When crypto markets are booming, almost every token model appears to work. Demand surges, incentives seem aligned, and user growth masks underlying fragilities. But market cycles are brutal teachers. The real test of any token economy happens when prices fall and that’s where most token models expose their critical flaws. These failures are not random. They reflect fundamental tokenomics risk embedded in how many projects design incentives, funding models, and utility.

Hidden Fragility in Supply–Demand Design

Tokenomics risk arises when supply inflation (through emissions) outpaces real utility-driven demand. During bull cycles, reward-based initiatives staking, LP incentives, P2E gameplay drive temporary engagement. But they also introduce high token velocity and speculative holding patterns. When the market turns, emissions continue, but demand evaporates. Tokens flood into the market and prices crash. Data from Binance Research shows 70 % of protocols in Q1 2024 saw token supply grow faster than on-chain revenue classic sign of unsustainable inflation .

This mismatch triggers a token dump that drives prices lower, which in turn accelerates further sell-offs and deepens the downward spiral. High velocity accelerates instability, while speculative patterns diminish community trust. At its heart: the architecture prioritizes short-term reward over long-term value accrual, a design flaw, not a market anomaly.

How Bear Markets Trigger Collapse

When markets reverse, the fragile structure of incentive-driven token models quickly collapses. Protocols built around reward emissions rather than genuine utility find themselves on the brink. Emissions continue as if user demand is intact, but yields plummet and staking participation dries up. Liquidity, once abundant during bull times, vanishes. Without protocol revenue to support these rewards, token demand implodes, and selling pressure becomes the dominant market force.

Data from Binance Research in Q1 2024 reveals that roughly 70% of tokens experienced supply growth outpacing on-chain revenue, a clear warning sign of unsustainable inflation. In this scenario, existential risk emerges not from external shocks, but from internal over-leverage: speculative incentives, high velocity, and emission-heavy frameworks collectively trigger a token death spiral.

