Real-World Asset (RWA) platforms are bridging the gap between traditional finance and blockchain, enabling real assets like real estate, bonds, and funds to be tokenized and traded on-chain in a compliant, institutional-friendly way. This emerging sector has already surpassed $20 billion in tokenized assets, with major players like BlackRock, KKR, Apollo, and Hamilton Lane driving momentum. Analysts even predict the tokenization market could unlock “hundreds of trillions” of dollars in real-world assets in coming years.

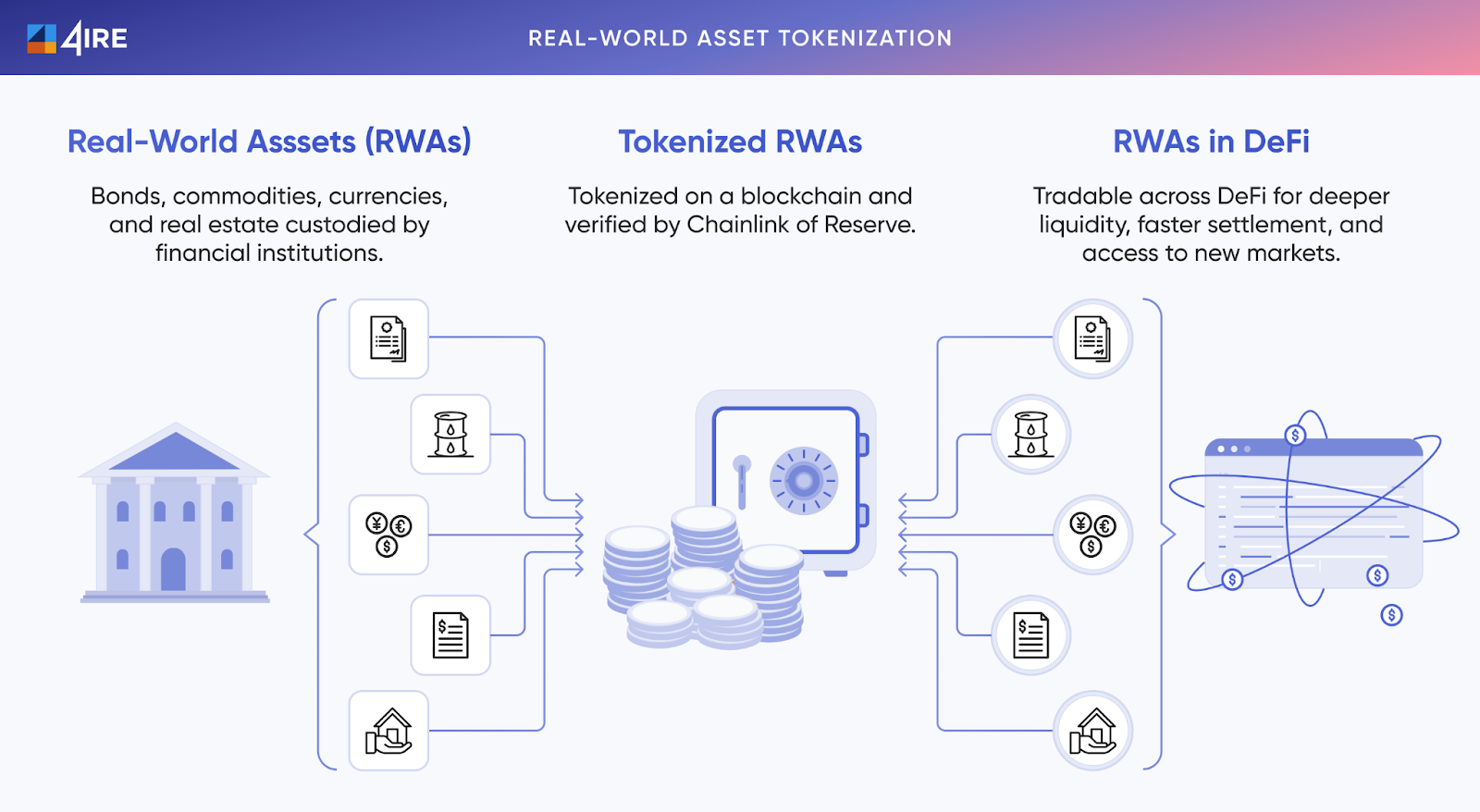

In this article, we’ll explore the top RWA platforms that are tokenizing real assets and making institutional DeFi a reality, highlighting how they ensure compliance and ease institutional adoption. Real-World Asset Tokenization ecosystem map (June 2025) highlighting key platforms, exchanges and service providers.

