Real-world asset (RWA) tokenization is reshaping how businesses and investors interact with physical assets. In 2025, RWA tokenization platforms are bringing asset-backed tokens for real estate, bonds, and commodities into the mainstream, enabling fractional assets and 24/7 trading on compliance-ready blockchain networks.

This blog highlights eight leading blockchain platforms that are tokenizing real-world assets in 2025 and how they empower people to unlock liquidity while navigating regulatory hurdles. (Hint: Twendee can help you leverage these platforms more on that in the conclusion)

Why Tokenizing Real-World Assets Matters in 2025

Tokenization converts ownership of tangible assets (like property, equity, or gold) into digital tokens on a blockchain. This process democratizes access to high-value assets by enabling fractional ownership, meaning an investor can own a small percentage of an asset instead of the whole. The benefits are profound:

- Increased Liquidity: Traditionally illiquid assets (e.g., real estate or fine art) become tradeable 24/7 as asset-backed tokens. Investors can buy/sell fractions of assets on secondary markets, greatly boosting liquidity.

- Greater Accessibility:Fractional assets lower the barrier to entry. For example, instead of needing millions to invest in a building, anyone can purchase a token worth a few hundred dollars to gain exposure.

- Efficiency & Transparency: Smart contracts automate compliance (KYC/AML), dividend payments, and transfers, reducing intermediaries and costs. Blockchain’s immutable ledger provides transparent ownership records, instilling trust.

- Global Market 24/7: Tokenized assets can be traded round the clock across global exchanges, attracting a wider investor pool. This global reach helps asset owners raise capital more easily and investors diversify internationally.

Importantly, RWA tokenization offers a compliance-ready blockchain environment, many platforms integrate regulatory checks (identity verification, transfer restrictions) to meet securities laws by design.

