck lies in fragmented liquidity, inconsistent regulation, and limited usability for businesses. Today, most enterprises cannot directly integrate stablecoins into payroll, invoicing, or retail checkouts without relying on complex intermediaries. As a result, stablecoins remain powerful in theory but underutilized in practice. The missing piece is not new tokens but the rails that make stablecoins usable for real-world cross-border payments and microtransactions.

Bridging this gap requires infrastructure providers that focus on making stablecoins usable at scale. Instead of creating new tokens, these firms build wallets, payment gateways, and compliance-ready settlement systems. Companies like Twendee contribute to this shift by developing solutions that allow businesses to transact with stablecoins securely and seamlessly. Their role is not to compete with issuers, but to ensure stablecoins can function as trusted, everyday payment utilities.

Stablecoin market capitalization changes from late 2024 to August 2025, highlighting both growth and corrections (Source: CryptoQuant)

The chart makes the problem visible: even as total market capitalization expands, the swings reveal how fragile adoption still is without strong payment rails. Stablecoins clearly have demand, but their long-term role in global payments depends on whether infrastructure providers can smooth these cycles by enabling consistent, real-world usage rather than speculative surges.

Conclusion

Stablecoins are moving from speculative assets to structural elements of global payments, but the transition is uneven. The Top 7 projects show how different strategies liquidity dominance, compliance, decentralization, synthetic models, retail integration, regional focus, and transparency are shaping adoption. Yet as the market data shows, growth depends not only on the tokens themselves but on the infrastructure that makes them usable at scale.

For businesses and innovators, the next wave of opportunity lies in bridging this infrastructure gap. As discussed in our latest blog on exchange listing standards, success increasingly depends on connecting blockchain assets with real-world requirements. Stablecoins will follow the same trajectory: the winners will be those that can balance liquidity, trust, and usability in global commerce.

Discover how Twendee helps leading teams integrate stablecoin payments and scalable blockchain solutions, and stay connected via X and LinkedIn.