Why RWA Platforms Matter for Institutional DeFi

Tokenizing real-world assets offers powerful benefits for institutions. By converting asset ownership into digital tokens, RWA platforms increase liquidity, accessibility, and efficiency in markets that were once illiquid or hard to access. Fractional ownership and 24/7 trading become possible, allowing institutions and investors to trade assets like real estate or bonds with ease.

Crucially, top RWA platforms bake in regulatory compliance (KYC/AML, securities laws) at the smart contract level, ensuring that tokenized assets meet legal requirements across jurisdictions. This compliance-first approach builds the trust needed for institutional adoption, effectively bridging TradFi and DeFi under a secure, regulated framework.

Visual flow: asset identification → token design → on‑chain minting → DeFi integration — illustrating the tokenization lifecycle (Source: 4irelabs)

Below we evaluate some of the leading RWA platforms enabling institutions to easily access tokenized assets. These platforms represent a new wave of institutional DeFi infrastructure, where Wall Street’s assets meet blockchain’s efficiency, all while maintaining the oversight and compliance standards that regulators expect.

Leading RWA Tokenization Platforms for Institutions

Securitize: Compliance-First Asset Tokenization

Securitize is a pioneer in regulated asset tokenization, providing an end-to-end platform to issue and manage digital securities on blockchain. Notably, Securitize is an SEC-registered transfer agent and broker-dealer, meaning it can facilitate tokenized equity, debt, and fund offerings within U.S. securities laws.

The platform handles the full asset lifecycle, investor onboarding with KYC/AML, cap table management, automated compliance, and even dividend distributions. Securitize also operates a regulated Alternative Trading System (ATS) called Securitize Markets for secondary trading of these tokenized securities.

- Institutional Adoption: Securitize has helped tokenize shares of private equity funds from firms like KKR and Hamilton Lane, as well as U.S. Treasury funds and credit products. This gives institutions on-chain access to assets previously limited to private markets, while remaining fully compliant with regulations.

- Why It Stands Out: By rigorously enforcing compliance on-chain and partnering with traditional finance (e.g. working with firms like KKR on tokenized funds), Securitize builds trust for large institutions to venture into DeFi. It truly bridges TradFi and blockchain with its licensed status and comprehensive tooling for digital asset securities.

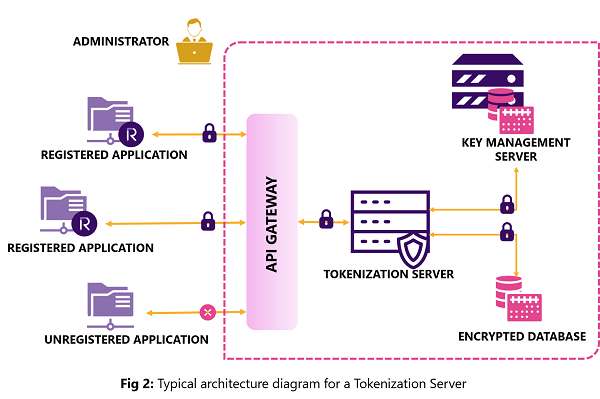

Typical tokenization architecture: from API gateway → tokenization server → secure key/vault and compliance enforcement (Source: HSC)

Polymath/Polymesh: Infrastructure for Regulated Assets

Polymath is an early leader in security token technology, famous for introducing the ERC-1400 standard for security tokens. Its flagship contribution is Polymesh, a purpose-built Layer-1 blockchain designed specifically for regulated assets and compliance. Unlike general public chains, Polymesh is permissioned with built-in identity verification, rule enforcement, and settlement finality to meet institutional requirements.

- Institutional-Grade Features: Polymath’s toolkit supports end-to-end tokenization, from issuance and cap table management to automatic compliance checks and controlled transfers. For example, only verified investors can hold or trade tokens, and transfer restrictions can be coded to enforce regulations (e.g. limits on who can buy/sell). This ensures asset tokens remain compliant across jurisdictions.

- Why It Stands Out: By creating a dedicated blockchain (Polymesh) for securities, Polymath addresses institutional concerns around privacy, governance, and regulatory control. It’s essentially an “enterprise Ethereum” for finance, where banks and issuers have the compliance tools needed on the base layer. This makes it easier for institutions to adopt blockchain without compromising on oversight.

Tokeny: Tokenizing Assets on Public Blockchains with Compliance

Tokeny provides a turnkey platform for issuing and managing tokenized assets on public chains (Ethereum, Polygon, Avalanche, etc.). Backed by the European stock exchange Euronext, Tokeny focuses on identity-bound tokens, tying each token to a verified investor identity via its ONCHAINID system. This allows every transfer to be automatically checked for compliance (KYC/AML, jurisdiction rules) before execution. In effect, Tokeny’s smart contracts enforce that only eligible, whitelisted investors can hold the tokens.