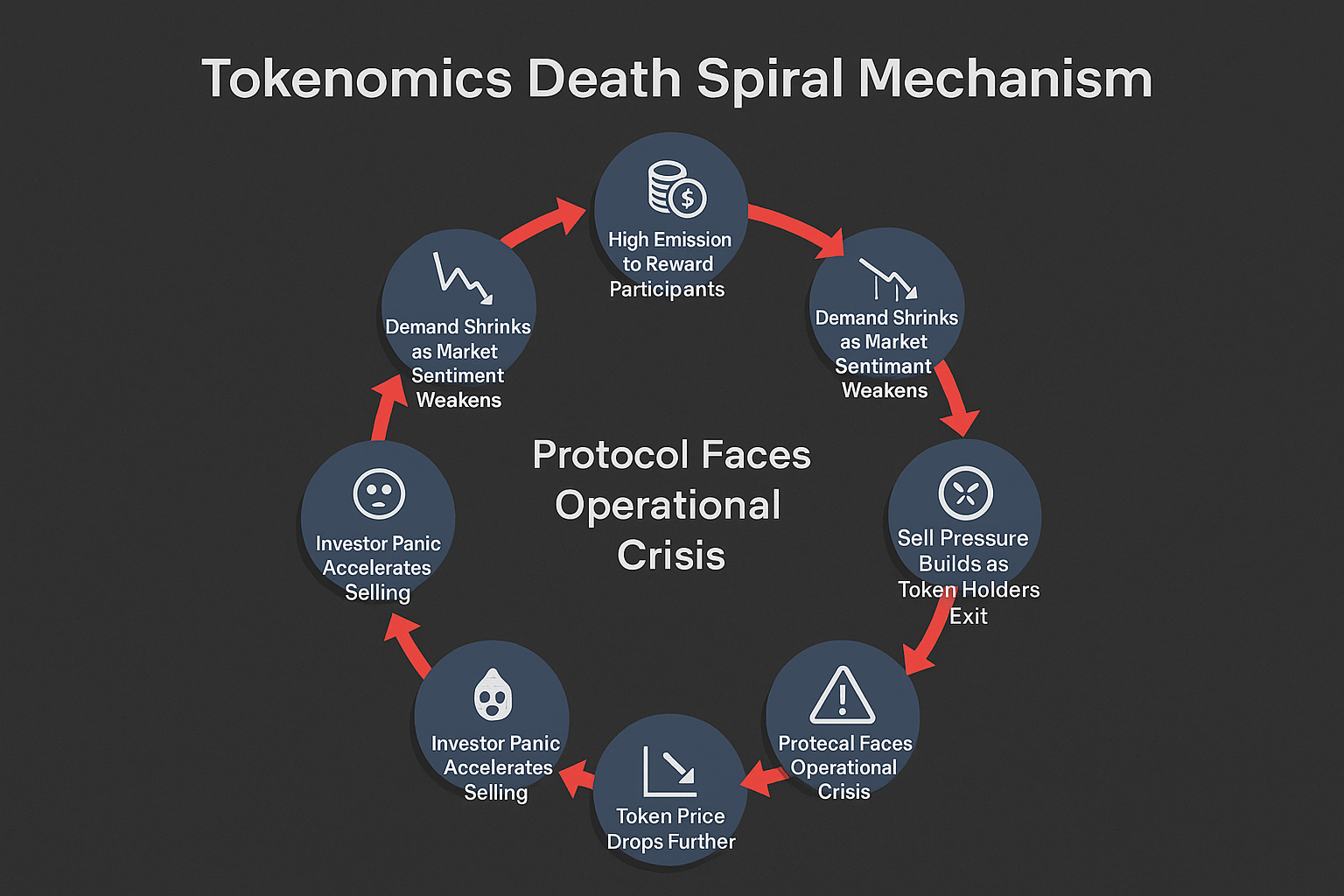

The Death Spiral Mechanism

- Emission continues: token holders expect yield.

- Demand shrinks, yields drop staking incentives disappear.

- Liquidity tightens, limiting buyers.

- Sell pressure escalates, as participants exit.

- Price drops, triggering psychological panic further selling.

Once initiated, this loop can collapse a protocol quickly, even when broader bear market is mild.

Visualizing the Tokenomics Death Spiral Mechanism: how emission-heavy models collapse under weakening demand, shrinking liquidity, and self-reinforcing sell pressure.

Most token breakdowns aren’t due to markets going down, they are due to misaligned token design. Reward-driven tokens without a revenue engine or real use case lack a price floor. During downturns, the design is exposed: tokens must earn their hold in the real world, not in temporary sentiment. Terra’s collapse in 2022 illustrates how quickly speculative tokenomics can unravel under market stress. Terra’s UST stablecoin was backed by LUNA, with the Anchor protocol offering unsustainably high yields of nearly 20% to attract deposits. When UST lost its peg, redemption pressure forced massive LUNA minting to absorb sell orders, driving the token price down exponentially. Over $45 billion in market cap evaporated in days, not because the market turned irrational, but because the token design could not absorb real demand shocks without spiraling into collapse.

Protocols with robust token fundamentals where emission is tied to utility or fee revenue don’t just survive bear cycles; they often build relative strength as weak models fail. This is why, when the tide goes out, the design of your token determines whether you stand tall or sink fast.

