In the blockchain startup space, investors increasingly demand a clear AI workflow strategy. This shift stems from AI’s ability to enhance productivity, automate operations and accelerate go-to-market timelines.

For VCs, a startup lacking a structured AI approach is a red flag – suggesting inefficiency and missed potential.

Defining AI Workflow Strategy in Blockchain Context

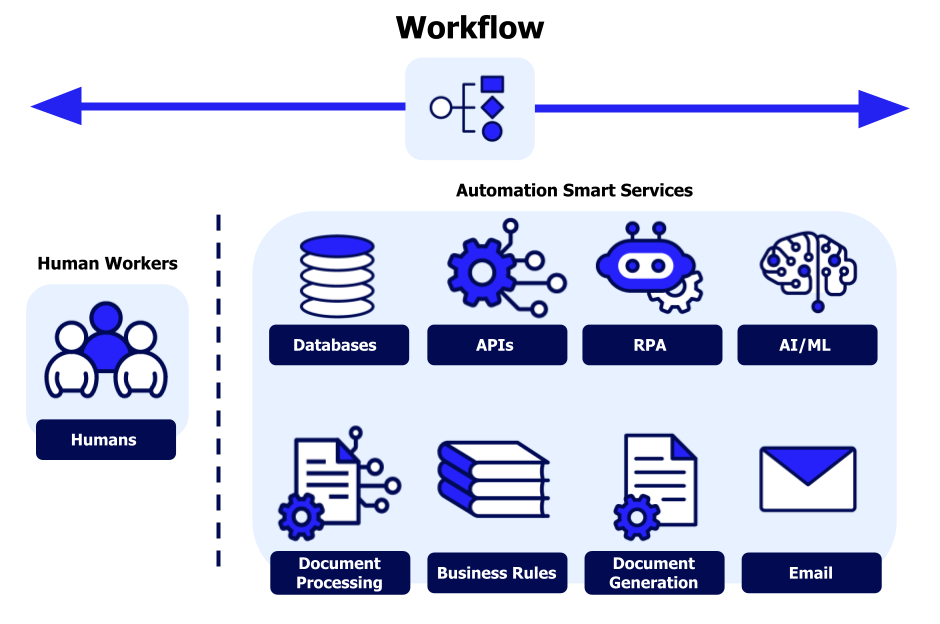

An AI workflow strategy refers to a structured plan for integrating artificial intelligence across a startup’s core operational processes. In blockchain projects, it spans multiple layers:

- Data intelligence: AI systems continuously ingest and analyze on-chain and off-chain data to produce real-time insights (e.g., wallet segmentation, protocol usage trends).

- Smart automation: Predictive algorithms automate functions such as fraud detection, liquidity rebalancing, or content curation.

- Augmented workflows: Tools like AI copilots assist in code generation, proposal drafting in DAOs, or moderation of decentralized communities.

Key distinction: Rather than treating AI as a feature, a true workflow strategy embeds it as infrastructure – influencing development pipelines, governance logic, and user experience.

This distinction is crucial in blockchain environments where transparency, scale, and efficiency define competitiveness.

AI Workflow Automation (Source: Appian)

Why VCs Prioritize This Strategy

VCs aren’t simply chasing trends. Their emphasis on AI workflow strategies is rooted in strong market evidence and deep strategic imperatives:

A. Market signals

Crunchbase (2025): Roughly $100B of global VC capital was allocated to AI startups, outpacing every other tech segment. This figure marks a pivotal shift, not just in investor preference, but in perceived inevitability: AI is seen as the operating layer of the next wave of software.

IBM (2024): A full 92% of executives reported they plan to integrate AI into core workflows by 2025, up from 53% in 2022. This rapid adoption trajectory signals an enterprise consensus: AI is no longer experimental; it is operational.

B. Strategic rationale

- Efficiency multipliers: AI-augmented startups can deliver more output per employee, a critical metric during capital-constrained cycles.

- Foresight markers: A defined AI workflow strategy suggests that founders are proactively navigating technological disruption, not reacting to it.

- Risk management: AI deployed for security, compliance, and protocol monitoring reduces systemic and operational risks.

Investors aren’t just backing vision, they’re betting on executional advantage. AI enables startups to close execution gaps with fewer resources and faster feedback loops.