- Key Offerings: The platform provides SDKs and APIs for banks, asset managers, and marketplaces to easily tokenize equity, bonds, or fund units. Features include built-in cap table management and even support for dividends and voting. All tokens are permissioned tokens that cannot be moved to unverified wallets, maintaining a compliant environment on public blockchains.

- Why It Stands Out: Tokeny’s approach brings together the openness of public networks (liquidity, interoperability) with the control of a permissioned system. By embedding identity and compliance at the token level, it enables institutional use of public DeFi rails without breaching regulatory rules. This hybrid model appeals to institutions that want the benefits of Ethereum or Polygon, but in a walled “compliance wrapper.”

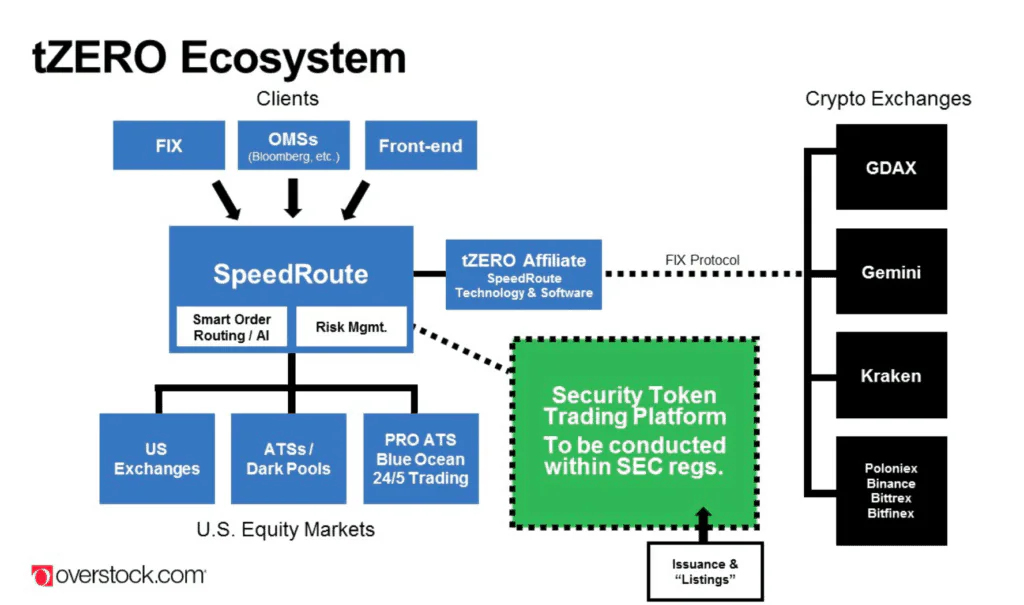

tZERO: Regulated Trading Venue for Tokenized Securities

tZERO is a regulated digital securities exchange and marketplace, one of the earliest in the space. It runs a FINRA and SEC-regulated ATS purpose-built for trading tokenized assets. With tZERO, issuers can tokenize traditional securities (private company equity, real estate, debt, etc.) and have those tokens trade in a regulated, 24/7 market accessible to qualified investors.

- Compliance & Custody: tZERO offers integrated brokerage accounts and works with regulated custodians (like Prime Trust) to hold the tokenized assets. Investors go through KYC and accreditation checks to participate. This ensures that trading of tokenized securities on tZERO’s platform mirrors the protections of traditional markets, but with blockchain efficiency (near-instant settlement, around-the-clock trading).

- Why It Stands Out: tZERO essentially provides the secondary market piece of the puzzle. Many RWA platforms focus on token issuance, but tZERO built the exchange infrastructure to actually buy/sell those tokens in compliance. It’s a crucial service for liquidity. By enabling secondary trading on-chain under regulatory oversight, tZERO unlocks liquidity for traditionally illiquid assets (like private shares) in a way institutions are comfortable with.

tZERO ATS infrastructure: risk control, smart order routing, and compliance layers connecting brokers and digital securities (Source: Securities)