Token‑Funded Operations: The Treasury Drain Trap

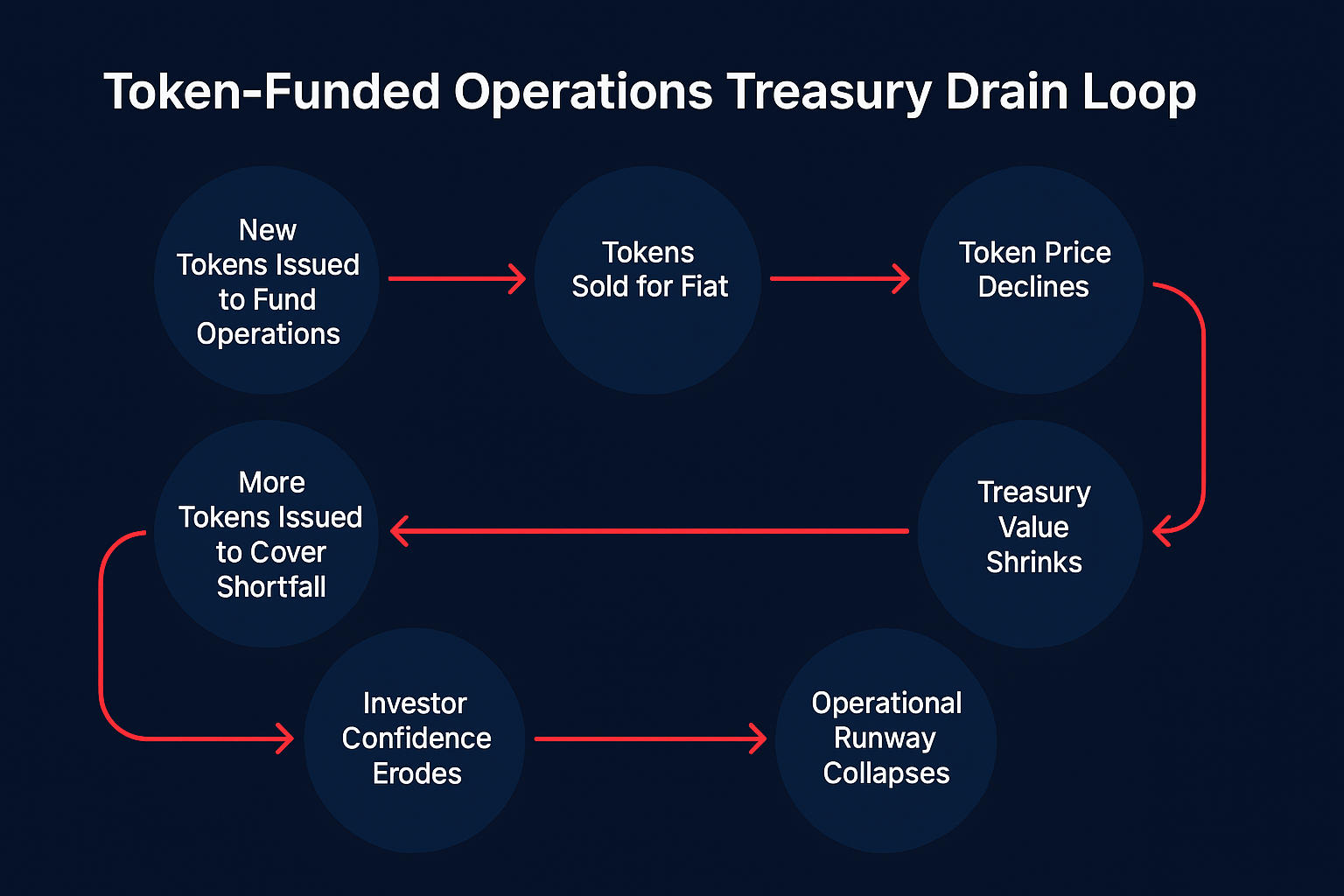

One of the most damaging yet often overlooked risks in token design lies in operational dependency on token sales. Many protocols fund payroll, development, and marketing by issuing new tokens, which are then sold to cover fiat costs. While this model appears sustainable during bull markets, it turns dangerously unstable when token prices decline.

As prices fall, protocols must sell increasingly larger volumes of tokens to meet the same fiat obligations, directly intensifying sell pressure. This triggers a vicious cycle: more token sales lead to further price drops, shrinking treasury value, forcing even more issuance.

Token-Funded Operations Treasury Drain Loop Visual

Messari’s Q2 2024 research quantified this spiral: across 15 major protocols analyzed, treasury buffers shrank by 45% within three months, with over $30 million liquidated to cover operations . Without meaningful revenue to offset these sales, protocols quickly drain their financial runway, just as investor confidence begins to erode.

This is not a temporary market fluctuation, it’s a self-reinforcing structural flaw embedded directly in token-funded operations. By the time the market fully reacts, most projects find themselves trapped in an accelerating collapse, where both treasury and token price spiral downward together.