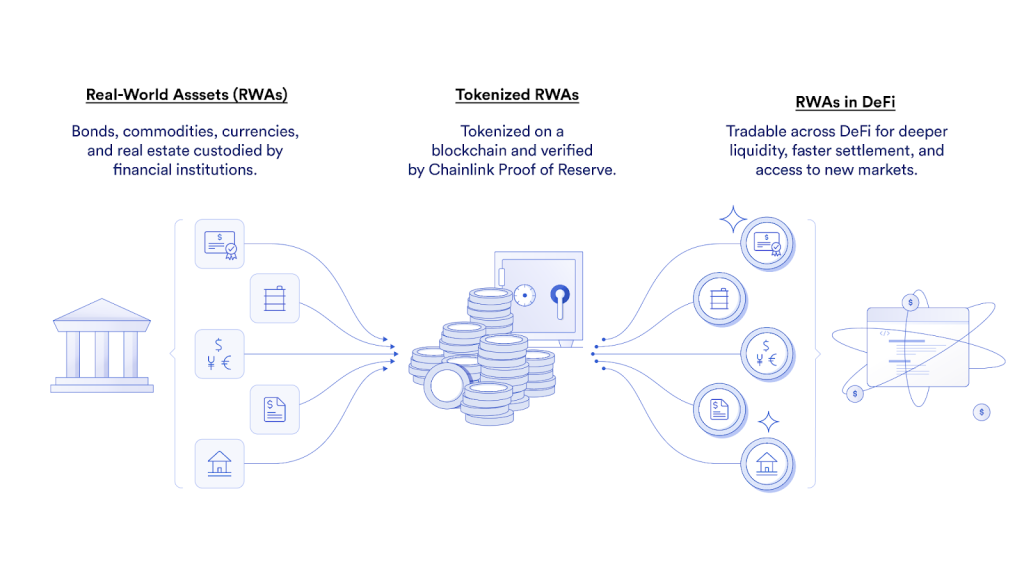

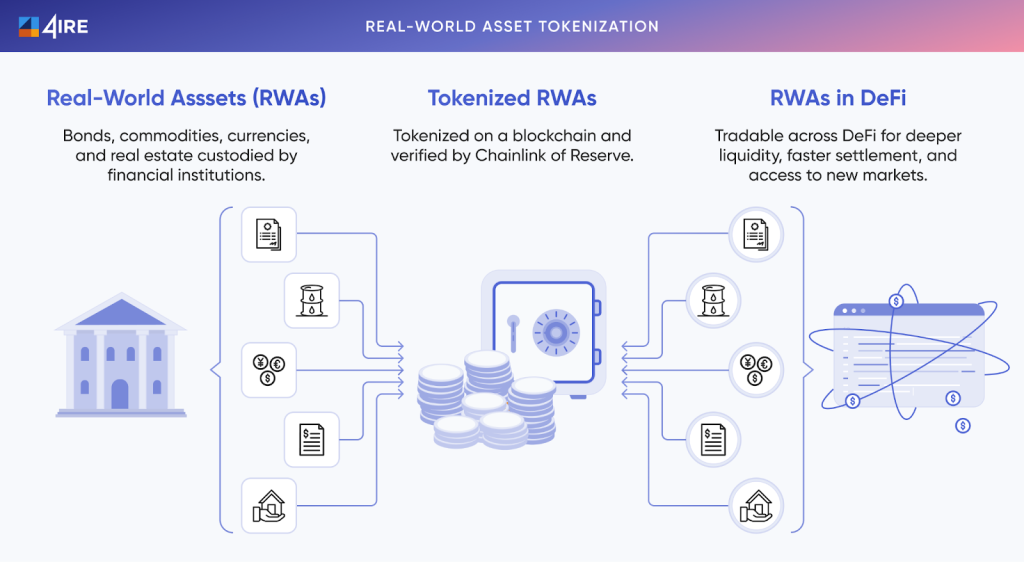

Diagram showing how real-world assets (RWAs) are collateralized off-chain and represented on-chain using proofs of reserve and oracles, enabling liquidity and verifiability (Chainlink Labs)

Below, we review the top 8 RWA tokenization platforms leading the charge in 2025, each enabling tokenization of real estate, equities, debt, or commodities in a secure and compliant manner.

Top 8 RWA Tokenization Platforms in 2025

1. Securitize – Digital Securities & Compliance Leader.

Securitize is a compliance-first RWA tokenization platform that bridges traditional finance and blockchain. As an SEC-registered transfer agent and broker-dealer, it enables regulated issuance of asset-backed tokens representing private equity, debt, or fund shares. Key features include:

- End-to-End Tokenization: Securitize’s platform handles everything from investor onboarding (KYC/AML) to token issuance, cap table management, and secondary trading on its regulated ATS (Alternative Trading System). This full lifecycle support simplifies the process for companies to tokenize assets while staying compliant.

- Market Traction: Securitize has tokenized over $1 billion in assets for more than 3,000 clients and 1.2 million investors. In fact, it attracted a $47 million investment led by BlackRock to expand RWA tokenization efforts, underscoring its credibility.