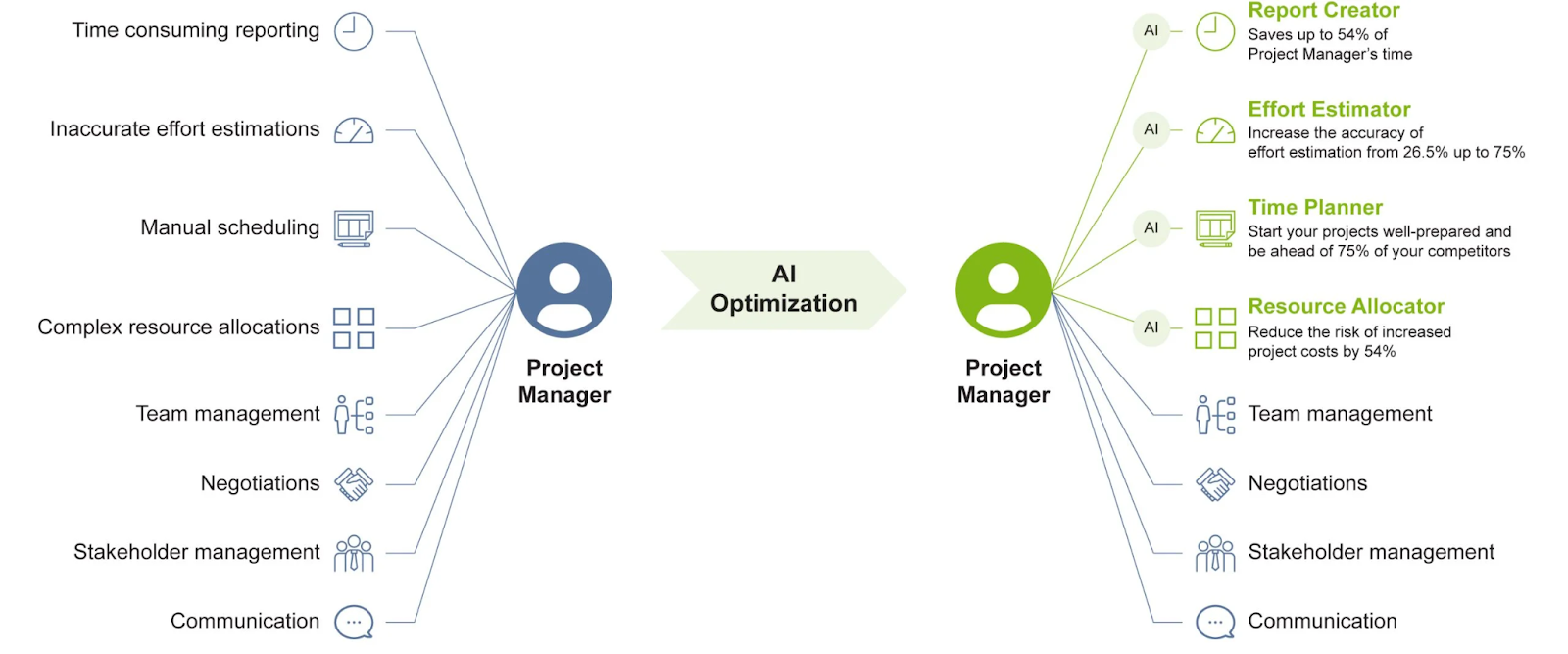

Example of adding AI to your workflow

Twendee’s Internal Agent Bot is a clear expression of this principle. It orchestrates engineering task flows without increasing headcount, cutting internal delivery time by 35%. That means faster sprints, reduced overhead, and higher deployment cadence, all factors that translate directly into capital efficiency.

In short, investors increasingly view a well-articulated AI workflow strategy as a proxy for scalability, resilience, and founder competence in a fast-evolving ecosystem.

Suggested AI Workflow Strategy for Blockchain Startups

A robust AI strategy is not one-size-fits-all. Instead, it should align with a startup’s operational maturity, risk profile, and product roadmap. Below are five core pillars that can guide blockchain companies in building a practical yet forward-looking AI workflow strategy:

1. Identify Workflow Bottlenecks

Begin with a diagnostic audit: map your internal and external workflows to uncover inefficiencies, latency points, or error-prone routines. Focus particularly on areas such as:

- Customer support backlogs

- Grant proposal or DAO voting documentation

- Monitoring on-chain activity for abnormal behavior

Strategic rationale: These low-complexity, high-repetition zones are ideal for automation. Offloading these tasks to AI agents frees your core team to focus on innovation.

2. Choose AI Models by Use Case

Avoid a monolithic AI stack. Instead, tailor your model selection to the functional requirement:

- LLMs: For governance proposal generation, community responses, documentation drafting.

- Anomaly Detection: For fraud monitoring, sybil detection, and liquidity risk analysis in DeFi protocols.

- Reinforcement Learning: For optimizing DeFi strategies, game economies, or dynamic fee mechanisms.

Tip: Integrate model performance KPIs to determine when to retrain or replace.

3. Create an AI Orchestration Layer

This middleware links your AI logic to both smart contracts and frontend interfaces. It should:

- Capture real-time inputs (e.g., token flows, user behavior)

- Trigger outputs (e.g., DAO recommendations, rebalancing actions)

- Allow human override and feedback integration

- Maintain transparent logs for auditability

Maturity indicator: Investors view orchestration infrastructure as a sign that you’re not just experimenting with AI, you’re productionizing it.