Building Resilience Through Real Value

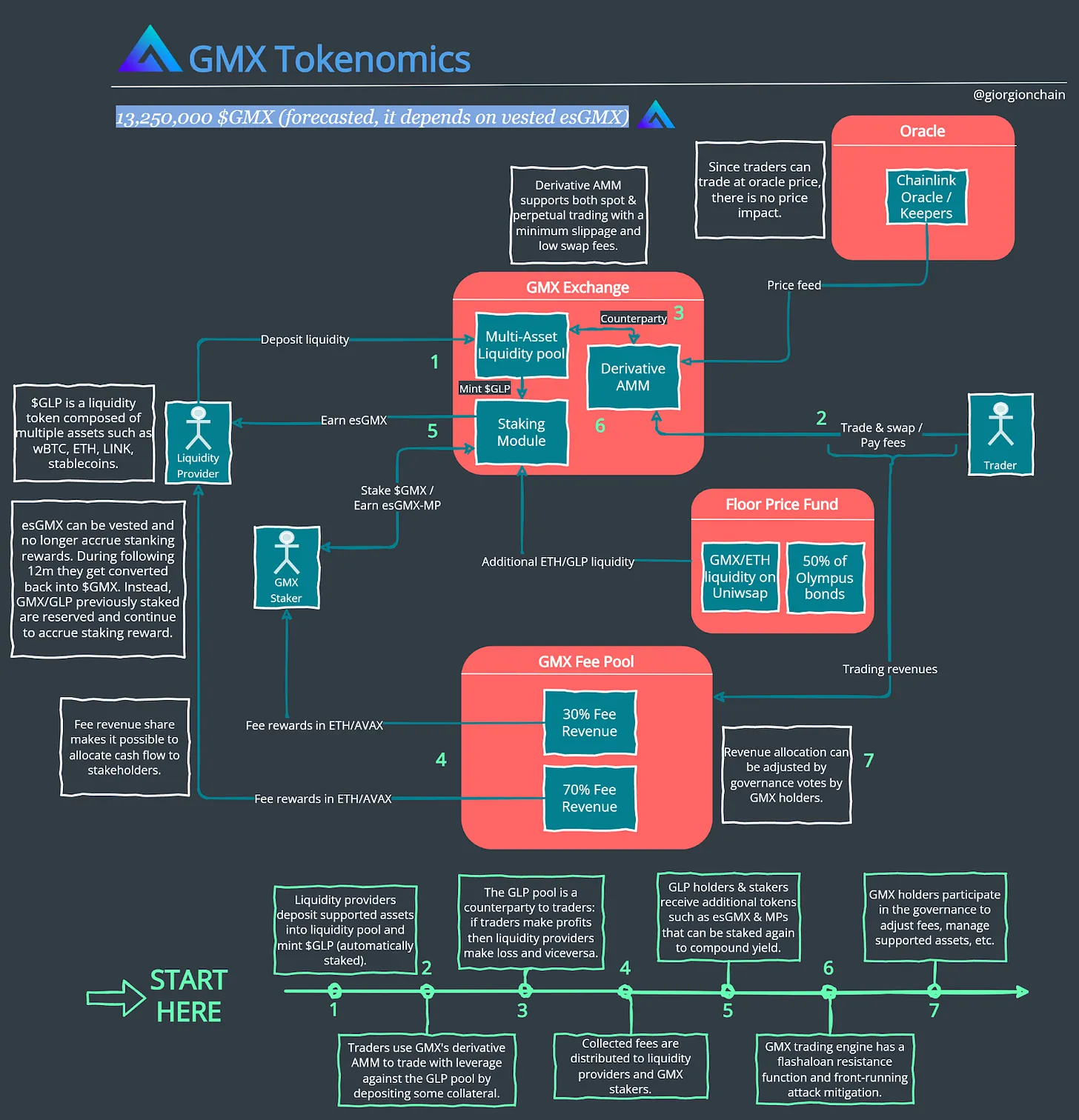

The only way to reduce tokenomics risk long-term is to move beyond emissions and anchor token models in real protocol usage. Sustainable token design begins with revenue-backed mechanics. Projects like GMX distribute trading fees directly to stakers, ensuring that token demand grows as platform adoption scales rather than relying on artificial emission schedules.

Controlled supply remains equally critical. Well-designed models adjust emissions dynamically based on protocol activity, using burn mechanisms or buybacks to prevent oversaturation and price erosion. Simultaneously, treasury diversification through holding reserves in fiat or stablecoins shields core operations from market swings and reduces the need for token sales during downturns. Beyond fiat and stablecoins, real-world asset tokenization offers protocols an emerging path to diversify treasury reserves, mitigating native token sell pressure and anchoring operational stability to off-chain asset value in this blog. .

Visualizing GMX’s revenue-backed tokenomics structure, where trading fees directly fuel staking rewards and protocol stability. (Source: @giorgionchain)

At the core lies a utility-first architecture. Tokens must serve essential roles inside the protocol, whether for governance, service access, staking, or fee discounts, giving users actual reasons to hold irrespective of price cycles. Finally, operational hedging by combining fiat salaries with revenue-aligned spending breaks the feedback loop where falling token prices force increased sell pressure to fund operations.

By rebalancing token design toward usage, revenue, and operational stability, protocols can endure market cycles on business fundamentals rather than speculative momentum.

Lido’s liquid staking model applies many of these principles. It collects a fee from staking rewards and channels that revenue to token holders and treasury reserves. As more users stake ETH through Lido, both stETH holders and the platform itself benefit directly from expanded protocol usage, creating a self-sustaining growth loop rather than a speculative emissions cycle.

Conclusion

Token models rarely fail because markets turn. They fail because their design was never equipped to survive volatility. Models built on emissions, speculative demand, and token-funded operations expose their fragility the moment liquidity dries up. This is the essence of tokenomics risk. It is not a market problem; it is a structural flaw in how incentives, supply, and revenue were misaligned from the start.

Sustainable token design corrects this by anchoring tokens in real usage, revenue-backed demand, controlled supply, treasury resilience, and operational stability. Protocols that adopt these fundamentals do not simply survive market cycles; they grow stronger as weaker models collapse. As Web3 matures, the difference between collapse and resilience will be decided at the design table long before any market shift arrives.

If your team is building or optimizing tokenomics frameworks, TwendeeLabs provides strategic consulting across token design, revenue models, and treasury operations to help protocols build resilience from day one. Follow our insights on X and LinkedIn