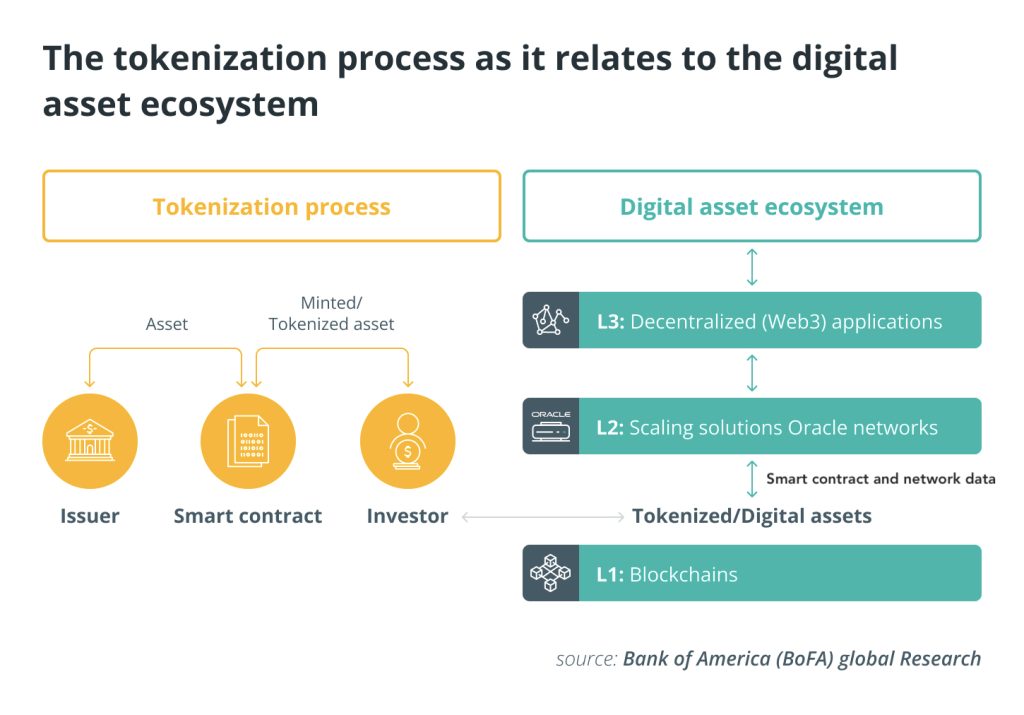

Tokenization process layers from asset → smart contract → investor on compliance-ready blockchain (Source: amberdata)

2. Tokeny – Institutional-Grade Tokenization (Europe)

Tokeny is a leading European platform offering institutional-grade tokenization for a range of assets, including real estate, private equity, funds, and debt instruments. Founded in 2017 and now partially owned by the Apex Group, Tokeny stands out for:

- Modular Compliance Infrastructure: Tokeny provides a white-label tokenization SaaS with built-in compliance modules (investor whitelisting, transfer restrictions, etc.), making it easy for financial institutions to issue tokens that meet EU and global regulations.

- Scale and Adoption: Tokeny’s platform has facilitated over $28 billion in tokenized assets through more than 3 billion transactions. Major financial institutions have adopted Tokeny’s technology, reflecting trust in its security and scalability.

- Key Use Cases: Tokeny has been used to tokenize loan portfolios, equity in private companies, and even tokenized funds. Its success in Europe’s regulated environment showcases how asset tokenization can be done at scale in a compliance-conscious manner.

3. Polymath (Polymesh) – Pioneering Security Token Issuance.

Polymath is a pioneer in the security token space, known for creating the ERC-1400 standard for security tokens and launching Polymesh, a Layer-1 blockchain built specifically for regulated assets.

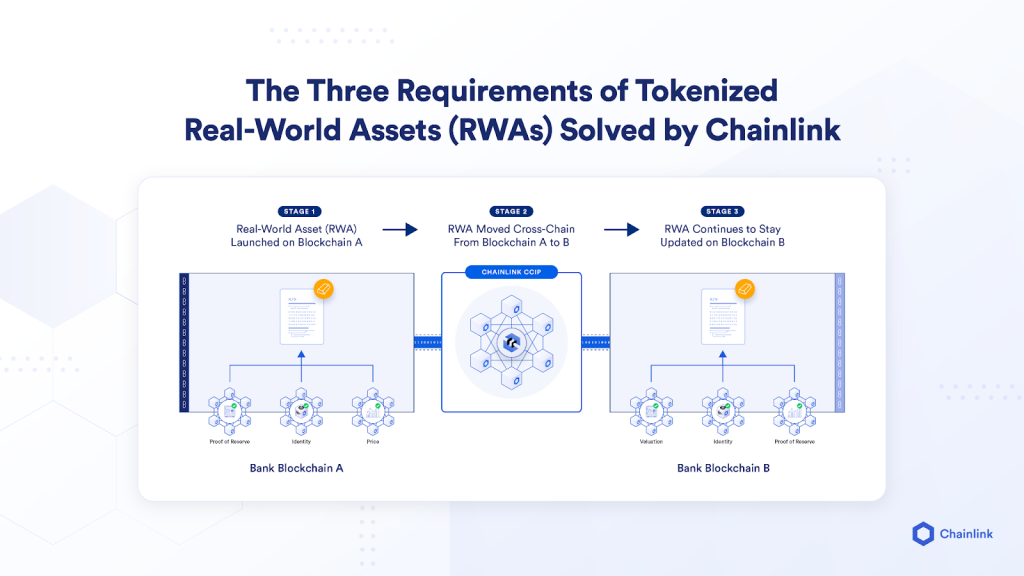

Diagram showing cross-chain movement and availability of RWAs, enabling global participation (Source: Perflexity AI)

- Compliance Automation: Polymath’s issuance platform automates compliance across jurisdictions and asset classes. It integrates KYC/AML checks and restrictions directly into the tokens (using standards like ERC-1400 and ERC-3643), ensuring that only authorized investors can hold or trade the tokens.

- Polymesh Blockchain: Recognizing the need for a compliance-ready blockchain, Polymath spearheaded Polymesh – a permissioned blockchain where identity is built-in and regulatory requirements are embedded at the protocol level. This network is optimized for financial institutions to issue and manage security tokens with confidence in areas like governance and finality.