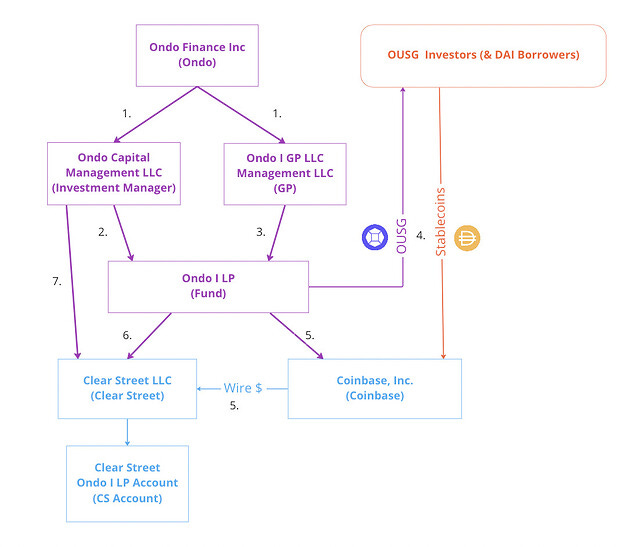

Ondo Finance: Tokenized Treasuries and Institutional DeFi Yield

Ondo Finance is at the forefront of bringing real-world yield onto DeFi platforms. It tokenizes traditional fixed-income products, notably launching tokens like OUSG, which represents shares in a short-term U.S. Treasury fund managed by BlackRock. Ondo’s platform offers institutional investors a way to hold tokenized U.S.

Ondo Finance OUSG architecture – user subscription → stablecoin deposit → OUSG issuance via Coinbase custody and integration with XRPL for 24/7 liquidity (Source: llamarisk)

Treasury bills, bonds, and money market funds on-chain, gaining the benefits of crypto (24/7 liquidity, composability) while enjoying the safety of government-backed assets.

- Institutional Focus: Ondo operates with a strong compliance framework: it uses SEC-registered custodial partners for the underlying assets and only allows accredited/ institutional participants for certain offerings. The tokenized fund shares (like OUSG) are ERC-20 tokens, so they can integrate with DeFi lending, DEXs, and other protocols, effectively bridging institutional capital into DeFi liquidity pools.

- Why It Stands Out: In the wake of declining DeFi yields, Ondo’s tokenized Treasuries have been a game-changer, providing stable, regulated yield on-chain that attracted many users and even DAOs. By mid-2025, tokenized T-bill products like Ondo’s had surged in popularity, with on-chain Treasury tokens growing almost 8× in 2023 alone as investors sought safer yields. Ondo’s success shows that compliant, yield-bearing RWA tokens can significantly boost institutional DeFi adoption.

Centrifuge: Decentralized RWA Financing Protocol

Centrifuge takes a decentralized approach, focusing on turning real-world assets into collateral for DeFi lending. Its protocol lets asset originators (like invoice factoring companies, real estate lenders, etc.) tokenize their assets as NFTs and pool them to borrow liquidity from DeFi investors. Centrifuge’s Tinlake platform, for example, allows the creation of pools backed by assets like invoices or mortgages, which then issue yield-bearing tokens to investors.

Notably, Centrifuge is a key gateway for bringing assets into MakerDAO’s ecosystem (Maker uses Centrifuge pools to back DAI with RWAs).

- Institutional Connectivity: Centrifuge runs on its own Polkadot parachain for scalability, but bridges to Ethereum for liquidity. This design means institutions can benefit from Polkadot’s controlled environment while still accessing the large capital pools on Ethereum. By 2024, major DeFi lenders like Aave and Maker had integrated Centrifuge to accept RWA-backed collateral. For example, MakerDAO has onboarded tokenized real estate loans and trade receivables (via Centrifuge) as collateral for generating DAI stablecoin.

- Why It Stands Out: Centrifuge shows how SMEs and fintech lenders can tap global crypto liquidity by tokenizing their real-world debt. It brings on-chain financing to assets like invoices and mortgages, which is attractive for institutions looking to diversify yields. By bridging RWAs to DeFi protocols (with over $440 million TVL by 2025), Centrifuge has proven that decentralized platforms can handle real assets at scale, all while embedding features for identity and investor verification as needed.

ADDX: Fractional Private Markets on Blockchain

ADDX is a regulated private market exchange from Singapore that leverages tokenization to open up investments to a wider audience. Licensed by the Monetary Authority of Singapore, ADDX hosts offerings like tokenized private equity, hedge funds, bonds, and structured products.

By tokenizing these typically illiquid assets, ADDX can lower minimum investment sizes from millions to just ~$1,000, allowing family offices and accredited individuals globally to participate in deals that were once reserved for institutions.

- Compliance and Trust: Operating under one of the world’s strictest regulators (MAS), ADDX built robust compliance into its platform, all investors go through full KYC and accreditation checks, and smart contracts enforce transfer restrictions so only eligible investors hold the tokens. Regular audits and disclosures are provided, and the platform offers an integrated secondary marketplace for trading these securities, providing liquidity opportunities to exit investments.