4. Define Governance Parameters

AI, especially in decentralized systems, must operate within clear governance frameworks. Your AI agents should:

- Only act within community-approved conditions

- Require human validation for high-stakes actions (e.g., treasury reallocations)

- Submit proposed updates to their own logic for DAO review

Example: A DAO may allow an AI to adjust staking rates within a 5% margin but require a vote for structural changes.

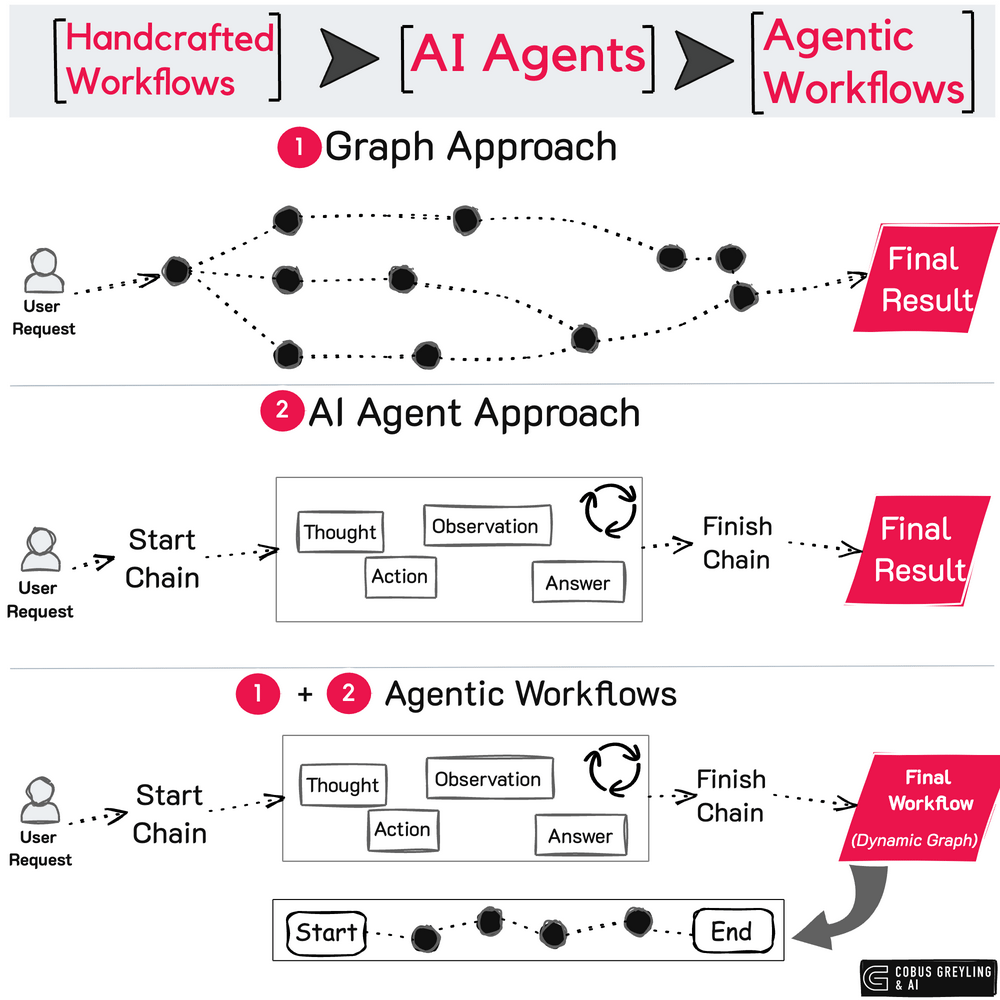

5. Scale with Modularity

Structure workflows as composable agents or microservices. This enables:

- Seamless integration of new capabilities (e.g., adding sentiment analysis to proposal review)

- Fault isolation (one broken agent doesn’t bring down the system)

- Community contribution (e.g., open bounty for improving an AI agent’s performance)

From Handcrafted Workflows to AI Agents to Agentic Workflows (Source: Cobus Greyling)

Best Practice: Start with a narrow scope, like automating treasury monitoring and expand gradually. Demonstrating small, successful deployments builds internal and external credibility.

A well-structured AI workflow strategy not only improves efficiency but also enhances your startup’s narrative: that it is lean, scalable, and deeply attuned to the future of decentralized automation.

Conclusion

In blockchain, AI is no longer “nice to have”. A robust AI workflow strategy is now a credibility marker for founders and a decision filter for investors. It reflects foresight, resource leverage, and readiness to operate in a lean but scalable manner.

Twendee Labs supports Web3 ventures in designing and deploying such strategies, from governance automation to AI-native developer tools.

Explore our blockchain & AI services at Twendee Labs

Follow our insights on X and LinkedIn