- Industry Impact: Polymath has facilitated tokenization of over $100 million in assets so far, including various pilot projects for security token offerings (STOs). Its continuous innovation and focus on the needs of institutional issuers keep Polymath at the forefront of the security tokenization movement.

4. RealT – Fractional Real Estate Ownership.

RealT is a platform that specializes in tokenizing real estate, particularly residential rental properties in the U.S. It has become a front-runner in bringing real estate investment to the blockchain by allowing fractional ownership of properties.

Visual showing examples of tokenized real-world assets & fractional ownership options (Source: Koinz)

- How It Works: RealT acquires rental properties (e.g., single-family homes, duplexes), then issues ERC-20 tokens (RealTokens) that represent fractional ownership of each property. Investors worldwide can buy these tokens, often for as little as a few hundred dollars, to share in ownership.

- Rental Income via Tokens: Token holders receive their share of rental income directly to their crypto wallets (usually in stablecoins) on a weekly basis. This model turns rental properties into yield-generating digital assets – a revolutionary concept in real estate investing.

By 2025, RealT has tokenized dozens of properties and plans to exceed 200 tokenized properties. It enabled investors (even those of modest means) to own stakes in properties that would otherwise be out of reach. This democratization of real estate through fractional assets and instant liquidity (tokens can be traded anytime) is a showcase for RWA tokenization’s potential.

5. Centrifuge – DeFi Infrastructure for Real-World Assets.

Centrifuge is a decentralized platform that bridges real-world assets to the world of DeFi (decentralized finance). It allows businesses to tokenize invoices, receivables and other financial assets and finance them via crypto liquidity pools. Key features:

- Tokenizing Invoices & Loans: Through its Tinlake protocol, Centrifuge lets originators create DROP and TIN tokens backed by pools of real-world assets (like trade invoices, SME loans). These tokens can be purchased by investors to finance the underlying assets and earn yield.

- MakerDAO Integration: Centrifuge has partnered with MakerDAO, enabling tokenized real-world assets to serve as collateral for the DAI stablecoin. This means, for instance, a pool of loans tokenized via Centrifuge can be deposited in MakerDAO to generate DAI, effectively bringing real-world credit into DeFi.

- Impact: Since launching in 2017, Centrifuge has helped fund hundreds of millions of dollars in real-world assets by providing liquidity to businesses that tokenize assets. It’s known for daily risk monitoring and transparency, ensuring off-chain data (like borrower payments) are fed on-chain via oracles for investor confidence. Centrifuge’s success in turning invoices and other off-chain credit into on-chain tokens proves the viability of tokenizing even complex, traditionally illiquid assets.