- Why It Stands Out: ADDX demonstrates how tokenization can transform private markets in a legally compliant manner. By fractionalizing big-ticket funds and bonds, it enables liquidity and accessibility without compromising investor protections. For institutional asset managers, ADDX shows a path to reach a broader capital base by tokenizing their funds, while for investors it proves that compliant exposure to alternatives (PE/VC funds, etc.) can be achieved on a regulated digital exchange. This model is likely to be replicated in other financial hubs as regulators warm to tokenization.

RealT & Lofty: Fractional Real Estate for Global Investors

While many platforms target big institutions, RealT and Lofty AI focus on democratizing real estate via tokenization, an approach that also appeals to smaller institutions and fintech investment firms. These platforms let investors worldwide buy fractional tokens of rental properties in the U.S., earning rental income via stablecoins and benefiting from property appreciation.

- RealT: One of the earliest real estate tokenization platforms, RealT tokenizes individual rental homes through a U.S.-based LLC structure for each property. Investors anywhere (after KYC) can purchase ERC-20 tokens representing shares of the LLC, effectively owning a fraction of the property. Rental income is distributed daily or weekly in stablecoins (USDC/xDAI) to token holders. Compliance is ensured by using whitelisted wallets and requiring all trades to occur within the platform’s framework (so only verified investors can transact). RealT has made it possible to invest in properties in Detroit, Chicago, etc., with as little as $50–$100 per token.

- Lofty AI: Lofty offers a similar model, focusing on U.S. rental properties and utilizing the Algorand blockchain for its tokens. Investments start at $50 per token, and daily rental payouts are issued to investors’ wallets in stablecoins. Lofty differentiates itself with a built-in secondary marketplace for instant liquidity, investors can sell their property tokens at any time, which provides a degree of exit flexibility not typical in real estate. It also involves token holders in governance, letting them vote on certain property decisions (e.g. maintenance, tenant issues) in a decentralized way.

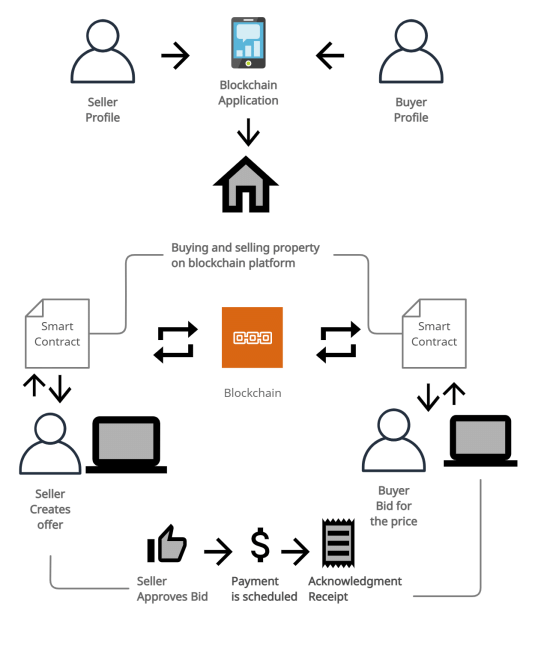

Blockchain-based real estate tokenization: seller lists, smart contract escrow, fractional tokens, and rental/deed management via on-chain processes (Source: Ledger Insight)

- Why They Stand Out: RealT and Lofty showcase how asset tokenization can open up real estate to global investors by lowering barriers and automating income distribution. For institutions, these platforms offer a template for how fractional ownership of real assets can work (with legal structures and compliance in place). Smaller investment firms or REITs could partner with such platforms to broaden their investor base. Moreover, the success of RealT and Lofty, evidenced by consistent user growth and property acquisitions, sends a signal to larger institutions that tokenization is a viable method to unlock liquidity in real estate portfolios while maintaining legal compliance.

Conclusion

Real-world asset (RWA) platforms are no longer experimental, they’re reshaping institutional finance. From Securitize and Centrifuge to BlackRock’s $2.5B tokenized fund on Ethereum, the shift toward on-chain assets is accelerating, backed by improving global regulation and rising institutional demand.

For businesses, this marks a strategic opportunity to modernize asset exposure, unlock liquidity, and streamline operations, all within a compliant framework.

Twendee Labs helps companies harness blockchain and AI to stay ahead of the curve. If you’re exploring RWA or institutional DeFi solutions, our team is ready to support your journey

Connect with us on LinkedIn or X to explore how Twendee can support your transformation: Twitter & LinkedIn PageRead latest blog: Open-Source AI vs Big Model Monopoly: Can Developers Still Compete?