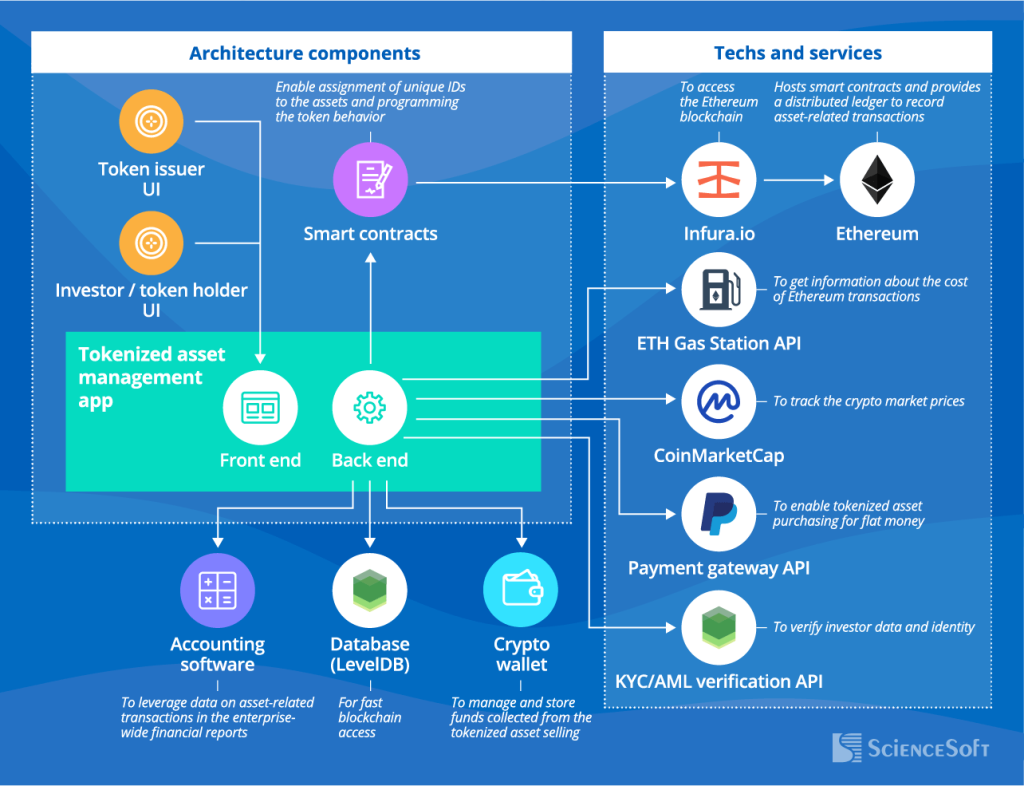

Architecture diagram of asset tokenization platform showing compliance modules, smart contracts, front-end/back-end, KYC/AML verification (Source: Sciencesoft)

6. Ondo Finance – Tokenized Bonds & Treasuries.

Ondo Finance is a DeFi platform focused on tokenizing fixed-income assets – notably U.S. Treasury bonds and corporate bonds – to offer on-chain, stable yield opportunities. It exemplifies how traditional debt securities can be transformed into crypto assets. Highlights include:

- Tokenized Funds (OUSG): Ondo launched OUSG, a token fully backed by short-term U.S. Treasury ETFs, offering the safety of Treasuries with the flexibility of a cryptocurrency. OUSG tokens are 24/7 redeemable and provide holders with yield from the underlying bonds. By mid-2025, OUSG’s market capitalization surpassed $700 million, showing strong demand for blockchain-based access to Treasuries.

- Other Offerings: Ondo also created tokens for corporate bond portfolios and other yield-generating assets, structured to be principal-protected (meaning they aim to preserve the initial capital while paying interest). These tokens comply with securities regulations for accredited investors, yet integrate with DeFi protocols for lending and trading.

- Bridge Between TradFi and DeFi: Ondo’s ability to package regulated bond ETFs into crypto tokens that trade on-chain is a pioneering move at the intersection of traditional finance and DeFi. It provides institutional and retail investors an easy on-ramp to fixed-income yields through a familiar DeFi interface. With over $10 billion of real-world assets tokenized industry-wide by 2025 (many in Treasuries), platforms like Ondo are driving that growth by making bonds as accessible as any cryptocurrency.

7. tZERO – Regulated Trading Platform for Digital Securities.

tZERO is a U.S.-based fintech company that operates one of the first regulated trading platforms for tokenized securities. Backed by the parent company of the NYSE (Intercontinental Exchange), tZERO provides infrastructure for both issuing tokens and trading them on a regulated exchange. Key points:

- End-to-End Ecosystem: tZERO and its subsidiaries hold multiple regulatory licenses, it runs a FINRA-regulated Alternative Trading System (ATS) for secondary trading of digital securities, has a special-purpose broker-dealer license to custody digital assets, and acts as a placement agent for primary offerings. This comprehensive regulatory stack is unique and assures compliance at every stage (issuance, custody, trading).

- Notable Projects: tZERO has facilitated trading of tokenized shares of private companies and even real estate. In 2025, tZERO announced it is launching its own blockchain (tZERO Chain) to further scale regulated asset tokenization, expecting to onboard up to $1 billion in tokenized assets across equities, funds, real estate and more.

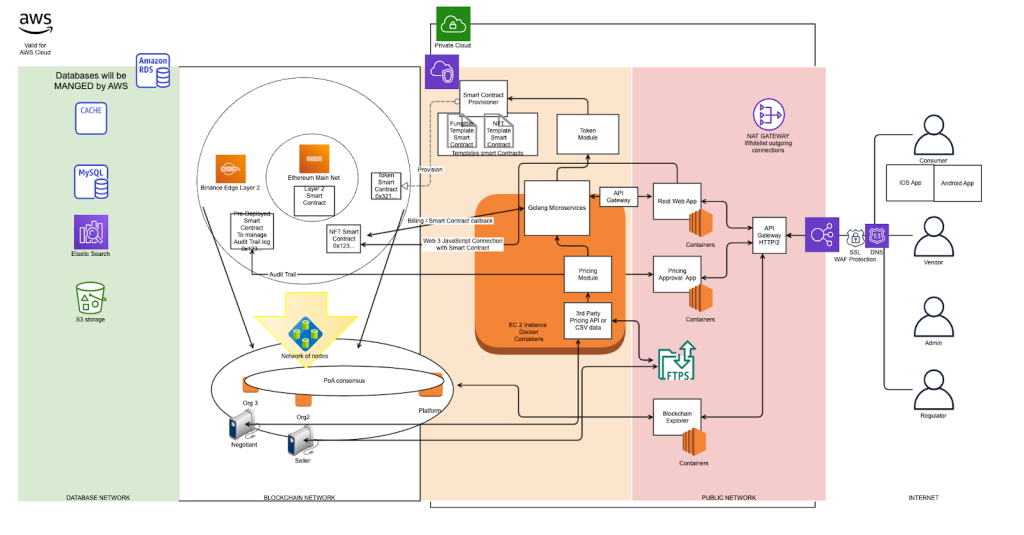

A detailed architecture diagram: custody, issuance engine, identity management, compliance modules, trading & governance layers (Source: Vadzim Belski)

For enterprises and investors seeking a compliance-ready blockchain platform with a trusted secondary market, tZERO is a leading option. Its platform demonstrates that tokenized assets can trade in a regulated environment similar to traditional stock exchanges, combining the benefits of blockchain (speed, 24/7 access, programmability) with investor protections of traditional markets.

As tokenization expands to potentially trillions in assets by 2030, tZERO aims to be at the forefront of providing the market infrastructure for this new era.

8. ADDX – Private Market Exchange (Asia).

ADDX is a Singapore-based digital securities exchange that opens up private market investments (like pre-IPO equity, hedge funds, bonds, and commercial real estate) to accredited investors via tokenization. It’s one of Asia’s trailblazers in RWA tokenization. Key aspects:

- MAS-Licensed Platform: Backed by Singapore’s Monetary Authority (MAS license), ADDX provides a user-friendly marketplace where investors can buy and sell tokenized securities. It specializes in tokenizing private equity, venture funds, bonds, and asset-backed securities, essentially bringing opportunities that were once limited to large institutions onto a regulated blockchain market.

Top asset tokenization platforms table chart showing ADDX among other leading platforms, comparison of features like standards, blockchain technology, and adoption (Source: 101 Blockchain)

- Innovation in Fundraising: In 2024, ADDX made headlines by facilitating the world’s first tokenized private credit fund. By converting a private debt fund into digital tokens, ADDX enabled the fund to raise capital faster and more efficiently than through traditional fundraising. This proof-of-concept showed how tokenization can streamline complex financial products (in this case, a credit fund) while maintaining compliance.

- Global Reach, Lower Minimums: ADDX allows issuers to reach a global base of accredited investors, while investors benefit from lower minimum ticket sizes for high-end investments (for instance, getting into a private equity fund with a few thousand dollars via tokens instead of the usual six-figure minimum).

ADDX presents a compliance-ready blockchain solution to unlock liquidity in assets that typically have long lock-up periods. It demonstrates how progressive regulation (like Singapore’s) combined with blockchain tech can transform private markets.

Conclusion

As we’ve seen, the tokenization of real-world assets is accelerating in 2025, with platforms enabling everything from fractional real estate ownership to on-chain bond trading. For business leaders and tech innovators, this trend heralds a new era where ownership is digitized and markets are more accessible, liquid, and efficient.

However, launching a tokenization project involves navigating a complex maze of technology and regulations – from smart contract development and cybersecurity to compliance with securities laws across jurisdictions.

This is where Twendee can empower you. As a seasoned IT services provider (with deep blockchain expertise), Twendee can help you design and implement a custom RWA tokenization platform or integrate with the top solutions above. We understand the technical intricacies of smart contracts, blockchain integration, and security audits, as well as the critical importance of regulatory compliance (KYC/AML, legal structuring, etc.).

Our team will work with you to reduce the technological and legal barriers to tokenizing your assets, so you can focus on unlocking value and new investment opportunities!

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn Page

Read latest blog: AI Chatbots Are Cutting Customer Support Costs by 40% in Enterprise SaaS